Rug Pull Crypto Explained: Is It Illegal?

A rug pull in crypto is a deceptive maneuver where the creators of a cryptocurrency project suddenly abandon it and take all the investors’ money. The rug pull meaning refers to this sudden exit, which leaves investors with worthless tokens. The rug pull definition highlights it as a scam where project developers pull the “rug” out from under their investors after gaining their trust and funds. This matters a lot because it causes people to lose their money and makes it harder to trust new crypto projects.

This guide explains what a crypto rug pull is and the common types of rug pull scams. We’ve also explored how to detect rug pull crypto scams by checking project teams, liquidity, and smart contract codes.

What Is a Rug Pull?

A rug pull scam in crypto is a type of fraud where developers of a new cryptocurrency project suddenly abandon it, taking all the investors’ money with them. This is like someone inviting you to invest in a brand-new, exciting project, promising huge returns, and then, after you’ve put your money in, they just vanish. The rug pull meaning points to this sudden and deceptive withdrawal.

Typically, these scams happen with new tokens on decentralized exchanges (DEXs) where anyone can list a coin without much oversight. The scam developers will create a new token, then they will promote it heavily on social media, and get a lot of people to buy it. It will drive up its price. They might even make it seem like a very legitimate project with a great responsive website and a token roadmap as well.

Now, once a good amount of money has been invested, the developers either remove all the liquidity (meaning they will take all the crypto pairs, like the newly created token and a stablecoin like USDC, out of the trading pool) or they may implement malicious code that prevents investors from selling their tokens. Hence, the token’s price crashed to near zero, as no one can buy or sell it anymore. The rug pull definition is rooted in this act of trickery and theft, where trust is built only to be shattered for financial gain by the project creators.

Is Rug Pulling Illegal?

Rug pulling is illegal, but not always punishable, since crypto is highly regulated. While there might not be a specific law that says “rug pulling is illegal” in every country, a rug pull scam definitely falls under existing laws against fraud and theft.

Think of it this way: when some developers do a rug pull, they are intentionally misleading people and taking their money under false pretenses. Now, this sounds a lot like fraud, no matter if it’s done with traditional money or cryptocurrency. Also, in many places, authorities like the FBI or similar organizations are indeed going after people who pull these kinds of fraud. They often get charged with things like wire fraud, money laundering, or other financial crimes.

Here, the main challenge is that crypto operates across borders, and regulations vary a lot from country to country. So, what might be clearly illegal in one place might be a bit of a grey area in another. However, the general rug pull definition involves deception and taking assets without consent, which is a big no-no in almost any legal system. So, while you might not find a direct “anti-rug pull” law, the actions involved in a rug pull scam are almost certainly considered illegal.

What Are Crypto Rug Pull Examples?

The top list of rug pull crypto scams includes Squid Game Token (SQUID), Thodex, and AnubisDAO.

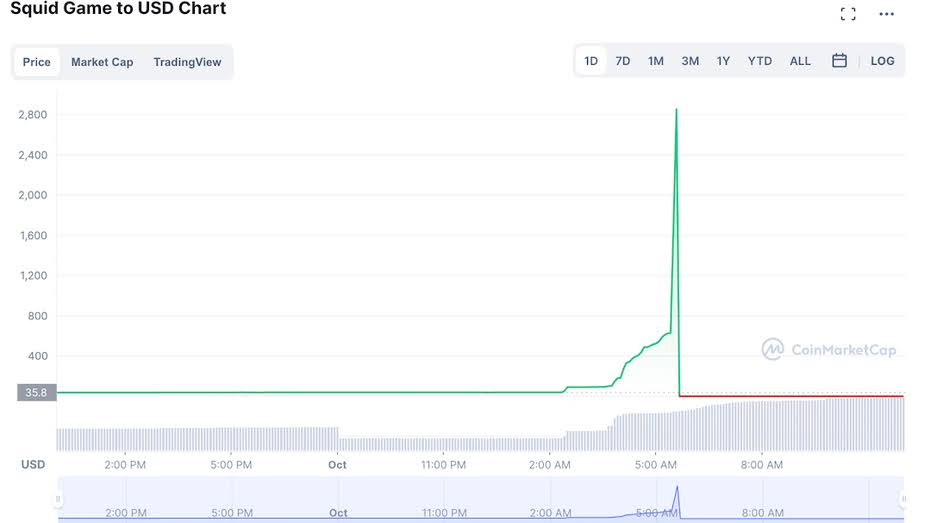

- Squid Game Token: This one is the most talked-about rug pull scam example. This project rode on the popularity of the hit Netflix show. Due to this, the token’s price shot up incredibly fast, going from tiny fractions of a cent to thousands of dollars in just a few days. But there was a massive catch: investors couldn’t sell their tokens. The developers had put a hidden rule in the smart contracts code preventing sales. Hence, once the price was high enough, the creators vanished, taking millions of dollars with them, leaving everyone with worthless tokens they couldn’t get rid of.

- Thodex: While technically a centralized exchange, its CEO, Fatih Faruk Özer, allegedly fled Turkey in 2021 with an estimated $2 billion of user funds, essentially pulling a massive rug pull on his exchange’s users. As a result, the platform suddenly halted all trading and withdrawals, and the CEO disappeared, leaving around 400,000 users in financial ruin. Of course, he was later arrested and faces severe charges.

- AnubisDAO: This was a decentralized finance (DeFi) project that raised about $60 million in Ethereum in less than 24 hours. Well, the project had very little information available, no website, no whitepaper, and some anonymous developers. So, shortly after collecting the funds, the developers drained the entire liquidity pool, causing the token’s price to plummet to zero. Again, it was a classic “liquidity pull” type of rug pull.

What Is the Biggest Rug Pull Crypto?

OneCoin is one of the biggest, if not the biggest, crypto scams that operated like a massive rug pull. Active from 2014 to 2016, OneCoin was first marketed as a revolutionary cryptocurrency, but in reality, it had no real blockchain and couldn’t be traded on exchanges.

It was a massive pyramid scheme that basically relied on people recruiting new investors. Its founder, Ruja Ignatova (dubbed the “Cryptoqueen”), disappeared in 2017, and the scheme is estimated to have pulled in around $4 billion from unsuspecting victims worldwide. While not a typical liquidity pull from a DEX, it fits the rug pull definition of developers abandoning a project and taking investor funds.

What Rug Pull Crypto Checker Offers the Most Accurate Results?

Token Sniffer and De.Fi Scanner is two of the most well-known rug pull crypto checkers that offer the most accurate results.

- Token Sniffer

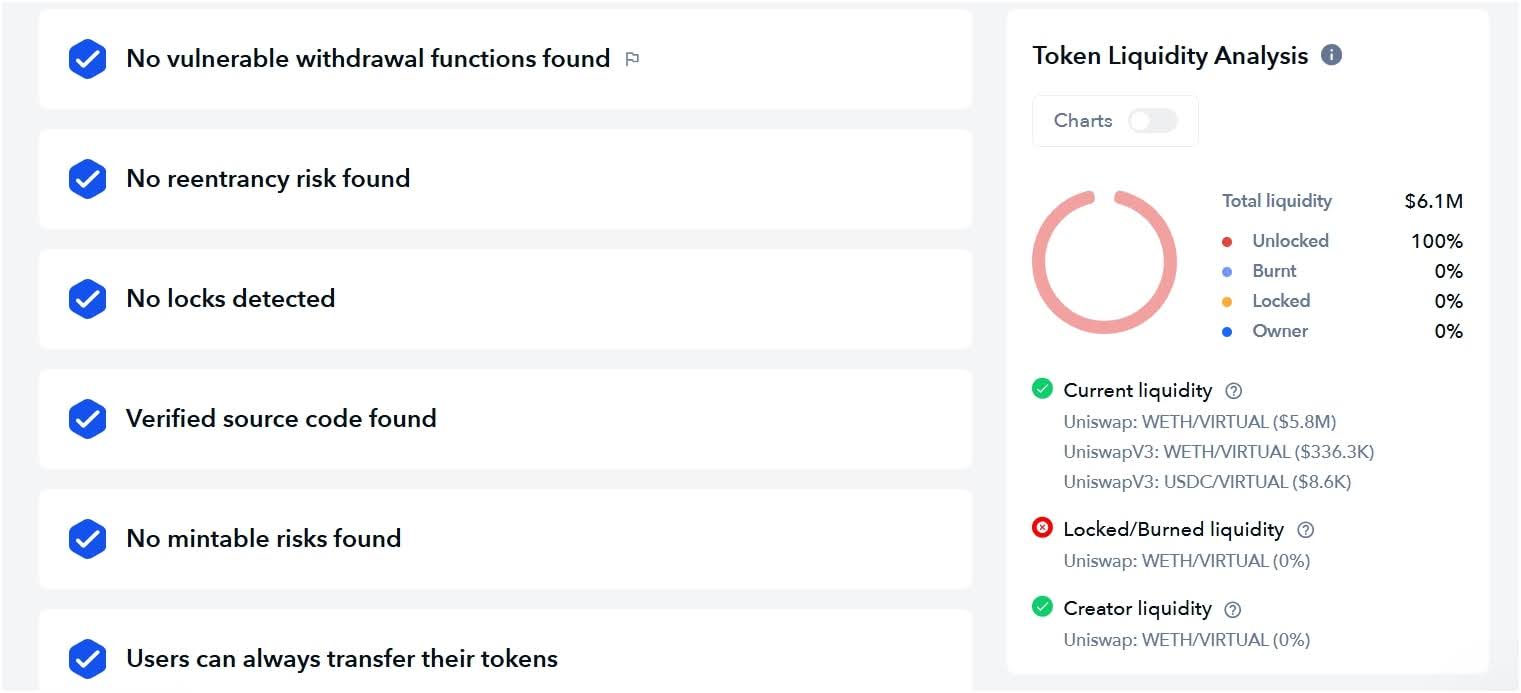

Token Sniffer is a widely used and respected tool that helps identify potential rug pull scams and “honeypots” (scams where you can buy but can’t sell). It works by analyzing the smart contract code of a token, along with its liquidity and trading activity.

How it works: You simply paste the contract address of the crypto token you’re curious about into Token Sniffer’s search bar. It then quickly runs a series of checks. It looks for things like:

- Ownership renounced or not: If the contract owner hasn’t renounced ownership, it means they still have control and could potentially change the contract to their benefit, like blocking trades or minting unlimited new tokens.

- Liquidity locked or not: This is a huge one. If the project’s liquidity isn’t locked up for a certain period, the developers can just withdraw it all, leaving the token worthless. Token Sniffer checks if the liquidity is locked and for how long.

- Mint function present: If the contract allows the creation of new tokens out of thin air, developers could suddenly create a huge supply, crashing the price.

- Modifiable fees or hidden functions: Some contracts have sneaky code that allows developers to charge huge transaction fees or even blacklisting addresses from selling.

- Presence of a honeypot: It tries to simulate a small buy and sell to see if you’d be able to sell the token after buying it.

Token Sniffer then gives you a “score” or a list of identified issues, highlighting potential risks with warnings. It doesn’t tell you what will happen, but it shows you the potential for things to go wrong based on the code and liquidity.

- De.Fi Scanner

De.Fi Scanner (formerly DeFiYield) is a more comprehensive “antivirus” for the crypto space, aiming to scan not just tokens but also smart contracts and even NFTs across multiple blockchains. It’s known for its detailed reports and multi-chain capabilities.

How it works: Similar to Token Sniffer, you input the contract address. De.Fi Scanner then performs a deep dive, analyzing various risk factors. Its checks go beyond just the contract to include:

- Ownership retention: Like Token Sniffer, it checks if developers can still modify the contract.

- High dump risk: It looks at token distribution – if a few wallets hold a huge percentage of the tokens, there’s a higher risk they could “dump” them all at once, crashing the price. This is a crucial aspect of identifying a potential rug pull scam.

- Honeypot detection: It also performs tests to see if selling is restricted.

- Liquidity analysis: Checks for sufficient and locked liquidity.

- Social media and community indicators: While harder to automate perfectly, some versions of such tools try to factor in community sentiment or lack of developer activity, which can also be red flags.

- De.Fi Score: It often provides an overall risk score, summarizing the project’s safety level, making it easier for users to quickly gauge risk.

What Are NFT Rug Pulls?

An NFT rug pull is basically the same scam as a crypto rug pull, but it happens in the world of non-fungible tokens. Here, instead of new cryptocurrencies, it’s about NFT collections. The rug pull NFT meaning is that the creators of an NFT project hype it up, sell a bunch of NFTs to eager buyers, and then suddenly disappear with the money, leaving the buyers with digital art or collectibles that are now essentially worthless.

Here’s how it usually plays out: developers launch an NFT collection, often with cool-looking art, promises of future benefits (like access to exclusive communities, games, or even real-world perks), and a lot of marketing hype on social media like Discord and Twitter. As a result, people get excited, perhaps fearing they’ll miss out on the next big thing, and they will start “minting” (buying) these NFTs.

Hence, once a good chunk of the collection is sold and the developers have collected a significant amount of money, they simply abandon the project. This means their website goes down, their social media accounts disappear, and all those promised future benefits never happen. The NFTs that people bought lose all their value because the project behind them is gone, and there’s no longer any community or development to support them.

What Are Common Types of Rug Pull Crypto Scams?

The common types of rug pull crypto scams are liquidity stealing, limiting sell orders, pump and dump schemes, and malicious smart contract backdoors.

- Liquidity Stealing

This is probably the most straightforward and brutal kind of rug pull. Developers create a new token and pair it with a well-known cryptocurrency (like Ethereum or a stablecoin) to create a “liquidity pool” on a decentralized exchange. As people buy the new token, more funds flow into this pool. Once enough money has been collected, the malicious developers simply withdraw all of the legitimate crypto from the pool, making it impossible for anyone to trade the new token, and its value instantly drops to zero.

- Limiting Sell Orders

In this type of rug pull crypto scam, the developers code the token’s smart contract in a way that allows people to buy the token but prevents them from selling it back. They might even let a few early investors sell to make it look legitimate, but once the price goes up due to new buyers, they activate the hidden code.

- Pump and Dump

This is where developers, or even large holders working with them, create massive hype around a new token using social media and fake news to drive its price up artificially (the “pump”).

They encourage a lot of people to buy, creating a frenzy. Once the price reaches a high point, these insiders then quickly “dump” (sell) all their own large holdings. This sudden sell-off floods the market, causing the token’s price to crash dramatically, leaving new investors with huge losses and a devalued asset.

- Malicious Smart Contract Backdoors

This is more technical, where the developers intentionally include hidden code within the token’s smart contract that allows them to take control of investor funds or manipulate balances without anyone knowing. They might have the ability to mint unlimited new tokens, directly drain wallets, or alter transaction fees to their benefit.

Note: There are mainly two types of rug pull scams: soft and hard rug pulls. A soft rug pull happens when crypto project developers slowly drain funds without breaking the project’s rules. They may sell large amounts of tokens, reduce liquidity, or abandon the project silently. A hard rug pull is when developers suddenly remove all liquidity and disappear with investor funds.

What Happens After a Rug Pull?

After a rug pull, the most immediate thing that happens is that the value of the crypto token crashes to near zero. This is because the creators have either drained the liquidity pool or made it impossible for anyone but themselves to sell. So, all those digital assets that people bought become worthless almost overnight.

For the victims, it means significant financial loss. Their invested money is gone, often with little to no hope of getting it back. The project’s website usually disappears, social media accounts go dark, and any promised future developments vanish into thin air.

How to Detect Rug Pulls?

To detect cryptocurrency rug pulls, you need to check the project team, liquidity pool, smart contract code, token distribution, and unrealistic promises & hype.

- Research the Project Team (Transparency Check)

First thing, legitimate projects usually have a team that’s willing to put their real names, faces, and professional backgrounds out there. You need to check if the core development team members are publicly known, have LinkedIn profiles, or have worked on other verifiable projects in the crypto space. For deeper insights into how crypto markets operate, explore this cryptocurrency trading guide.

- Analyze the Liquidity Pool (Security Check)

This is one of the most critical steps. For new tokens, especially on decentralized exchanges (DEXs), there should be a “liquidity lock”. This means the money (like ETH or SOL) that allows people to buy and sell the new token is locked away in a smart contract for a set period. You can use tools like Token Sniffer or Birdeye, which allow you to paste the token’s contract address and see if the liquidity is locked and for how long.

- Review the Smart Contract Code (Technical Check)

A third-party security audit doesn’t guarantee safety, but it shows the team is really serious about security and has had experts review their code for vulnerabilities or malicious functions. Also, if you or someone you trust understands code, look for functions that allow developers to:

- “Mint” (create) unlimited new tokens.

- “Blacklist” addresses from selling.

- Change transaction fees to extremely high levels.

- Upgrade the contract without community approval.

There are some tools like Token Sniffer or De.Fi Scanner can automatically analyze a contract’s code for common rug pull indicators and give you a risk report, even if you’re not a coder.

- Evaluate Token Distribution (Fairness Check)

You need to use a blockchain explorer to check the token holders’ list. If a very small number of wallets (especially those linked to the developers) hold a huge percentage (e.g., over 20-30%) of the total token supply, that’s a major red flag. If a few “whale” wallets (those with massive amounts of the token) are visible, they could easily dump their holdings, as a result, crashing the price.

- Be Skeptical of Unrealistic Promises & Hype (Common Sense Check)

If a project promises guaranteed, incredibly high returns (like 1000% APY in a short time) with minimal risk, it’s almost certainly a scam. If something sounds too good to be true, it probably is.

While marketing is normal, excessive hype, especially from anonymous accounts or paid influencers without real engagement, can be a sign. Legitimate projects focus on their technology and community, not just “to the moon” promises. If you’re navigating new trends like meme coins, this guide on how to buy meme coins can help you stay cautious and informed.

How to Avoid Rug Pull in Crypto?

To avoid a crypto rug pull, you need to be very careful and always look for transparent teams, make sure the project’s liquidity is locked, and be very skeptical of promises that sound too good to be true. Plus, you can also check for a professional and clear whitepaper or roadmap, and make sure the token distribution isn’t too concentrated in a few wallets.

How Is AI Being Used to Prevent Rug Pull Scams in Crypto?

AI is used to prevent rug pull scams in crypto by being a super-smart detective. It can quickly check a token’s code for sneaky tricks that let developers steal money. AI also watches all the trading action to spot unusual patterns, like big wallets suddenly dumping tokens. Plus, it can also scan social media for sudden, fake hype or bad vibes about a project. This helps catch potential scams early on.

The post Rug Pull Crypto Explained: Is It Illegal? appeared first on CryptoNinjas.

CryptoNinjas