What Is Nominated Proof-of-Stake (NPoS) and Why Do We Need It?

Mining proved that consensus can work, but not that it must waste energy. NPoS, or nominated proof-of-stake, takes the same goal—agreeing on valid transactions—and makes it collaborative. It’s a modern model that combines fairness, transparency, and efficiency—one that’s already powering ecosystems like Polkadot and Kusama.

What Is Nominated Proof-of-Stake (NPoS)

Nominated proof-of-stake (NPoS) is a type of proof-of-stake (PoS) consensus mechanism where token holders take an active role in securing the network. Instead of running a node themselves, these network participants—called nominators—choose trustworthy validators who create and verify new blocks.

Both sides share rewards and penalties, which keeps everyone aligned. The more tokens you bond, the more weight your vote carries. This setup makes NPoS work as a democratic and transparent process where reputation, trust, and performance matter. It’s how Polkadot, Kusama, and other Substrate-based networks keep their ecosystems secure and fair.

What Makes NPoS Different from Other Proof-of-Stake Systems

While NPoS is built on the same foundation as proof-of-stake (PoS), it takes a different approach to fairness and validator selection. In traditional PoS, anyone can run validator nodes by staking tokens—the higher the stake, the higher the chance to validate.

NPoS changes this by letting token holders nominate validators, and only validators with broad community backing join the validator set. Unlike delegated proof-of-stake (DPoS), where a small, fixed group controls validation, NPoS keeps hundreds of validators active. This design creates a more decentralized system that avoids centralization risks common in traditional proof-of-stake and DPoS models.

Read also: What Is Delegated Proof-of-Stake (DPoS)?

Common PoS Challenges That NPoS Solves

Classic proof-of-stake systems face issues like uneven power distribution and weak incentives for fairness.

Nominated proof-of-stake addresses these using game theory and discrete optimization to create balance among validators.

The network’s algorithm spreads nominations evenly to improve network security and prevent dominance by a few large players. It also minimizes energy consumption by replacing competition with cooperation. Most importantly, it ensures fair representation, giving smaller participants a role through nomination pools and transparent elections.

This blend of math and social trust keeps the network stable, secure, and inclusive for all.

How NPoS Works (Step by Step)

The nominated proof-of-stake (NPoS) model uses a structured election process where nominators and validators work together to secure the network. Let’s break it down step by step.

Bonding: How to Lock Tokens for Staking

Token holders bond their stake—locking tokens to participate in staking. On Polkadot, you can stake directly or join a Nomination Pool with as little as 1 DOT. Your bonded stake stays locked until you unbond it, ensuring commitment to network security.

Staking Election: Validator Selection Process

The staking election process determines the active validator set every era (which are 24 hours on Polkadot and 6 hours on Kusama). Elected nodes secure the network—they process and validate transactions, then package them into new blocks.

Each election cycle uses the Phragmén Method to select validators fairly from hundreds of candidates.

Phragmén Method: How Fairness Is Maintained

The Phragmén Method is a mathematical algorithm ensuring the system stays fair and efficient. It distributes nominators’ votes to keep validators’ backing balanced, preventing whales from dominating. Each process is transparent and verifiable on-chain.

Era and Session: Timeframes for Rewards and Elections

An era lasts 24 hours on Polkadot and 6 on Kusama, divided into smaller sessions (4h and 1h). Validators create new blocks, earning Era Points for uptime and reliability.

Reward Distribution: How Staking Rewards Are Shared

Validators earn staking rewards for good behavior—acting honestly and staying online. These rewards are shared with users (nominators) based on stake proportion. The average Polkadot yield is ~14% nominal and ~5–6% real after inflation.

Slashing: Penalties for Misbehavior

When validators display misbehavior or bad behavior, like double-signing or downtime, they’re slashed. This protects the network from attacks and keeps it securing blocks safely.

Unbonding Period: How Withdrawals Work

Unstaking triggers an unbonding period—28 days on Polkadot, 7 on Kusama. During unbonding, your funds remain on the chain, but you can’t transfer them until full validation and verifying transactions are complete. This delay discourages sudden exits and strengthens the network.

Benefits of NPoS

The nominated proof-of-stake (NPoS) model combines decentralization, efficiency, and user participation. Here’s what makes it stand out:

Security Through Distributed Stake

Stake is spread across many validators: More than 297 validators on Polkadot and around 1,000 on Kusama keep the network secure. Because nominators share both rewards and penalties, validators stay responsible and motivated to act honestly.

Energy Efficiency and Sustainability

NPoS is highly energy-efficient, since there’s no mining or hardware race. Validators take turns creating blocks, keeping costs and power use low.

Decentralization and Inclusivity

With hundreds of validators and Nomination Pools, anyone can support the network. Even users with small balances can join staking with 1 DOT or less.

Efficiency and Transparency

Automatic stake balancing keeps the system efficient, while all validator actions and rewards are visible on-chain. The algorithm ensures fair stake backing across participants.

Risks and Limitations of NPoS

Like any consensus system, nominated proof-of-stake (NPoS) has trade-offs you should understand before staking.

Financial Risk from Shared Slashing

Both validators and nominators face financial risks. If a validator displays bad behavior—like going offline or signing two blocks—everyone backing them loses a share of their stake.

On Polkadot, penalties range from 0.1% to 100%, depending on severity. This rule keeps validators accountable but exposes nominators to shared losses.

Technical Risk and Node Reliability

Each validator runs one or more nodes to stay connected. Hardware failure, slow updates, or poor uptime reduce rewards for all participants. This is why choosing reliable validators matters.

Minimum Stake and Accessibility

A minimum stake is required to earn rewards directly. On Polkadot, it changes dynamically but can reach several dozen DOT. Smaller users can still join through Nomination Pools, but direct access remains limited for some.

Illiquidity During the Unbonding Period

When you unstake, funds enter a 28-day unbonding process on Polkadot (7 on Kusama). During this time, you can’t move your tokens, which adds a short-term liquidity risk to the system.

Real-World Examples of NPoS

The nominated proof-of-stake (NPoS) model is used most notably in Polkadot and Kusama, two connected networks built on Substrate. They share the same design but serve different purposes—Polkadot for stability, Kusama for experimentation.

Polkadot

Polkadot currently runs with 600 active validators, selected from over 1,200 candidates each era. Exactly 22,500 nominators stake their tokens to secure the network. Roughly 50% of all DOT is staked, generating an average 14% nominal reward, or about 5–6% real yield after inflation. Validators produce new blocks every 6 seconds, maintaining fast and reliable block times.

Kusama

Kusama, Polkadot’s canary network, uses the same NPoS process but operates faster. It has around 1,000 active validators, 6-hour eras, and a 7-day unbonding period. Because it’s more experimental, yields fluctuate between 12–18%, depending on total stake. Kusama’s open governance and rapid upgrades make it a live testbed for future Polkadot innovations.

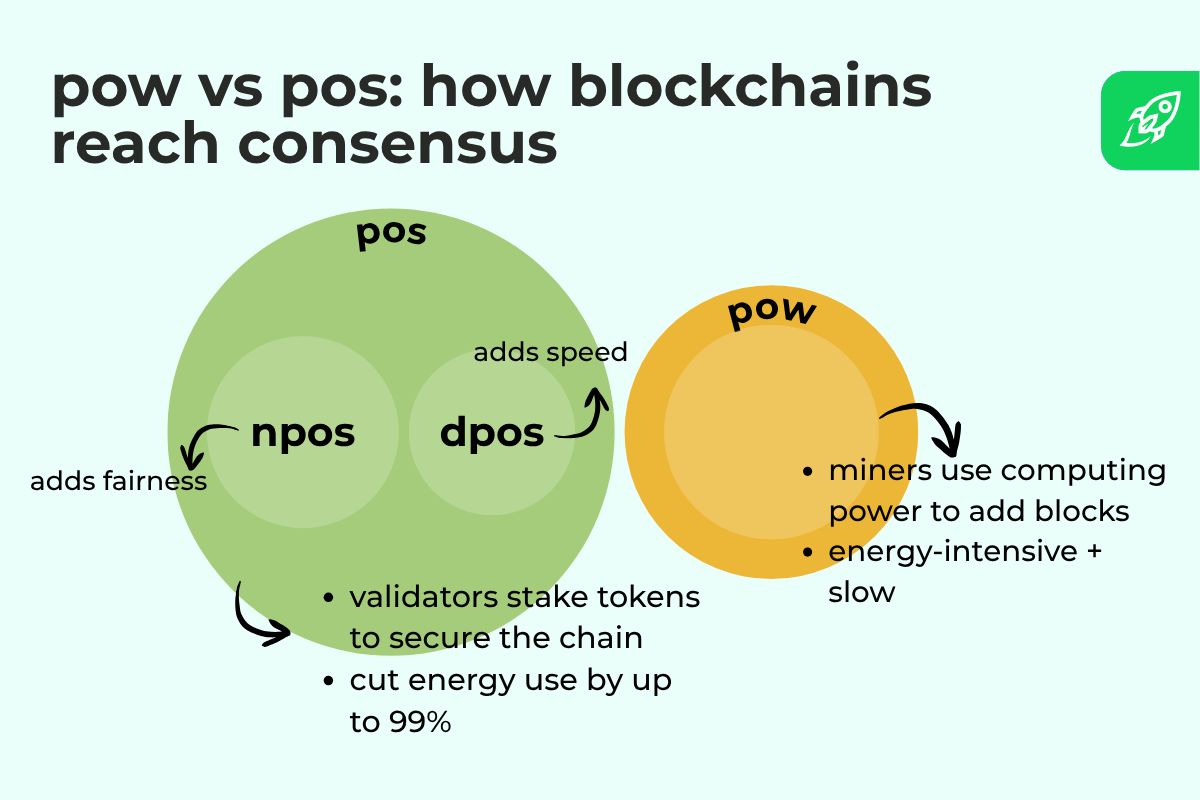

NPoS vs. Other Consensus Mechanisms

Every blockchain needs a consensus mechanism to agree on valid transactions. Nominated proof-of-stake (NPoS) belongs to the proof-of-stake (PoS) family but adds its own fairness and accountability layer. Here’s how it compares to other major models.

NPoS vs. Delegated Proof-of-Stake (DPoS)

In delegated proof-of-stake (DPoS), users vote for a small, fixed group of delegates—often 21–30 validators—who handle all block production. This can lead to centralization and vote trading.

NPoS, by contrast, runs with hundreds of validators and uses algorithmic elections instead of direct popularity votes. Nominators share both rewards and penalties, encouraging good behavior and fairer validation.

DPoS systems prioritize speed above all, while NPoS focuses on security and balance.

NPoS vs. Traditional Proof-of-Stake (PoS)

In standard proof-of-stake, validators are chosen randomly and weighted by stake—no community input is required. NPoS replaces randomness with mathematical elections (via the Phragmén Method) that distribute stake evenly. Both models are energy-efficient, but NPoS achieves stronger decentralization and more predictable validator turnover.

NPoS vs. Proof-of-Work (PoW)

Proof-of-work secures the network through physical cost—miners use vast computing power to add blocks. NPoS replaces that cost with economic proof: staked tokens. It requires minimal energy and produces blocks every few seconds.

While PoW guarantees safety through expense, NPoS achieves it through stake-based trust and community accountability—a far more efficient and sustainable consensus process for modern blockchain networks.

Final Thoughts

NPoS makes blockchain technology fair, stable, and efficient. Instead of machines competing, users work together to protect the network.

It’s a simple idea with lasting value, and one that rewards honesty, punishes risk, and keeps decisions transparent. This balance is what makes the system strong.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post What Is Nominated Proof-of-Stake (NPoS) and Why Do We Need It? appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly