The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

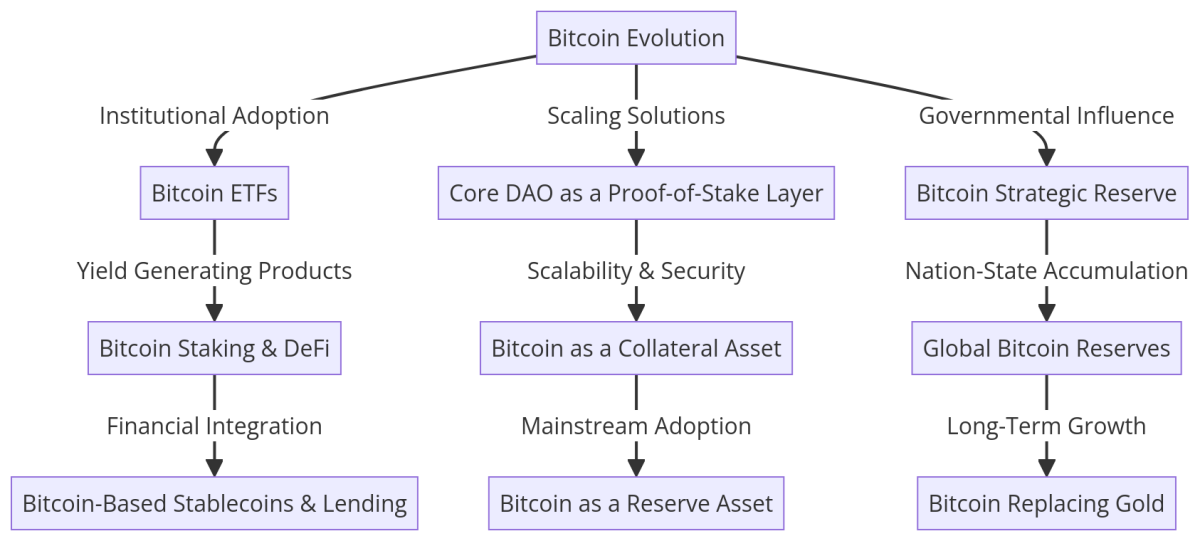

Bitcoin’s evolution from an obscure digital currency to a global financial force has been nothing short of extraordinary. As Bitcoin enters a new era, institutions, governments, and developers are working to unlock its full potential. Matt Crosby, Bitcoin Magazine Pro’s lead market analyst, sat down with Rich Rines, contributor at Core DAO, to discuss Bitcoin’s next phase of growth, the rise of Bitcoin DeFi, and its potential as a global reserve asset. Watch the full interview here: The Future Of Bitcoin – Featuring Rich Rines

Bitcoin’s Evolution & Institutional Adoption

Rich Rines has been in the Bitcoin space since 2013, having witnessed firsthand its transformation from an experimental technology to a globally recognized financial instrument.

“By the 2017 cycle, I was pretty determined that this is what I was going to spend the rest of my career on.”

The conversation delves into Bitcoin’s growing role in institutional portfolios, with spot Bitcoin ETFs already surpassing $41 billion in inflows. Rines believes the institutionalization of Bitcoin will continue to reshape global finance, particularly with the rise of yield-generating products that appeal to Wall Street investors.

“Every asset manager in the world can now buy Bitcoin with ETFs, and that fundamentally changes the market.”

What is Core DAO?

Core DAO is an innovative blockchain ecosystem designed to enhance Bitcoin’s functionality through a proof-of-stake (PoS) mechanism. Unlike traditional Bitcoin scaling solutions, Core DAO leverages a decentralized PoS structure to improve scalability, programmability, and interoperability while maintaining Bitcoin’s security and decentralization.

At its core, Core DAO acts as a Bitcoin-aligned Layer-1 blockchain, meaning it extends Bitcoin’s capabilities without altering its base layer. This enables a range of DeFi applications, smart contracts, and staking opportunities for Bitcoin holders.

“Core is the leading Bitcoin scaling solution, and the way to think about it is really the proof-of-stake layer for Bitcoin.”

By securing 75% of the Bitcoin hash rate, Core DAO ensures that Bitcoin’s security principles remain intact while offering greater functionality for developers and users. With a growing ecosystem of over 150+ projects, Core DAO is paving the way for the next phase of Bitcoin’s financial expansion.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Expansion

One of the biggest challenges facing Bitcoin is scalability. The Bitcoin network’s high fees and slow transaction speeds make it a powerful settlement layer but limit its utility for day-to-day transactions. This is where Core DAO comes in.

“Bitcoin lacks scalability, programmability. It’s too expensive. All these things that make it a great settlement layer is exactly the reason that we need a solution like Core to extend those capabilities.”

Core DAO functions as a proof-of-stake layer for Bitcoin, allowing users to generate yield without third-party risk. It provides an ecosystem where Bitcoin holders can participate in DeFi applications without compromising on security.

“We’re going to see Bitcoin DeFi dwarf Ethereum DeFi within the next three years because Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

Governments and sovereign wealth funds are beginning to view Bitcoin not as a currency but as a strategic reserve asset. The potential for a U.S. Bitcoin strategic reserve, as well as broader global adoption at the nation-state level, could create a new financial paradigm.

“People are talking about building strategic Bitcoin reserves for the first time.”

The idea of Bitcoin replacing gold as a primary store of value is becoming more tangible. Rines asserts that Bitcoin’s scarcity and decentralization make it a superior alternative to gold.

“I think within the next decade, Bitcoin will become the global reserve asset, replacing gold.”

Bitcoin Privacy: The Final Frontier

While Bitcoin is often hailed as a decentralized and censorship-resistant asset, privacy remains a significant challenge. Unlike cash transactions, Bitcoin’s public ledger exposes all transactions to anyone with access to the blockchain.

Rines believes that improving Bitcoin privacy will be a critical step in its evolution.

“I’ve wanted private Bitcoin transactions for a really long time. I’m pretty bearish on it ever happening on the base layer, but there’s potential in scaling solutions.”

While solutions like CoinJoin and the Lightning Network offer some privacy improvements, full-scale anonymity remains elusive. Core is exploring innovations that could enable confidential transactions without sacrificing Bitcoin’s security and transparency.

“On Core, we’re working with teams on potentially having confidential transactions—where you can tell that a transaction is happening, but not the amount or counterparties involved.”

As governments continue to increase scrutiny over digital financial activity, the need for enhanced Bitcoin privacy features will only grow. Whether through native protocol upgrades or second-layer solutions, the future of Bitcoin privacy remains a crucial area of development.

The Future of Bitcoin: A Trillion-Dollar Market in the Making

As the interview progresses, Rines outlines how Bitcoin’s economic framework is expanding beyond speculation and into productive financial instruments. He predicts that within a decade, Bitcoin will command a $10 trillion market cap, with DeFi applications becoming a significant portion of its economic ecosystem.

“The Bitcoin DeFi market is a trillion-dollar opportunity, and we’re just getting started.”

His perspective aligns with a broader industry trend where Bitcoin is not only used as a store of value but also as an active financial asset within decentralized networks.

Rich Rines Roadmap for Bitcoin’s Future

Final Thoughts

The conversation between Matt Crosby and Rich Rines provides a compelling glimpse into the future of Bitcoin. With institutional adoption accelerating, Bitcoin DeFi expanding, and the growing recognition of Bitcoin as a strategic reserve, it is clear that Bitcoin’s best years are ahead.

As Rines puts it:

“Building on Bitcoin is one of the most exciting opportunities in the world. There’s a trillion-dollar market waiting to be unlocked.”

For investors, developers, and policymakers, the key takeaway is clear: Bitcoin is no longer just a speculative asset—it is the foundation of a new financial system.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Bitcoin Magazine – Bitcoin News, Articles and Expert Insights