What Are Crypto Trading Signals on Telegram in 2025?

Crypto signals on Telegram are actionable recommendations advising traders to buy or sell a particular cryptocurrency. For beginner traders or those lacking time to analyze charts, signals simplify decision-making, these cryptocurrency signals can save time, enable you to make informed trading decisions, and reduce the chances of losing capital due to a bad call.

Most crypto signals providers use Telegram to share crypto signals with their community because of how fast messages are delivered and how easy it is to follow updates. You get alerts in real time and a detailed analysis supporting each recommendation.

In this article, we will cover what crypto signals are in detail, how crypto signals work, the popular types of cryptocurrency trading signals, and the benefits and risks of crypto signals on Telegram. Additionally, you will learn how to read crypto trading signals and how to choose a crypto signals Telegram group to follow.

What Are Crypto Signals on Telegram?

The crypto signals on Telegram are trading instructions that suggest when to buy or sell a cryptocurrency. Each signal includes clear entry and exit points or prices, which comprise a stop loss to manage risk and a take-profit target to secure gains. Telegram crypto signal groups often advise selling a percentage of the position based on market conditions.

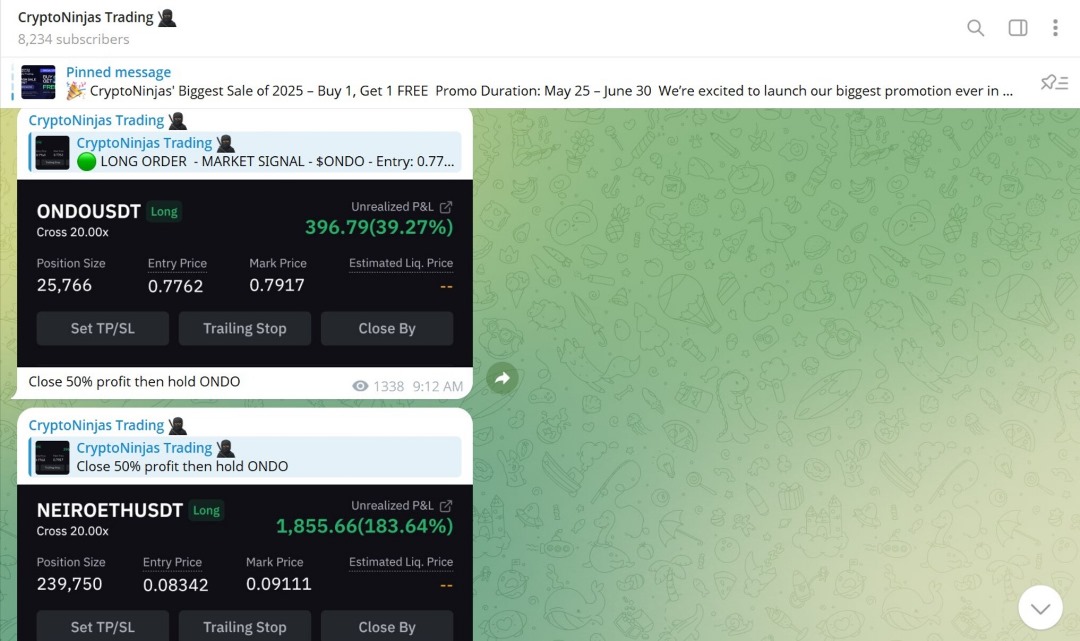

For example, a signal for ONDO/USDT in futures trading might predict a significant price increase. You enter a short position at $0.055 (5,500 ONDO at 1x leverage, for instance). When ONDO rises by a certain percentage, say 40%, the provider will advise you to take profit on 50% of the position and hold the remaining 50% in anticipation of a higher rise that reaches the initial take-profit target you set.

This approach helps you lock in partial profits while still leaving room for potentially larger gains if the trade hits the preset take-profit margin. This risk management strategy protects traders from market volatility.

Cryptocurrency signals rely on market data, such as price charts, volume, technical indicators, and social media sentiment. Using this data, experienced analysts share predictions to guide traders in profiting from volatile markets.

For the signal groups, providers usually offer free and paid services. Many paid crypto signal groups offer free signals, with premium users receiving enhanced insights and guidance. Telegram is a common platform for delivering these crypto trading signals because of its real-time message delivery, fast notifications, and strong crypto communities.

How Do Crypto Trading Signals Work?

Crypto trading signals work by giving a full plan for entering and exiting a trade. This plan tells you when to buy or sell, where to take profit, and when to close the trade if the price goes in the wrong direction. The goal is to remove guesswork and help traders make clear decisions based on analysis.

To get these trading signals, experienced traders analyze these data to create actionable signals, including price charts, volume, technical indicators (RSI, MACD, Bollinger Bands), sentiment from social media and news, and on-chain data. With this analysis, they make predictions and recommend them to their crypto inner circle or signal group. Each crypto trading signal typically includes three main parts, which are listed below:

1.Entry Price: This is the price range where the trade should begin. It is the point where the crypto signal providers expect the market to move in the predicted direction. Now, say the entry price of a trade is 0.0950, and you got the signal a few minutes later when the market price has moved a bit, you can still open your position at the current market price and set the parameters shared in the signals group.

2. Stop Loss: Stop loss is a price that limits how much you can lose if the trade fails. If the price drops or rises too far in the opposite direction, the trade closes automatically at this point. This protects your account and prevents one trade from causing significant financial loss.

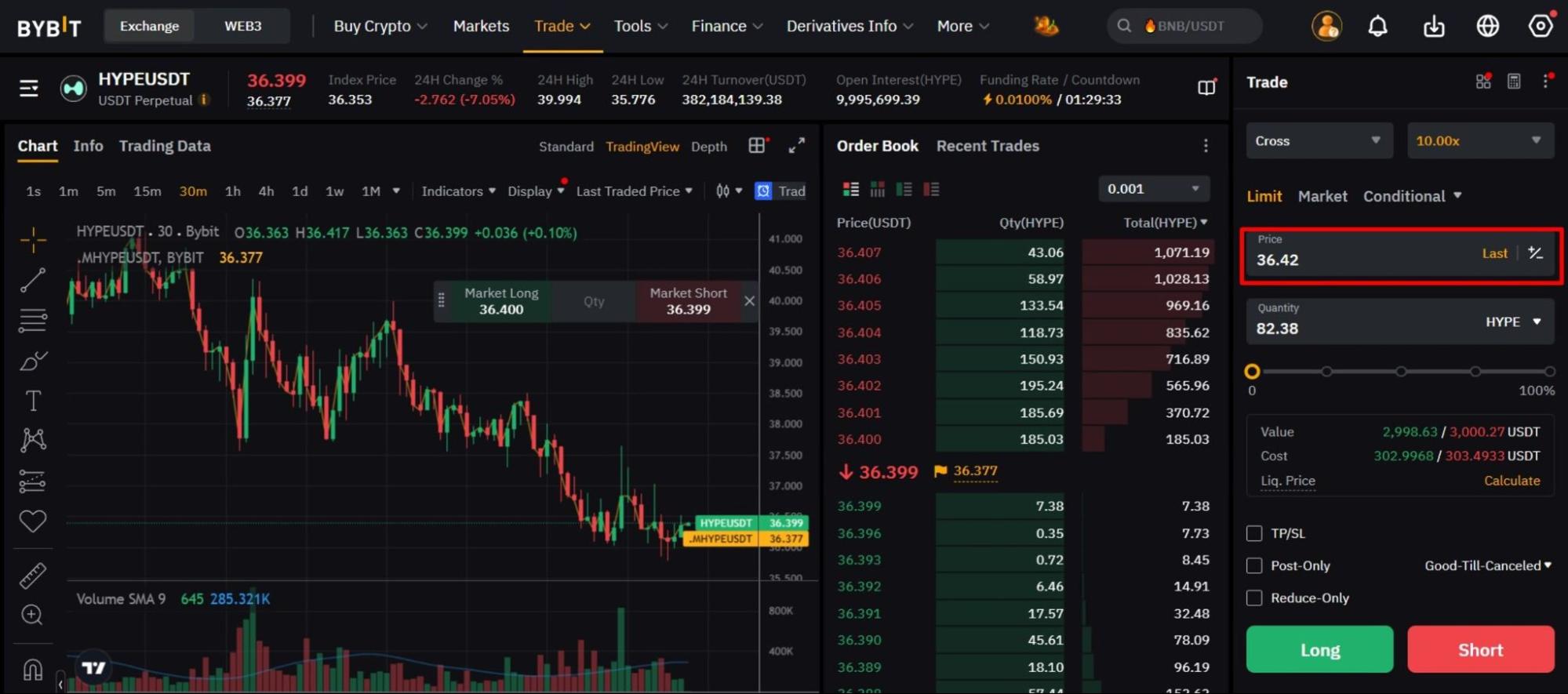

Depending on the crypto exchange you are using to trade, you can find this tool at the bottom corner of the trading interface, which is usually depicted as TP/SL (Take Profit/Stop Loss).

3. Take Profit: Take profit is the price at which you close the trade with a gain. Some trading signals give one target, while others give two or three targets. Traders can close the trade fully at one level or take part of the profit at each stage (this is where selling in parts or percentages comes in). This strategy reduces risk and secures gains incrementally.

These three trading tools work together to form detailed signals that traders can follow and potentially make profits. Your Telegram crypto signal groups provide all the details for manual signals. All you have to do is enter these details to execute trades quickly without spending hours watching charts.

Why Telegram for Crypto Signals?

Experienced traders and technical analysts use Telegram for crypto signals because messages are delivered fast. The moment a signal is sent, everyone in the group sees it in real-time. This is important in trading due to crypto market volatility, where a delay of even one minute can affect the result of a trade.

Beyond real-time delivery, Telegram fosters trader connections through community features. Most crypto signal groups have large group chats and broadcast channels, making it easy to organize communities around specific trading strategies or digital assets. Users can also follow updates, ask questions, and interact with others while getting actionable recommendations from experienced traders.

What are the Popular Types of Cryptocurrency Trading Signals?

The popular types of cryptocurrency trading signals are crypto futures signals, day trading signals, and buy and sell signals.

Crypto Futures Signals

Crypto futures signals are made for traders who deal with contracts instead of buying coins directly. Here, traders predict the token’s future price movements without owning the assets. A crypto futures signal tells you when to enter the trade, what direction to take, where to exit, and how much leverage to use. It also includes a stop loss, which protects your account if the trade goes wrong.

Here is what a typical crypto futures signal looks like:

Crypto Day Trading Signals

Day trading signals are used for short trades where traders need to act fast to capitalize on market movements. The idea of this trading style involves opening and closing trades within 24 hours. Like the futures trading signal, the crypto day trading signal also includes detailed signal information like the cryptocurrency to trade, entry price, stop-loss level to limit losses, and take-profit targets.

Crypto Buy and Sell Signals

Buy and sell signals are for spot trading. This is when you buy a coin, hold it, and sell it when the price goes up. When following spot trading signals, investors directly own the underlying crypto assets, unlike futures trading, where contracts are used. Spot crypto signals specify the action (buy or sell), the particular coin to trade (e.g., BTC, ETH), entry price zones, stop-loss levels to limit downside risk, and take-profit targets.

Spot trading signals help traders capitalize on short-term price swings, compound gains over time, and avoid funding fees or expiry dates associated with leveraged products. Without leverage, spot trading avoids liquidation risks, making it safer for cautious traders.

What are the Benefits and Risks of Crypto Signals on Telegram

The benefits of crypto signals on Telegram for beginners and advanced traders are real-time alerts, convenience and time-saving, insights from more experienced traders, opportunities for learning, and emotion-free trading. Meanwhile, the risks of crypto signals on Telegram include a lack of guaranteed accuracy, over-reliance on signal groups, and pump-and-dump schemes.

Advantages of Using Crypto Signals

Below are the advantages of using crypto signals:

- Real-Time Trading Signals: Crypto trading signal providers offer investors timely and reliable signals, while Telegram delivers instant notifications. This speed allows traders to capitalize on market opportunities without needing to monitor charts constantly.

- Convenience and Time-saving: A high-quality crypto signal gives you a clear plan with the entry and exit points, stop loss, and profit targets. You can place the trade and go about your day while still staying involved in the market. Additionally, Telegram is mobile-friendly and easy to use, which makes following and reacting to trade alerts simple and accessible.

- Insights From More Experienced Traders: Some crypto signal providers are professional traders or analysts offering high-accuracy signals based on market insights, sentiments, and technical analysis. Trading signals shared by traders with experience give beginners a head start. It can also help traders who don’t have the time to conduct detailed market analysis with their crypto trading strategy.

- Opportunities for Learning: After interacting with multiple crypto trading signals, certain price levels and setups begin to become recognizable. Over time, this helps you make better decisions on your own because you understand the thinking behind those moves.

- Emotion-free Trading: Trading signals reduce impulsive decisions driven by emotions like fear or greed. Crypto signals limit impulsive modifications, promoting disciplined trading..

Potential Risks and Challenges of Using Crypto Signals

Below are the potential risks and challenges of using crypto signals:

- No Guaranteed Accuracy: Anyone can open a crypto Telegram channel and start sharing trade ideas. That does not mean they know what they are doing. If the trading signals are not based on strong market research, you can lose money fast. Even legitimate analysts can be wrong because the crypto market is unpredictable, so there is no guarantee of accurate signals or profits.

- Over-reliance on Signal Groups: Traders might rely solely on the crypto signals providers instead of doing their own research and becoming more familiar with technical analysis to comfortably make modifications to the recommendations received. If all your trades come from one person or team, you are placing full trust in their judgment. If they go wrong, you go down with them.

- Market Manipulation (Pump-and-Dump Schemes): Some groups coordinate to artificially inflate the price of a low-volume coin and then dump it once others buy in, leaving followers with losses. So, avoid crypto signals Telegram groups that promise huge profits or 100% guaranteed wins.

How to Read Crypto Trade Signals on Telegram

Here’s how to read crypto trade signals on Telegram like a pro.

- Entry Price: This is the number that tells you when to open the trade. Some crypto trading signals give one clear price. Others provide a small range, which means the trade can be entered anywhere between two values. If the price is still outside the range, set a limit order with the price you want to buy/sell at.

- Stop Loss: If the market moves in the opposite direction of the trade, the stop loss is where you close the position and take the loss.

- Take Profit: Signals often include one or more profit targets. Each target is a price level where you can close part or all of the trade. You can decide whether to take your full profit at the first level or hold part of the position for later targets.

- Direction Tells You Whether to Buy or Sell: If the signal says “long order,” the trader expects the price to go up. If it says “short order,” the goal is to profit from the price drop of the crypto asset.

- Signal Type: Some crypto trading signals are for spot trading (buying and holding the actual coin), while others are for futures trading (speculating on the future price of cryptocurrencies without owning the underlying asset).

- Leverage: If a signal includes leverage, it will mention how many times to multiply your position. This means you are borrowing extra funds to make the trade larger. While leverage can increase profits, it also increases risk.

- Screenshots or Chart Links: Good crypto signal providers sometimes share a chart showing the setup. This lets you see where the price is, what pattern is forming, and where the targets sit on the chart.

- Follow-up Messages: After a signal is shared, the group might post updates depending on market conditions. These could include messages like “move stop loss to entry” or “take partial profit now.” Do not ignore these updates. They guide you as the trade unfolds and help you manage it better. Always keep alerts on if you plan to act on trading signals in real time.

If you want to explore more about signal setups or how traders use bots with Telegram alerts, this article on Telegram trading bots will understand how automated trading tools on Telegram work and how you can use them to execute trades directly through the Telegram app.

Are All Crypto Signals Reliable?

No, not all crypto signals are reliable. The best Telegram crypto signal groups are backed by research and real experience, resulting in about 90% accurate signals, but others are based on guesses or copied from other groups. To get reliable trading signals, ask friends for recommendations. Whichever crypto trading signals group you choose, ensure the platform has at least a 90% success rate.

How to Choose a Crypto Signals Telegram Group

To choose a crypto signals telegram group, you must first find a reliable or reputable crypto signals provider, pay attention to members’ interaction, and then choose trades to follow.

- Check the Signal Quality and How Often They are Updated

Before following a crypto signals group, start by joining the group and watching how it works. Research on the Telegram channel to see if they have a track record of successful or failed trades. Then, look at how the trading signals are shared. Check if the team shares frequent signals and whether the messages contain all the necessary details.

In addition to frequent signals, serious cryptocurrency signal service providers will give updates if the market changes and will tell you when to close early, take a percentage of your profits, or shift your stop loss.

- Supported Exchanges and Trading Strategies

Verify if the group supports your preferred crypto exchange, such as Binance, BingX, KuCoin, and Bybit. Then, check if the trading style the group focuses on aligns with what you need. Remember, the crypto trading types to expect include, but are not limited to, day trading, basic buy and sell (spot trading), and advanced strategies in the futures market.

- Pricing (Paid Vs. Free Crypto Signals Channels)

Many groups charge subscription fees ranging from $30 to over $150 monthly, but some offer free trials, while others offer free trading signals for life. Such signal groups help beginners and traders with tight budgets to experiment and earn profit without paying for crypto trading signals. On the other hand, paid groups offer exclusive signals with higher accuracy, more comprehensive support, and professional insights, suitable for high-volume traders.

- Reputation and User Reviews

Research reviews on platforms like Trustpilot, Reddit, Telegram discussions, and educational resources. Look for and follow established groups with a large, active user base and positive feedback. A good place to start your search would be our detailed compilation of the best crypto signals trading Telegram groups to join this year.

- Community Engagement and Support

Whether you are considering paid or free trading signal groups, choose Telegram channels with active chats where members discuss signals, market trends, and trading strategies. In addition, responsive admins and additional support, like educational materials, webinars, or personalized advice, are valuable.

- Educational Content

Some top groups provide educational resources alongside trading signals, helping you understand market analysis and improve your crypto trading skills. For instance, Cryptoninjas offer educational resources, including in-depth guides, exchanges and token reviews, and timely news on market trends to help you keep up with happenings in the crypto world.

In addition to the recommendations from the crypto signals group, you need to do your own research to understand the crypto world and know which coins to trade. To help you get started, check out this list of the best low-cap cryptocurrencies to invest in. With this, you can know what cryptos have high growth potential, what trading signals to participate in, and the ones to ignore.

The post What Are Crypto Trading Signals on Telegram in 2025? appeared first on CryptoNinjas.

CryptoNinjas