What Is Self-Custody in Crypto? A Simple Guide for Beginners

Here’s an interesting fact: Most people don’t lose their crypto to hackers, but to bad custody choices. You buy Bitcoin, store it somewhere, and assume it’s safe—but that safety can be fragile. This guide explains what self-custody is in crypto, how a crypto wallet really works, what happens to your private keys, and how these elements shape security, freedom, and risk in the crypto ecosystem.

What Is Self-Custody in Crypto?

Self-custody means you control your crypto, not a company, a wallet app, or some other platform. When you use self-custody, you’re the one holding your private keys, which gives you direct access to your digital assets on the blockchain. There are no middlemen who control anything “for you”, and no external approvals needed to do what you want with your coins. No one can freeze or move your funds without your consent.

With self-custody, you hold all the keys—and all the responsibility. That control comes with freedom, but also risk. If you lose access to your keys, nobody can restore them. But if you protect them well, nobody can take your funds. It’s where the popular saying comes from: “Not your keys, not your coins.”Self-custody is deeply rooted in crypto, which was designed to remove the reliance on banks and other traditional financial institutions. Bitcoin launched in 2009 as a response to the 2008 financial crisis, when trust in centralized systems collapsed. Its core idea was simple: give people direct ownership of money without intermediaries. To this day, this remains the core goal of self-custody.

Key Concepts in Self-Custody

Before you can use self-custody safely, you need to understand its essential building blocks. These concepts explain how control, access, and ownership work in crypto.

- Private keys.

A private key is a secret number that proves ownership of your digital assets. Whoever controls it controls the funds. There is no approval step and no help if you try to recover what you’ve lost. - Public keys and addresses.

A public key is created from your private key. It generates your wallet address, which others use to send you crypto. Remember that sharing this is safe. It doesn’t give spending access. - Transactions.

A transaction happens when your crypto wallet uses its private key to sign a transfer. The network verifies that signature and records it permanently. Once confirmed, it cannot be reversed. - Seed phrase.

A seed phrase is a human-readable backup of your private keys, usually 12 or 24 words. Anyone with it can access your funds. Lose it, and recovery becomes impossible. - Control and responsibility

Self-custody gives you full control. There are no intermediaries, but also no safety net. Security becomes your sole responsibility, not any company’s.

How Self-Custody Works (Private Keys and Seed Phrases)

Self-custody works by giving you full control over your private keys, which means only you can access and move your crypto. Let’s take a look at each step of that process in more detail.

- A private key is created.

Your crypto wallet generates a private key. This is a long, random number that proves ownership of your crypto. Whoever controls it controls the funds. - A public key and address are derived.

The private key creates a public key, which then generates your crypto wallet address. This address is safe to share. It lets others send you crypto, but it cannot spend anything. - Your wallet stores and uses the key.

The wallet holds your private key and uses it to sign transactions. The key never leaves the wallet. It simply proves that you authorized the action. - A seed phrase backs everything up.

The wallet also creates a seed phrase, usually 12 or 24 words. This phrase can recreate all your private keys. If your device breaks or disappears, the seed phrase restores access. - Transactions are signed and sent.

When you send crypto, the wallet signs the transaction locally using your private key. The network checks the signature with your public key, and records it permanently. - There is no undo button.

Once confirmed, the transaction cannot be reversed or appealed. Because of this, if your seed phrase is lost or exposed, your funds are as good as gone.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Self-Custody vs. Custodial

With self-custody, you manage your crypto directly. With custodial wallet services, a third party does it for you. That one choice changes how access, risk, and ownership work.

Read more: Custodial vs. Non-Custodial Wallets

Pros and Cons of Self-Custody

Self-custody gives you real ownership, but it also means you’re the one responsible for everything. That tradeoff matters, and you should understand it before committing funds.

When Should I Start Using Self-Custody?

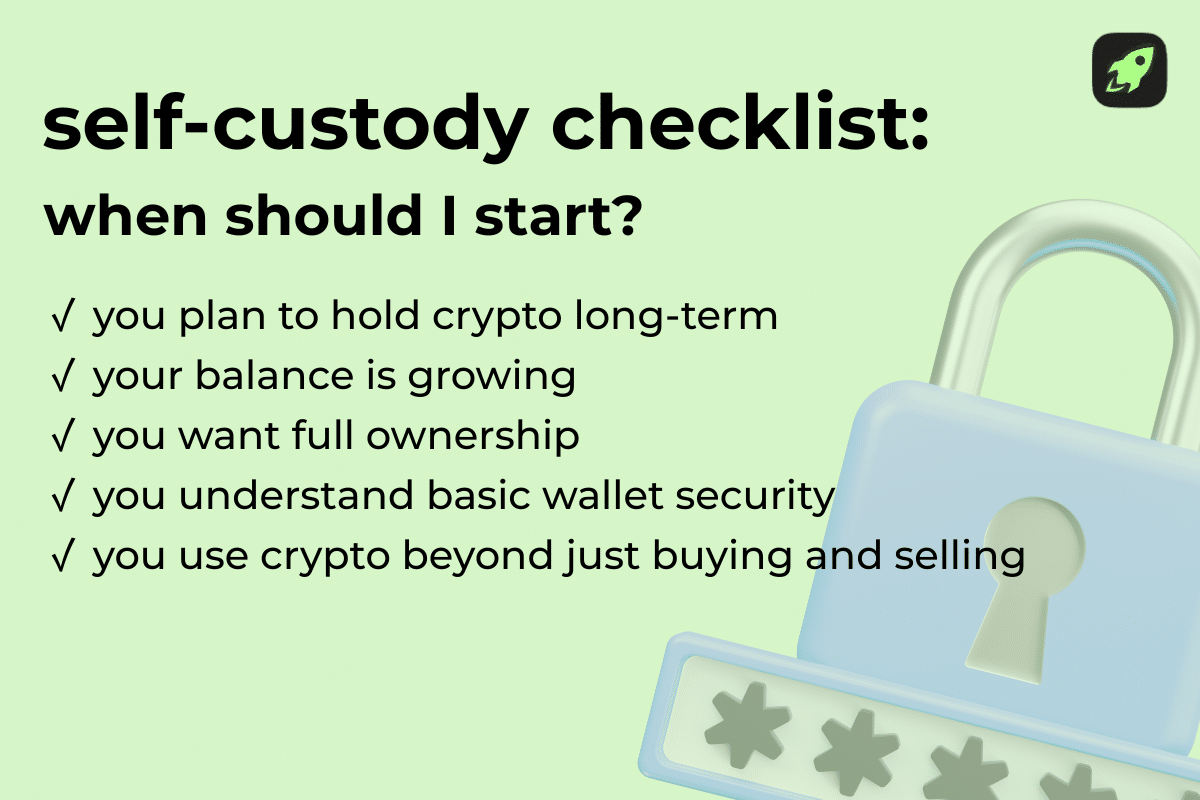

You should start using self-custody when you want real ownership of your crypto and are ready to take responsibility for it. There is no one perfect moment. The right time depends on how much you hold, how often you transact, and how comfortable you are managing security yourself. Here are some common “tells” that it’s time to think about using self-custody.

- You hold crypto long-term.

If you plan to keep Bitcoin or other assets for months or years, self-custody reduces exposure to exchange failures and account freezes. - You’ve moved past small experiments.

Once your balance grows beyond what you’re comfortable losing, relying on a third party becomes risky. - You want real ownership.

Self-custody gives you direct access to your assets without permission from a platform or service provider. - You understand basic wallet security.

If you know how to store a seed phrase and protect your device, you’re ready to manage your own setup. - You use crypto beyond buying and selling.

If you interact with decentralized apps, move funds between networks, or manage multiple assets, self-custody becomes necessary.

Is a Self-Custody Wallet Safe?

It’s safe if you use it correctly. That safety comes from removing any third parties that could gain access to your funds. Self-custody removes exposure to exchange hacks, frozen accounts, and platform failures. No company can lock you out or move your funds. That already removes a major source of loss in crypto history.

Instead, the risk shifts to how you manage security. Malware, phishing, and careless backups can still do damage. If your device is compromised or your recovery phrase leaks, funds can disappear fast. There is no support desk to reverse mistakes, and all the responsibility is on you.

A strong setup adds extra layers of security to help with this. Many people use a hardware wallet for long-term storage and keep only small amounts in a software wallet for daily use. This adds distance between attackers and your assets.

What Mistakes Should I Avoid with Self-Custody?

Most losses in self-custody don’t come from hackers. They come from simple mistakes. Avoiding these common errors can protect you from permanent loss.

- Storing your seed phrase digitally.

Screenshots, cloud notes, emails, or password managers are risky. If your device gets compromised, your funds can vanish. - Losing your backup.

If you lose your seed phrase and your device fails, recovering your assets becomes impossible. Always keep a secure physical backup. - Keeping everything in one place.

Storing your wallet and backup together creates a single point of failure. Separate them physically. - Skipping test transactions.

Always send a small amount first. One wrong address or network can cost you everything. - Trusting random links or messages.

Phishing attacks often look incredibly realistic. Never enter your recovery phrase anywhere except inside your wallet during setup. - Using one device for everything.

A compromised phone or laptop can expose your wallet. Dedicated or clean devices reduce risk. - Assuming you can fix mistakes later.

Blockchain transactions are final. There is no undo button.

How to Store Crypto Safely with Self-Custody

Safe self-custody comes down to good habits, not tools. The right setup reduces risk long before something goes wrong. Here are a few tips to get you started:

- Use a hardware wallet for long-term storage.

A hardware wallet keeps your private data offline. This protects your assets from malware and remote attacks. It’s the safest option for holding larger amounts. - Keep your seed phrase offline and keep it secure.

Write it on paper or engrave it on metal. Never store it on a phone, cloud drive, or computer. Digital copies create easy attack paths. - Use secure physical storage.

Store backups in a fireproof and waterproof location. Consider using two locations to reduce single-point failure. - Separate access from storage.

Don’t keep your hardware wallet and recovery phrase together. If someone finds both, security is gone. - Test recovery before trusting it.

Recover your wallet using the seed phrase on a clean device. Confirm it works before storing real value. - Limit exposure.

Keep spending funds in a software wallet. Keep long-term holdings in cold storage. - Protect your devices.

Use strong passwords, device encryption, and updates. Treat every device as a security boundary.

Types of Self-Custody Wallets

Almost all self-custody wallet types work in essentially the same way. Still, each type balances security, convenience, and risk differently. Let’s take a look.

Hardware Wallets

This is a physical device built to store your crypto securely offline. It keeps sensitive data isolated from the internet, which makes remote attacks far harder. Transactions are signed internally, so secret information never touches your computer or phone. Even if your laptop has malware, the wallet stays protected. Hardware wallets work best for long-term storage. Many people use them to protect larger amounts and only connect them when they need to move funds.

Read more: What Is a Hardware Wallet?

Software Wallets

A software wallet runs on your phone or computer. It connects to the internet, which makes it a type of hot wallet. That makes it easy to use but also increases exposure to threats. These wallets are popular for daily activity. They let you send, receive, and interact with apps quickly. Most people use them for smaller balances or frequent transactions. They trade convenience for higher risk.

Paper Wallets

A paper wallet is a physical copy of your seed phrase or private key, usually printed or written down. That makes it a type of cold wallet. It contains the information needed to access your funds without any digital storage. This method removes online attack risk, but it introduces physical risk. Paper can burn, tear, fade, or be lost. If someone finds it, they can take everything. Paper wallets work only if stored extremely carefully. Today, they are less common, but some still use them for deep cold storage.

Final Thoughts: Is Self-Custody Right for You?

Self-custody gives you real ownership, real control, and real responsibility. It removes middlemen and puts you in charge of your assets. If you value independence, understand the basics, and are willing to protect your setup, self-custody is worth it. If not, start small and learn first.

FAQ

Is self-custody only for people with large amounts of crypto?

No. You can use self-custody at any level. Many people start with small amounts to learn how wallets work before storing larger balances.

How can I tell if a wallet is custodial or non-custodial?

If the service holds your keys or can freeze access, it’s custodial. If you control the recovery phrase and no one else can access your funds, it’s a non-custodial wallet.

Can I use both a custodial exchange and a self-custody wallet?

Yes. Many people buy or trade on exchanges, then move funds to self-custody for storage. This balances convenience with control.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post What Is Self-Custody in Crypto? A Simple Guide for Beginners appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly