Sasa

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The backcountry gates at Hokkaido ski resorts offer excellent, mostly lift-accessible terrain. Early in the season, the burning question is when there will be sufficient snow coverage for the gates to open. The problem for skiers is the prevalence of sasa, which is the Japanese word for a type of bamboo. The stalks are thin and reed-like but possess razor-sharp green leaves that can cut your skin if you are not careful. Attempting to ski over sasa is dangerous because your edge could slip and enter you into a round of a game I call “Man vs. Tree.” Therefore, if there is insufficient snow to cover the sasa, the backcountry is extremely dangerous.

Snow is dumping in Hokkaido in quantities not seen in almost seventy years. The powder is deeeeeppppp. As such, the backcountry gates were opened in late December instead of the first or second week in January. As we begin 2025, the question on crypto investors’ minds is whether the Trump pump can continue. In my latest essay “Trump Truth”, I argued that the high expectations for policy action out of the Trump camp set up the market for disappointment. I still believe that is a potential negative factor that could weigh upon the market in the short term, but against that, I must balance the dollar liquidity impulse. Bitcoin, for now, jukes and jives as the pace of dollar emissions changes. The monetary mandarins that wield power at the US Federal Reserve (Fed) and the US Treasury Department determine the quantity of dollars supplied to the world financial markets.

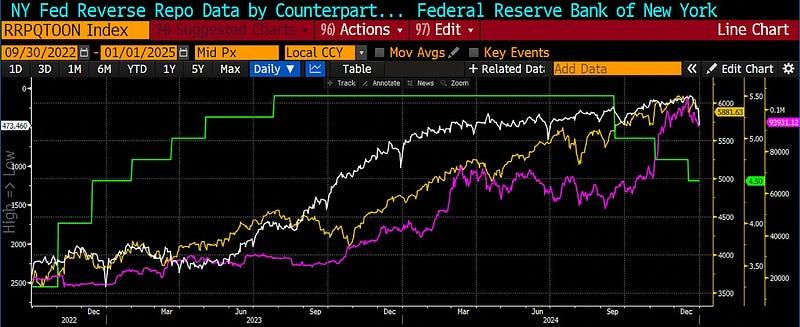

Bitcoin bottomed in Q3 2022 when the Fed’s Reverse Repo Facility (RRP) reached its zenith. At the behest of Bad Gurl Yellen, the US Treasury Secretary, her department issued fewer longer-dated coupon bonds and more shorter-dated zero-coupon bills, which drained over $2 trillion from the RRP. This is a liquidity injection into the global financial markets. Crypto and stocks, especially US-listed big tech stocks, ripped as a result. The chart above shows Bitcoin (LHS, yellow) vs RRP (RHS, white, inverted); as you can see as the RRP fell, Bitcoin rose.

The question I aim to answer, at least for the first quarter of 2025, is whether a positive dollar liquidity impulse can smother the sasa of a disappointment in the speed of implementation and impact of Trump’s supposedly pro-crypto and pro-business policies. If so, then it is safe to shred, and Maelstrom should be increasing the risk on its books.

First, I will discuss the Fed, a minor consideration in my analysis. Then, I will address how the US Treasury will respond to the debt ceiling. If politicians dither in raising the debt ceiling, the Treasury will spend down its general account (TGA) at the Fed, injecting liquidity into the system and creating positive momentum for crypto.

In the interest of brevity, I will not explain why debits and credits from the RRP and TGA are dollar liquidity negative and positive, respectively. If you are not a frequent reader of my essays, please refer to “Teach Me Daddy” to understand the mechanics.

The Fed

The pace of the Fed’s quantitative tightening (QT) policy is continuing at $60 billion per month, which is a reduction in the size of its balance sheet. There has been no change in the forward guidance from the Fed about the pace of QT. I will explain why later in the essay, but my prediction is that the market peaks in mid to late March, so this equates to a removal of $180 billion worth of liquidity due to QT from January to March.

The RRP has fallen to almost zero. To drain the facility completely, the Fed belatedly changed the policy rate of the RRP. At its December 18th, 2024 meeting, the Fed cut the RRP rate by 0.30%, which was 0.05% more than the cut to the policy rate. This was to tether the RRP rate to the Fed Funds Rate (FFR) lower bound.

If you are curious as to why the Fed waited until the RRP was almost empty to realign the rate with the lower bound of FFR and make it less attractive to deposit money in the facility, I implore you to read Zoltan Pozar’s essay “Cheating on Cinderella”. My takeaway from his essay is that the Fed is exhausting all tools at its disposal to bolster demand for US Treasury debt issuance before resorting to stopping QT, granting a supplementary leverage ratio exemption once again for US commercial bank branches, and possibly resuming quantitative easing (QE) aka Money Printer Go Brrrr.

Right now, there are two pools of money that will help keep bond yields in check. To the Fed, the 10-year US Treasury yield cannot be allowed to go over 5% as this is the level where bond market volatility explodes (MOVE Index). As long as there is liquidity in the RRP and the TGA, the Fed doesn’t have to change its monetary policy drastically and admit that fiscal dominance is in play. Fiscal dominance essentially confirms Powell’s status as a beta cuck towel bitch boy to Bad Gurl Yellen and after January 20th, Scott Bessent. Scotty boy will get a nickname at some point, I haven’t thought of anything catchy yet. If this sways his decision-making, I’ll be more flattering in a choice of nickname if he makes me into a modern-day Scrooge McDuck by devaluing the dollar vs. gold.

Once the TGA is depleted (dollar liquidity positive) and subsequently replenished (dollar liquidity negative) due to the debt ceiling being hit and then raised, the Fed will be out of stop-gap measures to arrest the inexorable march higher in yields after their decision to begin an easing cycle last September. This isn’t important to first-quarter dollar liquidity conditions but just a passing thought about how Fed policy might evolve later in the year if yields keep rising.

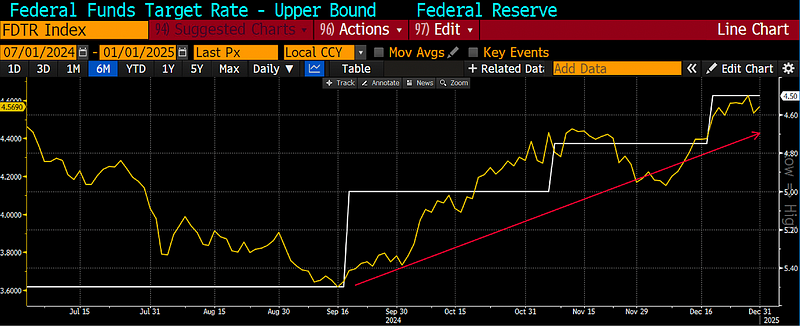

The FFR upper bound (RHS, white, inverted) vs the US 10-year yield (LHS, yellow) clearly shows that bond yields have risen as the Fed reduced rates in the face of higher than their target inflation rate of 2%.

The real question is the pace at which the RRP goes from ~$237 billion to zero. I expect it to reach near zero sometime in the first quarter as money market funds (MMF) maximize their yield by withdrawing funds and purchasing higher-yielding Treasury bills (T-bill). To be extremely clear, this represents an injection of $237 billion of dollar liquidity in the first quarter.

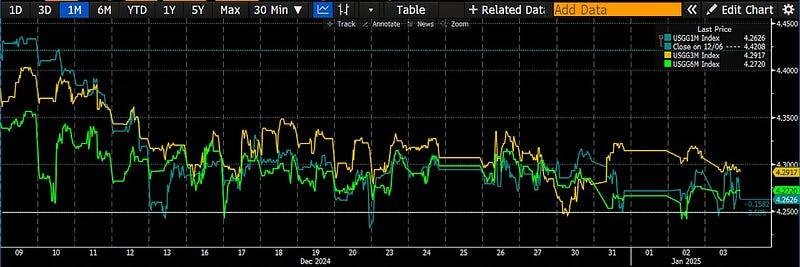

After the December 18th RRP rate change, T-bills of less than twelve months in maturity feature yields above 4.25% (white), which is the FFR lower bound.

The Fed will remove $180 billion of liquidity due to QT and encourage an additional $237 billion of liquidity due to the reduction in RRP balances caused by their tinkering with the award rate. This totals a net injection of $57 billion in liquidity.

The Treasury

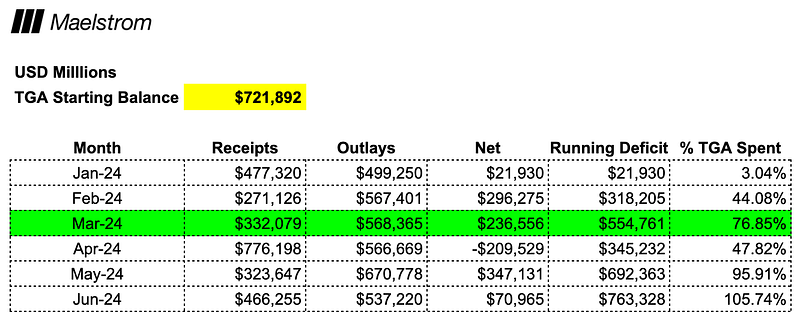

Bad Gurl Yellen told the market that she expects the Treasury to begin “extraordinary measures” to fund the USG between January 14th and 23rd. The Treasury has two choices on how it pays the government’s bills. They can either issue debt (dollar liquidity negative) or spend money from its checking account at the Fed (dollar liquidity positive). Because the aggregate amount of debt cannot rise until the US Congress increases the debt ceiling, the Treasury can only spend funds from its checking account, the TGA. Currently, the TGA balance stands at $722 billion.

The first big assumption is when politicians will agree to raise the debt ceiling. This will be the first test of how rock-solid Trump’s support is amongst Republican legislators. Remember his governing margin — i.e., the majority of Republicans over Democrats in the House and Senate — is razor thin. There is a wing of the Republican party that likes to puff their chests, strut around, and claim they care about reducing the size of the bloated government every time the debt ceiling comes up for debate. They will hold out voting in favor of an increase until they get something juicy for their district. Trump already failed to convince them to torpedo a 2024 end-of-year spending bill unless the debt ceiling was raised. The Democrats, after receiving their ass-kicking in a gender-neutral bathroom during the previous election, will be in no mood to help Trump unlock government funds to achieve his policy goals. Harris 2028, anyone? Actually, the Democratic presidential nominee is going to be the silver fox, Gavin Newsom. Therefore, to get things done, Trump will wisely exclude the debt ceiling issue from any proposed legislation until absolutely necessary.

Raising the debt ceiling becomes necessary when failure to do so would result in a technical default of maturing Treasury debt or a complete government shutdown. Using 2024’s receipts and outlays published by the Treasury as a guide, I estimate that such a situation would occur between May and June of this year when the TGA balance would be completely exhausted.

It’s helpful to visualize the pace and intensity of TGA usage to fund the government and predict when drawdowns will have their maximum effect. Markets are forward-looking. Given that this is all public data, and we know how the Treasury functions when it cannot increase the aggregate amount of US debt when the account is close to exhausted, the market will look for a new source to score a hit of dollar liquidity. At 76% depleted, March appears to be a time when the market will ask, “What’s next?”.

If we add the dollar liquidity amounts from the Fed and Treasury until the end of the first quarter, the total is $612 billion.

What happens next?

Once default and shutdown are imminent, a last-minute deal will be reached, and the debt ceiling will be raised. At that point, the Treasury will be free to borrow on a net basis again and must refill the TGA. This will be dollar liquidity negative.

The other major date in the second quarter is April 15th, when tax payments are due. From the table above, it is clear that the government’s finances dramatically improve in the month of April, which is dollar liquidity negative.

If factors affecting TGA balances were the only things that determined crypto prices, then I would expect a local market top right at the end of the first quarter. In 2024, Bitcoin hit a local high of ~$73,000 in mid-March, then traded sideways, and began its multi-month decline on April 11th right before the 15th tax payment deadline.

Trading Tactics

The problem with this analysis is that it assumes that dollar liquidity is the most crucial marginal driver of aggregate fiat liquidity globally. Here are a few other considerations:

– Will China speed up or slow down the amount of yuan credit created?

– Will the Bank of Japan start raising its policy rate, which would appreciate the dollar-yen and unwind the leveraged carry trade?

– Will Trump and Bessent conduct a massive overnight devaluation of the dollar vs. gold or other major fiat currencies?

– How effective will team Trump be at quickly reducing government spending and passing bills into law?

None of these major macroeconomic issues can be known a priori, but I have confidence in the math behind how the RRP and TGA balances will change over time. My confidence is further bolstered by how the market has behaved from September 2022 until the present: the dollar liquidity increase, due to the decline of the RRP balance directly resulted in the ramp in crypto and stocks, despite the Fed and other central banks raising rates at the fastest pace since the 1980s.

FFR upper bound (RHS, green) vs Bitcoin (RHS, magenta) vs S&P 500 Index (RHS, yellow) vs RRP (LHS, white, inverted). Bitcoin and stocks bottomed in September 2022 and pumped as the RRP’s decline injected over $2 trillion of dollar liquidity into the global markets. This was a deliberate policy choice of Bad Gurl Yellen to issue more T-bills to drain the RRP. Powell and his campaign to tighten financial conditions to fight inflation was nullified entirely.

Given all the caveats, I believe I answered the question I posed at the outset. That is, the sasa of a letdown by team Trump on his proposed pro-crypto and pro-business legislation can be covered by an extremely positive dollar liquidity environment, an increase of up to $612 billion in the first quarter. Right on schedule, just like almost every other year, it will be time to sell in the late stages of the first quarter and chill on the beach, at the clerb, or on a ski resort in the southern hemisphere and wait for positive fiat liquidity conditions to re-emerge in the third quarter.

Fulfilling my role as the Chief Investment Officer at Maelstrom, I will encourage the risk-takers at the fund to turn the risk dial to DEGEN. A first step in that direction is our decision to ape into the burgeoning Decentralized Science shitcoin field. We love undervalued dogshit and purchased $BIO; $VITA; $ATH; $GROW; $PSY; $CRYO; $NEURON. For an in-depth evaluation on why Maelstrom believes the DeSci narrative is ripe for a re-rating much higher, please read “Degen DeSci”. If things pan out at a high level, as I described, I will cut the baseline and ride the 909 open hi-hat sometime in March. Of course, anything can happen, but on balance I am bullish. Did I change my mind from my last essay? Kinda. Maybe the Trump dump occurred from mid-Dec until the 2024 year-end instead of mid-Jan 2025. Does that mean I’m sometimes a shitty prognosticator of the future? Yep, but at least I ingest new information and opinions and change them before they result in significant losses or missed opportunities. That is why this game of investing is intellectually engaging. Imagine you made a hole-in-one every time you hit a golf ball, sunk every three-point shot taken in basketball or off the break, and always pocketed every ball playing billiards. Life would be excruciatingly dull. Fuck that shit, give me failure and success, and out of that, happiness. But hopefully a bit more success than failure.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The post Sasa appeared first on BitMEX Blog.

BitMEX Blog