What Is a Fork in Crypto?

A fork is one of the most common—and misunderstood—events in crypto. You hear about forks when blockchains upgrade, split, or create new coins. But what actually happens under the hood? And what does it mean for you as a user or investor? This guide explains forks in simple terms, shows why they happen, and helps you understand when they matter, and when they don’t.

What is a Fork in Blockchain?

A blockchain fork happens when a blockchain changes how it operates. You can think of it as an update to the blockchain protocol. Every blockchain follows a protocol made of strict protocol rules. These rules live in the blockchain’s code and its underlying code.

When developers introduce a protocol upgrade, they add new rules. If everyone agrees, the original blockchain continues smoothly. If not, the network can split. This is how forks form.

Bitcoin offers a clear example. The original bitcoin blockchain followed one rule set. Later upgrades challenged that model. At first, there is one blockchain and one original coin. After a fork, different versions may exist at the same time.

You can review how protocols define forks in official documentation, such as the Bitcoin developer guide.

Types of Forks

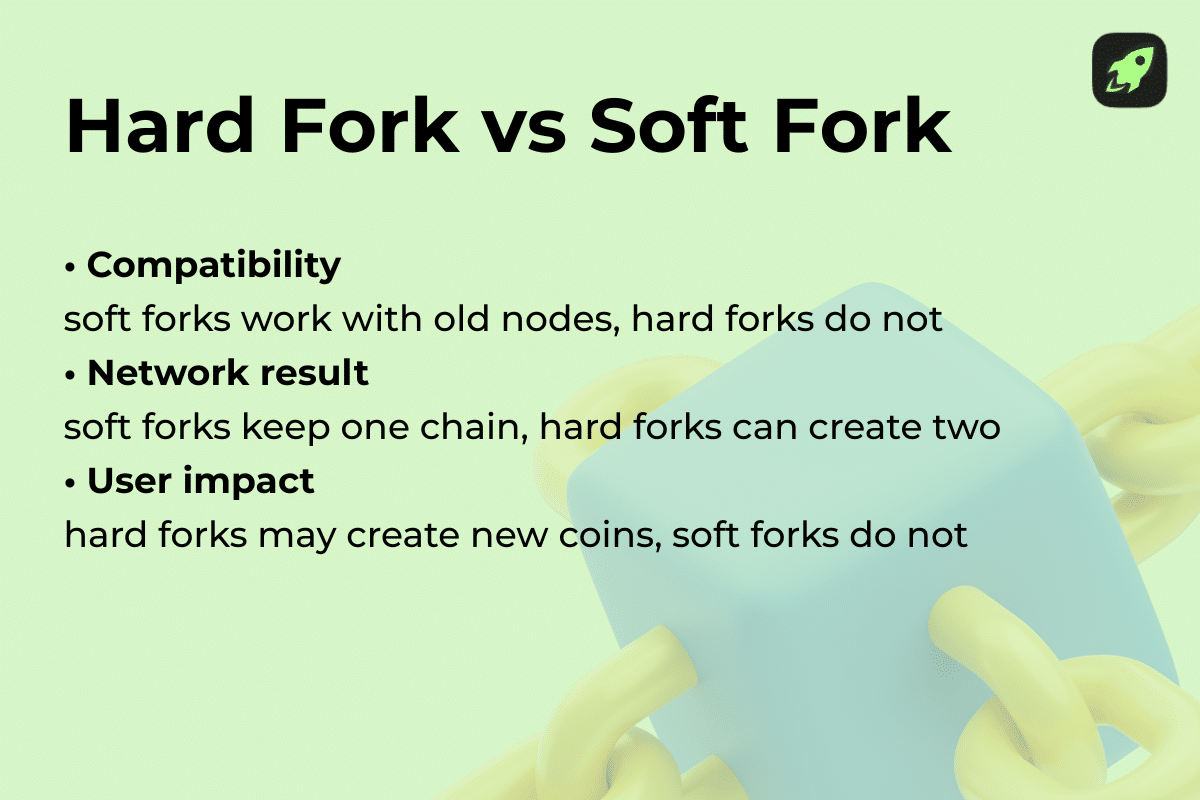

Blockchain networks use different types of forks to change or maintain the system. The two main categories are hard and soft forks.

You may also see hard and soft used together to describe upgrade paths. Over time, many forks appear as networks evolve. Some forks add features. Others fix risks. Each fork type affects users differently. You need to know which fork changes rules and which keeps compatibility.

Hard Fork

A hard fork introduces fundamental changes to a blockchain’s rules. Developers release a new protocol or a new version that old software cannot follow. This creates an entirely new blockchain. After the split, there are separate blockchains with two separate blockchains running side by side. They operate independently and can run simultaneously. Nodes must upgrade to stay compatible. If they do not, they remain on the old chain.

Example: Bitcoin → Bitcoin Cash

The bitcoin cash hard fork is the clearest real-world case.

Launched in August 2017, it created the bitcoin cash blockchain from bitcoin. Split supporters wanted bigger blocks. They argued this aligned better with the bitcoin protocol vision of cheap payments. Others preferred keeping the original bitcoin rules. The disagreement triggered a permanent split. Bitcoin Cash increased block size to 8 MB, Bitcoin kept smaller blocks. Both networks continued from the same history.

What changes and why it is incompatible

A hard fork changes core rules of the network. These new rules affect how blocks form, how transactions validate, or how limits apply. Because of this, forward compatibility breaks by design.

Nodes that follow old rules cannot understand blocks created under the update. Old nodes see those blocks as invalid. They reject them immediately. The network then splits at that point. From one shared history, two paths continue.

Each path enforces different rules. One chain follows the update. The other does not. This creates separate coins on each chain. You now have two separate coins, even though both started from the same history. In some cases, the fork launches a new coin or an entirely new cryptocurrency.

This incompatibility forces choice. Wallets, miners, and exchanges must decide which chain to support.

Without coordination, confusion follows. Bitcoin’s own documentation explains that incompatible consensus changes require a hard fork, not a soft one, because old software cannot safely adapt.

Soft Fork

A soft fork updates a blockchain without breaking existing rules. It introduces backward compatibility, so nodes that do not upgrade can still follow the chain. These updates focus on backward compatible changes. They add features through minor changes and minor adjustments, not radical redesigns. Developers implement minor rule tweaks that tighten validation. This approach keeps the network unified. You avoid chain splits while still improving the protocol.

Example: SegWit in Bitcoin

SegWit is a well-known soft fork on the bitcoin network. It changed how data fits into blocks on the bitcoin blockchain. By separating signature data, it improved transaction speed without increasing risk. SegWit also reduced pressure on block size limits and made the block size limit more flexible in practice. The upgrade activated in 2017 after community support.

What backward compatibility means

Backward compatibility means consensus rules stay valid for older software. Nodes running older versions still validate transactions correctly. Old nodes accept new blocks because they follow stricter rules, not conflicting ones. This lets the network upgrade smoothly. Users do not need to act immediately. Miners and nodes can update gradually. This makes soft forks safer and less disruptive than hard forks.

Accidental Forks & Chain Reorgs

Not all forks come from planned upgrades. Some happen by accident during normal network activity.

A chain reorganisation (reorg) occurs when two miners produce new blocks at nearly the same time. For a short moment, the network sees a split. Both blocks share the same history, but only one can survive. The block that loses becomes an orphan / stale block.

This has happened many times on Bitcoin and Ethereum. In 2013, Bitcoin experienced a short reorg caused by a software version mismatch. The network resolved it within hours. Users did not lose funds.

Blockchains resolve these events automatically through consensus. Nodes follow the longest valid chain. Mining pace and validation rules guide this process through difficulty adjustment. Once one chain grows faster, the other disappears.

In rare cases, a network partition can delay resolution, such as during outages or regional connectivity issues. Even then, the network converges once connections restore. Reorgs are expected behavior, not failures. Bitcoin’s developer documentation describes them as part of normal consensus mechanics.

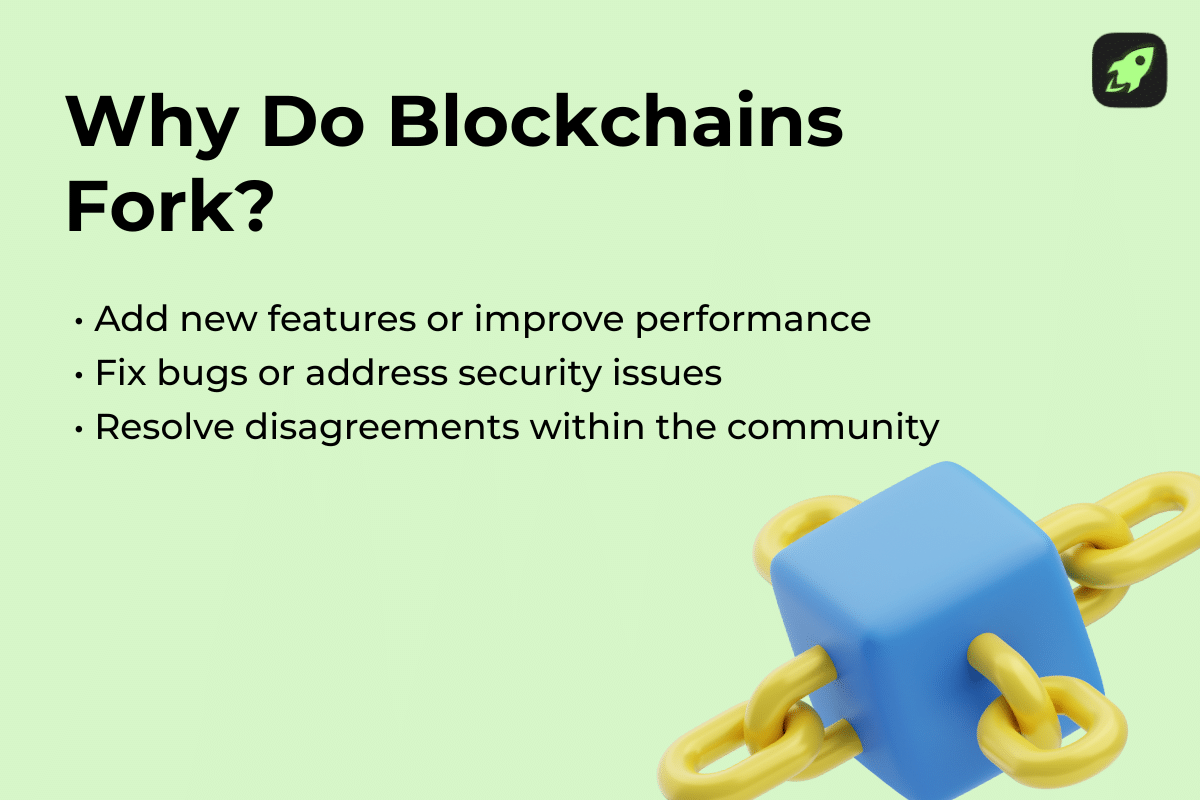

Does the Crypto Community Need Forks at all?

Yes, the crypto community needs forks. A protocol upgrade cannot ship without a fork. Forks unlock new features and new functionalities without restarting the system. They let a blockchain network evolve while staying decentralized.

Forks also reflect governance consensus. There is no central authority. Developers propose changes. Miners, nodes, and users choose whether to adopt them. That process played out many times inside the bitcoin community, from SegWit to Taproot.

Are Forks in Crypto Always Good?

No, forks are not always good. Forks can introduce security risks, especially when coordination fails. Poorly executed forks confuse crypto investors and fragment liquidity. This can hurt market cap in the short term. Each fork also creates a new digital asset, which may lack users, developers, or infrastructure.

That said, forks are not inherently bad. Successful forks fix flaws and unlock upgrades. Failed forks fade fast. Data shows this clearly. Most forked coins lose relevance within months, while only a few gain traction.

How Forks Get Activated

Forks do not activate by accident. Each upgrade follows a clear activation mechanism agreed on in advance. The most common approach uses miner or node signaling. The network watches a signalling threshold to measure support. Once enough participants signal readiness, the fork activates.

Modern blockchains often rely on version bits to track support. Nodes and miners flag readiness inside block headers. This method reduces risk and improves coordination. Bitcoin introduced this system with BIP9.

There are two main soft fork paths. A user-activated soft fork (UASF) lets nodes enforce new rules at a fixed point. A miner-activated soft fork (MASF) depends on miner signaling instead. Both methods use predefined checkpoints like block height activation or timestamp activation.

Governance proposals formalize this process. Bitcoin uses BIP documents; you can review official activation standards in Bitcoin Core documentation. Ethereum relies on EIP proposals working via Ethereum’s EIP registry.

What Happens to You as a Crypto Holder

As a crypto holder, a fork affects your assets directly. Coin holders usually keep access to funds on both chains. If the fork creates separate coins, you may receive new tokens on the new chain. This depends on wallet and exchange support.

Most forks use a snapshot to record balances at a specific block. Your balance at that moment determines what you receive. You must also watch for replay protection. Without it, a transaction on one chain can repeat on the other.

Examples in the Real World

Bitcoin Cash (2017)

Bitcoin Cash is a classic chain split example. In August 2017, Bitcoin split into two chains after a scaling dispute. This chain splits event created Bitcoin Cash as an altcoin via fork. The new chain increased block size to allow cheaper, faster payments. Bitcoin kept smaller blocks and focused on layered scaling. Both chains shared history up to the fork, then diverged permanently.

Ethereum Classic

Ethereum Classic formed after the DAO hack in 2016. The ethereum forks debate centered on reversing stolen funds. One group supported a rollback. Another defended immutability. The network split into Ethereum and Ethereum classic. Both chains still operate on the ethereum network principles but follow different philosophies.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

When Forks Can Be an Opportunity

Forks can create real opportunities for you. Some forks deliver upgrades and new features that improve speed, security, or usability. Others show community governance in action, where users influence the network’s direction.

In some cases, a fork creates a new coin. If you held the original asset, you may benefit from the creation of a new token at no extra cost. Bitcoin Cash is a clear example. These opportunities depend on adoption, liquidity, and long-term support. Not every fork succeeds, but some reward informed holders.

Risks and Challenges of Forks

Forks can divide people before they divide code.

Community disputes and splits often start over priorities, not bugs. When groups disagree, coordination breaks. That slows upgrades and weakens trust across the network.

Code risk comes next.

Technical bugs and unintended consequences appear when new rules activate. A small mistake in client software can invalidate blocks or freeze transactions. These issues usually surface early, when fewer users have upgraded.

Security risks matter most.

Replay attacks and double-spending risks happen when transactions work on both chains. Without strong replay protection, the same transaction can drain funds twice. This risk is highest right after a fork.

Finally, user mistakes cost money.

Losses due to poor wallet or exchange choice happen when platforms delay support or block withdrawals. If your service does not support the fork, your funds may stay locked.

Final Thoughts

Forks are not edge cases in crypto. They are how blockchains evolve. Some forks add features. Others fix risks. A few create lasting splits. As a user, you do not need to fear forks, but you do need to understand them. When you know how forks work, you make better choices. You protect your funds. You avoid panic. And you stay in control of your crypto.

FAQ

Do smaller cryptocurrencies also fork, or is it mostly Bitcoin and Ethereum?

Yes, smaller cryptocurrencies also fork. Forks happen on any blockchain with active development. The difference is scale. Smaller networks fork less often and attract less attention. Many forks on small chains pass quietly. The process works the same way, but the impact is usually limited to a smaller user base.

Could a fork make my existing crypto worthless if most people move to the new chain?

Yes, it can. If most users, developers, and exchanges move to the new chain, the old one can lose value fast. Liquidity dries up. Market interest drops. The coin may still exist, but demand may fall close to zero. This happened to several failed forked coins over time.

Can I lose my crypto during a fork if I do nothing?

Yes, you can. You risk losses if your wallet or exchange mishandles the fork. Funds can lock temporarily. Replay attacks can also drain balances if protections are missing. Doing nothing is safest only when your wallet confirms full fork support. Always check before major forks happen.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post What Is a Fork in Crypto? appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly