Solana ETF Frenzy: High Volumes, High Hopes

TL;DR:

TL;DR:

- Futures Solana ETFs volumes jumped to a new high as odds for spot ETF approval hit 99%

- Solana price retreated from a six-month peak following hotter-than-expected US PPI data

- Technical indicators suggest near-term selling pressure may continue, though the uptrend remains intact

Traders eye Solana ETF approval: Is it crypto’s next big opportunity?

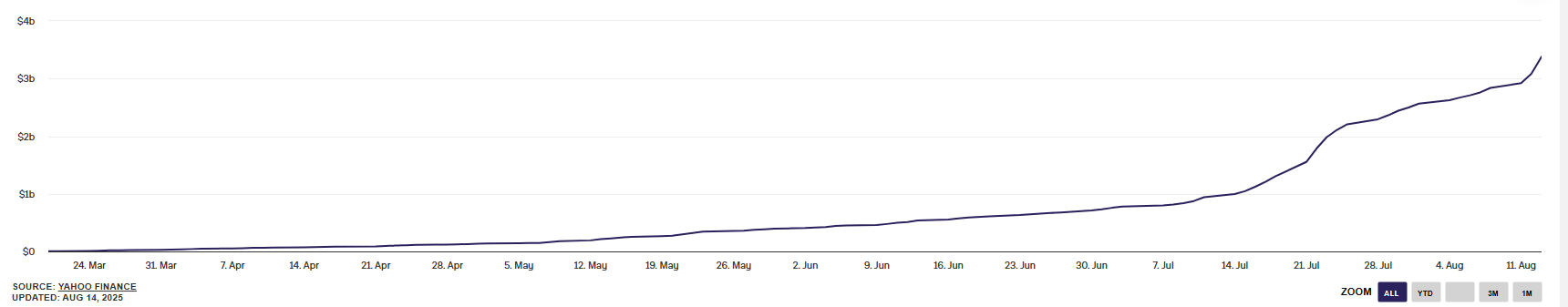

The race to get a spot Solana ETF approval is heating up amid surging institutional demand. The Block’s data shows that cumulative Solana futures ETF volumes soared to a new high of US$3.4 billion on 13 August, with single-day inflows reaching a record of US$297 million. The trend mirrors skyrocketing Ethereum ETF inflows in August, which reached US$4.48 billion on Thursday.

The odds of a spot Solana approval this year rose to 99% following the July launch of the REX-Osprey Solana + Staking (SSK) ETF. Traders and institutional investors have been closely monitoring the progress of key applicants as they seek regulatory clearance.

If approved, Solana could become the next red-hot cryptocurrency to lead a digital asset rally. However, the US SEC postponed its review of two major applications from Bitwise and 21Shares to 16 October.

Solana price retreats from six-month high

On Wednesday, Solana reached as high as US$210 amid broad risk-on sentiment, a level not seen since 4 February. As of 12:40 am UTC, the token was trading just above US$190, down 5.6% from the previous day, according to BitMEX. The drop may have been primarily triggered by profit-taking after the United States reported an unexpectedly large increase in a key inflation gauge, the producer price index (PPI).

Other major cryptocurrencies, including Bitcoin, Ethereum, and XRP, have all declined between 4 % and 6% over the last 24 hours. Solana’s market cap currently stands at US$104 billion, making it the sixth-largest cryptocurrency. The token rallied 18% over the past month, compared to a 1.4% decline in Bitcoin, suggesting that an altcoin season may be underway. This trend is also evidenced by Ethereum’s 51% surge since mid-July.

An uptrend remains, with a near-term retreat expected

While the uptrend remains intact, Solana is likely to see further weakness as a double-top pattern takes shape. A jump in trading volume also indicates further selling pressure, which could drive the price down to test an immediate support at the Fibonacci 50% retracement level near US$184, followed by the 50-day moving average around US$170. Meanwhile, the upward trendline should be pivotal support at this stage, potentially sustaining Solana’s rally.

The post Solana ETF Frenzy: High Volumes, High Hopes appeared first on BitMEX Blog.

BitMEX Blog