DAT Stocks vs Crypto: Which is the Better Investment?

While past cycles were driven by retail FOMO and celebrity hype, this cycle has a new engine: Digital Asset Treasury (DAT) Stocks. These companies have amassed heavy trading volumes and are accumulating crypto supply like there’s no tomorrow. This raises a crucial question: are they a better way to get long exposure to a cryptocurrency, or are traders better off simply buying the underlying asset?

While past cycles were driven by retail FOMO and celebrity hype, this cycle has a new engine: Digital Asset Treasury (DAT) Stocks. These companies have amassed heavy trading volumes and are accumulating crypto supply like there’s no tomorrow. This raises a crucial question: are they a better way to get long exposure to a cryptocurrency, or are traders better off simply buying the underlying asset?

In this article, we looked across DAT stocks around Bitcoin, Ethereum, Solana and BNB. Our argument is that the days of consistent DAT stock outperformance may be behind us. When Strategy ($MSTR) first pioneered the model, there was little competition among DATs. Today, with virtually no barriers to entry, we’re seeing an overexpansion of DAT stocks all competing to acquire the same assets. This crowding has diluted the scarcity premium and reduced demand compared to the early $MSTR era.

The evidence speaks for itself. Even the most high-profile names—$BMNR and $SBET—have failed to outperform $ETH over the past month. For an even starker example, $BNB is at all-time-highs, but its related treasury stocks, such as $WINT, have sunk to lower lows over the same period.

Our view: when multiple DAT stocks are racing to build the largest treasury for the same crypto, aggressive equity issuance and competition erode the investment case. In those situations, traders who are bullish on the asset should skip the stock wrapper and own the underlying coin directly.

Case Studies

- Bitcoin – MicroStrategy (MSTR)

$MSTR outperformed $BTC by over 250% since 2024

In the early days of the DAT phenomenon, Strategy was the perfect example of how a listed company could massively outperform the underlying crypto. By aggressively accumulating Bitcoin and capitalizing on a large and persistent premium to its modified net asset value (mNAV), MSTR delivered gains far beyond BTC’s own performance.

However, this outperformance trend has since died off amid the emergence of $ETH and other DATs. $MSTR underperformed $BTC by 17% in the last month.

However, this outperformance trend has since died off amid the emergence of $ETH and other DATs. $MSTR underperformed $BTC by 17% in the last month.

Fast forward to today, and the picture has changed. Over the past month, MSTR has struggled to keep pace with Bitcoin itself. The mNAV ratio—a key measure of how much of a premium investors are willing to pay for the “stock wrapper” over the value of its BTC holdings—has compressed to around 1.6, close to its all-time low. This erosion in premium highlights how competition in the DAT space and investor preference for direct exposure have made it harder for even the most established name to sustain its advantage.

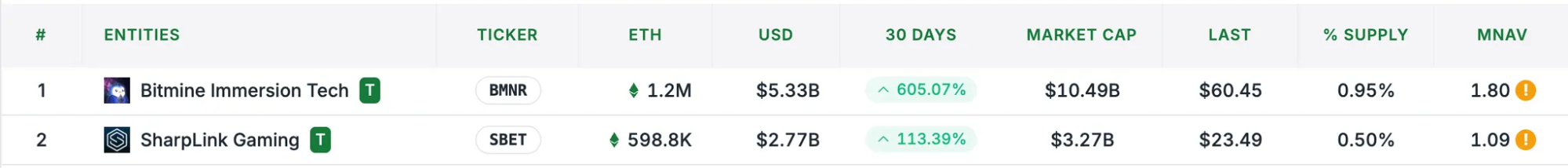

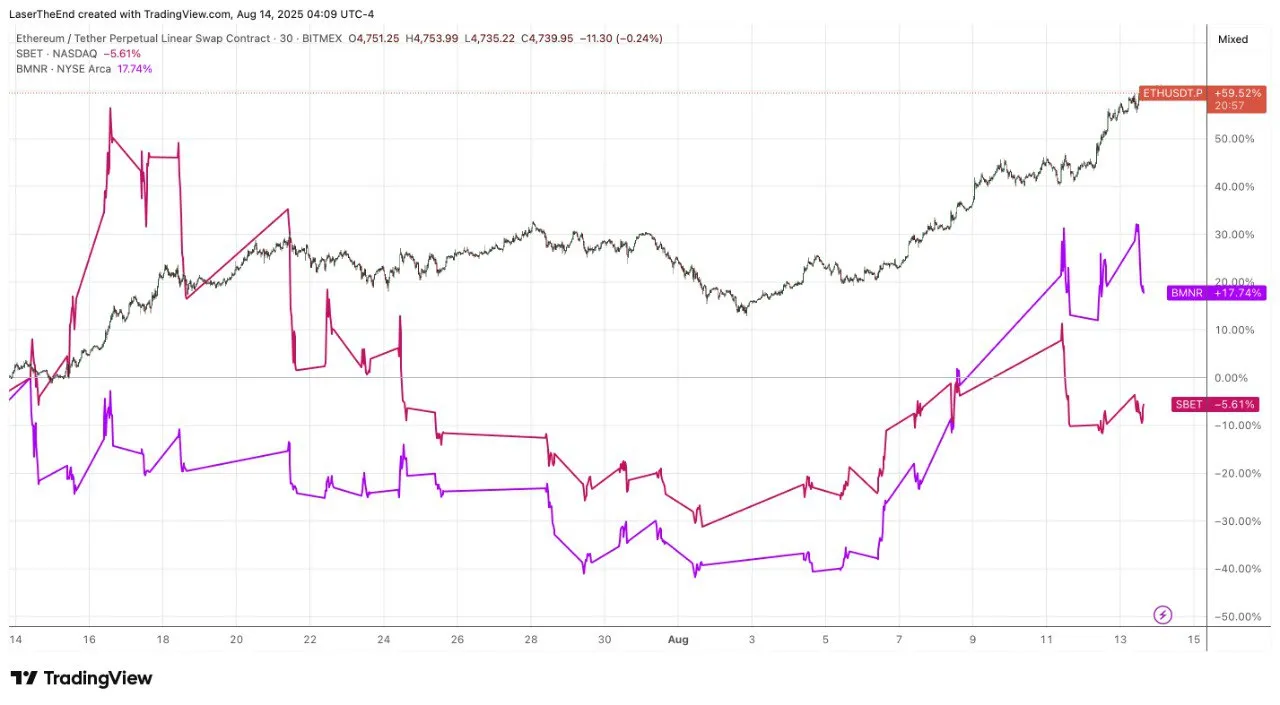

2. Ethereum – SharpLink ($SBET) vs. BitMine Immersion ($BMNR)

Last 1 month performance: $ETH outperformed $BMNR and $SBET by over 40%

Ethereum’s DAT race is currently one of the most intense in the market. SharpLink (SBET) and BitMine Immersion (BMNR) have both publicly committed to becoming the world’s largest ETH treasury, and their strategies are almost identical: raise as much capital as possible through at-the-market (ATM) offerings and direct placements, then deploy the proceeds into ETH purchases.

This has created a dynamic that isn’t favourable for shareholders and actually benefited ETH hodlers more —as long as the mNAV stays above 1.0, both companies have an incentive to keep issuing new shares, increasing ETH holdings but also steadily diluting existing shareholders. SBET’s mNAV is now only slightly above 1.0, which limits its flexibility, while BMNR is still actively raising and buying. In the meantime, Ethereum itself has been the clear winner, benefiting from large, sustained buy pressure from both treasuries. For traders, this raises the question: if multiple entities are buying $ETH almost every day and competing heavily on the scoreboard, isn’t the asset that can capture the most upside is $ETH itself?

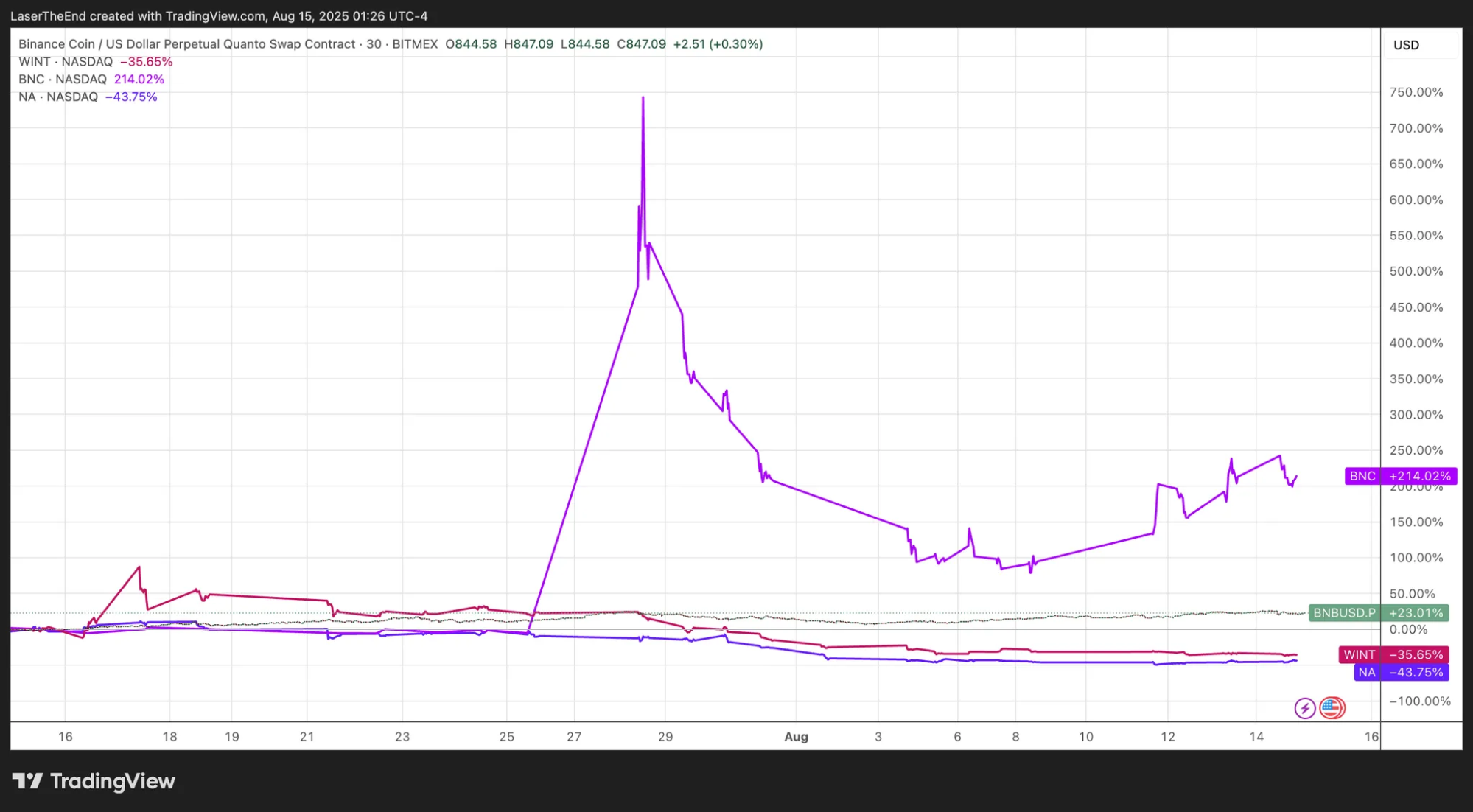

3. BNB – Multiple DATs Competing in Parallel

Last 1 month performance: $BNB breaks ATH, while $WINT and $NA keep heading down. NOTE: BNC announced the PIPE deal on July 28th, but its stock price also underperformed $BNB since the initial spike.

Last 1 month performance: $BNB breaks ATH, while $WINT and $NA keep heading down. NOTE: BNC announced the PIPE deal on July 28th, but its stock price also underperformed $BNB since the initial spike.

BNB’s DAT stocks are more fragmented, with at least three large players—each managing or planning treasuries in excess of $300 million—competing for dominance. This fragmentation means there is no single “premium” stock that captures investor demand; instead, capital and attention are split across multiple wrappers.

The most visible names include:

- Windtree Therapeutics (NASDAQ: WINT) — plans to raise $200–$700 million to acquire BNB.

- CEA Industries / BNB Network Company (NASDAQ: BNC) — Rebranded with the goal of becoming the world’s largest public BNB treasury, securing a $500 million PIPE plus up to $750 million in warrants, and continuing accumulation through at-the-market (ATM) offerings.

- Nano Labs (NASDAQ: NA) — a Hong Kong–based chipmaker aiming for a $1 billion BNB acquisition, funded by a $500 million interest-free convertible note.

So far, the result has been underwhelming performance. $WINT and $NA’s share prices have been in steady decline despite BNB itself breaking ATHs. In a crowded field like this, each player must continually issue new equity or debt to scale their treasury, but without the scarcity premium that helped early Bitcoin DATs like MSTR outperform. For traders bullish on BNB, direct ownership—and staking if desired—offers cleaner exposure with fewer moving parts.

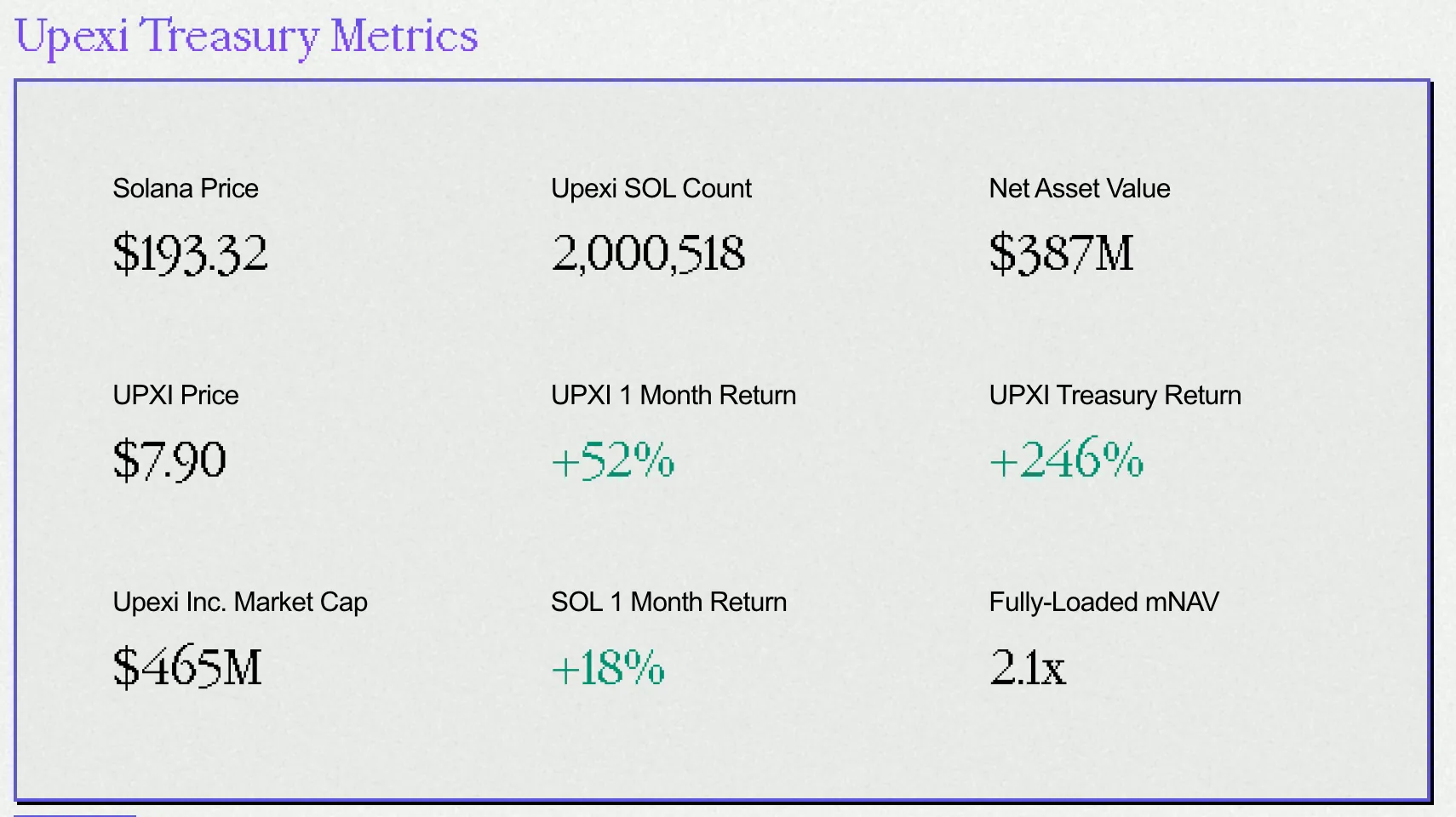

4. Solana – Upexi (UPXI), a Rare Outperformer

$UPXI outperformed $SOL by 34% in the past month

Upexi (UPXI) and Solana currently stand out as a rare example of a Digital Asset Treasury (DAT) stock that has outperformed its underlying token. Upexi trades at a mNAV of 2.1×, meaning its market cap is more than double the raw value of its SOL holdings.

We think Upexi hasn’t yet faced serious competition as the leader of Solana DAT space. The DAT’s market cap is much higher than the rest of the Solana DATs and recently the company was able to hire our very best Arthur Hayes as the advisor. That might explain why Upexi’s share price has a significant premium to SOL itself, but we don’t think it will last as more competitors will likely enter the DAT space, given that these stocks are all at a premium and there’s no barrier of entry.

Conclusion – Underlying Assets are better than DATs

DATs has certainly attracted a wave of new buyers, but our case studies show the limitations of this approach in 2025. The early MSTR era thrived on scarcity—one dominant player with an innovative approach. That world is gone.

In Ethereum and BNB, competition among multiple DATs has turned into an arms race of equity issuance and ATM sales. This constant dilution chips away at mNAV premiums and leaves the underlying token—$ETH or $BNB—as the main beneficiary of sustained buying pressure. Even in Bitcoin, MSTR’s once-lofty premium has compressed to near historic lows, and it has underperformed BTC over the past month.

A meaningful exception is Solana DATs, but with no real barriers to entry, that advantage can evaporate as quickly as it emerged.

For traders, the takeaway is simple: if you’re bullish on a cryptocurrency and the DAT landscape for that asset is crowded, owning the token directly is the cleaner play. DAT stocks may still offer short-term opportunities around premium swings, but on days where there are more DATs chasing one coin, the underlying remains king.

The post DAT Stocks vs Crypto: Which is the Better Investment? appeared first on BitMEX Blog.

BitMEX Blog