The Dream of Banking the Third World is Still Alive with Azteco

Bitcoin Magazine

The Dream of Banking the Third World is Still Alive with Azteco

Azteco, the international Bitcoin gift card company, has announced a series of partnerships with digital gift card distributors that unlock 598 million new potential buyers, with an expected 1.3 billion potential customers as the rollout of distribution deals continues.

“We’re turning Bitcoin from being a noun into a verb so that you can Bitcoin it,” Akin Fernandez, founder of Azteco, told Bitcoin Magazine in an exclusive interview. The company, whose brand first appeared in Bitcoin in 2014, has been focused on banking the unbanked throughout the developing world for over a decade, with Bitcoin gift cards or vouchers as the technology of choice.

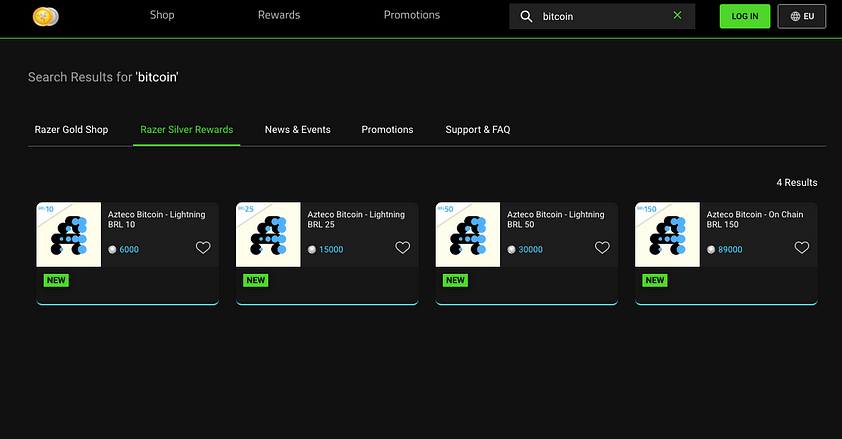

The new partnerships include Razor, the video game software and hardware company, which today has 240 million tech-savvy customers, according to Fernandez.

Focused on Brazil, Europe, the Middle East and Africa, other distribution partnerships include Enterative®LIVE, with an estimated 30 million customers; DTOne, a global estimate of 190 million customers; KaBum!, with 8 million; and PicPay, having just cleared compliance and is expected to unlock another 60 million users in Brazil, per data shared by Fernandez.

“Bitcoin has all the utility of money and that’s an absolutely enormous market, the size of which makes the current price of bitcoin completely irrational,” Fernandez added when discussing the potential market size of Bitcoin.

Azteco, who originally raised $6 million in seed funding from various angel investors, including Jack Dorsey, has now launched a new seed extension raise, targeting $4 million to fund the expansion.

“My contribution to Azteco comes out of a deep respect for their mission. The unbanked population is immense. We have the technology and resources to close this gap, but until now, no one has taken that important next step. Azteco is providing so much more than just access to a secure financial system; it is building an ecosystem of financial self-determination that is secure and supported by local communities. I am honored to support them.” — Jack Dorsey, Block.

The Mission

Banking the unbanked, a popular slogan of an older generation of Bitcoiners, is still alive and well in Azteco. Popularized by Andreas Antonopoulos around 2014, this mission statement for Bitcoin highlighted the vast gap in access to financial services and technologies between the Western elite — be it in New York or London — to that of the rest of the world. The unbanked often lack the to basic access to long-distance financial rails, reasonably priced credit and the relative security of a normal bank account.

Proponents of banking the unbanked as a clear use case of Bitcoin argued that, as a technology, it could go a lot further than banks since it doesn’t need to identify its users; bitcoin simply works as a bearer asset regardless of who controls or or where in the world it is sent from. Access to cheap mobile phones and basic telecommunications infrastructure like text messages, allowed novel implementations of Bitcoin to exist and function in environments where traditional Western banks simply could not justify the administration and onboarding costs.

“To experience the future of money. To gain a glimpse into an exciting technology. To learn about how money could be in the future and also become aware of how limited money and banks are today. For the ‘other 6 billion’ who don’t enjoy international, control-free banking as we do, bitcoin represents an opportunity to become part of a global economy which up till now did not exist. For those users, bitcoin is more than just a curiosity, it might be a doorway to connect to the world.” — Antonoplous, 2015.

This vision for Bitcoin began to struggle as the transaction fees of sending BTC on-chain started to spike around 2017, leading to the infamous Blocksize wars and, as a consequence, the build-out of the Lightning Network.

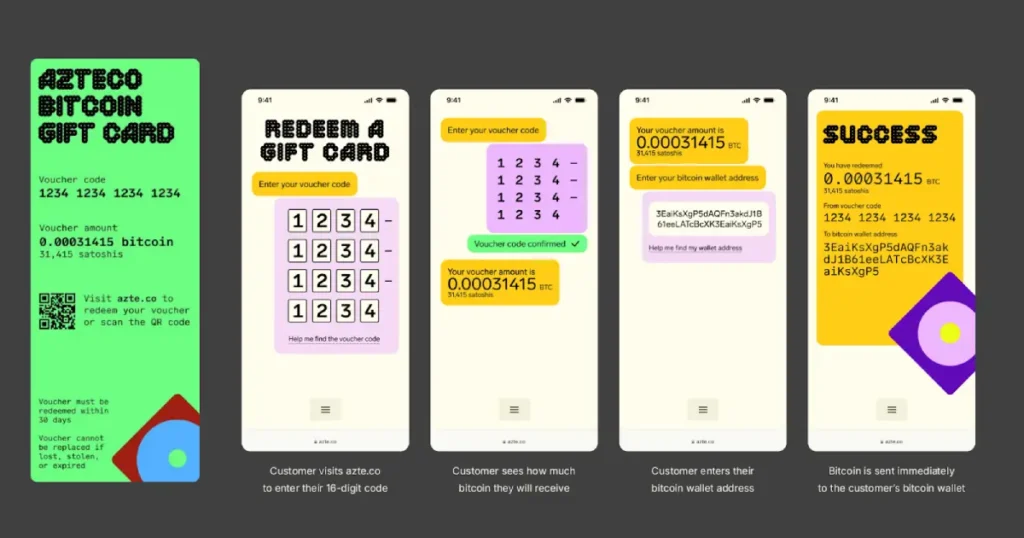

Azteco vouchers could be purchased as early as 2014. Fast-forward to 2025, and Azteco has upgraded its technology from natively using Bitcoin on-chain addresses in its vouchers in 2014 to adding Lightning Network support via the LNURL standard via compatible apps like Wallet of Satoshi, Muun or Blink.

The deep experience Azteco has with the Bitcoin technology stack is self-evident in their design today, which removes an incredible amount of friction from normal ways of buying bitcoin and delivers it in a beautiful package.

Going further than the economic argument for servicing an unbanked and underbanked population, out of reach of the legacy banking system, Fernandez differentiates between ethical and unethical bitcoin along the same lines. In an unpublished document on the matter, shared with Bitcoin Magazine, Fernandez writes:

“What is ‘Ethical Bitcoin’? This can best be described by stating what it is not. It is not ethical to connect a user’s identity to the money they use, or the content of the messages they send on a network. It is unethical to cut people off from being able to use their money. It is unethical to surveil people and then use that information to control them. It is unethical to arbitrarily block people from selling goods and services.”

With this statement, Fernandez strikes at the fundamental, structural difference between legacy finance and Bitcoin. Censorship resistance; confidence that users can access their accounts and transfer value without the need for personal information, despite the way the political winds are blowing — that is Bitcoin’s killer app.

A very different mindset than popular generations of Bitcoiners who, in internet parlance, seem to mostly just care about NGU (“number go up), even if it’s in the form of an ETF or bitcoin treasury company. Nothing wrong with that, but perhaps this generation of Bitcoiners has either forgotten or not been exposed to enough content by Andreas Antonopoulos. They might not realize how big a portion of the global market is cut off from legacy finance, how many are unbanked.

The Developing World

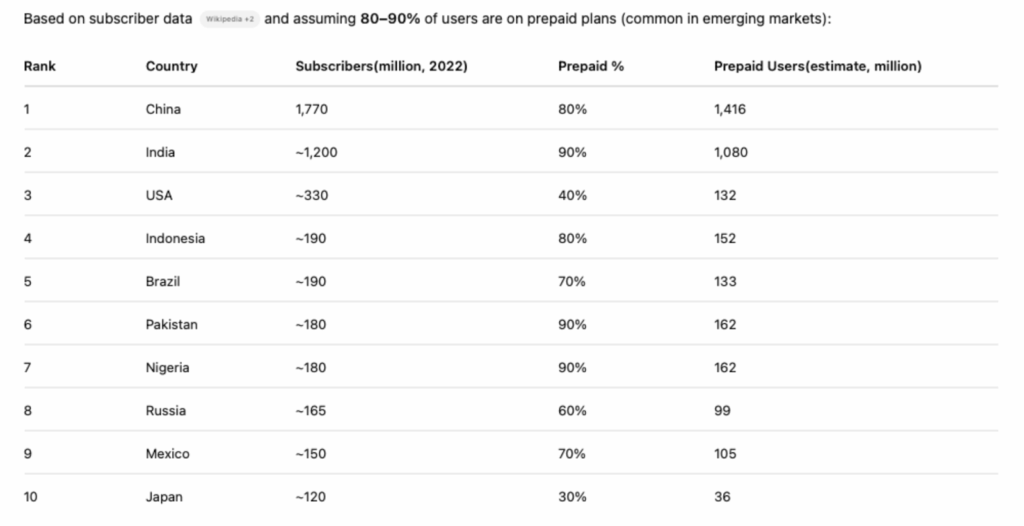

Azteco’s thesis is far from just ideological; there’s a big market at play. Focusing on the prepaid phone data market, Fernandez points out that “there are 3.4 billion users of prepaid mobile smartphones” worldwide. Which means that almost half of the global population has access to smartphones and is already used to topping up their phones “on an ad hoc basis,” including via digital vouchers of various kinds. Every one of these users of the internet network is capable of installing “Wallet of Satoshi, Proton Wallet, Blockstream App or BitKey; all they have to do is take 30 seconds to put it on their Android or iPhone,” he adds.

The utility of bitcoin to them is not that different from sending a WhatsApp message, says Fernandez, which, for near-zero cost, allows billions of people in the developing world to coordinate across great distances every day. Bitcoin unlocks the same velocity but for the transfer of monetary value, be it in the form of payments or remittances, while also serving as an accessible safe-haven asset from their local fiat currencies — most of which are trending to zero compared to bitcoin.

Fernandez notes that “The remittances market is very, very, very large, it is worth $782 billion a year. Imagine we take, I don’t know, 12% of that, or 15% of that and switch them all onto bitcoin. That would be a super disruptive event.” He added that “just like in WhatsApp, if you have a family of 15 people and you put them all onto Wallet of Satoshi or Blockstream Wallet then all of a sudden you have a lot of people who are moving bitcoin from and to, and they all need to be fed with bitcoin.”

The problem is, of course: How will they acquire the bitcoin? “If they’re not Americans or they’re not Europeans, getting bitcoin through an exchange, first of all, is very difficult. And secondly, it’s very slow and privacy-invading. Azteco vouchers are much better for them because they can go to a place where they’re already buying their video games and stuff like that, they can buy a $25 voucher or go to the supermarket and buy a $25 voucher. And then they have their bitcoin that they can send to wherever it is they want. The use case, once again, is money.”

This is not just theoretical. Fernandez shared some of Azteco’s sales numbers with Bitcoin Magazine, having sold roughly “500,000 vouchers over the last couple of years” with a rough average $280-$315 in value transferred and many purchases of $20-$30. In Q1 of 2024, Bitcoin Magazine reported that Azteco had sold vouchers to a million people worldwide since their inception, suggesting an acceleration of interest throughout the developing world in recent years. Fernandez believes these numbers can be a lot bigger and the key obstacle to developing that market is user experience.

“I mean we’re all at an all-time high now of what it is, $123,034 but just imagine if the whole world, just people who are on mobile phones are using bitcoin as money to send to each other, to save money and to spend online; that 123,034 is a pittance compared to the size of the market. But none of this can happen if bitcoin is hard to get. It must be trivially easy to get, as easy as topping up your mobile phone to make phone calls,” Fernandez concluded.

This post The Dream of Banking the Third World is Still Alive with Azteco first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine