Zoomex Review: Is It a Good and Safe Crypto Exchange in 2025?

Zoomex crypto exchange is a global trading platform launched in 2021 that offers both spot and high-leverage derivatives markets. It combines a centralized exchange (CEX) and a decentralized exchange (DEX) in one place. The best features that make Zoomex a good exchange are high leverage up to 1,000x, competitive trading fees, over 500 supported cryptocurrencies, integrated copy trading, and an optional no-KYC account.

Zoomex is a safe exchange to trade on, but it is not legal in the United States. Any U.S. authority does not license the exchange, yet it operates as a no-KYC platform, which means you can still create an account and trade.

In this Zoomex review, you will learn about its pros and cons, trading fees, supported cryptocurrencies, and the deposit and withdrawal process. We will also go over key features like copy trading and the DEX, the types of trading it focuses on, and its overall legitimacy. At the end, we will provide a step-by-step guide on how to open a new trading account on Zoomex.

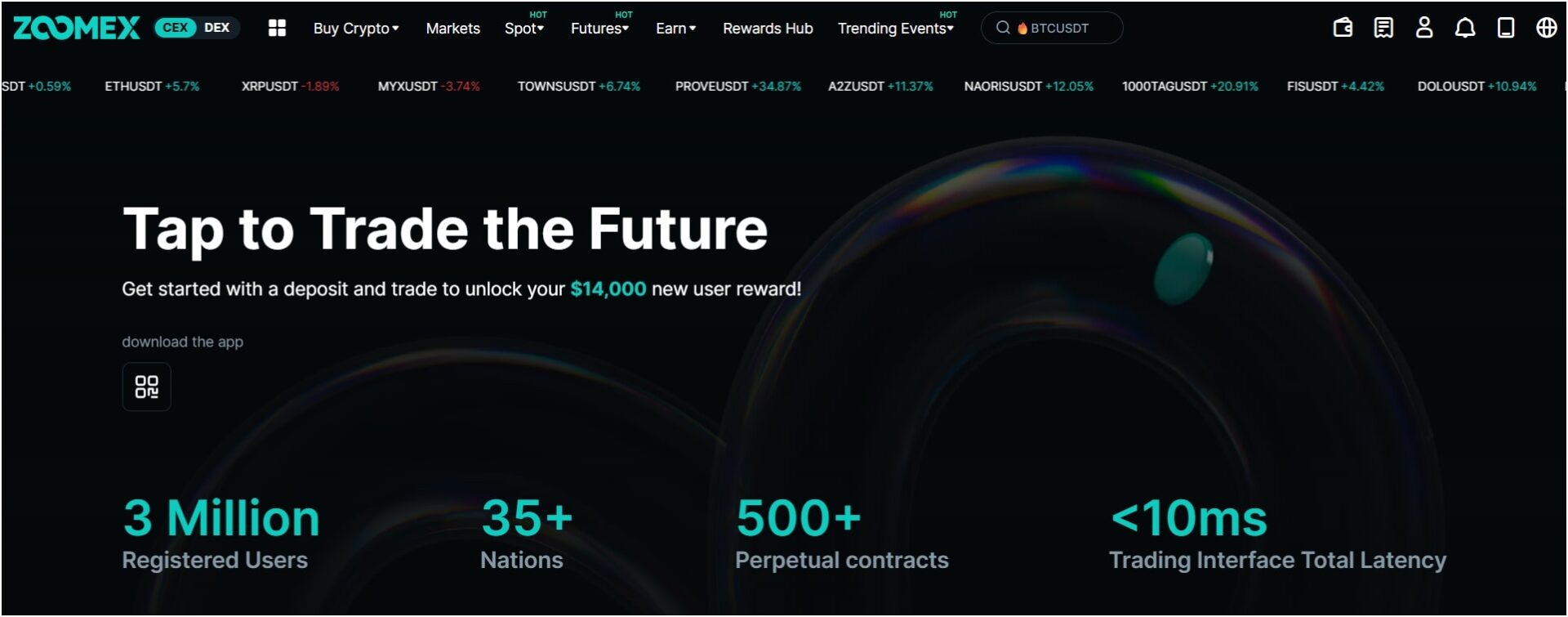

Zoomex Review: What Is It?

Zoomex is a cryptocurrency trading platform, launched in 2021, that offers both a centralized exchange (CEX) and a decentralized exchange (DEX). You can trade spot pairs, futures, and perpetual swaps on the CEX, or connect a wallet and trade on the DEX without creating an account. The exchange says it serves over 3 million users across more than 35 countries. Zoomex also emphasizes privacy by allowing you to sign up with just an email or phone number; no mandatory KYC is required unless you want to raise your withdrawal limit.

The platform supports over 500 cryptocurrencies, from well‑known coins like Bitcoin (BTC) and Ethereum (ETH) to smaller altcoins and DeFi tokens. Here, traders can choose between spot trading, perpetual contracts, and inverse contracts with leverage up to 1,000x, and the trading interface includes advanced charting tools from TradingView.

Zoomex is registered in Hong Kong and holds a Money Services Business (MSB) license from FINTRAC in Canada. So, this license allows it to legally offer crypto services in many jurisdictions, although it is not recognized in the United States. The company claims to follow strict security standards, including two‑factor authentication (2FA), cold storage of customer funds, an insurance fund, and regular third‑party security audits. And since its launch, Zoomex has not reported any major security breaches.

What Are the Pros of Zoomex?

The pros of Zoomex are no-KYC trading, high leverage, a large selection of coins, integrated DEX access, a user-friendly app, and high security measures.

- No mandatory KYC: You can create an account with just an email address or phone number and start trading immediately. Up to 100 BTC per day can be withdrawn without submitting identity documents.

- High leverage and varied products: Zoomex offers leverage up to 1,000x on selected contracts, and you can trade spot pairs, USDT‑margined perpetuals, and inverse contracts, and choose isolated or cross margin to manage risk.

- Large selection of coins: With more than 500 supported cryptocurrencies, Zoomex lists major assets (BTC, ETH, XRP, LTC, SOL, ADA) and many smaller projects. Also, new coins are added frequently.

- Integrated DEX: Zoomex runs a decentralized exchange that shares liquidity with the CEX. You can connect a wallet like MetaMask and trade perpetual contracts without registering or transferring funds to Zoomex.

- User‑friendly interface and mobile app: The web interface and mobile app (available on iOS and Android) provide clear order books, charts, and quick order placement. You can trade on the go and set price alerts.

- Security measures: The exchange is highly secure. Funds are stored in cold wallets, withdrawals require 2FA, and the exchange undergoes regular security audits. An $50 million insurance fund provides a backstop in extreme market conditions.

What Are the Cons of Zoomex?

The cons of Zoomex are limited fiat support, thin liquidity on new coins, and restricted in certain countries.

- Limited fiat support: Buying crypto with fiat is possible only through third‑party providers such as Onramper and Transak. These services charge their own fees (often 1-3%), and direct bank transfers are not widely supported.

- Thin liquidity on new coins: Zoomex has deep liquidity for major pairs but lower liquidity on smaller altcoins, which can lead to slippage when placing larger orders.

- Not available in all countries: Zoomex prohibits residents of mainland China, Iran, North Korea, Cuba, Syria, Sudan, and Crimea from using the platform. Users in these regions should use a local licensed exchange instead.

Where Is Zoomex Based?

Zoomex is headquartered in Hong Kong, a jurisdiction known for its flexible yet structured regulatory environment for digital assets. Being based in Hong Kong allows Zoomex to serve markets across Asia and Europe while maintaining operational freedom.

The company holds a Money Services Business (MSB) license from FINTRAC in Canada, which permits it to offer cryptocurrency services to international customers (except those in restricted regions). Zoomex also has regional offices or representatives in Singapore and South Korea.

Is Zoomex Legal in the US?

Zoomex is not legal to use in the US, but since this is a no-KYC exchange, you can use it in the United States. If you want a legal exchange, you should choose platforms like Coinbase, Kraken, or Binance U.S., all of which comply with U.S. regulations.

What Are the Exchange Fees for Zoomex?

The Zoomex exchange fees are 0.1% maker/taker for spot trades and 0.02% maker and 0.06% taker for futures trading. It does not charge deposit fees and has variable withdrawal fees based on network congestion.

Zoomex Deposit Fees

Zoomex does charge deposit fees. You simply need to generate a deposit address on the platform for the chosen coin and send funds from your external wallet. The only cost you pay is the blockchain network fee, which goes to miners or validators; Zoomex does not charge extra. For example, sending Bitcoin may cost around 0.0001 BTC in network fees, depending on network congestion, and Zoomex will credit the full amount it receives.

Also, if you want to purchase crypto with fiat currency, Zoomex uses third‑party payment gateways like Onramper and Transak. You can also use credit cards, Google Pay, or other local methods where supported. These providers charge their own processing fees, which typically range from 1% to 3% of the purchase amount. Zoomex does not add additional fees for these transactions, but the final cost depends on your chosen provider and location.

Zoomex Withdrawal Fees

Zoomex withdrawal fees are a fixed fee that covers blockchain costs and the exchange’s service charge. Common withdrawal fees at the time of writing are (subject to change):

- Bitcoin (BTC): 0.00005 BTC per withdrawal

- Ethereum (ETH): 0.0005 ETH per withdrawal

- Tether (USDT ERC‑20): 10 USDT per withdrawal

- Solana (SOL): 0.01 SOL per withdrawal

- Ripple (XRP): 0.25 XRP per withdrawal

Zoomex Trading Fees

Zoomex uses a maker‑taker fee model. Makers add liquidity by placing limit orders, and takers remove liquidity by executing orders against the order book. The fee structure differs between spot and derivatives trading.

Spot trading fees

Spot trades cost 0.10% for both makers and takers at the basic level. But if you trade large volumes, you may qualify for VIP tier trading fee discounts. These reductions are mainly to encourage high‑volume trading.

Futures trading fees

Futures trades are cheaper than spot trades. Makers pay 0.02%, and takers pay 0.06% at the base level. VIP discounts apply as your trading volume grows; the highest VIP tier reduces derivatives fees to 0.002% maker and 0.024% taker. Also, keep in mind that funding rates apply to open positions and can add to or offset your trading costs.

What are the Supported Cryptocurrencies on Zoomex?

Zoomex supports over 500 cryptocurrencies, giving you the ability to trade both mainstream coins and emerging tokens. The selection includes popular coins like Bitcoin (BTC) and Ethereum (ETH), layer-1 and layer-2 projects like Solana (SOL) and Polkadot (DOT), and stablecoins like Tether (USDT) and USD Coin (USDC).

Most of the spot trading pairs are quoted against USDT, USDC, BTC, or ETH, and most derivatives contracts are USDT‑margined perpetuals or inverse perpetuals. With more than 500 assets listed, you can build diversified portfolios or pursue niche trading strategies on a single platform. Just remember that less‑traded tokens may have limited liquidity and higher volatility.

What are the Best Features of Zoomex?

The best features of Zoomex are derivatives trading with 1,000x leverage, a separate DEX for decentralized trading, and crypto copy trading.

Efficient Derivatives Trading Experience

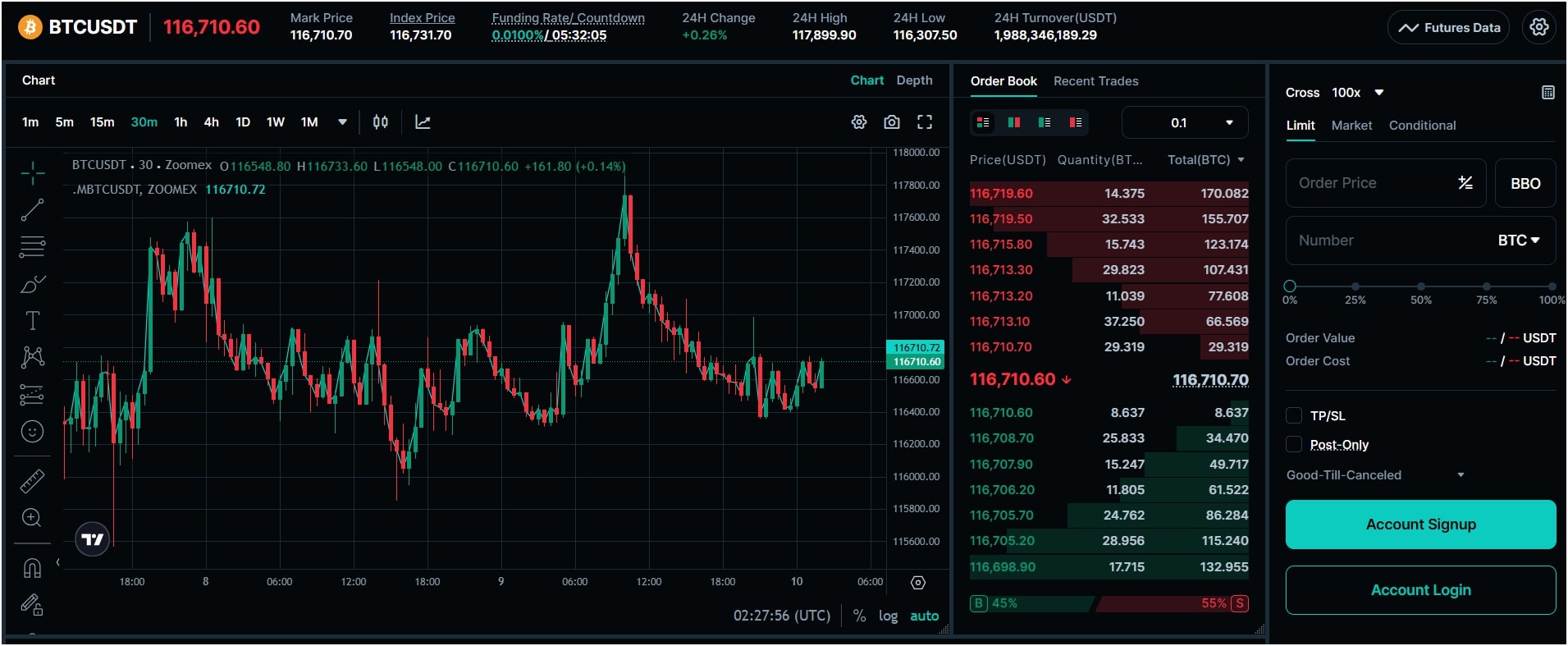

Derivatives trading is the main focus of Zoomex, and the platform builds most of its tools around speed, leverage, and risk control. You have access to USDT-margined perpetual contracts, which are settled in Tether (USDT) regardless of whether you trade long or short, making profits and losses easier to track in a stable currency.

You can also trade inverse perpetual contracts, where settlement happens in the base cryptocurrency, such as BTC or ETH, allowing you to earn or lose directly in the asset itself. Leverage ranges from 1x to 1,000x depending on the pair you choose.

The interface uses TradingView charts with a full set of indicators and drawing tools for technical analysis. You can choose an isolated margin, where only the margin assigned to a position is at risk, or a cross margin, where your entire account balance can support open positions to reduce the chance of liquidation. The system updates liquidation prices, margin requirements, and position values in real-time as you adjust trade size.

Liquidity comes from multiple market makers and external exchanges, which helps keep spreads tight and reduces slippage on active pairs. Orders are processed with latency often under 10 milliseconds. Funding rates for perpetual contracts are updated every eight hours and shown clearly so you can see whether you will pay or receive funding. There is also an insurance fund that exists to cover losses in extreme market moves, lowering the chance of forced position reductions through auto-deleverage.

If you want to automate trades, API access is also available. You can run trading bots to open, close, and manage orders continuously. Hence, the overall setup makes Zoomex’s derivatives section both advanced for experienced traders and approachable for those learning to manage leveraged positions.

Zoomex DEX

Zoomex operates a decentralized exchange alongside its centralized platform. The DEX lets you trade USDT‑margined perpetual contracts directly from your own wallet without creating a Zoomex account. You can connect a wallet (MetaMask, WalletConnect, or the Zoomex plug‑in) and sign transactions to place orders. Because you never deposit funds to the exchange, you retain full control over your assets. The DEX shares liquidity with the CEX, so order books are deep and spreads are tight.

The current DEX offering mainly focuses on perpetual contracts with leverage up to 150x. Spot trading is not yet available on the decentralized side, but Zoomex has hinted that more products could be added. Although the DEX is self‑custodial and privacy‑friendly, it lacks some features of the CEX, such as copy trading and the full range of supported coins. Nevertheless, it provides an attractive option if you prioritize anonymity and control over your funds.

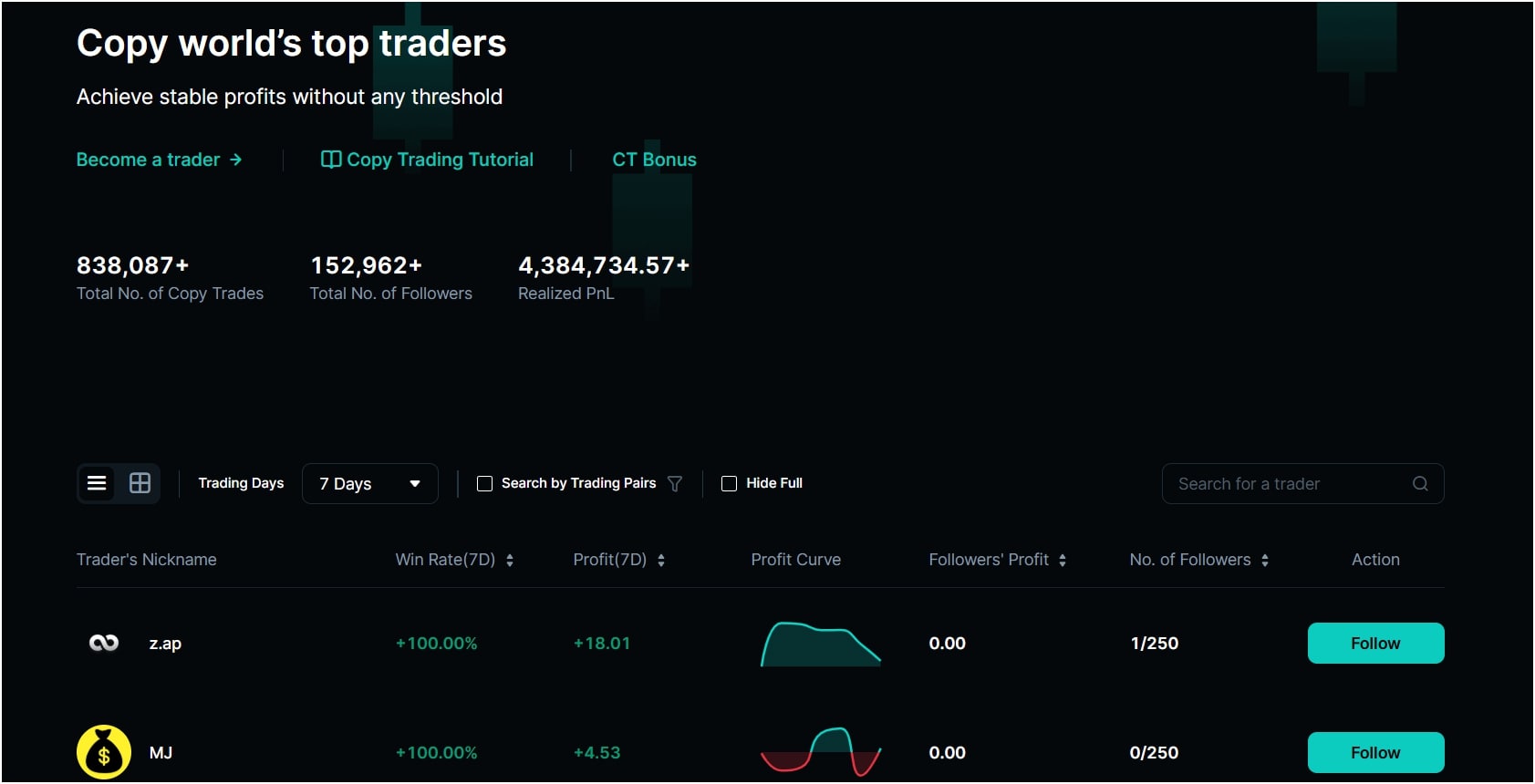

Zoomex Copy Trading

Copy trading on Zoomex allows you to automatically replicate the trades of experienced traders. You can start by browsing a list of master traders, each with statistics showing total return, drawdown, win rate, number of followers, and fees. After reviewing these profiles, you can choose a master whose risk level and strategy match your preferences.

Then, you need to allocate a portion of your balance to copy their trades. Your account will open, adjust, and close positions in proportion to the master’s account. A performance fee (typically 10-20% of net profits) is paid to the master only when you make money.

Copy trading suits beginners or busy traders who cannot monitor markets constantly. However, it carries risks because past performance does not guarantee future results, and masters often use leverage, which can amplify losses. You should diversify by copying more than one master or combining copy trading with your own strategies. Zoomex provides tools like stop copying and daily loss limits to help manage risk.

How to Open a New Trading Account on Zoomex Crypto Exchange?

To open a new trading account on Zoomex Crypto Exchange, you need to register through the website or mobile app, verify your contact details, secure your account with two-factor authentication, deposit funds, and start trading.

Step 1: Create a Zoomex account

You need to begin by going to the Zoomex homepage or launching the app. The Sign Up button is always in the top navigation bar. Click it, then enter your email or mobile number along with a strong password. Read through the terms, agree to them, and submit the form. Here, you can also enter our Zoomex referral code to get a free crypto sign-up bonus.

Now, Zoomex sends a short verification code to your email or phone. You have to type that code into the form to confirm you actually own the account details you entered.

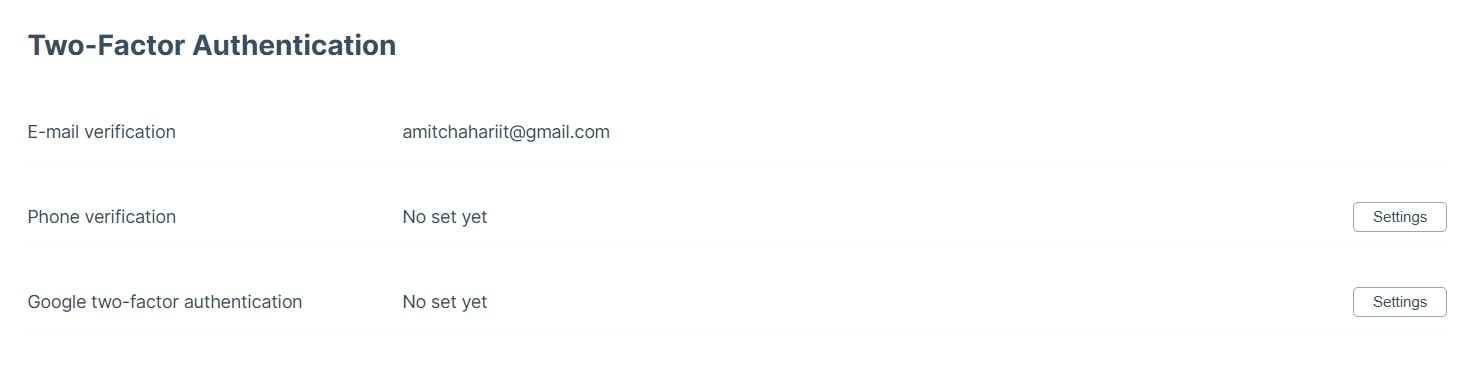

Step 2: Secure your account

Once you are inside your new account, it is worth adding extra protection before doing anything else. In the Security Settings menu, turn on two-factor authentication using Google Authenticator or a similar app. You can also set up a Withdrawal Whitelist so that funds only go to approved wallet addresses, and add an Anti-Phishing Code that appears in every official email from Zoomex. These features make it harder for anyone to compromise your account.

Step 3: Fund your account

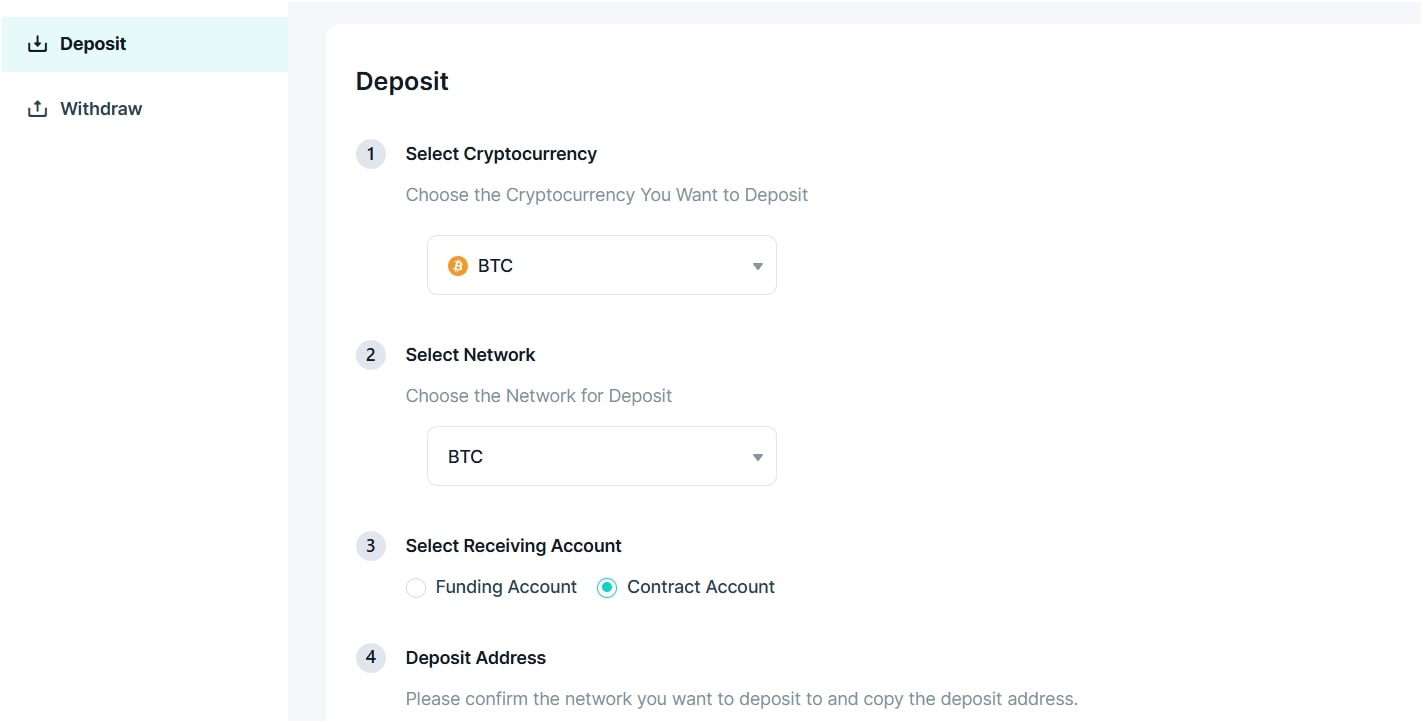

To deposit crypto, open the Assets menu and click Deposit. Select the coin you want, choose the right blockchain network, and decide where the funds should go. You can transfer them to the Funding Account, Contract Account, Spot Account, or Copy Trading Account. Zoomex gives you a wallet address and a QR code. Once your external wallet sends the funds, you can track the deposit progress in your history.

If you are buying crypto with fiat, hover over Buy Crypto and select “Fiat Deposit”. Pick your local currency, the coin you want, and how much you wish to spend. Then choose a payment channel from the list shown. You will see the exchange rate before you can confirm it. Here, you should keep in mind that payment partners may charge their own fees.

Step 4: Start trading

When the balance shows in your account, you are ready to trade. Click on Spot or Derivatives from the top menu, choose a pair, and set your order type – market or limit order. If you are in derivatives, adjust the leverage slider and add stop-loss or take-profit levels if you want extra risk control.

If you are interested in features like Copy Trading or the Zoomex DEX, you can reach them from the main menu or dashboard. The interface updates margin requirements, liquidation prices, and position details in real time, so you always know where you stand.

Zoomex also lets you connect through its API Management page if you plan to run automated strategies. You can create API keys and link them to trading bots, but keep an eye on them, especially if using high leverage, since the price volatility can be high.

What Type of Trading Does Zoomex Primarily Focus On?

Zoomex’s main focus is derivatives trading. While the exchange offers spot trading for hundreds of coins, its user interface, fee structure, and marketing materials emphasize futures and perpetual contracts. You can trade USDT‑margined perpetuals and inverse perpetuals (settled in BTC or ETH), and leverage options range from 1x to 1,000x depending on the pair. The different order types include market, limit, stop‑limit, take‑profit, stop‑loss, and one‑cancels‑the‑other (OCO). And, funding rates apply to perpetuals and are updated every eight hours.

Because of this derivatives focus, Zoomex appeals more to active traders and speculators than to casual investors who simply want to buy and hold crypto. So, if you primarily trade spot markets or are new to crypto, you may find exchanges like Binance, Bybit, or Bitget easier to navigate. Conversely, if you enjoy leveraging your positions, hedging your portfolio, or copying professional traders, Zoomex provides a sophisticated and cost‑effective environment.

Is Zoomex a Good and Legit Cryptocurrency Exchange?

Yes, Zoomex is a legitimate and good exchange for trading crypto, but it is not perfect. The company has operated since 2021 without any significant security incidents.

It holds a Canadian MSB license, adheres to AML and CTF regulations, and invests in security measures such as cold storage, 2FA, and insurance funds. Also, its partnerships with sports teams like Villarreal CF and the MoneyGram Haas F1 Team signal long‑term investment and public exposure.

What Are the Best Alternatives to Zoomex?

The best alternative crypto exchanges to Zoomex are MEXC, Bitget, and Binance. Zoomex offers much higher leverage at 1,000x compared to MEXC, Bitget, and Binance, which cap at 200x or lower. While MEXC supports the largest number of coins, Zoomex still covers 500+ assets, along with optional no-KYC trading and built-in copy trading. For more info, you can read our in-depth MEXC review, Binance review, and Bitget review.

| Criteria | Zoomex | MEXC | Bitget | Binance |

| Launch Year | 2021 | 2018 | 2018 | 2017 |

| Supported Coins | 500+ | 3,500+ | 1,200+ | 350+ |

| Max Leverage | 1,000x | 200x | 125x | 125x |

| Spot Trading Fee | 0.1% maker/taker | 0.1% maker/taker | 0.1% maker/taker | 0.1% maker/taker |

| Futures Fee | 0.02% maker / 0.06% taker | 0.02% maker / 0.06% taker | 0.02% maker / 0.06% taker | 0.02% maker / 0.05% taker |

| KYC Requirement | Optional | Optional | Mandatory | Mandatory |

| Copy Trading | Yes | Yes | Yes | Yes |

| No-KYC Withdrawal Limits | 100 BTC/day | 10 BTC/day | NA | NA |

| Mobile App | iOS & Android | iOS & Android | iOS & Android | iOS & Android |

| U.S. Availability | Yes (Without KYC) | Yes (Using VPN) | No | Separate Binance.US |

The post Zoomex Review: Is It a Good and Safe Crypto Exchange in 2025? appeared first on CryptoNinjas.

CryptoNinjas