The Boros Blueprint: How to Trade Funding Rates

TL;DR:

- Funding rates exhibit predictable patterns: They tend to fluctuate within a range, influenced by a “structural floor” from the funding formula’s inherent bias and a “capital ceiling” enforced by arbitrageurs. Recognising this structure can be the foundation for a trading strategy.

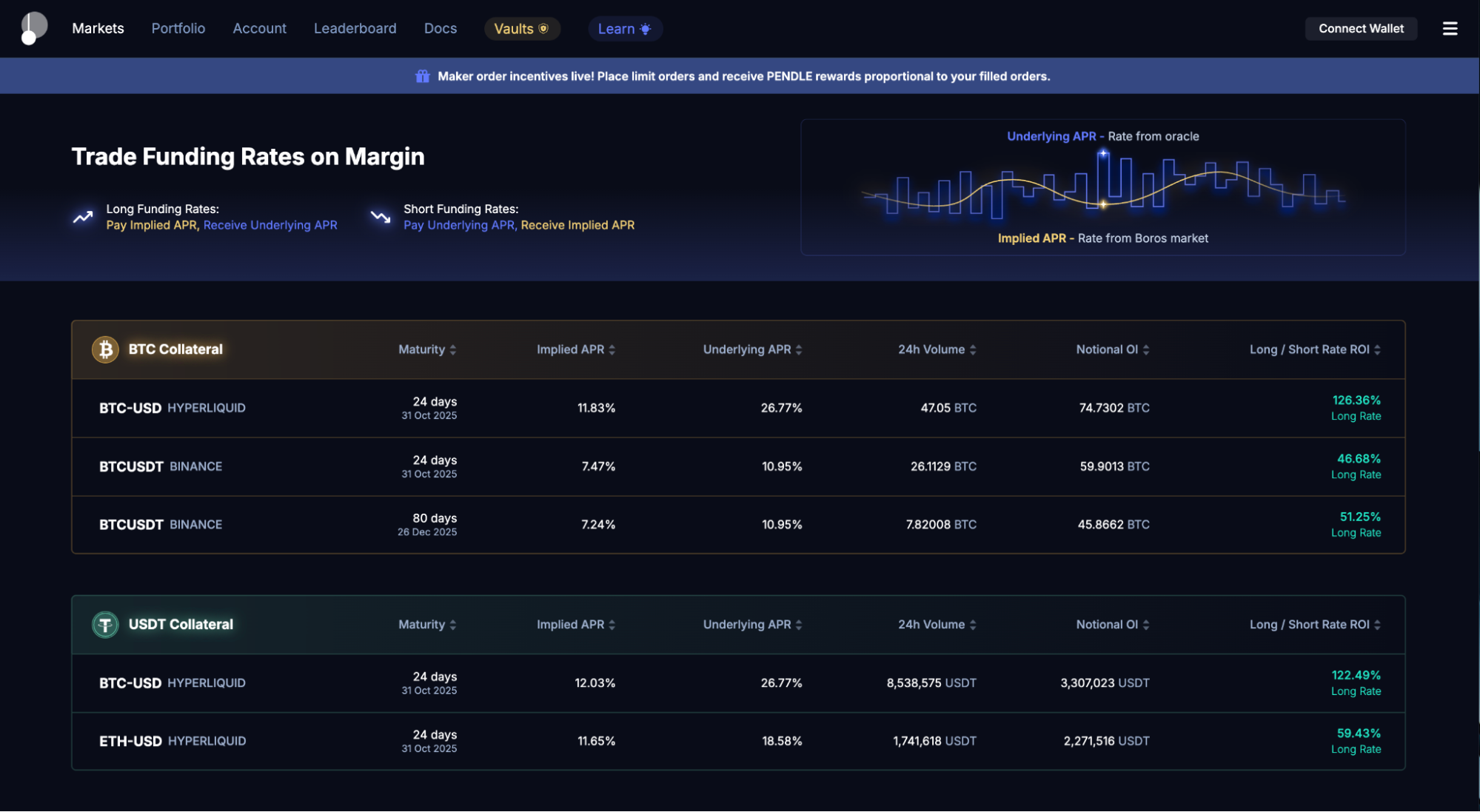

- Funding futures allow traders to now bet on the movement of funding rates, and use leverage to either amplify returns, or to hedge their exposure to funding rates with Pendle’s new protocol, Boros.

- Trading on Boros can offer two sources of return: 1) Periodic payments from the difference between the exchange’s funding rate and the traded implied rate, and 2) Capital gains from changes in the traded implied rate.

- A successful trade hinges on 3 key factors: 1)The time to expiration of the contract (with shorter durations favoring speculation and longer ones for trend-following), 2) the choice of trading venue (as volatile venues may offer opportunities to capture rate spikes, while more stable venues can be better for yield generation), and 3) the implied rate at the point of entry, which should be aligned with one’s overall market outlook (be it bullish, bearish, or neutral).

Introduction

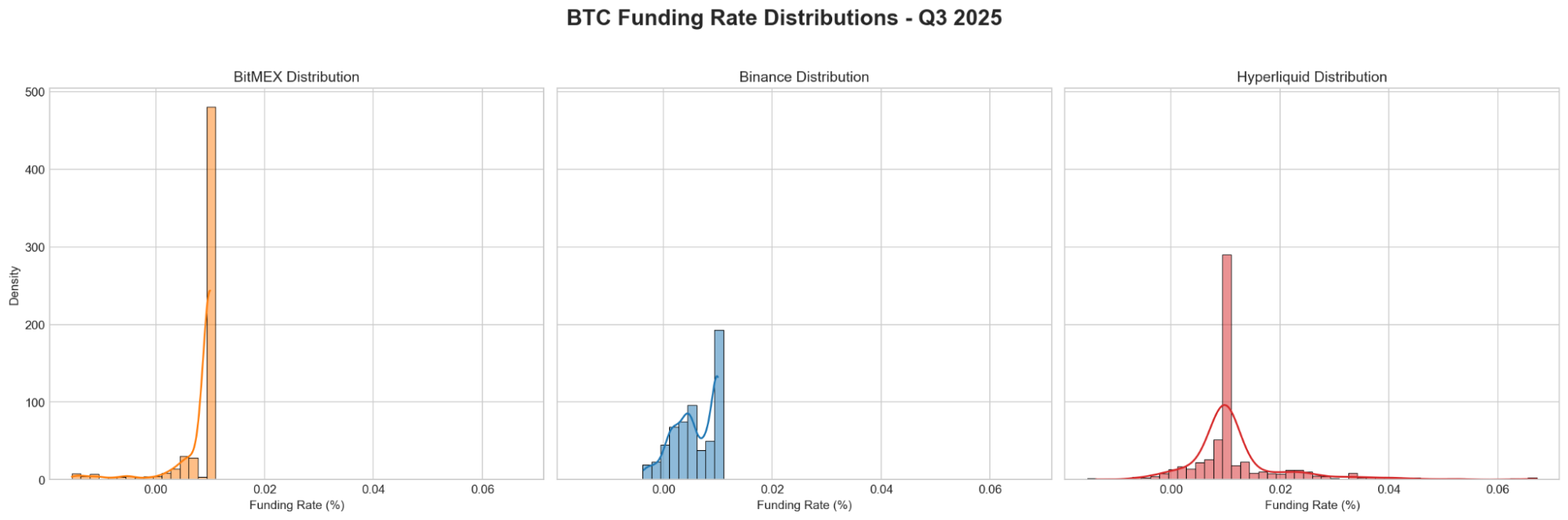

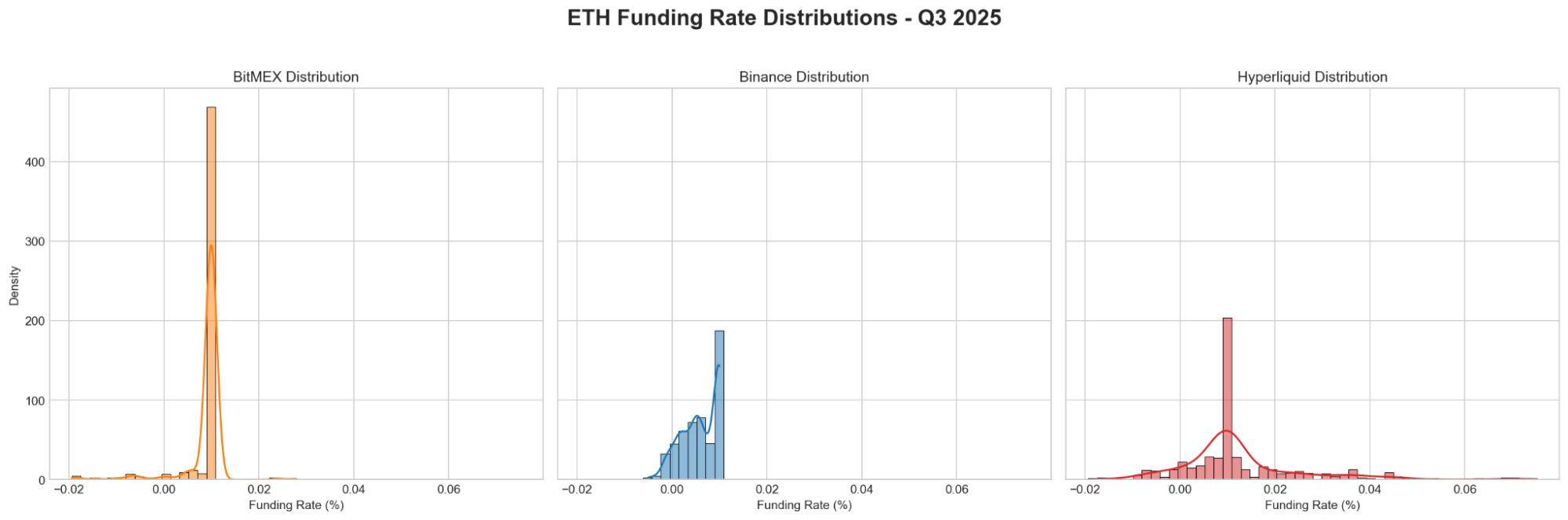

Our Q3 Derivatives Report, “The Anchor and the Ceiling: Understanding the Structure of Funding Rates,” analysed the funding rate market, focusing exclusively on the structural forces that appear to influence it: the formula’s gravitational pull to the 0.01% baseline and the significant institutional capital that takes advantage of high funding rates. This revealed a bounded and often predictable environment, which is exactly the type of inefficiency that traders look to turn into consistent profit.

Understanding the fundamental mechanics is crucial, but the true challenge lies in applying to the trading desk. This article builds directly on our structural findings to provide a practical trading playbook on navigating funding futures as a novel trading instrument. It will cover everything from venue selection to executing funding futures trades on Boros.

Pricing a ‘Fair’ Funding Rate for Bitcoin & Ethereum: The Floor and the Ceiling

Our previous report states that the funding rate formula is essential to anticipate the rate’s surprising behaviour in certain market conditions. Our analysis revealed that there is a gravitational zone defined by a structural floor and a capital-enforced ceiling.

- The Structural Floor: A Positive Bias by Design

The funding rate formula itself provides a powerful “floor.” Recall the formula: F = P + clamp(I – P, -0.05%, 0.05%), where I is 0.01%/8-hour for the exchanges in our analysis (BitMEX, Binance and Hyperliquid).

This formula inherently creates a positive bias. To illustrate, consider a scenario where sentiment is bearish and the perpetual trades at a discount to spot, with a premium (P) of -0.02%.

- The clamp function becomes: clamp(0.01% – (-0.02%), …) = clamp(0.03%, …) = 0.03%

- The final funding rate is still : F = -0.02% + 0.03% = +0.01%

Even with the perpetual at a discount, the funding rate remains positive at its baseline. This mechanism provides a strong structural floor, explaining why funding rates for BTC are positive over 93% of the time in Q3 2025 on BitMEX, despite largely non-trending price action and a >10% drop towards the end of the quarter. A negative rate requires significant and sustained selling pressure to overcome this built-in positive drift.

- The Arbitrage Ceiling: The 10.95% Line in the Sand

If the formula provides the floor, institutional capital provides the ceiling. The baseline funding rate is annualised to 10.95% APY. This is roughly 100% more than the risk-free rate offered by USD money market funds, making it attractive for large players like Ethena. When premiums push the rate significantly above this level, it becomes a glaring opportunity for large-scale funding rate arbitrage.

Players like Ethena have billions of ready-to-deploy dollars to capture this delta-neutral yield by shorting the perpetual and buying the spot asset. This immense weight of capital acts as a hard ceiling, aggressively pushing any rate spikes back down toward the 0.01% anchor.

Together, the floor and ceiling create a predictable range, and significant deviations from this zone often represent trading opportunities.

Constructing Trade Idea Frameworks for Boros

Constructing Trade Idea Frameworks for Boros

Understanding the structural floor and ceiling is the first step. The next is applying that knowledge to a trading venue. This requires a deeper look at the mechanics of Boros and a strategic framework that considers time, trading venue, and the implied rate.

What is Boros?

Boros enables the trading of funding rates on-chain. With Boros markets, traders can hedge their funding rate exposure, as well as speculate on the volatility and movement of funding rates. With over 2.6 billion in volume less than 3 months since launch, it’s a nascent DeFi protocol with the potential to tap into a much larger perp market overall.

Understanding Boros’ Mechanics: Two Sources of Return

Trading on Boros is distinct from simply holding a perpetual swap. A trader’s profit or loss comes from two primary sources:

- Periodic Payments: This is the cash flow component. For every funding interval (e.g., 8-hours on BitMEX), you either pay or receive the difference between the actual funding rate on the exchange and the implied funding rate you traded on Boros. If you go long on the implied rate and the actual rate ends up being higher, you receive a payment, and vice versa.

- Capital Gains: This is the price appreciation component. The implied funding rate on Boros is determined by its own order book and fluctuates based on trader expectations. If you long the implied rate at 15% APY and market sentiment pushes it to 20% APY, the value of your position increases, which creates an opportunity for capital gains if you sell.

The Trading Strategy

A robust strategy considers three main variables: time, trading venue, and the entry point for the implied rate.

Variable 1 – Time (Expiration Matters): Every implied funding rate market on Boros has an expiration date. This is a critical factor in how sensitive the position is to short-term rate changes.

- Longer Expirations: Contracts with weeks or months until expiry are less sensitive to a single funding rate payment. They represent the market’s expectation of the average funding rate over the entire period. These are better suited for betting on longer-term trends or structural shifts.

- Shorter Expirations: Contracts nearing expiration are highly sensitive to the next few funding payments. These are better for speculative, short-term bets on immediate rate spikes or drops.

Variable 2 – Trading Venue (Choose Your Battlefield): As our previous report highlighted, the underlying venue dictates the rate’s behaviour.

- For Stability and Yield: A venue like BitMEX with its 8-hour window and deep liquidity, offers a more predictable environment for baseline yield strategies.

- For Volatility and Speculation: A venue like Hyperliquid with its 1-hour window, is built for volatility and presents more frequent opportunities for capturing dramatic spikes and dips.

Metric | BitMEX (Stable) | Hyperliquid (Volatile) | Takeaway |

Mean Rate | 0.0090% | 0.0150% | Hyperliquid carries a higher average premium. |

Std. Dev. | 0.0045% | 0.0250% | Hyperliquid is nearly 6x more volatile, creating more trading opportunities. |

Min / Max | -0.0194% / 0.0276% | -0.05% / 0.10% | The trading range on Hyperliquid is significantly wider on both ends. |

Freq. > 0.05%/8hr | < 1% | ~15% | Spikes offering high yield are far more common on Hyperliquid. |

Variable 3 – Implied Rate(A Scenario-Based Framework): With time and venue selected, the final decision is timing your entry based on the market’s implied rate relative to your expectation.

Scenario | Trade |

1: Expecting an Overheated Market | If you anticipate a period of bullish exuberance, funding rates are likely to trend higher. Trade: Long the implied rate when it’s below 10% APY. Justification: While the 10.95% anchor creates a powerful gravitational pull, periods of intense speculation can cause rates to temporarily overshoot this ceiling, offering an opportunity to capture both periodic payments and capital gains as the implied rate rises. |

2: Expecting a Neutral Market | If you believe the market will be relatively balanced, significant deviations from 10.95% can be seen as opportunities.

Trade: Longing the implied rate if it drops significantly below this anchor, or shorting it if it rises too far above, betting on a reversion to the structural rate. Justification: The 10.95% APY acts as a structural anchor. Trading on deviations from this anchor allows for profit as the implied rate reverts to its structural mean. |

3: Expecting a Bearish Market | If you anticipate bearish sentiment, remember the structural floor. The funding rate is still likely to remain positive due to the formula’s bias. This creates an asymmetric opportunity. Trade: Short the implied funding rate when it is relatively high (e.g., above 7% APY). Justification: The goal is not to bet on the rate going negative, but on it compressing from a high positive level towards its lower, structurally-supported floor (e.g., near 4% APY). |

How to Trade Funding Rates on Boros

The following steps provide a general framework for implementing a strategy based on the concepts discussed.

Step 1: Formulate a Thesis

Before placing any trade, establish a clear thesis based on the structural framework. Are you expecting a reversion to the mean, a spike due to market exuberance, or a compression towards the structural floor?

For example, a thesis could be: “The implied rate on Hyperliquid is currently elevated due to short-term FOMO, and I expect it to compress back towards its structural anchor.”

Step 2: Select Your Market and Expiration

Based on your thesis, choose the appropriate trading instruments:

- Venue Selection: Decide on the underlying market. As shown in the analysis, funding rates can vary widely across exchanges. If your strategy relies on capturing sharp, short-term moves, a volatile venue like Hyperliquid might be suitable. If it’s based on earning a reliable baseline yield, a more stable venue could be preferable.

- Time Horizon: Select a contract expiration that matches your strategy. For short-term, speculative bets on immediate rate changes, choose a contract nearing expiry. For longer-term views on the average rate, select a contract with weeks or months remaining.

Step 3: Execute the Trade on the Order Book

Step 3: Execute the Trade on the Order Book

Navigate to the Boros platform and connect your wallet. Based on your thesis, you will either long or short the implied funding rate.

Navigate to the Boros platform and connect your wallet. Based on your thesis, you will either long or short the implied funding rate.

- Go Long (Expecting Rates to Rise): Place a buy order for the implied funding rate on the Boros order book. This position profits if the implied rate increases (capital gains) or if the actual funding rate payments are higher than your entry’s implied rate (periodic payments).

- Go Short (Expecting Rates to Fall): Place a sell order for the implied funding rate. This position profits if the implied rate falls (capital gains) or if the actual funding rate payments are lower than your entry’s implied rate (periodic payments).

Step 4: Monitor and Manage Your Position

Once your order is filled, actively manage the position by monitoring the two sources of return:

- Periodic Payments: Track the cash flow from the difference between the actual funding rate on the underlying exchange and the implied rate of your trade.

- Capital Gains/Losses: Monitor the market price of your position on Boros. The implied rate will fluctuate based on market expectations, creating opportunities to exit for a profit or loss before expiration.

Step 5: Exit the Strategy

You can realise your profit or loss in two primary ways:

- Sell Your Position: Close your trade on the Boros order book before the contract expires. This is ideal for capturing capital gains that have resulted from a favourable move in the implied rate.

- Hold to Expiration: Maintain your position until the contract expires. Your final profit or loss will be the sum of all the periodic payments you received or paid over the life of the contract.

The Bottom Line: Structure Over Sentiment

The ability to trade funding rates directly marks a significant evolution in crypto derivatives. Our analysis suggests that success in this new arena may come less from predicting market sentiment and more from understanding market structure.

By recognising the structural floor created by the funding formula and the hard ceiling enforced by arbitrage capital, traders can build a robust framework. The playbook is no longer about guessing market direction but about identifying when the market is deviating from its own structural norms. By systematically fading unsustainable premiums or buying into fear-driven dips toward the structural floor, traders can begin to master the new, more predictable world of funding rate derivatives.

The post The Boros Blueprint: How to Trade Funding Rates appeared first on BitMEX Blog.

BitMEX Blog

Constructing Trade Idea Frameworks for Boros

Constructing Trade Idea Frameworks for Boros