Robinhood Launches Micro Crypto Futures, Unlocking XRP and Solana for Small Traders

Key Takeaways:

- Robinhood introduces micro futures contracts for XRP, Solana, and Bitcoin Friday futures.

- The new instruments lower capital requirements, targeting retail traders seeking precise exposure.

- The move follows Robinhood’s $200M Bitstamp acquisition, reinforcing its global crypto expansion.

Robinhood is ramping up its crypto strategy. On Friday, the trading platform officially announced the launch of micro futures contracts for XRP, Solana, and Bitcoin Friday futures—allowing retail investors to access derivatives markets with a fraction of the typical cost. The expansion signals Robinhood’s intent to dominate not just in equities but also in crypto derivatives trading.

Robinhood’s Micro Futures Strategy Targets Retail Inclusion

The latest Robinhood offering includes micro futures contracts for XRP, Solana, and Bitcoin, offering traders exposure to crypto derivatives with the least amount of margin requirement. The value of these mini contracts is to provide access to futures trading for retail traders at a low capital cost relative to a standard contract.

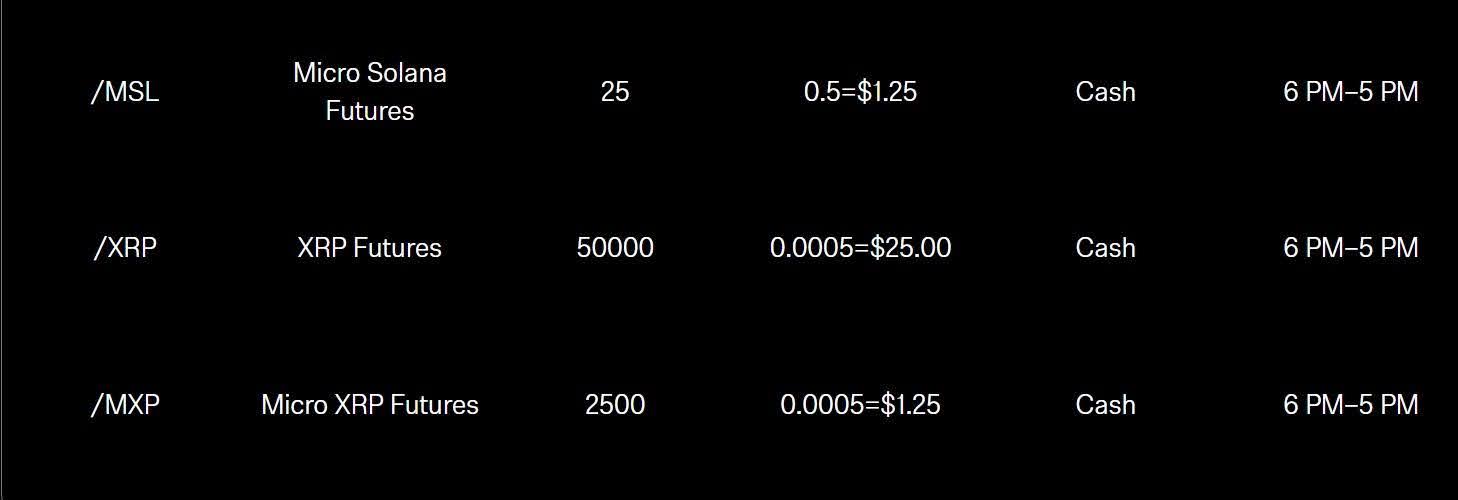

By way of comparison, a micro XRP Contract has a multiplier of 2,500 tokens and each tick of 0.0005 XRP is worth $1.25—far lower than the $25 tick value found in the full-sized offerings. In the same vein, micro futures are also available for Solana using a 25-token multiplier and a tick size of 0.5 each priced at $1.25 to offer greater flexibility and tighter risk management to conservative investors.

All contracts are cash settled and have a nearly 24-hour trading schedule – with trading from 6 p.m. – 5 p.m. ET daily to reflect the global cryptocurrency market.

This move brings Robinhood’s total crypto futures offering to nine, building on earlier launches like standard Bitcoin and Ethereum futures and its initial rollout of Bitcoin Friday futures in 2024.

Read More: Binance vs. Robinhood: Which One Is Better for Trading Crypto and Bitcoin?

XRP and Solana Rejoin Robinhood in Derivatives Push

Robinhood’s micro contracts come shortly after relisting XRP, Solana, and Cardano on its U.S. spot trading platform. The tokens were previously delisted following regulatory uncertainties but have now been reinstated, driven by renewed customer demand and clarifying legal developments.

The futures rollout follows a broader industry shift, where regulatory clarity—especially under the current U.S. administration—has emboldened firms like CME Group and Coinbase to also list XRP and Solana derivatives.

Robinhood is tapping into this momentum. Its entry into XRP and Solana futures mirrors recent launches by CME Group, which on May 19, 2025, introduced institutional-grade futures for both assets. Within weeks, CME’s contracts recorded over $540 million in notional trading volume and more than $70 million in open interest—a clear sign of growing institutional appetite.

Robinhood’s addition of micro contracts helps bridge the gap between these large-scale institutional products and everyday retail traders looking for fractional access.

Strategic Acquisitions Strengthen Robinhood’s Global Crypto Presence

Robinhood’s crypto futures expansion is part of a wider strategic pivot fueled by aggressive acquisitions. In June 2025, the company finalized a $200 million acquisition of Bitstamp, one of the world’s longest-running crypto exchanges. The deal brought Robinhood:

- Access to over 50 global licenses and registrations

- Institutional-grade infrastructure

- A strong European foothold

Before that, Robinhood acquired WonderFi for $179 million, adding Bitbuy and Coinsquare—two of Canada’s leading regulated platforms—to its ecosystem. Together, these firms manage billions of dollars in customer assets, adding to Robinhood’s credibility as a serious participant in global crypto finance.

The company’s crypto war chest is also expanding. With over 25 million funded user accounts, Robinhood’s in a strong spot to cross-sell its derivatives products and establish itself as a global, multi-asset financial platform.

Competitive Landscape and Regulatory Tailwinds

Robinhood is not the only one ramping up its crypto derivatives business. Old-school players such as Charles Schwab, E*TRADE, and CME Group are also scaling up digital asset offerings to keep up with rising demand. But its mobile-first interface, its user-friendly design and its commission-free model offer Robinhood a unique edge among younger, retail enthusiasts.

Moreover, the prevailing market landscape is becoming more favorable to crypto innovation. Market insiders are talking more and more about the increasing likelihood of an approval of a spot XRP ETF (currently being put at 95% for 2025 by Bloomberg analysts). If passed, these instruments would provide additional legitimacy for XRP and Solana as institutional-grade assets.

And with a more crypto-friendly administration at the federal level, platforms like Robinhood are using the momentum provided by these mega-therapy sessions to expand into regulated derivatives, international spot trading and lending services — well beyond conventional brokerage services.

Read More: Uniswap Integrates with Robinhood, MoonPay, and Transak: Facilitating the Fiat-to-Crypto Bridge

Micro Futures—Small Size, Big Potential

While Robinhood’s micro contracts are small, their significance is not. In providing micro futures, the firm is making it possible for:

- Lower-risk exposure for new traders

- Better position sizing for experienced users

- Increased liquidity across new trading pairs

The flexibility of micro contracts is particularly appealing in the volatile world of crypto markets, where big moves can liquidate leveraged positions. Even with these relatively small tick values and low margin requirements, traders can get involved in XRP and Solana futures without overleveraging themselves.

Importantly, its app includes a trading ladder tool, making orders seamless, and enabling traders to respond quickly to changes in rapidly-moving markets.

Robinhood’s is part of a larger trend: democratizing access to intricate financial products that used to be the sole domain of hedge funds and institutional trading desks.

The post Robinhood Launches Micro Crypto Futures, Unlocking XRP and Solana for Small Traders appeared first on CryptoNinjas.

CryptoNinjas