Why Does Bitcoin Have Value?

You can’t touch it. You can’t see it. It’s not backed by any governments, gold standards, or anything physical. But then, why is Bitcoin valuable? Good question! If it’s just a string of code running on a blockchain network, why do people pay thousands of dollars for a single coin? And here’s the crazy part: it isn’t just expensive, it works. Bitcoin doesn’t rely on central banks or middlemen like fiat currencies. It’s a decentralized digital currency with a limited supply, coded and built using cryptography and blockchain technology. In this guide, you’ll learn what makes it worth something—and why it might just be the most important digital asset ever.

Why Traditional Currencies Have Value

Every day, you transfer dollars, euros, or yen without even thinking about it. But have you ever thought about why they’re actually worth something? It’s because central banks say so—and the people agree.

These are fiat currencies. ‘Fiat’ means they have no intrinsic value. Their value comes from trust. You trust the government won’t let the currency collapse. You trust the money you’ve got saved in your account will still be good to buy some coffee tomorrow.

That trust is enforced by monetary policy, taxes, and legal tender laws. Everyone accepts it, so you do too. But when that trust breaks—like in countries with unstable currencies—things fall apart fast.

Traditional currencies are valuable because of one thing: belief. When that belief fades, so does their purchasing power.

What Is the Point of Bitcoin?

This is the problem: traditional financial systems rely on middlemen like banks and governments. These institutions decide who gets access, what fees they charge, and how much money they print. This sort of system works—until it doesn’t.

Bitcoin offers an alternative to the system. It’s a decentralized currency you can use freely. No bank accounts. No gatekeepers. All you need is an internet connection and a wallet. It gives your finances freedom. You control your assets, and you can send them across the network without needing anyone’s permission. And that’s the point. It challenges the idea that a single entity must oversee and approve how you use your money.

And it’s not just about convenience, either. It’s about shifting power. From institutions to individuals. From inflation to sound money. Bitcoin operates on rules written in code—not changed behind your back.

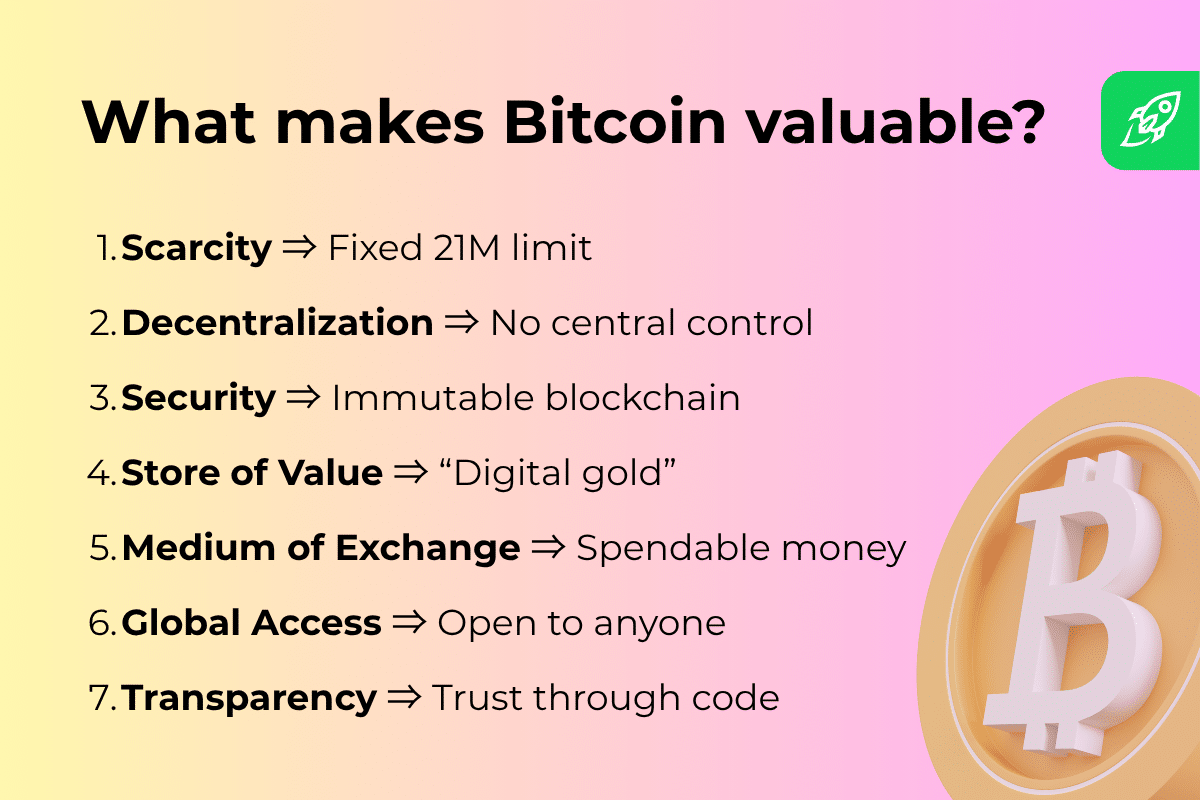

Why Is Bitcoin Valuable?

Bitcoin isn’t backed by anything physical. It’s not issued by any government. It has no intrinsic value. So why do millions of people see it as valuable? Short answer: because it solves real problems. It’s scarce, secure, and outside the control of central authorities. Let’s break down the key factors behind the value of BTC. Together, they make it something no traditional currency or crypto token can match.

Scarcity and the 21 Million Limited Supply Cap

You can’t print more BTC. Ever. Its code limits the total circulating supply to 21 million. No overrides. No emergency bailouts.

Read more: What is Circulating Supply?

This built-in scarcity mimics precious metals like gold. But Bitcoin is even more transparent. You can check its exact supply at any time—no need to guess or do any complicated research.

Central banks can print as much fiat currency as they like. But the number of Bitcoin on the market is capped. That makes it a potential store of value, especially if fiat currencies lose their trust. If demand increases, the supply is still fixed, and the price of a single Bitcoin can go way up in value. It’s just supply and demand.

Decentralization and the Absence of Central Control

There are no CEOs. No boardrooms. No switch to turn the whole thing off. Bitcoin runs on a decentralized network of nodes and miners all around the world. No single person, company, or country controls it. That’s how it was designed.

Because of this decentralization, Bitcoin is much harder to censor, shut down, or manipulate. Unlike traditional currencies, it has no central authority pulling its strings. Decisions are made by code, consensus, and math—not politics or panic.

This independence gives it a level of resilience most other similar systems can’t match.

Security and Immutability Through the Blockchain

Bitcoin doesn’t rely on trust. It relies on math.

Every single transaction on the network is recorded on a public ledger that’s called a blockchain. Once the transaction’s there, it’s locked in. You can’t change or erase it. It’s immutable—and that’s a big deal.

Bitcoin secures its network through computing power. Thousands of miners solve cryptographic puzzles to add new blocks to the network. This is called proof-of-work consensus, the mechanism that keeps the network honest and resistant to attack. Over a decade later, the Bitcoin blockchain has still never been hacked. That track record is part of what makes it a reliable store of value.

Read more: What is Proof-of-Work?

Bitcoin as a Store of Value (“Digital Gold”)

Gold—the asset—has been around for thousands of years. And Bitcoin? Just over a decade. But comparing the two is actually quite common, and for good reason.

Both Bitcoin and gold are scarce. They’re durable. They’re hard to fake. That’s why many call Bitcoin “digital gold.” You can’t just print more, like with fiat currencies. It has limited supply. But you don’t need a vault to store it like you do with gold. Just a secure wallet and a backup phrase.

People can use Bitcoin to safeguard their assets when they don’t trust banks or fiat currencies. It’s more attractive to some investors, since inflation can make traditional financial systems wobble. That’s how it’s earned its place as a modern hedge against chaos.

Bitcoin as a Medium of Exchange

Bitcoin’s no longer just an investment opportunity. Nowadays, you can actually spend it, too. As it becomes more widely accepted, it’s proving itself as a real medium of exchange—not just a store of value.

You can use it to buy flights, laptops, VPN services, coffee, and so much more. Major retailers and payment processors are starting to support crypto payments directly or through third-party apps.

Sure, price fluctuations make some merchants cautious. But the amount of businesses that are accepting Bitcoin is growing and growing. After all, there are no banks, and no currency conversions necessary—just digital money that works across borders, on your own terms.

Global Accessibility and Permissionless Nature

There’s no need for a bank account, or a bank, for that matter. You just need an internet connection and a wallet to use Bitcoin. It’s open to anyone, anywhere. Whether you’re in New York or Nairobi, you can send and receive BTC. No gatekeepers. No forms to fill. No approvals.

That’s a big deal in places with broken financial systems. Billions of people across the world are underbanked. Bitcoin gives them access to global value transfer and opens the door to decentralized finance, instantly and freely.

No one can block your account. No one can freeze your funds. That’s the power of a truly open financial tool.

Transparency and Trust Through Code

You don’t need to trust a bank when you use Bitcoin. You can see everything for yourself. Every single transaction is recorded, immutably, on a public ledger. Anyone can verify it. There are no backdoors. No funny business. Just raw data, and cryptographic algorithms doing their thing.

The rules are open-source. The code is public. You can inspect how Bitcoin works for yourself, anytime. That kind of transparency creates trust, all without needing a central authority.

You don’t have to wonder if someone’s printing extra coins. You can go check for yourself, and prove that they’re not.

Who Gave Bitcoin Value?

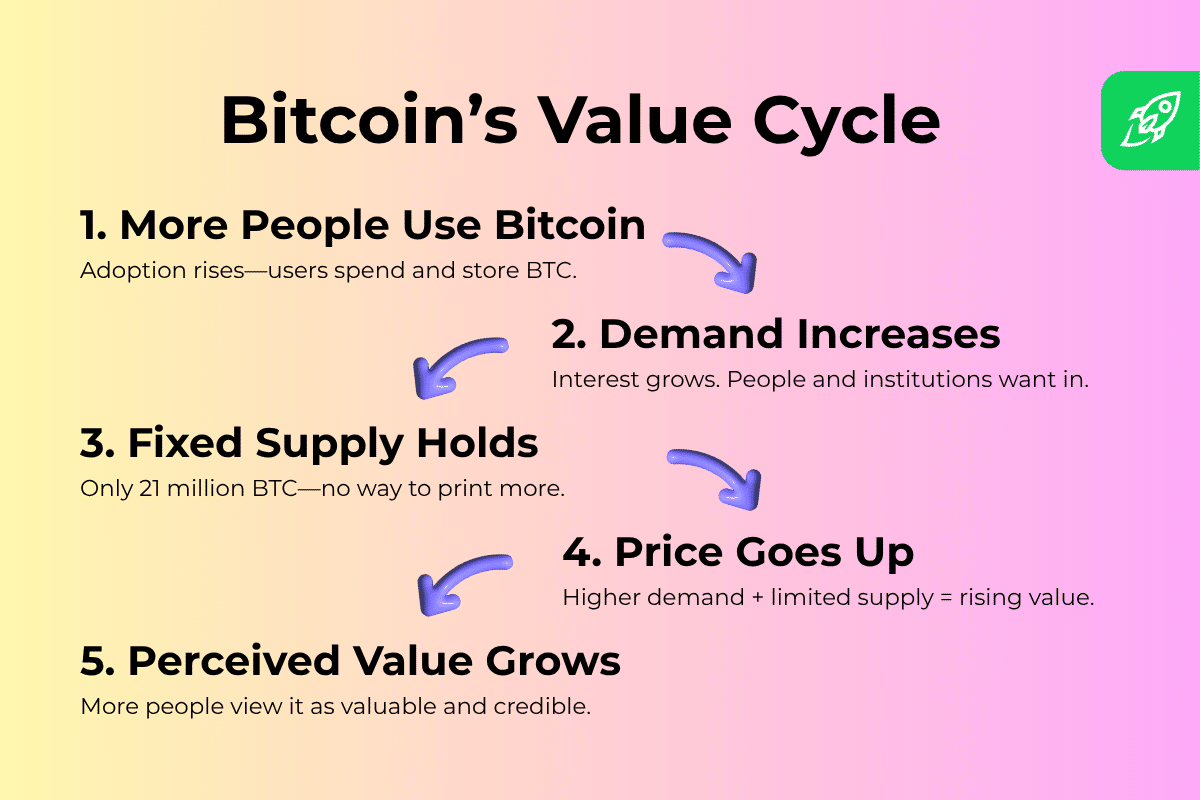

Bitcoin barely cost anything when it first appeared. So who exactly made it so valuable today? The answer: people started using it, and it acquired value in the process.

In 2010, the first real Bitcoin transaction happened when developer Laszlo Hanyecz paid 10,000 BTC for two pizzas. After this moment, it was no longer just an internet plaything, but something with worth in the real world.

From there, more and more early adopters began steadily using and promoting Bitcoin in business. For example, Overstock.com became one of the first major retailers to accept BTC in 2014, proving the digital currency could work at larger scales.

As more and more people started buying and spending BTC, demand rose—while the supply stayed fixed. This imbalance of limited supply and increasing demand pushed up its price. The more people and companies used it, the more of it others wanted. This kept driving up its value.

So BTC’s current price wasn’t assigned by decree. It was earned—by the people, businesses, and networks who have put it to work.

Why Bitcoin Has an Advantage Over Other Cryptocurrencies

But Bitcoin isn’t the only digital asset on the market anymore. Thousands of cryptocurrency tokens exist today. Still, it manages to lead the pack—and not just because it’s the oldest.

Its advantage is down to various factors, including trust, its track record, and its underlying technology. New coins might offer fancier features, but most haven’t stood the test of time like Bitcoin has. Let’s break down why this coin still holds the crypto crown.

The First-Mover Advantage and Network Security

Bitcoin was the first—and that’s a serious advantage. It built the largest, most secure decentralized network in the history of crypto. More users. More miners. More nodes. That scale makes it hard to attack or manipulate.

Other coins are trying to catch up, but Bitcoin’s headstart means deeper liquidity, broader adoption, and stronger infrastructure.

The Lindy Effect: The Longer Bitcoin Exists, the Stronger It Becomes

The Lindy Effect claims that the longer something’s already existed, the longer it’s likely to keep going. Well, Bitcoin’s already been running since 2009, through plenty of crashes, bans, and constant media cycles. And each passing year it survives, trust grows. That track record gives it a kind of financial gravity. Investors, institutions, and even critics treat it differently than newer crypto tokens.

Why Bitcoin Is More Resistant to Manipulation Than Altcoins

There’s some kind of face behind most altcoin projects—a founder, a foundation, a company. Bitcoin doesn’t have that. There’s no CEO. No board. That means it’s more independent. With no central point of failure and a massive circulating supply, it’s highly resistant to pump-and-dump schemes and backroom dealings.

It’s slow to change, and that’s by design. That’s what keeps it honest.

Criticisms of Bitcoin’s Value

Bitcoin’s got fans, but plenty of critics, too. Some call it volatile. Others call it wasteful. And many more claim that, nowadays, other cryptocurrencies can do its job better.

These issues aren’t just noise—they’re worth hearing out if you want the whole picture. So let’s take a closer look at what the skeptics say.

Volatility and speculation

Bitcoin’s price chart over the past five years is like a rollercoaster. It’s climbing one month and crashing the next. That sort of price movement scares off a lot of investors. It also feeds the idea that the coin’s value is driven more by speculation than actual utility.

On top of that, the cryptocurrency market is still young. News, changing regulations, and internet hype can trigger massive swings. That means the price of BTC isn’t always tied to fundamentals. Instead, it can react quickly, and sometimes irrationally.

It’s true that the long-term trends are pointing up. But in the short-term, it’s often chaotic.

Environmental concerns

Mining Bitcoin takes energy. A lot of it. This is because the Bitcoin network relies on Proof-of-Work consensus, where miners compete using more and more powerful machines to validate transactions, securing the chain. All that computation burns electricity.

Critics argue that this sort of increasing power usage is bad for the environment, and highly wasteful. Some governments, such as China, have even banned mining due to this high energy consumption, while others are pushing for greener alternatives. Either way, the environmental debate is complex, and isn’t going away anytime soon.

Comparisons to other cryptocurrencies

Bitcoin isn’t the fastest crypto, and it’s definitely not the cheapest. It doesn’t support smart contracts, either, like Ethereum or other chains. So why stick with it?

Critics claim that newer digital currencies already offer better tech, lower fees, and more flexibility. Some coins process thousands of transactions per second. Bitcoin can process around seven.

But Bitcoin wasn’t built for bells and whistles. It was built as sound money—simple, secure, and slow to change. While other cryptocurrencies evolve quickly, they often trade stability for their speed. Bitcoin’s strength is that it doesn’t try to do everything. It just tries to do one thing well. And for many, that’s good enough.

What Drives the Price of Bitcoin?

The price of BTC isn’t magic. Like any asset, its value comes down to supply and demand. The supply is fixed—only 21 million will ever exist. So when there’s an increase in demand, rising prices usually follow.

But there’s more. News, regulation, media coverage, and institutional investors all play their roles. Then there’s sentiment. When people feel bullish, they buy. When they panic, they sell. It’s part emotion, part economics—and always in motion.

Will Bitcoin Hold Its Value?

That’s the billion-dollar question.

Supporters say yes—because of its limited supply, growing adoption, and rising trust. They see it as sound money in a world where governments keep printing more and more.

Skeptics aren’t so sure. They point to price fluctuations, the risks of blockchain technology, and possible regulation as reasons the coin might lose steam. It’s not backed by any authority, and that makes some investors nervous.

But here’s the thing: Bitcoin has already outlived dozens of doomsday predictions over the years. It’s been through bubbles, bans, crashes—and it just keeps bouncing back. Will it hold its value forever? No one knows. But it’s held strong for over a decade, and there’s more than luck behind that.

Conclusion: Why Bitcoin’s Value Is Here to Stay

Bitcoin isn’t just valuable because someone said it should be. It’s valuable because it works—and keeps working. It’s scarce. It’s secure. It runs without needing banks, borders, or permissions. It gives you total control over your assets in a way fiat currencies can’t.

Yes, it’s volatile, and has its critics. But it’s also got serious staying power. People have used Bitcoin to save, spend, and survive in failing economies for more than a decade now. Institutions have poured in. Countries have taken notice.

Bitcoin’s value wasn’t an easy success. It’s an earned victory. One block, one use case, one believer at a time. And as long as people keep choosing it, that value isn’t going anywhere.

FAQ

Can Bitcoin lose all its value?

It’s highly unlikely. As long as people use and trust it, BTC will still hold some value. Total collapse would require global, permanent loss of market demand.

Is Bitcoin too expensive to buy?

Actually, no! You can buy fractions of Bitcoin, called “satoshis,” down to 0.00000001 BTC. You don’t need to afford a whole coin. Most exchanges let you start with $10 or less.

Can Bitcoin be hacked?

The Bitcoin network has never been hacked. It’s secured by computational power and cryptographic algorithms. Most hacks target exchanges or users, not the blockchain itself.

Why is Bitcoin compared to gold?

It’s because it shares several key traits with the precious metal. Bitcoin’s scarcity, durability, and use as a store of value are why it’s called “digital gold”. But Bitcoin beats gold in speed, divisibility, and portability.

Will Bitcoin ever replace traditional money?

It’s not likely. But Bitcoin doesn’t need to replace it to matter—it can act as an alternative or backup, especially in places with unstable currencies or limited financial access.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post Why Does Bitcoin Have Value? appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly