BTC and ETH ATHs: Where to Next?

TL;DR:

- Expectations for U.S. Fed interest rate cut are heating up with institutions continuing to increase their holdings, the crypto market has surged again, with its total market cap surpassing $4.18 trillion.

- Bitcoin hit a new all-time high, touching $124,000 before a slight pullback; Ethereum broke the $4,700 mark, just a step away from its all-time high.

- A technical correction risk for Bitcoin is emerging, as the hashrate and price trends are starting to diverge.

Expectations for U.S. Fed interest rate cuts are heating up: Bitcoin hits all-time high, with ETH approaching its record.

US inflation data for July came in below market expectations. This has boosted investor confidence that the Fed will cut interest rates again in September, increasing global risk appetite. As US stocks hit new highs, the crypto market is showing strong performance. According to CoinMarketCap, the total global crypto market cap hit a new record of over $4.18 trillion in Thursday’s early Asian trading session, with a trading volume of $245 billion.

Bitcoin hit its fourth new all-time high of the year on Thursday. According to BitMEX, Bitcoin spot price rose over 3.5% in the last 24 hours, stabilising above $128,000 at 8:25 AM SGT. This surpasses its previous record of $124,000 from mid-July, bringing its year-to-date gains to a staggering 31%. Bitcoin’s global market cap now exceeds $2.4 trillion, making it the largest cryptocurrency. This valuation is comparable to Google’s market cap.

But it is not just Bitcoin making moves. The world’s second-largest cryptocurrency, ETH, is surging. It is being pushed by both favourable macro policies and growing institutional demand. Over the past month, its price has jumped 59%. On Thursday, ETH’s price climbed above $4,750, and its market cap surpassed $570 billion. It is now less than 3% away from its November 2021 all-time high of $4,868.

Net inflows into Bitcoin and ETH ETFs continue to rise

Since Donald Trump’s U.S. presidential victory on November 5, 2024, Bitcoin has repeatedly hit new highs. The price broke through a key resistance level of $74,000 on positive news and has since risen by a staggering 67%. The Trump administration has been vocal in its support for the crypto industry. In March, an executive order was signed to classify Bitcoin as a strategic reserve asset. At that time, the U.S. Treasury held approximately 200,000 Bitcoins.

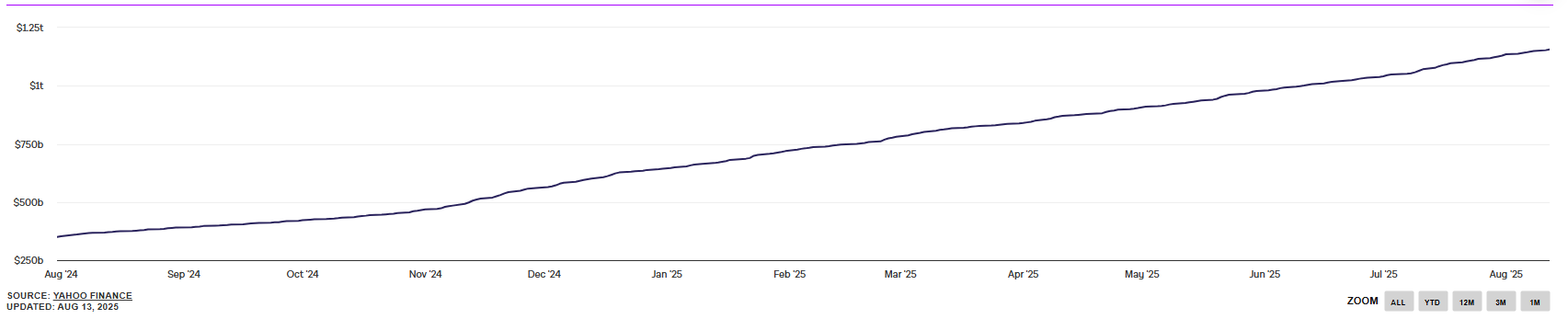

According to data from Yahoo Finance, cumulative net inflows into Bitcoin spot ETFs reached $1.16 trillion as of August 12, 2025. BlackRock’s iShares Bitcoin Trust (IBIT) accounts for 80% of this, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) is second at 8.8%.

In mid-July, the US Congress passed its first stablecoin regulation bill, the ‘GENIUS Act’. This bill paved the way for US asset-backed stablecoins to be used for international payments. This drove institutional buying of ETH. The stablecoin USDC is built on the Ethereum blockchain, and its issuer, Circle, went public in early June with its stock price soaring over 500%. According to Yahoo Finance, ETH ETF cumulative inflows jumped from $100 billion on 15 July to $141.5 billion by 12 August. That same day, it hit a single-day record of $57.5 million in inflows.

Demand for Bitcoin and ETH as institutional reserve assets is also rising. This shows that as regulations improve, crypto is gaining acceptance as a mainstream financial asset. As of 13 August, the cumulative value of Bitcoin held by institutions as a reserve asset reached $15.7 billion. A Cointelegraph report shows that as of 11 August, companies holding ETH as a primary reserve asset—including BitMine and SharpLink Gaming—held a total value of over $13 billion.

Bitcoin may face a short-term pullback risk

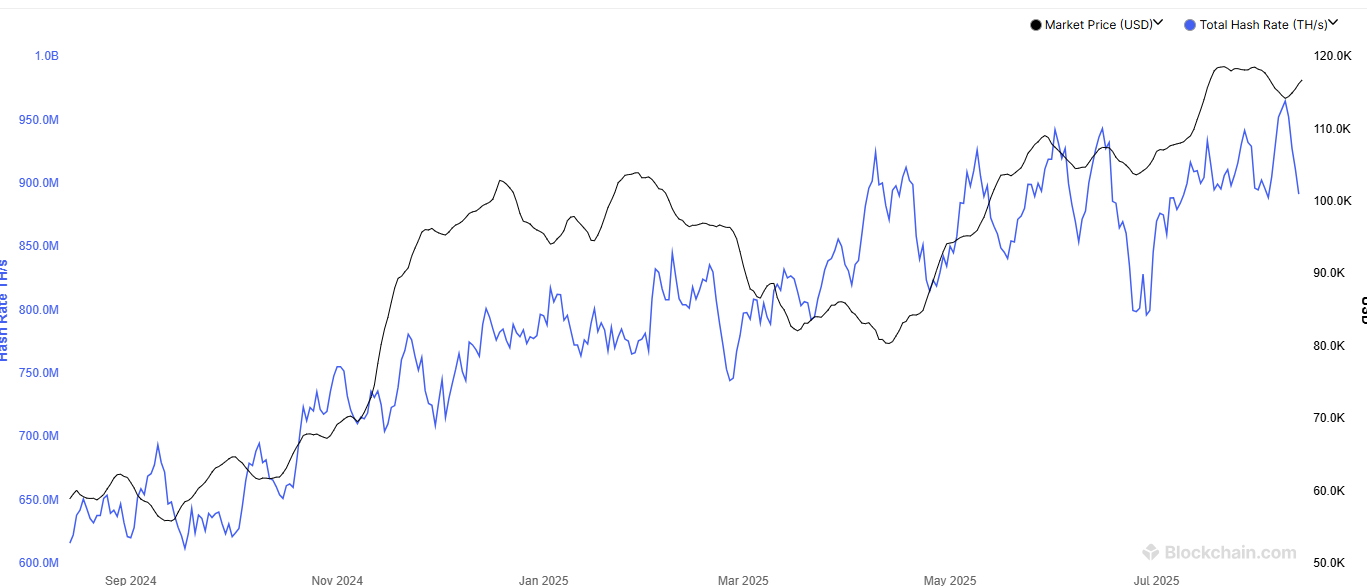

While long-term fundamentals remain strong, Bitcoin may face a short-term correction. According to Blockchain.com, Bitcoin’s hashrate has fallen quickly since 7 August. It dropped from a high of 965 million terahashes per second (TH/s) down to 892 million TH/s by 13 August. Since hashrate and price are typically positively correlated, this trend could signal a short-term price pullback.

A technical analysis of Bitcoin’s price shows a potential bearish divergence with the MACD (See the image below). The current price may be forming a double-top pattern with the July high, which could trigger a pullback.

The next potential support is the low of 2 August, which was also the high of May, at around $112,000. The blue uptrend line is key support. A break below it could lead to further declines.

The post BTC and ETH ATHs: Where to Next? appeared first on BitMEX Blog.

BitMEX Blog