The Ugly

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The Ugly is the first of three essays. “The Good” will focus on the rise of political memecoins. “The Bad” will discuss how US crypto holders are at risk of getting cucked by the Trump administration regarding crypto regulatory policy.

Disclaimer: I am an investor in and advisor to Ethena, the parent company behind the $USDe stablecoin I mention several times in this essay.

“Stop – thirty-meter spacing on this face,” were the instructions from my guide as we abruptly slowed our pace skiing up a dormant volcano a few weeks back. It had been a very chill hike up the slope until that point. But at 1600 meters elevation, something changed.

When we stopped at the ridge line together, my guide said, “That last section made my stomach drop. The avalanche risk is too high, so we will ski from here.” I do not feel the same when detecting subtle yet profound changes in the snowpack. That’s why I always ski tour with a certified guide. What looked like an innocuous piece of terrain could have sealed me in a frozen tomb. One can never know if skiing over a particular aspect will trigger an avalanche. Still, if the perceived probability rises above one’s comfort zone, then it’s prudent to stop, reassess, and change course.

I told the world about my bullishness, at least in the first quarter, in my first essay of the year. But as we close out January, my giddiness has evaporated. Subtle movements between central bank balance sheet levels, the rate of banking credit expansion, the relationship between the US 10-yr treasury/stocks/Bitcoin prices, and the insane $TRUMP memecoin price action produced a pit in my stomach. This is a similar feeling I got in late 2021, right before the bottom fell out of the crypto markets.

History doesn’t repeat itself, but it does rhyme. I don’t believe this bull cycle is over; however, on a forward-looking probabilistic basis, I think we are more likely to go down to $70,000 to $75,000 Bitcoin and then rise to $250k by the end of the year than to continue girding higher with no material pullback. Therefore, Maelstrom has raised the amount of staked Ethena $USDe it holds to record levels and continues to take profits on several shitcoin positions. We are still bigly net long, but if my feeling is correct, then we will be positioned with copious amounts of dry powder ready to buy the dip on Bitcoin and a mega dip on many quality shitcoins.

A pullback of this magnitude would be ugly because the current level of bullishness is so high. Trump continues to say the right things via executive orders, improve sentiment by pardoning Ross Ulbricht, and stoke the degen crypto spirits with his recent memecoin launch. But these things were mostly expected, bar the memecoin launch. What is not being fully appreciated is the slowdown in filthy fiat creation in Pax Americana, China, and Japan. The rest of the essay will discuss the charts and monetary policy announcements that have caused me to decrease Maelstrom’s crypto holdings.

The US

There are two firmly held views that color my outlook on US monetary policy:

- The 10-year treasury yield will rise to between 5% to 6% and will trigger a mini-financial crisis.

- The US Federal Reserve governors hate Trump but will do what is necessary to safeguard Pax Americana’s financial system.

Let me explain the interplay between these two views.

10-year Treasury

The USD is the world’s reserve currency, and the US Treasury debt securities are the reserve assets. That means if you have a surplus of dollars, purchasing treasuries is the safest place to store them and earn yield. Treasuries are deemed risk-free by accountants, and therefore, financial institutions are allowed to borrow money and assets against them using almost infinite leverage. Finally, if the value of treasuries declines quickly, accounting fairytales will morph into economic nightmares, and systemically important financial players will go bust.

The 10-year treasury is the benchmark for which most medium- to long-term fixed-income instruments are priced, such as mortgages or car loans. It is the most important asset price in the filthy fiat system, which is why the 10-year yield is so important.

Given that every financial crisis since 1913 (the founding date of the Federal Reserve) was “solved” with printed dollars, the leverage has been compounding in the system for over a century. As such, the strike yield at which a large financial player goes under progressively lowers. We know that the entrance to Struggle Street is at 5% because when the 10-year briefly breached that level, Bad Gurl Yellen (former US Treasury Secretary) initiated a policy of issuing more and more treasury bills (T-bills) as a stealth form of money printing. The immediate result was a decline in the 10-year yield to 3.60%, this cycle’s local low.

If 5% is the level, why would yields rise from around 4.6% to over 5%? To answer that question, we need to understand who the large marginal buyer of treasury debt is.

As the world knows, the US is issuing debt at a pace unmatched in the empire’s history. The debt pile currently stands at $36.22 trillion, up from $16.70 trillion as of the end of 2019. Who is buying this dogshit?

Let’s go through the usual suspects.

The Fed – the Fed ran a money printing ruse called quantitative easing (QE) from 2008 until 2022. It bought trillions of dollars of treasuries. However, starting in 2022, it turned off the money printer go brrr machine, which is called quantitative tightening (QT).

US Commercial Banks – they got torched buying treasuries at all-time high prices right before getting rugged by transitory inflation and the Fed hiking rates at the fastest pace in 40 years. To add insult to injury, to follow pesky capital adequacy rules set down by Basel III, they cannot buy treasuries without pledging more expensive equity capital against them. As a result, their balance sheets are fully utilized, and they cannot buy more treasuries.

Major Foreign Surplus Nations – I’m talking about oil exporters like Saudi Arabia and goods exporters like China and Japan. As the dollars they earn from global trade balloon, they have not been buying treasuries. For example, China’s trailing trade surplus was $962 billion as of November 2024. Over the same time frame, China’s holdings of treasuries decreased by roughly $14 billion.

Given that there hasn’t been a debt crisis yet as the US stuffs treasuries down the throat of the world financial system, I ask again, who the fuck is buying this debt single-ply rough toilet paper? Whoever is buying this shit ain’t respecting their poopy hole.

Let’s give a round of applause to relative value (RV) hedge funds. These funds, which are domiciled in places like the United Kingdom, Cayman Islands, and Luxembourg for tax reasons, are the marginal buyers of treasuries. How do I know? The most recent treasury quarterly refunding announcement (QRA) named them specifically as the marginal buyer keeping a lid on yields. Also, if you peruse the monthly TIC report published by the Treasury, you will see the counties mentioned have amassed extensive holdings.

Here is how the trade works. As long as a cash treasury security trades cheaper than its corresponding listed futures contract, the hedge fund can arbitrage the basis. The basis is minimal, so the only way to make real money is to trade billions of dollars of notional. Hedge funds don’t have that kind of cash lying around, so they need to call on the help of the banking system to provide them leverage. The hedge fund buys the bond for cash but enters into a repurchase agreement (repo) with a large bank before it must deliver the cash. The hedge fund delivers the bond and receives cash. The cash is then used to pay for the bond purchase. Voila, the hedge fund buys the bond with other people’s money. The only money the hedge fund posts is the margin on a bond futures exchange like the Chicago Mercantile Exchange.

In theory, RV hedge funds can buy an infinite number of treasures assuming the following hold true:

- The banks have enough balance sheet capacity to facilitate repos.

- The repo yield is affordable. If it is too high, the basis trade becomes unprofitable, and the hedge fund will not buy treasuries.

- The margin requirements remain low. If the hedge fund must post more margin to hedge its bond purchases using futures contracts, it will buy fewer bonds. Hedge funds have a finite amount of capital; if a large percentage of it is tied up on the exchange, they will trade less.

The RV hedge fund buyer is endangered due to the factors listed above.

Banks Balance Sheet / Repo Yield:

Under Basel III, the balance sheet is a finite resource. Supply and demand dictate that the closer you get to exhausting the supply, the higher the price for space on the balance sheet becomes. Therefore, as the treasury issues more debt, the RV hedge funds conduct more basis trades, which require more repos, using more balance sheet, and at a certain point, the price of o/n repo spikes. Once that happens, buying abruptly stops, and a treasury market meltdown begins. For a detailed explanation of how this works at a fundamental money market plumbing level, I suggest you subscribe to Zoltan Pozar’s newsletters.

Exchange Margin Requirements:

Very simply, the more volatile the asset, the higher the margin requirement. Volatility rises when bond prices fall. If the bond prices fall / yields rise, volatility (look at the MOVE Index) spikes. When that happens, margin requirements on bond futures increase and bond buying by RV hedge funds decreases rapidly.

Both of these factors act upon each other in a reflexive manner. The question then becomes, is there a way to cut the Gordon knot using monetary policy and allow RV hedge funds to continue financing the treasury?

Of course, our monetary masters can always implement accounting gimmicks to solve a financial crisis. In this case, the Fed can suspend the supplemental leverage ratio (SLR). Suspending the SLR as it relates to treasury holdings and associated repos allows the banks to use infinite leverage.

The following would occur after an SLR exemption:

- Banks could buy as many treasury bonds as they liked without pledging any capital against them, freeing up space on the balance sheet.

- With an unencumbered balance sheet, banks can facilitate repos at affordable prices.

The treasury gains two more marginal buyers: commercial banks and RV hedge funds. Bond prices rise, yields fall, and margin requirements are reduced. Boom, happy days.

If the Fed feels really generous, it can stop QT and resume QE. That makes three marginal buyers.

None of what I wrote is news to the Fed or the Treasury. The banking community has been begging for years for an SLR exemption like the one they received in 2020 during the Flu-19 crisis. The most recent Treasury Advisory Borrowing Committee (TABCO) report explicitly stated they needed an SLR exemption and the Fed to start QE again to fix the plumbing of the treasury market. The only thing lacking is the Fed’s political will, thus bringing me to my second view.

The Political Fed

Statements by former and current Fed governors and the Fed’s actions during the Biden presidency led me to believe the Fed will do what it can to frustrate the Trump agenda. However, the Fed’s obstruction has a limit. If the failure of a large financial player or the solvency of the empire itself required changing banking regulations, lowering the price of money, or printing money, then the Fed would show no hesitation in acting accordingly.

What did they say about Trump?

Here are two quotes, the first is from former Fed governor William Dudley (president of the New York Fed from 2009 to 2018), and the second is from the beta cuck towel bitch boy himself, Powell:

U.S. President Donald Trump’s trade war with China keeps undermining the confidence of businesses and consumers, worsening the economic outlook. This manufactured disaster-in-the-making presents the Federal Reserve with a dilemma: Should it mitigate the damage by providing offsetting stimulus, or refuse to play along? … Officials could state explicitly that the central bank won’t bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions…. There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives.

– The Fed Shouldn’t Enable Donald Trump, William Dudley

In response to a question about how the Fed was approaching the recent Trump victory at the policy meeting press conference, Powell said, “some people did take a very preliminary step and start to incorporate highly conditional estimates of economic effects of policies into their forecasts at this meeting.” That’s interesting. Before the election, one set of economic estimates was used to lower rates and help Harris, but another set of estimates is now being considered due to Trump’s victory. Indeed, the Fed should have used those same estimates throughout the months leading up to the election. But what do I know? I’m just a crypto muppet.

What did they do for Biden?

In the beginning, there was transitory inflation. Remember that? With a straight face, Powell claimed the rip-roaring inflation that was a direct result of the most money printed in the shortest period of time in US history was but a blip and would disappear quickly. Four years on, inflation has been higher than their own manipulated, fugazi, dishonest inflation metric. They used this sophistry to forestall the inevitable commencement of rate hikes until 2022 because they knew it might cause a financial crisis or recession. They weren’t wrong; the Fed was directly responsible for the 2023 regional banking crisis.

Then, the Fed played dumb. Bad Gurl Yellen completely nullified their monetary tightening crusade by issuing more T-bills to drain the Reverse Repo Program (RRP) starting in September 2022. At a bare minimum, the Fed could have spoken up against the Treasury because they are supposedly independent of the federal government.

After getting impaled by a red-bottom stiletto heel, the Fed paused raising rates in September 2023, when inflation was still above its target. In September 2024, they piled on the printed money gasoline by initiating a rate-cutting cycle. Was inflation below their target? Nyet.

The Fed talked big about slaying inflation, but the Fed played ball when it became a political necessity to keep the government funded at an affordable price and juice financial asset markets. It became a political necessity because the Biden administration was fucked from inception. Half the country thought Biden was a demented vegetable whose party cheated. In hindsight, the Republicans were right on Biden’s veggie characteristics and probably right that he was a cheater. In any event, the desire to keep the Republicans from taking back the House and Senate and Trump from winning re-election in 2024 led the Fed to do whatever was necessary to forestall a financial and economic crisis.

What did they do for the system?

In certain circumstances, the Fed went above and beyond the call of duty to help the Democrats. Case in point is the creation of the Bank Term Funding Program (BTFP) in response to the regional banking crisis in early 2023. The rate hike regime and subsequent bond rout caused a financial calamity where banks lost money on treasury bonds purchased at all-time high prices from 2020 to 2021. The Fed noticed the rot, and after letting three crypto-friendly banks bite the dust as a form of appeasement to Pocahontas (US Senator Elizbeth Warren), the Fed essentially backstopped $4 trillion worth of treasury bonds and mortgage-backed securities on US bank balance sheets.

In hindsight, the BTFP was probably overkill. However, the Fed wanted the market to have no doubt that if the Pax Americana financial system faced a mega threat, it would preemptively respond with the full force of its money-printing machine.

Bad Blood

Powell is a turncoat in that he was appointed in 2018 by Trump. This should come as no surprise because the full force of Trumpism was blunted by a coterie of disloyal lieutenants in his first term. Whether you believe that it is a good or bad thing is irrelevant; the point is that the relationship between Trump and Powell is poisonous at this junction. After Trump’s recent victory over Biden, Powell immediately quelled any doubts about a possible resignation; he intends to serve his full term until May 2026.

Trump routinely opines that the Fed must lower rates to Make America Great Again. Powell responds in his way that the Fed is “data dependent”, which means they will do whatever the fuck they want and tell the interns in the basement to cook up some economic mumbo jumbo to justify their decision. Remember the DSGE, IS/LM, and Ricardian equivalence? All that shit is nonsense unless you work at the Marriner Eccles building.

How does Trump get the Fed onside? He allows a mini-financial crisis to occur. Here is a possible recipe:

- Continue to run massive deficits, which requires the Treasury to issue a lot of debt. It’s telling that Trump selected Elon Musk, a man who would not be as rich as he is if not for billions of dollars of government funding in the form of subsidies and tax breaks for Tesla, to lead a meme department with no actual power. The Department of Government Efficiency (DOGE) is not a federal department, as creating one requires an act of Congress. It is a glorified advisory role that reports to Trump. Elon’s power is purely memetic. Memes are very powerful, but they ain’t going to cut healthcare benefits and defense spending; only direct actions by legislators will accomplish those herculean tasks. And why would a politician do that and endanger their reelection chances in 2026?

- Force a fight about the debt ceiling immediately. Bessent, the presumptive Treasury Secretary, has many tools at his disposal to forestall the date of a government shutdown. Yellen used those tools in the summer of 2023 during her fight with the debt ceiling. The drawdown of the Treasury General Account (TGA) provided financial stimulus to the markets and kept the government funded for many months; this delayed the point at which the politicians had to reach a compromise to allow the Treasury to borrow again. Bessent could sit on his hands and not spend down the TGA. The Treasury market would seize up, and nervous traders would dump treasuries as they worried about default.

This flammable cocktail recipe would quickly push the 10-year treasury yield above 5%. If Bessent confirms the date at which the debt ceiling will be reached and that his department will not spend down the TGA to keep the government operational for a few more months, this could happen in a matter of days.

As treasury yields ripped higher, stocks would tank, and some large financial players in the US or abroad would come under severe stress. The Fed would be backed into a political corner, and to save the system, they would do some or all of the following:

- Offer an SLR exemption for treasuries

- Cut rates aggressively

- Stop QT

- Restart QE

Trump would then laud the Fed for its commitment to America, and financial markets would be back in action.

The issues I described above can metastasize into a crisis triggered by the uncertainty surrounding the debt ceiling now or later; the choice of timing is up to Trump. The further into Trump’s reign the crisis begins, the more likely he and his Republican party will get blamed for a crisis that is in large part due to leverage built up during the Biden administration. Trump, in trading parlance, has to kitchen sink it. Voters must blame Biden and the Democrats for the crisis, and not Trump and the Republicans – or else Trumpism and MAGA will be another stillborn US political movement that lasted barely two years until the Democrats are swept back into power in the 2026 midterm elections.

The gusher of printed money will come, but only once the Fed comes onside with team Trump. The Fed isn’t the only game in town; is the banking system creating credit?

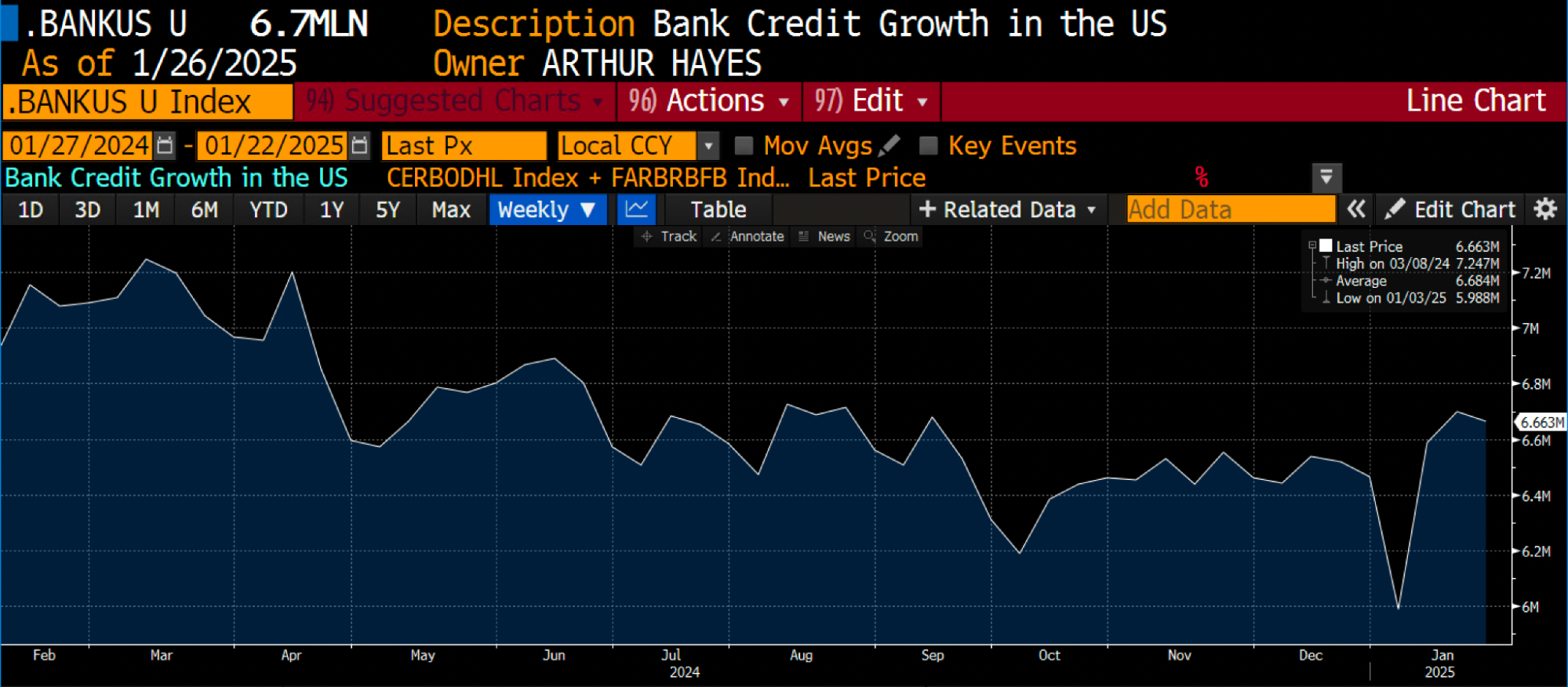

No, as you can see from my custom bank credit index, which is the sum of banking reserves held at the Fed and other deposits and liabilities.

The credit must flow. If the pace of credit creation disappoints, the markets will give back their Trump bump. Let’s move on to China next because even if the US is derelict in its money printing duties, China’s central bank is quite adept at deploying its red money-printer bazooka.

Choyna

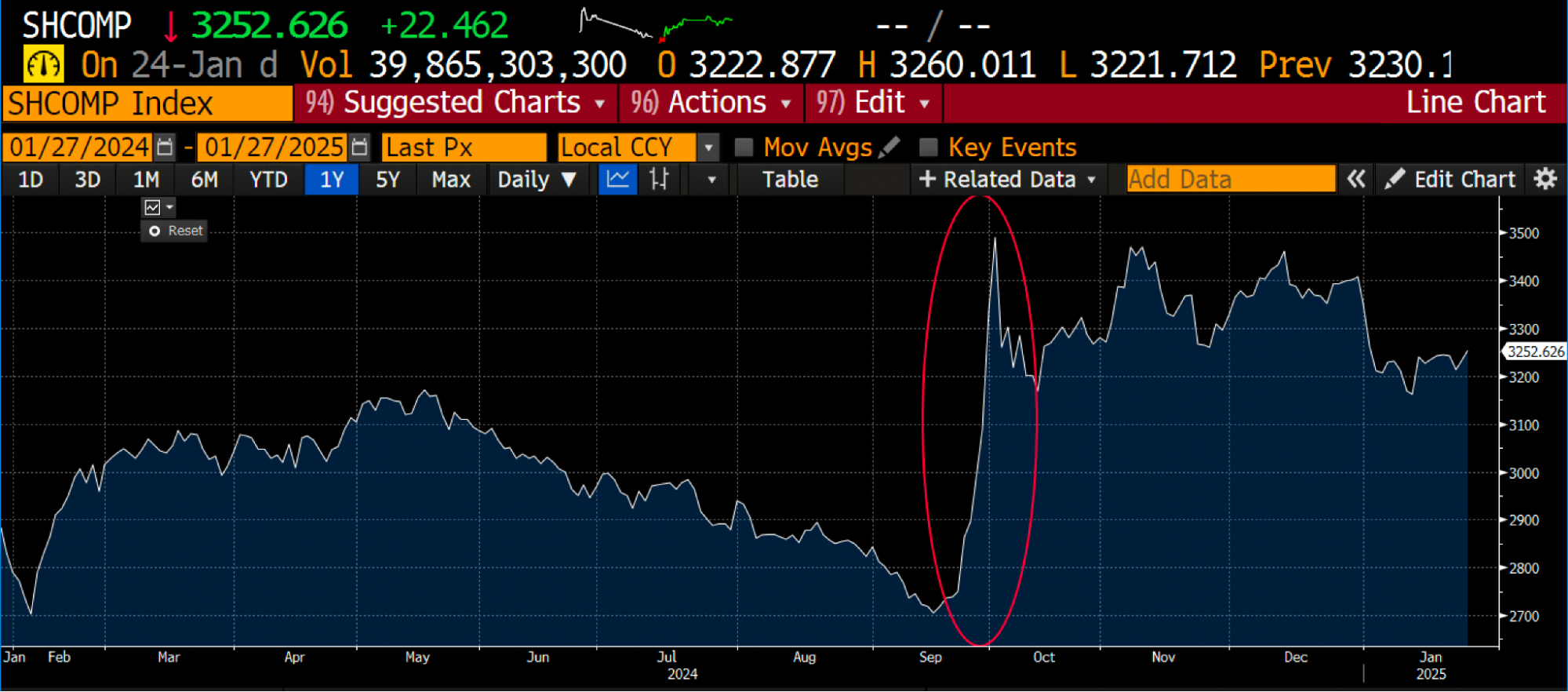

In the third quarter of last year, the People’s Bank of China (PBOC) announced a raft of measures meant to reflate the economy. That’s the polite term for money printing. They cut the banking reserve ratio requirement, started buying Chinese Government Bonds (CGB), and helped local governments refinance their debt load, to name a few measures. This ignited a furious rally in the A-share stock market.

In case your TikTok demented brain couldn’t figure out when the PBOC and central government announced their reflation policies, I circled it for you. The above is the Shanghai Composite Index. The authorities wanted comrades to front-run the red tsunami of printed yuan by purchasing stocks. The messaging worked.

In “加油比特币 Let’s Go Bitcoin,” I argued that Xi Jinping was ready to allow the currency to weaken, if necessary, as a result of the yuan money printing program.

The USDCNY was allowed to rise, which means the dollar will strengthen, and the yuan will weaken. Everything was going according to plan, but in early January, Xi changed course.

On January 9th, the PBOC announced it would end its bond-buying program. As you can see from the above chart, the PBOC stepped into the markets and started manipulating the yuan stronger. On the one hand, the central bank cannot use the yuan domestically to ease financial conditions, and on the other, it can destroy the yuan to strengthen the currency. The first personnel casualty of this dichotomy was the Deputy Head of China’s FX Regulator, Zheng Wei; he recently “voluntarily” stepped down.

There are many theories as to why Xi changed course. A recent Jamestown Foundation article entitled “The Four Main Groups Challenging Xi Jinping” speculates that Western-friendly powerful former politburo members, princelings, and People’s Liberation Army generals favor more integration with the West and clipped Xi’s wings a bit, forcing him to abandon reflation to maintain currency stability. Russell Napier believes Xi is saving his bullets for a tense negotiation with Trump, in which some sort of grand bargain will be reached. He suspects such an agreement could be reached because China and the US need a weak currency and strong exports to improve their domestic economies. Neither leader can accommodate the other, lest they backtrack on promises made to their plebes. But whatever the reason, China has chosen a strong yuan over reflating the economy. Therefore, the Chinese yuan money printing spigot will be closed until further notice.

Nippon

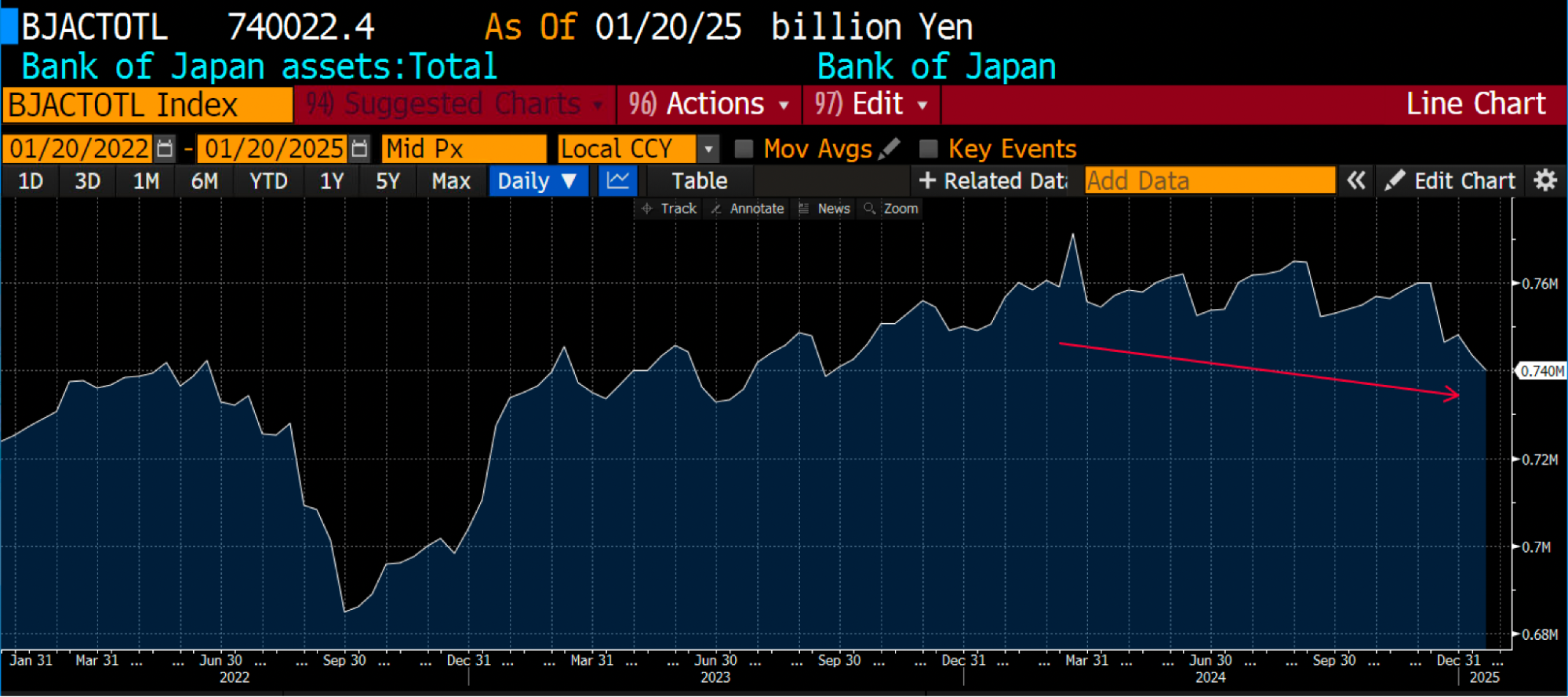

The Bank of Japan (BOJ) followed through on its pledge to continue raising rates. At its latest meeting, they raised their policy rate by 0.25% to 0.50%. A consequence of the rate normalization program is that the central bank’s balance sheet growth has stalled.

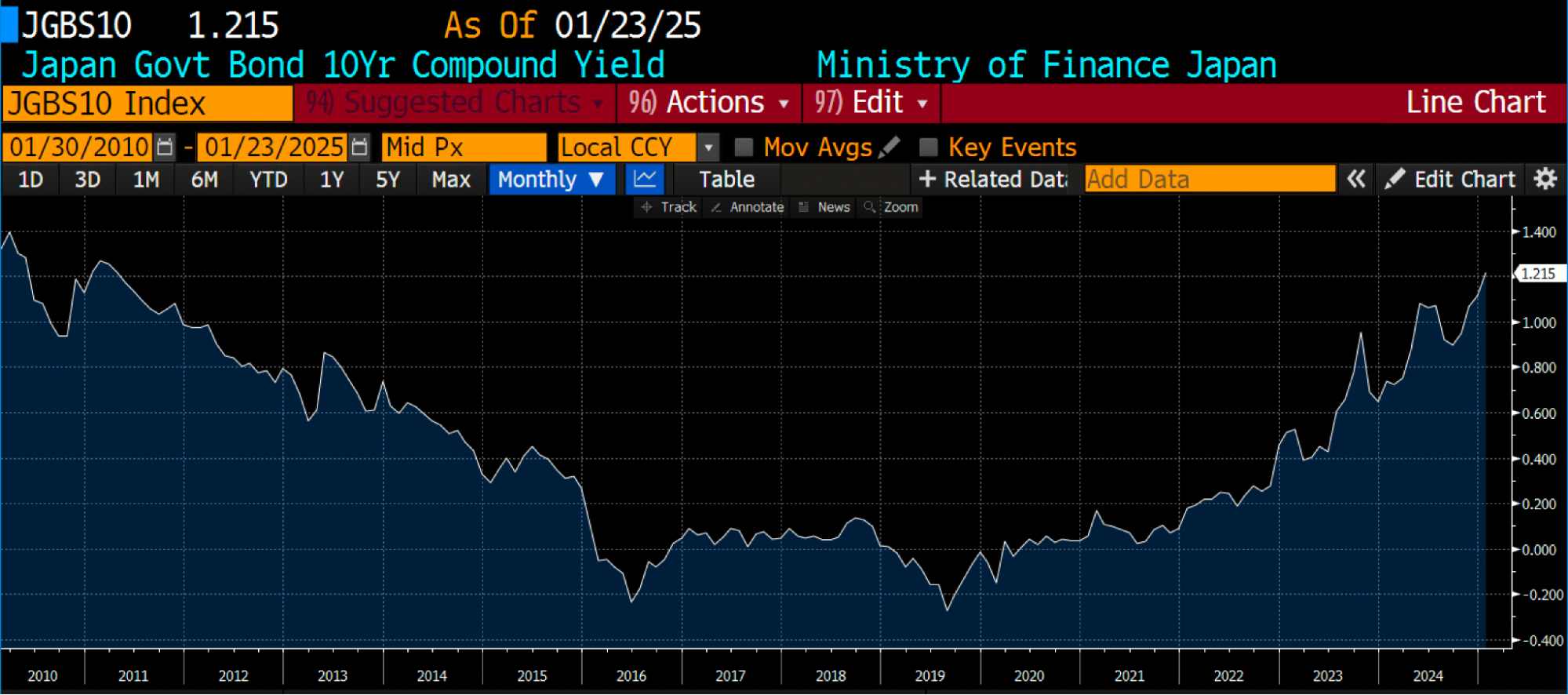

Alongside the rise in policy rates, Japanese Government Bond (JGB) yields are trading at levels not seen in almost 15 years.

The quantity of money is growing much slower than in recent times, and its price is increasing quickly. This is not an appropriate dashi for fiat-priced financial assets to appreciate in price.

Dollar-yen is in the process of topping out. I believe that over the next 3 to 5 years, the dollar-yen will reach 100 (the dollar weakens, the yen strengthens). As I have written about extensively, a strengthening yen causes Japan Inc. to repatriate trillions of dollars of capital, and anyone who borrowed yen must sell assets as their cost of carry spikes. The primary concern for fiat financial markets is how this selling negatively impacts the prices of treasuries. This is a secular structural headwind that Bessent must deal with. It will ultimately be dealt with using printed dollars emitted via some sort of swap line facility, but before that happens, pain must be felt to provide political cover to provide the needed monetary support.

I’ve explained why the fiat liquidity situation in dollars, yuan, and yen is not favorable for the price appreciation of fiat financial assets. Now, let me explain how this affects Bitcoin and the crypto capital markets.

Corrosive Correlation

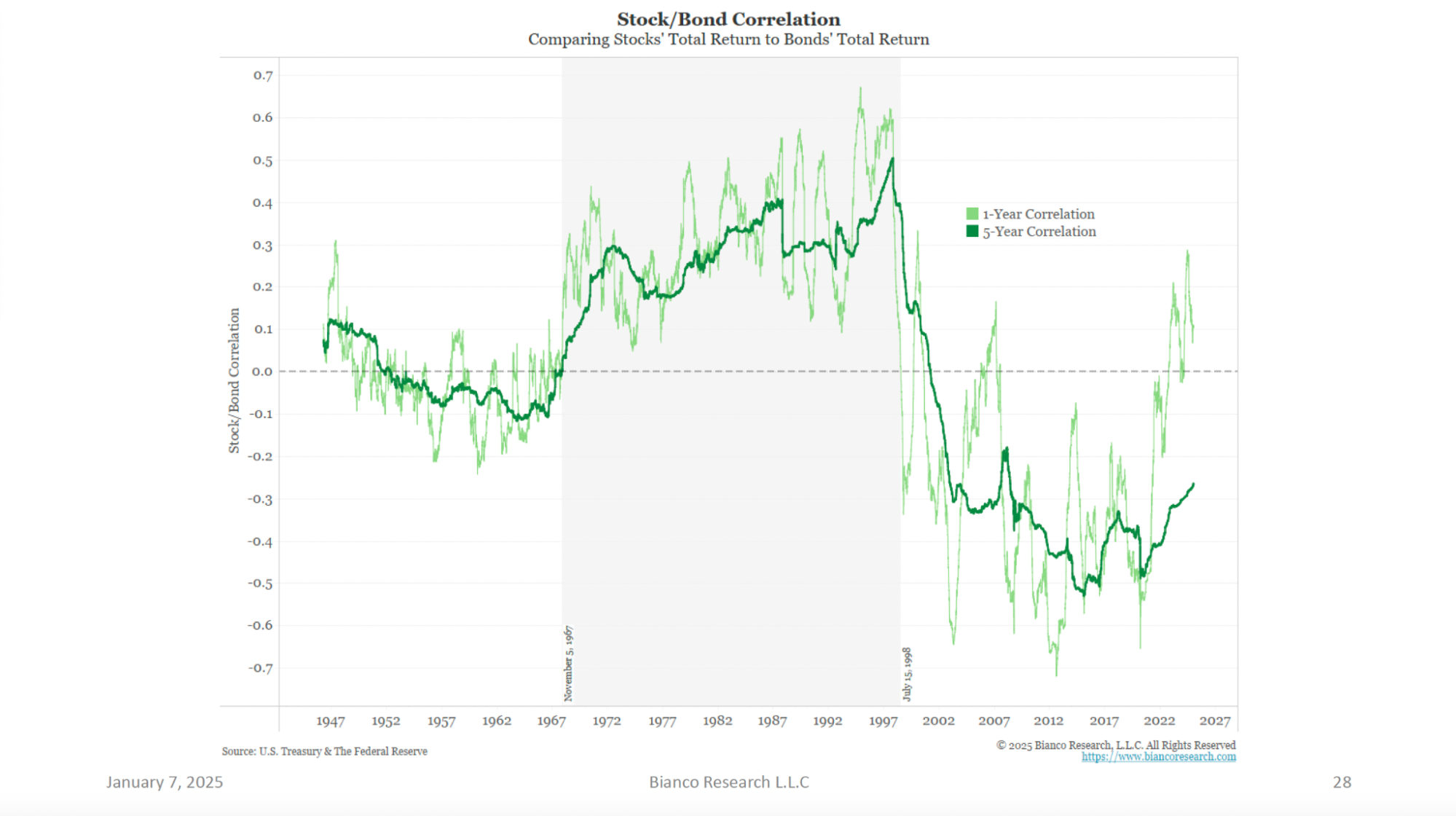

We need to discuss what bond investors are afraid of in Pax Americana. I’m going to spend a bit of time drawing conclusions from an excellent chart created by Bianco Research, which shows the 1-year and 5-year stock-to-bond price correlation.

Inflation was the boogie man of the 1970s until the turn of the millennium for US investors. Therefore, stocks and bond prices were correlated. As inflation raged and impacted the economy negatively, investors sold bonds and stocks together. That changed when China entered the World Trade Organization in 2001. US capitalists could outsource America’s manufacturing base to China in exchange for better reported corporate profits at home, and growth, not inflation, became the main worry. In this regime, falling bond prices meant growth was accelerating, so stocks should perform well. Stocks and bonds became uncorrelated.

As you can see, the one-year correlation shot higher in 2021, when inflation re-emerged during the Flu-19 crisis and hit 40-year highs. Bond prices fell in tandem with stocks in the early part of the Fed’s hiking cycle, which started in early 2022. The relationship between stocks and bonds returns to that of the 1970s to the 2000s. Inflation is the biggest worry.

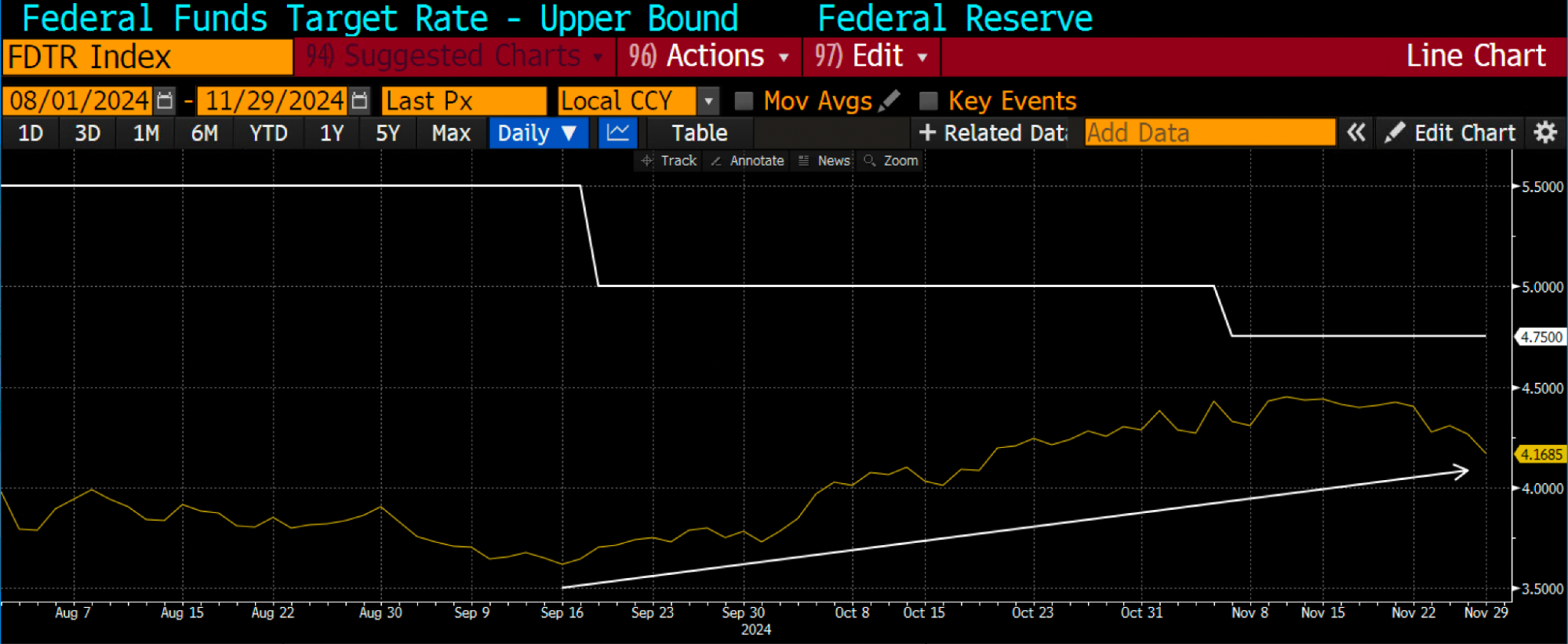

That is clearly evident in how the 10-year Treasury performed when the Fed paused hiking rates in September 2023 and started cutting them in September 2024 while inflation was still above its 2% target.

The following three charts: Fed Funds Upper Bound (white) vs. the 10-year treasury yield (yellow)

As you can see, the market fears inflation because yields are rising even though the Fed is easing monetary conditions.

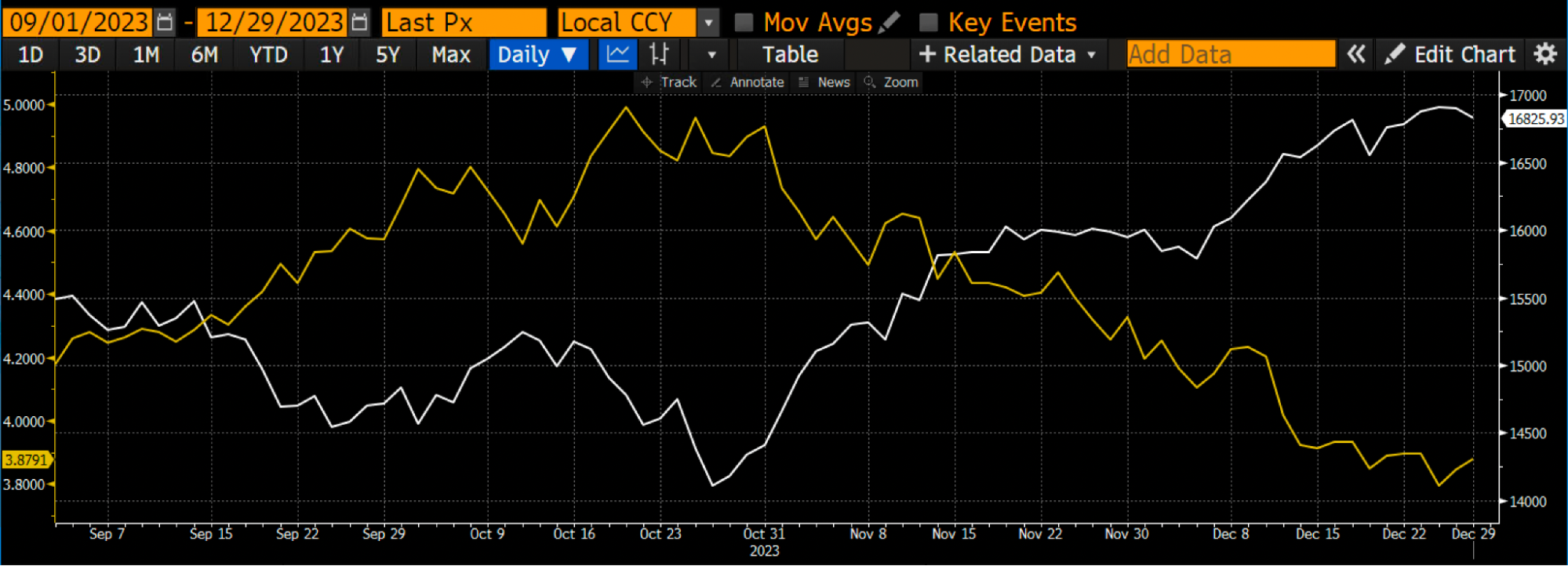

Contrast the previous two charts with the last cutting cycle, which started in late 2018 and finished in March 2020. As you can see, yields fell when the Fed cut rates.

No matter what anyone tells you, the price of money always affects fiat-priced assets. Tech stocks are very interest rate sensitive. You can think of them as a bond with an infinite maturity or duration. Simple maths tells you that its present value drops when you raise the discount rate on a stream of infinite cash flows. These maths rear their ugly head when the financial dysfunction yields strike price is reached.

The above chart shows the Nasdaq 100 (white) vs. the 10-year treasury yield (yellow). Around the 5% level, stocks declined as yields rose and then staged a massive rally when yields fell. This is part and parcel of a financial regime concerned about inflation, not growth.

Let’s put it all together. A dollar, yuan, and yen are interchangeable in the global financial markets. They all find their way into US big tech stocks in some shape or form. You may not like it, but it’s true. I just stepped through why, at least in the very short term, the US, China, and Japan are not increasing the pace of fiat money creation and in some cases, are raising the price of money. Inflation is still elevated and likely to go higher in the near future as the world decouples economically. This is why I expect 10-year yields to rise. What will stocks do if they are rising because of fears of inflation and a large and quickly growing pile of US debt with no marginal buyers in sight? They will dump.

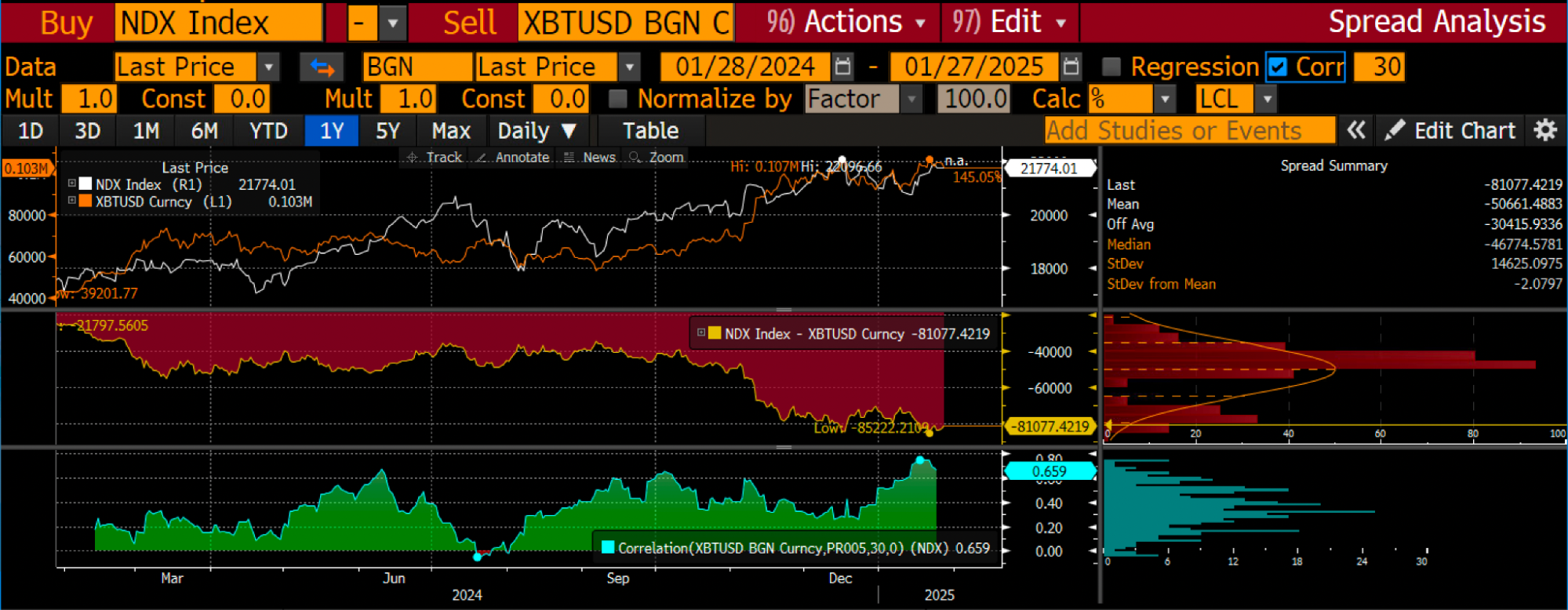

In the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term. Here is the 30-day correlation between Bitcoin and the Nasdaq 100. It’s high and rising. This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield.

Another belief I hold is that Bitcoin is the only truly global free market in existence. It is extremely sensitive to global fiat liquidity conditions; therefore, if a fiat liquidity crunch is forthcoming, its price will break down before that of stocks and will be the leading indicator of financial stress. If it is a leading indicator, then Bitcoin will bottom before stocks, thus predicting a re-opening of the fiat money printing spigots.

If financial stress materializes due to a bond market rout, then the answer from the authorities shall be to print money. First, the Fed will come onside with team Trump and do their patriotic duty … press dat USD Brrr button. Then, China can reflate alongside the Fed without suffering currency weakness. Remember, everything is relative, and if the Fed is creating more dollars, the PBOC can create more yuan, and the dollar-yuan exchange rate will remain unchanged. The largest holdings of Japan Inc. are USD financial assets. Therefore, if said assets fall in price, the BOJ will pause its rate hike program, easing the yen’s financial conditions.

Simply put, a mini financial crisis in the US would provide the monetary mana crypto craves. It would also be politically expedient for Trump. Overall, this puts my confidence interval for said scenarios within the first quarter or early second quarter at 60%.

Trading Probabilities and Expected Values

As mentioned in the preamble, an elevated perceived risk of an avalanche stopped us from skiing in our tracks. The point is to not fuck around and find out. Extending that metaphor to crypto, Maelstrom will hedge itself by being underinvested in the market. It’s all about expected value and not about whether I’m right or wrong.

How do I know when I’m wrong? You never truly know, but in my mind, if Bitcoin trades through $110,000 (the level reached during the height of the $TRUMP memecoin mania) on strong volume with an expanding perp open interest, then I’ll throw in the towel and buy back risk higher. To put a finer point on it, the $TRUMP memecoin pump to almost $100 billion in fully diluted value in 24 hours was truly insane. I bought it some hours after it launched and sold it halfway through my weekend spa vacation. My trip was paid for many times over with a few taps on my smartphone. Trading shouldn’t be that easy, but it is during a manic phase. $TRUMP is a top signal in my mind in the same way that FTX buying umpire logo rights for US Major League Baseball was in the 2021 bull market.

Trading isn’t about being right or wrong but about trading perceived probabilities and maximizing expected value. Let me explain my thought process. Obviously, these are perceived probabilities that can never be known objectively, but the game of investing involves making decisions with imperfect information.

Why do I believe in a 30% correction for Bitcoin? I’ve been trading this market for over ten years and experienced three bull cycles. These types of pullbacks occur often throughout the bull market, given how volatile Bitcoin is. More importantly, the market exceeded the March 2024 all-time high right after Trump won re-election in early November 2024. Many others, including myself, have written extensively about how Trumpism heralds an acceleration of money printing in the US and how other nations would respond in kind with money printing programs of their own to boost their domestic economies. However, this essay argues that none of these programs in the US, China, and Japan can begin in earnest until there is a little fire in the filthy fiat system. As such, I think we pull back to the previous all-time high and give back all of the Trump bump.

60% of a 30% correction on Bitcoin

40% chance of the bull market continuing and a buyback of Bitcoin 10% higher

(60% * -30%) + (40% * 10%) = -14% Expected Value

The maths tell me I’m right to reduce risk. I reduce risk by long-selling Bitcoin and holding more dry powder as staked USDe, which currently earns ~10% to 20% per annum. The shitcoin space will face Armageddon if Bitcoin dumps, and that’s where I really want to play. As mentioned at the outset, Maelstrom has many liquid shitcoin positions due to various early-stage investments and advisory allocations. We dumped most of them. The stuff of the highest quality will sell off >50% if Bitcoin drops by 30%. The final mega liquidation candle on Bitcoin will tell me when it’s time to back up the truck and go shopping for crypto dung.

Let me repeat; if I’m wrong, my downside is that we took profit early and sold a bit of Bitcoin we purchased using profits from prior shitcoin investments. But if I’m right, then we have the cash ready to quickly double or triple our money on quality shitcoins that got the stick in a general crypto market selloff.

As a final note, as this essay went to my editors during the Monday, 27 January 2025 trading day, the markets were in full panic mode as investors re-assessed their bullish case for NVIDIA and US tech exceptionalism due to the launch of DeepSeek. Nasdaq futures are falling, taking crypto along with them. DeepSeek is an AI model developed by a team from China which reportedly cost 95% less to train but bested the latest and greatest models from OpenAI and Anthropic. The thing about bubbles is that when investors begin to question one core tenet of their bullishness, they start to question them all. And the one I’m concerned about is the belief that interest rates don’t matter. The DeepSeek freak-out by Western investors could be the catalyst for them to freak-out about the terrible fiat liquidity situation at present and the secular rise in the 10-year treasury yield. Ain’t it funny how supposedly communist China is embracing the open-source movement, and capitalist America clings to walled gardens? Competition is a beautiful thing.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The post The Ugly appeared first on BitMEX Blog.

BitMEX Blog