Now Live: Trade With Any Margin Currency Through Multi Asset Margining

To further improve the trading experience for our users, we are pleased to announce the launch of our latest feature on BitMEX: Multi Asset Margining.

The arrival of Multi Asset Margining means users can now use multiple currencies – USDT, USDC, ETH, or BTC (XBT) – to trade any derivatives contract on our platform.

The result? A simpler and more convenient trading experience – no tedious asset conversions or fund transfers between different wallets or accounts. Simply deposit a currency of your choice and get trading. We’ll take care of the rest to make sure your funds are used as efficiently as possible*.

*Based on the traded contracts and margin currency used, we may apply a small haircut to ensure that necessary asset conversions can be executed.

For a lowdown on the new feature and how it works, read on.

If you haven’t signed up for a BitMEX account yet, we’re currently offering 10,000 BMEX Tokens to new users – you can register here.

What is Multi Asset Margining?

Multi Asset Margining is a powerful feature that allows traders to use currencies other than a contract’s settlement currency to place their trades on BitMEX. It serves to make trading as simple as possible on our platform.

Traders can use USDT, USDC, ETH, or XBT as margin currencies to trade any derivatives contract on our platform. In other good news, this list of tokens will expand in the near future.

The best part? Unlike most exchanges, BitMEX users don’t need to transfer funds between multiple wallets (e.g. Spot, Funding, futures etc) to place orders and trade.

To start trading, all you have to do is deposit a Margin Currency into your BitMEX account, choose a contract, and click to trade.

Here’s a quick example to highlight the use of Multi Asset Margining:

Let’s say trader A wishes to trade the XBTUSD contract. He wishes to use USDT to fund his trade.

He decides to deposit 500 USDT into his BitMEX account.

Previously, trader A would have needed to convert his USDT into XBT (given that XBTUSD is an XBT-settled contract) to open a position on XBTUSD.

With Multi Asset Margining enabled, trader A would no longer have to convert his USDT into XBT. When opening his XBTUSD position, the trader’s 500 USDT balance automatically contributes as margin for the position.

How to Enable Multi Asset Margining

- Navigate to the order form on the left side of your trading UI. Click on the ‘Single Asset’ button on the top left corner of the order form.

- In the pop-up window, select ‘Multi Asset Margining’.

- Once you do so, you should see the ‘Single Asset’ button changed to ‘Multi Asset’.

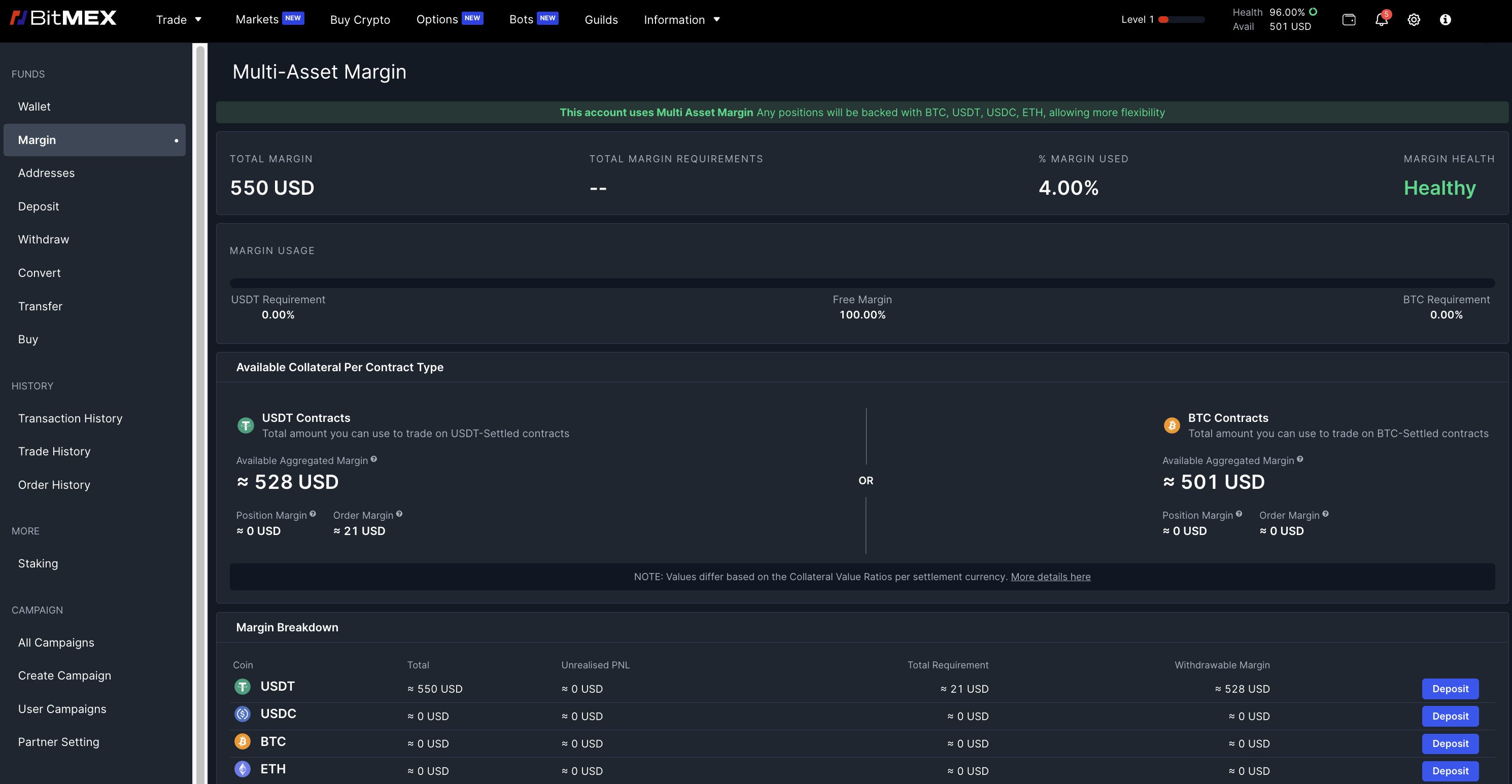

Any account with Multi Asset Margining enabled will also display the following notification on their Wallets page, as shown below.

Please note that Multi Asset Margin is compatible with most existing features on BitMEX but does not yet support Isolated Margin or Prediction Markets positions. If an account has open positions in Isolated Margin, you will only be able to enable Multi Asset Margin until these positions are closed.

How Does Multi Asset Margining Work?

Multi Asset Margining is available on BitMEX via Web and Mobile. Please note that users who wish to use the feature on BitMEX Mobile should update their application to version 2.5.5.

With Multi Asset Margining enabled, the margin balances in a selection of currencies count towards an account-level margin balance. Each currency in the balance is then used to support the margin requirements of all open positions on any derivatives contract which is settled in either USDT or XBT.

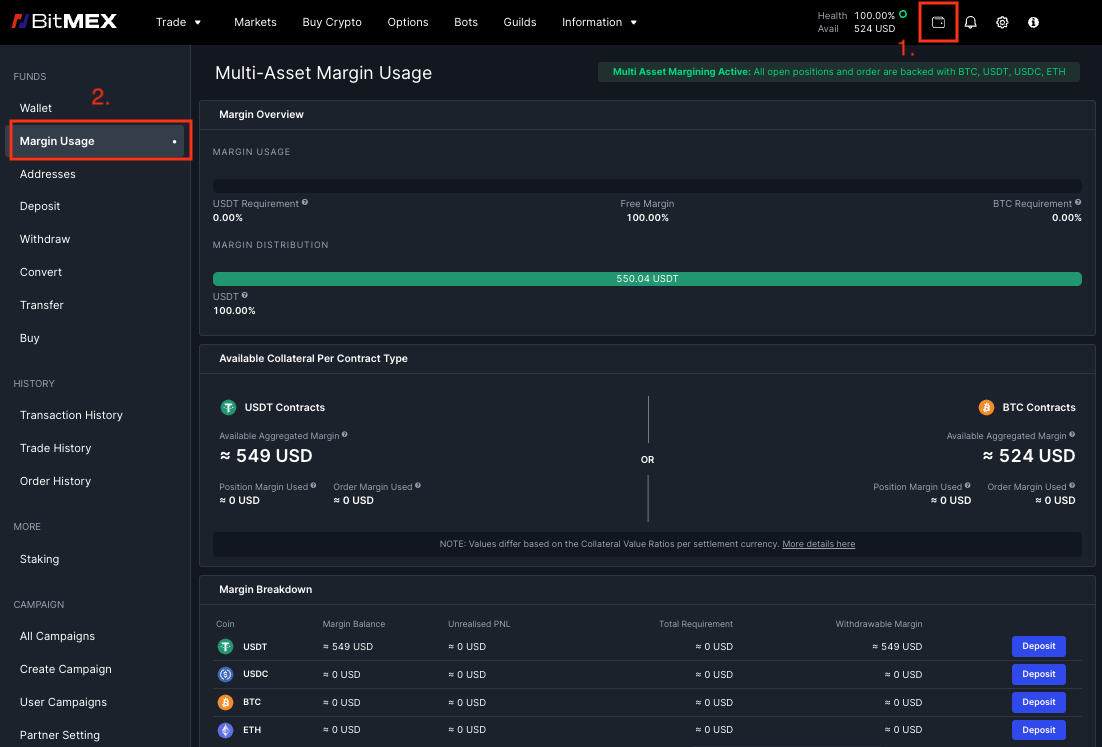

Monitoring Margin Balance

We have designed our Multi-Asset Margining system to allocate a user’s margin as efficiently as possible across their position requirements. However, it is important that a user monitors and manages their account-level margin balance consistently to avoid liquidation.

To do so, navigate to your Wallet page. On the left-hand side, click on Margin Usage. This will show you how much available margin you have to trade either XBT or USDT-margined contracts after haircuts are applied. It’s important to note that if one’s account margin goes negative, the entire account will be liquidated.

Fees and Funding Payments

With Multi Asset Margining enabled, any negative fees or funding payments will first be debited from your wallet balance in that currency. If this balance goes negative, BitMEX will convert some of your margin balance in other currencies to cover the deficit.

On the other hand, any positive fees and funding payments will be credited to your wallet balance in the settlement currency of a designated contract. For example, if one is to receive fees and funding payments from XBTUSD, they will receive it in XBT (the settlement currency).

Realised Profits and Losses

Any realised profits from a trade will be credited to your wallet in the settlement currency of the particular contract once the position is closed. As an example – if one makes a realised profit of $500 from trading XBTUSD, they will receive this profit in XBT (the settlement currency). This is the case regardless of what margin currency was used to open the position.

Any realised losses will be debited from your wallet balance in that currency – the same way that fees and funding payments are made. If this balance goes negative, BitMEX will convert some of your margin balance in other currencies to cover the deficit.

For the full details on how Multi Asset Margining works on BitMEX, head over to the FAQs page here.

To be the first to know about our new promotions, giveaways, listings, and product launches, you can visit https://www.bitmex.com/ or connect with us on Telegram and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.

The post Now Live: Trade With Any Margin Currency Through Multi Asset Margining appeared first on BitMEX Blog.

BitMEX Blog