Fungible vs. Non-Fungible Tokens: Everything You Need to Know

Crypto has a lot of terms that might sound confusing at first, but actually aren’t. The distinction between fungible vs. non-fungible tokens is one of them. It’s crucial to understand if you’re getting into crypto, and it’s actually simpler than it seems. Fungible tokens work like currency, and non-fungible tokens (NFTs) are unique and represent valuable assets. This guide will tell you exactly how both work, why they matter, and how to tell them apart.

What Are Fungible Tokens?

A fungible token is a kind of digital token where all individual units of a type have equal value, making them identical and interchangeable. That means one unit is always worth the same as any other, no matter who owns it or where it comes from. It makes them perfect for trading, spending, or saving, just like regular money.

There are many fungible tokens out there, and most follow some kind of standard, like ERC-20, which was launched on Ethereum in 2015. It ensures they’re uniform, easy to split, and simple to trade. They act like currencies or commodities, seamlessly circulating through the digital world without losing value. Imagine them like dollar bills. It doesn’t matter which one you hand over at the store. As long as it’s the same denomination, it’s worth the same amount everywhere.

Fungible tokens are the backbone of the crypto economy. They include Bitcoin (BTC), Ethereum (ETH), altcoins and stablecoins. As of April 2025, there are over 17,000 cryptocurrencies in existence—most of which are fungible tokens.

Examples

Here are some of the most popular fungible tokens you’ll run into:

- Bitcoin (BTC): The first fungible asset in crypto. It set the standard for all digital money.

- Ethereum (ETH): Used for payments across the world, and running smart contracts.

- Tether (USDT) and USD Coin (USDC): Stablecoins that track the US dollar’s value.

- Uniswap (UNI) and Aave (AAVE): Used in DeFi platforms for trading, lending, and governance.

- Axie Infinity (AXS): A game token that powers a play-to-earn economy.

Use Cases and Applications

Fungible tokens are literally everywhere in crypto. They can be used to:

- Buy goods, pay for services, transfer funds globally.

- Easily exchange coins on platforms like Binance or Coinbase.

- Provide liquidity, stake assets, and earn yield in DeFi.

- Serve as an in-game currency for blockchain games.

- Vote on changes in decentralized projects.

Benefits and Challenges

What Are Non-Fungible Tokens?

A non-fungible token (NFT) is a digital asset that represents something unique, with its own ID and metadata baked into the blockchain. That’s what makes it non-fungible—you can’t swap an NFT for any another. They don’t have equal value and can’t be copied.

Most NFTs follow Ethereum’s ERC-721 standard, launched in 2018. It lets developers create tokens that prove ownership records of assets with unique attributes. Those assets could be anything from art, a piece of virtual land, a rare game item, or a music track.

Think of NFTs like family heirlooms or collectibles. Each one is one of a kind, with its own story, meaning, and different value.

Examples

Here’s where you can see non-fungible tokens in action:

- CryptoPunks: One of the first big NFT collections, where each punk avatar is different.

- Bored Ape Yacht Club: Unique ape images, often used as profile pics.

- Beeple’s “Everydays” NFT: Sold for $69 million at Christie’s in 2021.

- NBA Top Shot: Basketball highlight clips as digital collectibles.

- Decentraland Land Parcels: Pieces of the digital world that you can buy.

Use Cases and Applications Beyond Digital Art

These days, NFTs are about more than just art. You can use them in many different ways:

- Virtual Real Estate: Buy land in games like Decentraland or Sandbox.

- In-Game Items: Own rare skins, weapons, or outfits that are uniquely yours.

- Music and Media: Buy strictly unique songs, videos, or albums.

- Tickets and Memberships: Some NFTs give event access or special perks.

- Physical Goods: Some brands link NFTs to real-world items like shoes or watches.

NFTs let you represent ownership of almost anything, from a digital file to real-world assets.

Benefits and Challenges

Why So Much Negativity Around NFTs in General?

NFTs get hate for a couple of reasons, and it’s important to keep these criticisms in mind if you’re thinking of buying one of your own. Some people think NFTs are scams or overpriced. Others worry about their environmental impact, since some NFTs run on energy-heavy blockchains (though this has improved since Ethereum’s 2022 upgrade to proof-of-stake). Critics also point out that anyone can copy and use the digital file an NFT represents. Plus, markets are full of fake collections and risky investments. All of this creates a lot of bad press.

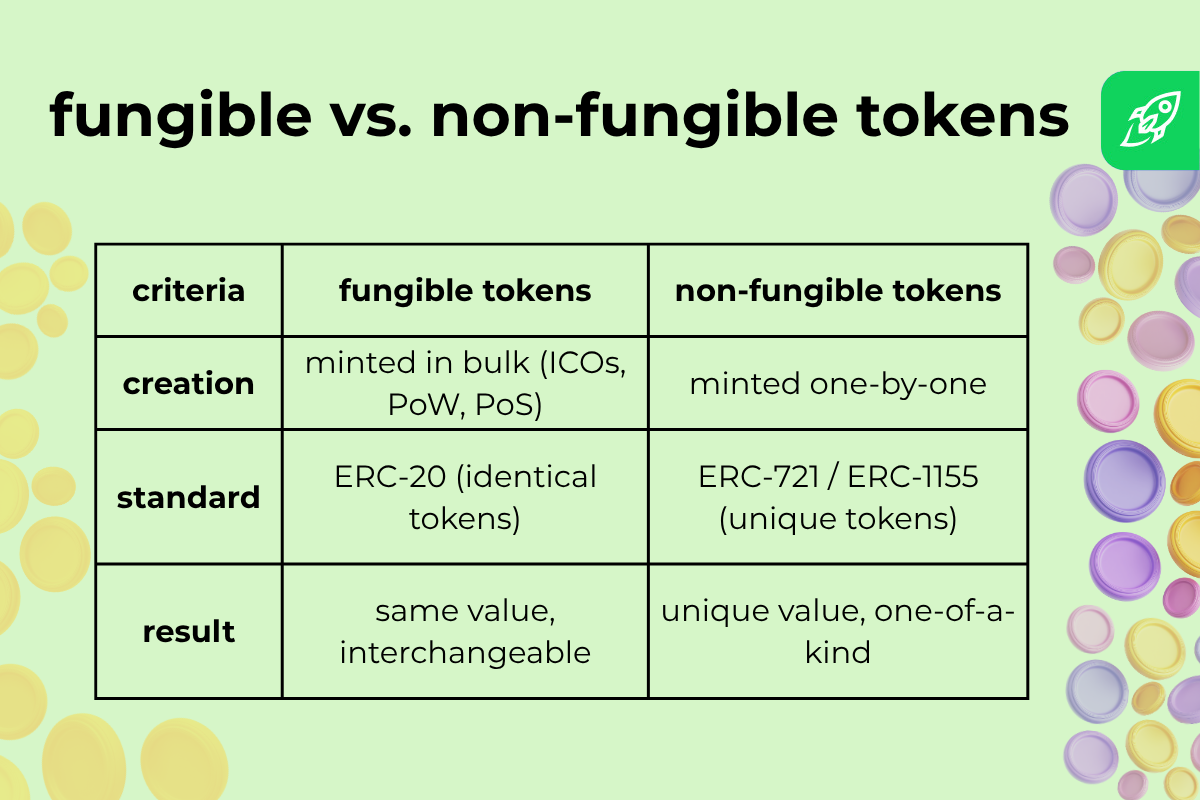

Key Differences Between Fungible and Non-Fungible Tokens

Both types live on the blockchain, but they work in very different ways and are use for different cases. Here’s how fungible vs. non-fungible tokens differ:

Standards

As we’ve covered above, fungible tokens usually follow the ERC-20 standard. This makes sure every token of the same type works exactly the same way. You can send, receive, or trade them without delving into the details.

Non-fungible tokens (NFTs) follow ERC-721 or ERC-1155 standards. Unlike other tokens, these standards allow developers to represent unique assets with their own IDs and metadata, making each NFT distinct and indivisible.

Ownership

With fungible tokens, ownership is arbitrary. If you hold 1 ETH or 1 BTC, it has the same value as anyone else’s. It doesn’t matter which exact unit you own.

With non-fungible assets, ownership is specific. Each NFT represents unique ownership of a digital asset. You own that exact token and no one else has anything like it.

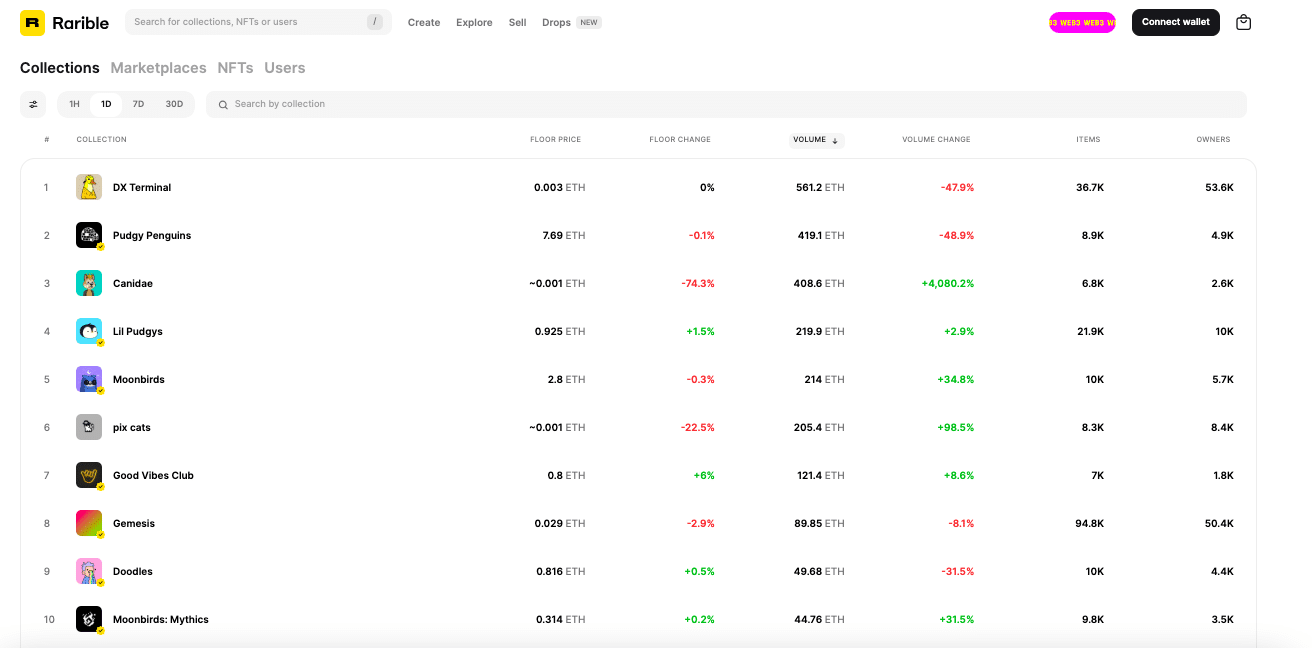

Marketplaces

You can trade fungible tokens on regular crypto exchanges like Binance, Coinbase, or Kraken. These platforms handle financial transactions for tokens with the same type and price.

For non-fungible assets, you’ll need to go to NFT marketplaces like OpenSea, Blur, or Rarible. These platforms let you buy, sell, or auction assets that are unique and non-interchangeable.

Interchangeability

Fungible tokens are considered fungible because they are fully interchangeable. That means you can swap one bitcoin for another bitcoin, for example, with no change in value. It’s like exchanging two dollar bills or two gold bars of the same weight for each other.

Non-fungible tokens are the exact opposite. Each one is completely unique. You can’t trade them on a one-to-one basis because they all have a different value depending on what they represent.

Divisibility

Fungible tokens are divisible. You can break them into smaller parts. Bitcoin divides into satoshis, and Ethereum into GWEI. This makes them useful for financial transactions of any size.

Non-fungible tokens, however, aren’t divisible. You can’t split an NFT into pieces at all. It’s either the whole thing, or nothing. It’s in line with their philosophy of strict uniqueness.

Liquidity

Fungible tokens have high liquidity. You can easily trade them on exchanges at the same price as everyone else. It’s simple, like exchanging fiat money at a currency counter.

On the other hand, non-fungible tokens have low liquidity. That means selling them depends on finding the right buyer who values that specific asset. It’s more like trying to auction off your diamond ring, and sometimes, it can take weeks to find someone who will take it off your hands.

Creation

Fungible tokens are often minted in bulk using consensus methods, token sales, or Initial Coin Offerings (ICOs). For example, Bitcoin is generated through proof-of-work mining, while Ethereum now issues new tokens via proof-of-stake rewards after the Merge in 2022.

Non-fungible tokens are created individually through minting. This process embeds the token’s metadata on the blockchain, giving each NFT a unique identifier and ownership record. It’s like stamping a certificate of authenticity on a digital collectible.

Storage

Fungible tokens live entirely on the blockchain. Your wallet doesn’t hold the coins themselves, it just stores your private key and reads the public ledger to show you your balance. Wallets like MetaMask or Trust Wallet simply display that on-chain balance when you connect.

Non-fungible tokens work differently. You keep ownership records on-chain, but the actual files—images, videos, metadata—are usually stored off-chain via solutions like IPFS. Your wallet just holds the ID and points to that file. Think of it like owning a receipt: the token proves you own something, while the asset itself lives in a separate vault.

Governance

Fungible tokens sometimes give you voting power. For example, utility tokens like UNI or MKR let holders vote on project updates or fee changes. In this case, your fungible assets can act like shares in a company, with each token acting as one vote.

Non-fungible tokens, meanwhile, usually don’t have governance features. Owning an NFT means you own a unique asset, but you typically don’t get a say in platform decisions.

Utility

Fungible tokens work like digital money. You use them to facilitate transactions and pay, trade, stake, or invest. They power DeFi apps, gaming economies, and day-to-day crypto transactions. If you’re sending crypto to a friend or buying cryptocurrency on an exchange, you’re using fungible assets.

Non-fungible tokens serve a different purpose. They represent ownership of unique things—like digital art, in-game items, collectibles, or real-world assets. Some NFTs unlock perks: event tickets, VIP memberships, or future proceeds from sales. Others just sit in wallets, as collectibles or status symbols.

Functionality

Fungible tokens are built for speed and simplicity. You use them to pay, trade, stake, or transfer value. They fuel everyday crypto activities, and keep the crypto economy moving by allowing fast, frictionless exchanges.

Non-fungible tokens serve a different purpose. They’re designed for provenance and tracking ownership. Each NFT links to a specific asset, and their function is to prove who owns what and maintain that record forever on the blockchain.

Security Risks

Fungible tokens face security issues that target the underlying blockchain technology, or user mistakes. They can include phishing, or exchange breaches, all of which If someone gets your private key, they can drain your wallet. Smart contract bugs can also lead to stolen funds. One example of this is the Poly Network hack of 2021, when a hacker took advantage of an exploit and drained over $600 million in ETH, USDT, and other assets from the DeFi protocol.

Non-fungible tokens have their own risks. For one, if the file linked to your NFT disappears from off-chain storage, you’re stuck with a token that points to nothing. Scams are common too, with fake collections, counterfeit NFTs, or links to malicious sites. Just look at the Evolved Apes case, where buyers paid for NFTs tied to a game promised by the creators—who then vanished with $3 million.

Read more: Risk Management in Crypto

Value

Fungible tokens get their value from market demand, and their price difference depends on supply, hype, and real-world use—just like stocks. For example, if more companies start accepting Bitcoin as payment, demand will rise and the price will go up.

With NFTs, each token has its own value based on its rarity and community interest. There’s an element of hype in what makes non-fungible assets popular. One example is the Bored Ape Yacht Club, which shot up when celebrities like Snoop Dogg and Eminem bought in and used their NFTs as profile pics, even performing as their avatars at the VMAs.

Future Perspectives

The future of fungible and non-fungible tokens is looking bright. For fungible tokens, adoption is on the rise. More and more companies are accepting crypto payments, and stablecoin projects such as Tether and Circle are partnering with corporations like Visa, Mastercard, and PayPal. Non-fungible tokens are expanding, too, moving beyond digital art into gaming, virtual land, and real-world assets. Even the New York Stock Exchange has filed trademarks for its own potential NFT platform.

Read more: Real-World Assets In Crypto

How to Buy Fungible Tokens

Changelly is a great place to start with crypto, and buying fungible assets on the platform is fast, easy, and beginner-friendly. Here’s how it works:

- Pick a token. You can choose Bitcoin, Ethereum, USDT, or over 1,000 others.

- Enter your wallet address. This is where your bought assets will go. Remember to always double-check your address!

- Pay with a debit or credit card, Apple Pay, or others. Changelly supports multiple payment options, including fiat currencies like USD or EUR.

- Receive your tokens. After payment, your assets are sent directly to your wallet. No hidden fees or extra steps.

You can buy up to $30,000 worth of crypto in a single transaction on Changelly. That makes it easy to start small, or go big.

Final Words

As we’ve seen, there are important differences between fungible and non-fungible tokens in the crypto world. Fungible assets are interchangeable and share the same value, serving as a form of digital currency and the core of the entire crypto community. Non-fungible assets are all strictly unique, and are used to represent art, collectibles, real-world assets, and other valuable commodities.

Fungible tokens are your best bet for trading, investing, or using crypto as currency, while non-fungible tokens make sense if you’re looking to collect digital assets, join gaming ecosystems, or invest in unique items in the real world.

FAQ

Why would someone buy a non-fungible token?

To own a totally unique digital asset, which could be digital art, a collectible, or an in-game item with special attributes. Some people also buy NFTs as investments or status symbols.

Do I need cryptocurrency to buy NFTs?

Yes. You can buy most non-fungible tokens (NFTs) with Ethereum or other cryptocurrencies. You’ll need a crypto wallet and some ETH to shop on platforms like OpenSea or Blur.

Are NFTs or fungible tokens a better investment?

It depends on your goals. Fungible tokens are better if you want to use crypto like money—for trading, saving, or paying for things. Non-fungible tokens are riskier, and have no fixed value, but they work better for collecting or long-term investing, especially if you believe that the asset will increase in value over time.

Can you make real money with NFTs?

Yes, but it’s not guaranteed. You can make money on an NFT by buying low and selling high, just like other crypto assets. Some NFTs shoot up in value when demand spikes, but others never do.

Can I convert NFTs to real money?

Yes, but it’s a two-step process. You can sell the NFT for crypto like ETH on a marketplace. Then convert that into cash using an exchange.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post Fungible vs. Non-Fungible Tokens: Everything You Need to Know appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly