Over 60% of Users Already Spend with Crypto Cards: Study by Changelly x Simple

Crypto-linked payment cards have evolved from a niche product into a mainstream payment method, with usage now measurable on a large scale.

In Q3 2025, Simple Wallet analyzed anonymized transactional data from 1,000 randomly selected European cardholders to measure actual spending behavior. At the same time, we at Changelly surveyed over 3,000 of our users worldwide to capture self-reported adoption trends. Together, this data provides one of the most detailed looks at how crypto cards are used in practice to date.

Changelly is a leading instant cryptocurrency exchange platform and global blockchain API provider.

Key Findings

- 60.6% of surveyed users already use crypto cards.

- Top use cases: online transactions (66%) and everyday purchases (61%).

- Average transaction size in Europe: €40.

- Top benefits: ease of use (65%), cashback (56%), flexibility (43%).

- Key barriers: 58% don’t know what crypto cards are, and 43% cite limited merchant acceptance (Changelly survey, 2025).

Adoption: 60% Already Use Crypto Cards

Survey data from over 3,000 Changelly users shows that 60.6% are already using a crypto card, while 39.3% are not. Transaction records from 1,000 Simple Wallet cardholders in Europe back this up, showing thousands of real-world purchases each month with an average ticket size of about €40. This combination of self-reported and observed data points to a clear majority of active crypto users already spending through cards.

User Motivations: Over 60% of All Transactions Are Everyday and Online Purchases

Crypto spending has shifted from occasional cash-outs to everyday use. Simple Wallet’s June 2025 analysis of 1,000 European cardholders shows that between 60% and 70% of all transactions go to routine expenses such as groceries, subscriptions like Netflix and Spotify, transport, utilities, online shopping, and cafés. Another 15% to 20% covers travel and cross-border spending: hotels, car rentals, purchases outside the EU, and tolls. Meanwhile, only 10% to 15% relates to topping up user accounts in neobanks like Revolut or high-ticket items. The average transaction size is about €40, and most payments are settled in USDC automatically converted at checkout.

Changelly’s global survey tells the same story: 66% say they use crypto cards for online transactions and 61% for everyday purchases, compared with 45% for fiat conversion and 41% for travel.

Together, these findings indicate that crypto cards are functioning as utility payment rails, not just liquidation tools. Providers looking to capture this market need to focus on seamless, low-friction everyday use cases and benefits that mirror traditional cards.

“When a Simple Wallet user pays for groceries, streaming, or transport with USDC, it shows the shift: crypto isn’t a future promise, it’s already part of the everyday economy,” says Alex Emelian, CEO of Simple Wallet.

What Users Value Most: 65% Say Simplicity, 56% Say Rewards

Both survey and transaction data points to the same conclusion: crypto cardholders value the same things as mainstream bank-card users. In Changelly’s global survey, 65% cited ease of use as the top benefit of crypto cards, 56% highlighted cashback and other rewards, and 43% pointed to flexibility—the ability to hold crypto until payment and spend on demand.

Simple Wallet’s internal metrics and insights based on years of experience mirror these findings. Customers use crypto cards because they behave like ordinary bank cards: tap-to-pay via Apple Pay/Google Pay, automatic conversion at the moment of purchase with no pre-swaps, and no disclosure of wallet balances to merchants or banks. Funds stay in crypto until payment, letting holders remain invested right up to checkout.

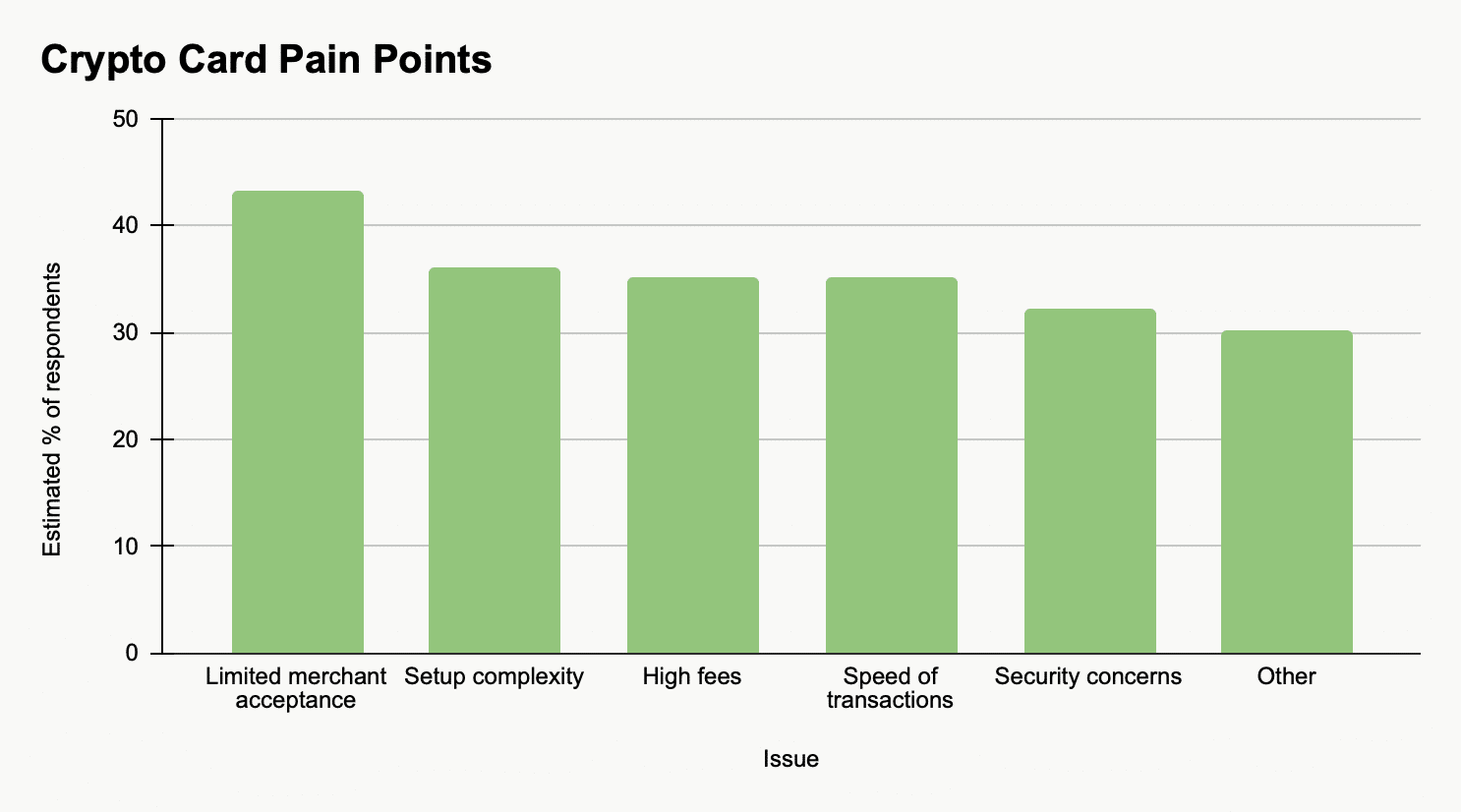

Pain Points: 58% Non-Users Claim Lack of Knowledge as Key Barrier

Changelly’s survey shows that crypto card users report relatively few problems. In fact, 59% of respondents said they experienced no challenges. Among those who do, the main issues are limited merchant acceptance (43%), setup complexity (36%), high fees (35%), speed of transactions (35%), and security concerns (32%).

For non-users, the picture is different. 58% cite lack of knowledge as the primary reason for not adopting crypto cards, followed by “I don’t own crypto” (24%) and smaller shares mentioning cost or trust issues.

These findings suggest that the main bottlenecks are education, trust, and infrastructure, rather than the technology itself. Addressing these factors is likely to have more impact on adoption than incremental feature changes.

Get the must-have checklist now!

Why Crypto Cards Matter

Crypto cards are not just about spending tokens—they close the loop between Web3 assets and the real economy. Simple’s experience shows that their value lies in four operational advantages:

- Convenience. Users pay exactly like with a normal card or Apple Pay/Google Pay. No extra steps, no pre-conversion.

- Privacy. For enhanced user privacy, the merchant only sees a standard card transaction, without access to the user’s crypto wallet details.

- Flexibility. Assets stay in crypto until the moment of purchase, allowing holders to remain invested and only convert at checkout.

- Crypto-native design. Cards accept direct crypto funding with a user-friendly compliance process for funding your account.

This positions crypto cards as everyday financial tools rather than speculative instruments. For businesses, they unlock new opportunities:

- Wallet providers gain higher stickiness and spend retention.

- Exchanges open revenue streams beyond spot trading.

In short, crypto cards make crypto easier to use in daily life and extend its reach across the wider financial ecosystem.

Strategic Implications

Survey data shows that 58% of non-users cite lack of knowledge as the main barrier to adoption, making education the primary growth lever for issuers. Clear onboarding and in-app guidance can convert a large share of potential users without major product changes. For example, Simple has reduced registration to a five-minute online passport/ID check for EEA residents, turning what was once a complex process into a quick standard step, converting a higher percentage of their wallet users into crypto card customers as a result.

Rewards and cashback are also decisive: In the Changelly survey, 56% of respondents named rewards as a key benefit. For maximum ease of adoption, UX must also mirror traditional cards. Simple has addressed this by adopting a banking-style interface with a built-in exchange and automatic selection of low-fee networks, removing confusion about fees and settlement.

Last but not least, with stablecoins such as USDC and EURC dominating card spending, providers should optimize liquidity pools and FX routing to minimize costs and improve reliability.

Taken together, these measures—education, frictionless onboarding, rewards and stablecoin-optimized infrastructure—define the roadmap for winning a share in the crypto card market over the next few years.

“This survey shows that education and usability are the real catalysts for wider crypto-card adoption,” says Zifa Mae, Head of Product at Changelly. “Instant exchange API providers like Changelly can help by making funding and conversion seamless, while crypto cards providers focus on fast onboarding, clear rewards and stablecoin infrastructure to match the convenience of traditional cards.”

The Next 5 Years in Crypto Cards

Card functionality is likely to become a standard feature of major crypto wallets over the next few years. Non-custodial, stablecoin-denominated cards will let users spend directly from their wallets and avoid double conversions or tax-triggering swaps.

Online banks such as Revolut and N26 are already adding crypto features, signaling that mainstream financial apps are likely to start accepting and routing crypto natively in the future. The model will shift from “convert then spend” to “spend directly,” with payroll, freelance earnings and passive income flowing straight to crypto cards.

This study shows a clear path forward: close the knowledge gap with education, win users over with seamless UX, and lock in loyalty through stablecoins and rewards. Providers who execute on these three levers will define the next generation of payment rails.

Changelly offers a comprehensive suite of blockchain APIs for business, with native crypto-to-crypto swaps, crypto-to-fiat purchases, and Changelly Pay—a unique solution for merchants looking to accept payments in crypto.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post Over 60% of Users Already Spend with Crypto Cards: Study by Changelly x Simple appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly