PrimeXBT Review 2025: Is This Crypto Broker Legit, Safe, and Worth Using?

PrimeXBT Global Exchange is a leading broker that offers users a comprehensive trading platform for investing in crypto and other traditional financial instruments, including contracts for difference (CFDs), forex, indices, and commodities.

The best features that make PrimeXBT a suitable exchange for both professional and beginner traders are copy trading, futures and margin trading, and an intuitive mobile app that offers features similar to those on the desktop version.

With these features, new and professional traders can easily manage their portfolio from a single account and make the most of their investments. In addition, users do not have to worry about the safety of their funds, because PrimeXBT is safe to buy and sell crypto and other assets in 2025.

To help you determine if PrimeXBT is a good exchange for you, this PrimeXBT review covers what PrimeXBT is, the platform’s fees, supported cryptocurrencies, the best features of PrimeXBT, a step-by-step guide on how to open a trading account, and PrimeXBT alternatives for traders who want to explore other options. Let’s get started!

PrimeXBT Review: What is it?

PrimeXBT is a leading cryptocurrency and CFD broker that offers a trading platform for buying, selling, and storing cryptocurrencies. PrimeXBT customers also have access to trade over 100 popular financial instruments, including crypto futures and CFDs, forex (FX), indices, and commodities.

The platform offers margin trading with leverage up to 200x for cryptocurrencies and 1000x for forex pairs, significantly enhancing profits. This makes it attractive to experienced traders who prefer high-risk, high-reward trading and are comfortable managing the risks associated with high leverage.

Initially built for copy trading, PrimeXBT has expanded to include futures and margin trading, yet copy trading remains a top feature. The PrimeXBT copy trading features integrate with Covesting, enabling new and/or less experienced traders to replicate the strategies of more experienced traders (strategy managers) and generate a profit without active participation.

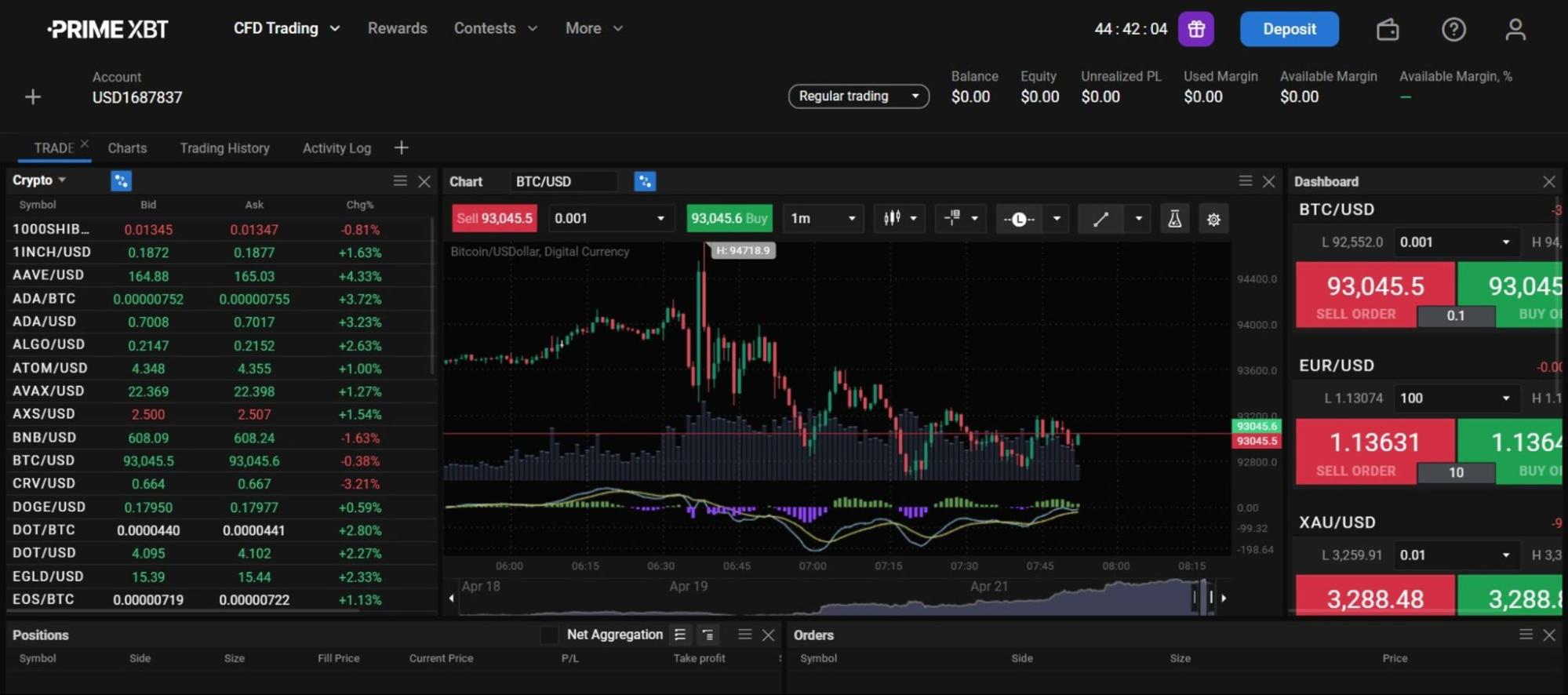

PrimeXBT also offers features like advanced charting and high leverage, ideal for casual, swing, and day traders. These features and trading options will be discussed in more detail in this PrimeXBT review. For now, the table below provides basic information about PrimeXBT, including its security features, trading options, and supported cryptocurrencies.

| Exchange | PrimeXBT |

| Founded | 2018 |

| Headquarters | Seychelles |

| Phemex Key Features | Copy trading (Covesting), futures and margin trading, and a mobile app. |

| Supported Cryptocurrencies | 40+ |

| KYC Requirements | Mandatory |

| Security Measures | Hardware security modules, multisig cold wallet storage, SSL encryption, segregated accounts, negative balance protection, two-factor authentication (2FA), withdrawal address whitelist, compensation fund, and advanced encryption. |

| Trading Options | Futures, margin, copy trading, forex, CFDs, indices, and commodities. |

| Leverage Trading | Yes, up to 200x for crypto and up to 1000x for forex. |

| Spot Trading | No |

| Automated Bot Trading | No |

| Earn Products | Refer a friend, participate in trading contests, and promotions (including new user sign-up, trade and earn, etc.) |

| Phemex Fees (Futures) | 0.01% for makers and 0.045% for takers. |

| Minimum Deposit | Crypto: $1 Fiat currencies: $10 |

| Payment Methods (Deposit and Withdrawal) | Credit/debit card, crypto, and third-party payment providers. |

| Customer Support | Email and Live Chat |

| Available in the US | No |

While PrimeXBT offers over five asset classes for trading and more than 100 financial instruments, it still lacks some features that would make it a poor fit for specific traders. For instance, the platform offers a limited selection of cryptocurrency assets and does not support spot or crypto bot trading.

Spot trading, a simple method for buying and selling assets, is widely used on exchanges. In fact, it is the best place for beginner traders to start, as it is easier to navigate. This allows them to familiarize themselves with the trading environment before transitioning to crypto futures trading.

Meanwhile, automated bot trading has been gaining momentum in the cryptocurrency trading industry. The adoption of this strategy has been on the rise, and some traders would prefer an exchange that offers the option to set parameters and let the bot execute trades in their absence. This suits traders focused on futures, forex, and CFD trading.

What are the Pros and Cons of PrimeXBT?

The pros of PrimeXBT are the Covesting (copy trading) feature, high leverage, multiple asset classes for trading, promotional offers, competitive fees, advanced trading tools, and responsive customer support.

- Covesting (Copy Trading) Module: This feature allows users to follow and automatically copy the trading strategies of top-performing traders. The goal is to help beginners and traders who frequently lack the time to monitor their trades, make a profit from trades without prior trading knowledge, and even when they are absent.

Covesting’s utility token, COV, is integrated into its copy trading module. Staking the COV token offers multiple benefits for traders. For instance, it enables traders to boost profits, secure fee discounts, and increase profit shares within the Covesting ecosystem.

- High Leverage Options: PrimeXBT offers leverage of up to 200x for cryptocurrencies and up to 1000x for forex, allowing traders to amplify their positions and potentially increase their profits. It is worth noting that while leverage can amplify gains, it also carries risk, so leverage trading is best suited for experienced traders seeking high-reward opportunities.

- Robust Security Features: PrimeXBT uses strong security measures such as cold storage for digital assets, two-factor authentication, withdrawal address whitelisting, and encrypted data transmission to protect users’ data and assets. While PrimeXBT is not regulated by major financial authorities, which is a concern, it is a member of the Financial Commission, providing a degree of assurance through its €20,000 compensation fund.

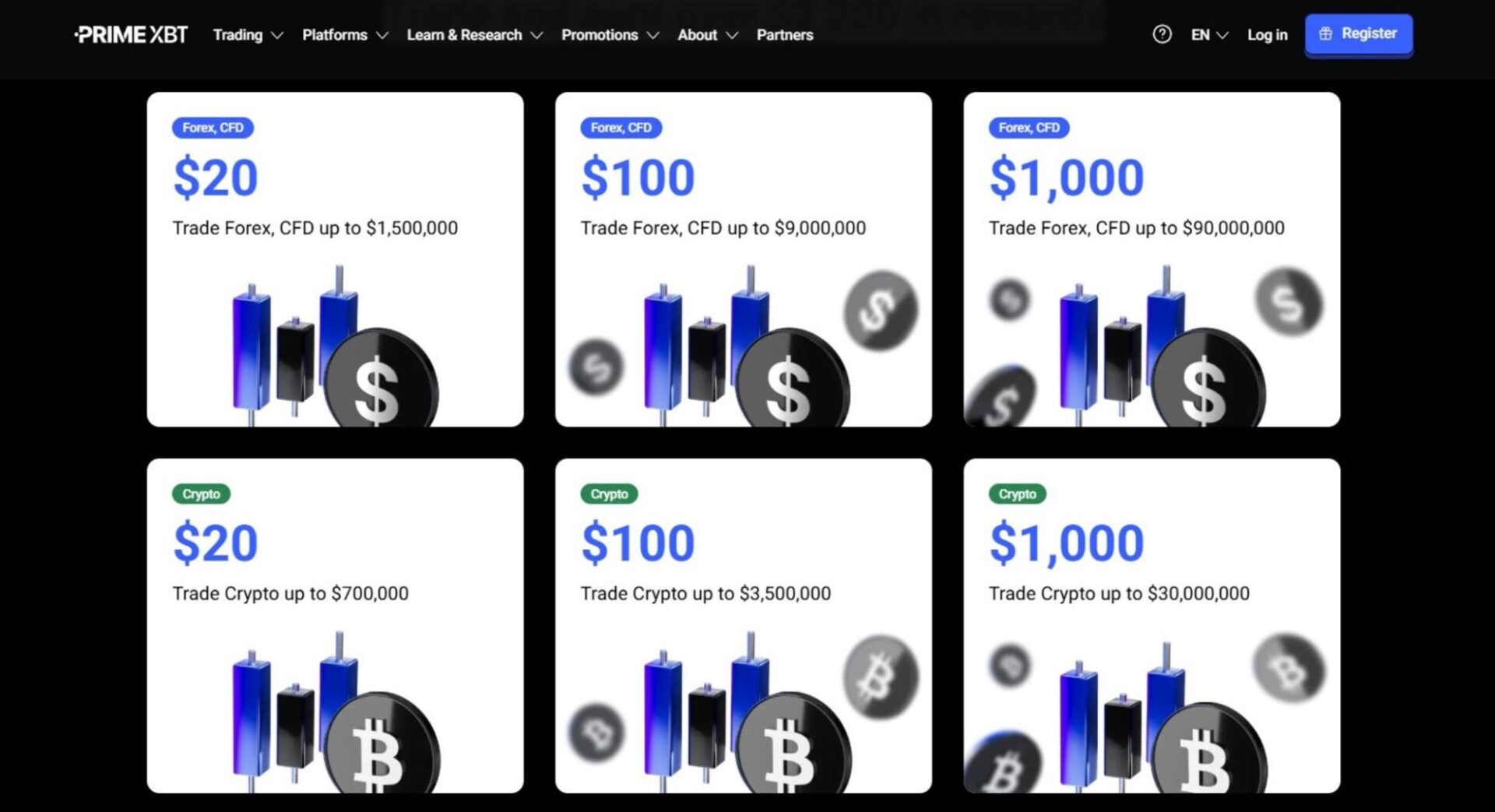

- Promotional Offers: The platform regularly runs trading contests, giveaways, and promotional campaigns that allow users to earn bonuses, rewards, and even cash prizes. They also offer new users welcome bonuses worth up to $500 for completing simple tasks, like funding their accounts.

These incentives help PrimeXBT customers grow their portfolios with added rewards. Promotional tasks on PrimeXBT are usually time-bound, but there is always something to do and earn rewards from. To earn these rewards, visit the Promotions page on the PrimeXBT official website to view available tasks and their corresponding rewards.

- Competitive Fees: PrimeXBT charges low trading fees, especially for cryptocurrency trading, making it an ideal choice for high-volume traders, frequent traders, and day traders. Fees for crypto futures trading on PrimeXBT Global Exchange are as low as 0.01% for makers and 0.045% for taker orders.

- Advanced Trading Tools: The trading platform integrates with TradingView, providing access to advanced charting tools, technical indicators, real-time market data, trading signals, and account management tools. Traders can analyze price trends, test strategies, and manage risk with precision and accuracy. Whether you are scalping, swing trading, or building a long-term plan, PrimeXBT offers the tools needed for professional trading.

- Responsive Customer Support: The PrimeXBT customer support team, available 24/7, often provides prompt and helpful responses. From our PrimeXBT review, we found that customer support is responsive, whether it’s a technical issue, an account question, or assistance with navigating the platform. Help is readily available through live chat, email, and comprehensive educational resources, including trading tutorials and articles.

- Multiple Asset Classes for Trading: PrimeXBT not only offers crypto trading but also supports a wide range of financial instruments, including cryptocurrencies, forex, indices such as the S&P 500 and FTSE 100, and commodities like gold, silver, and oil. This enables traders to execute diverse trading strategies and capitalize on market opportunities across various sectors, all from a single platform.

The cons of PrimeXBT are unregulated exchange, limited crypto options, no staking except for COV, no spot market, bot trading, and withdrawal delays.

- Unregulated Exchange: PrimeXBT holds a Financial Sector Conduct Authority (FSCA) license in South Africa, among other jurisdictions. However, it operates without oversight from major financial regulators. The lack of regulation means there’s limited recourse in the event of disputes, and it may not meet the compliance standards required by some institutional or professional investors.

- Limited Crypto Options: The platform supports over 40 crypto assets, including major cryptocurrencies such as Bitcoin and Ethereum. However, the overall selection is limited compared to other exchanges that support up to 500 coins. For this reason, it may not be a suitable option for traders seeking to access a broad range of altcoins or invest in newer, emerging cryptocurrency projects.

- No Staking Except for COV: PrimeXBT doesn’t support staking for popular cryptocurrencies such as ETH or ADA. The only available staking feature is tied to Covesting’s native token, COV, which limits passive income opportunities for users looking to earn rewards from holding other digital assets.

- No Spot Market: PrimeXBT focuses solely on futures and margin trading. It does not offer spot trading, which may deter users who prefer to buy and hold actual assets without leverage. This also means no direct crypto-to-crypto or fiat-to-crypto purchases, unlike on other exchanges such as Crypto.com, Binance, and Bybit.

- No Bot Trading: PrimeXBT does not support built-in or third-party trading bots, which limits automation options for users. Some traders rely heavily on crypto bots, which are tools that help them execute trades automatically. If you prefer to use algorithmic strategies, auto-rebalancing, and other bot execution strategies, you will find the platform restrictive.

- Withdrawal Delays: Some users have reported experiencing occasional delays in withdrawal processing, particularly during high network congestion or increased platform activity. While this concern is mixed, it’s something to consider for traders who require quick access to their funds.

What Countries and Regions are Available for PrimeXBT Users?

The countries and regions available to PrimeXBT users include South Africa, Switzerland, India, Brazil, Mexico, Argentina, Vietnam, Thailand, Turkey, the United Arab Emirates (UAE), and more than 140 other countries.

However, PrimeXBT is not available in certain restricted jurisdictions, including the United States, Canada, Japan, and a few other countries with stringent regulatory requirements. Users in these regions cannot create accounts or access the platform features due to compliance limitations.

Is PrimeXBT Available in the USA?

No, PrimeXBT is not available in the USA. The broker does not offer its products and services to traders in the United States due to regulatory issues. If you’re looking for a good alternative to PrimeXBT that provides similar services, such as copy trading, leverage trading, and multi-asset markets including crypto, forex, commodities, and indices, and is available to US traders, consider eToro.

eToro is a well-known platform for social trading and copy trading. It enables users to replicate the portfolios of top traders, offering a smooth and beginner-friendly experience. Unlike PrimeXBT, eToro is a regulated platform and offers real stocks, ETFs, crypto, forex, and commodities.

What are the PrimeXBT Fees?

The PrimeXBT fees are trading fees, deposit fees, and withdrawal fees. Below is a breakdown of PrimeXBT fees and its withdrawal limits.

PrimeXBT Trading Fees

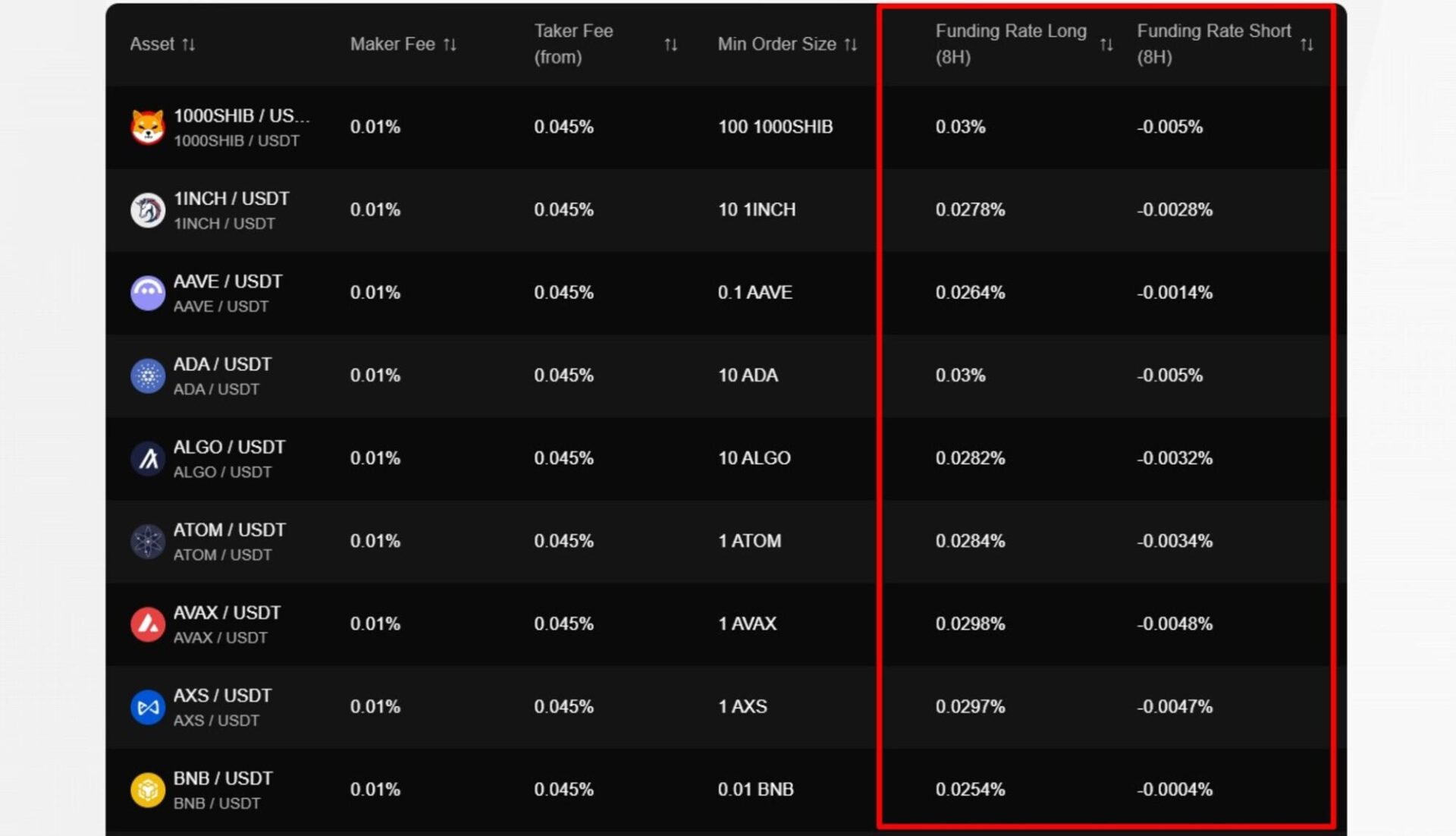

PrimeXBT trading fees are crypto futures fees, forex and CFD fees, copy trading fees, and funding rates.

- Crypto Futures Fees: Transaction fees for all traders on the Phemex futures market are 0.01% for market makers. For takers, the fees are divided into three tiers, depending on your 30-day trading volume. Users with less than $5,000,000 monthly volume pay 0.045%, those whose monthly volume is above $5,000,000 pay 0.035%, and finally, traders with more than $20,000,000 in monthly trading volume pay 0.02%.

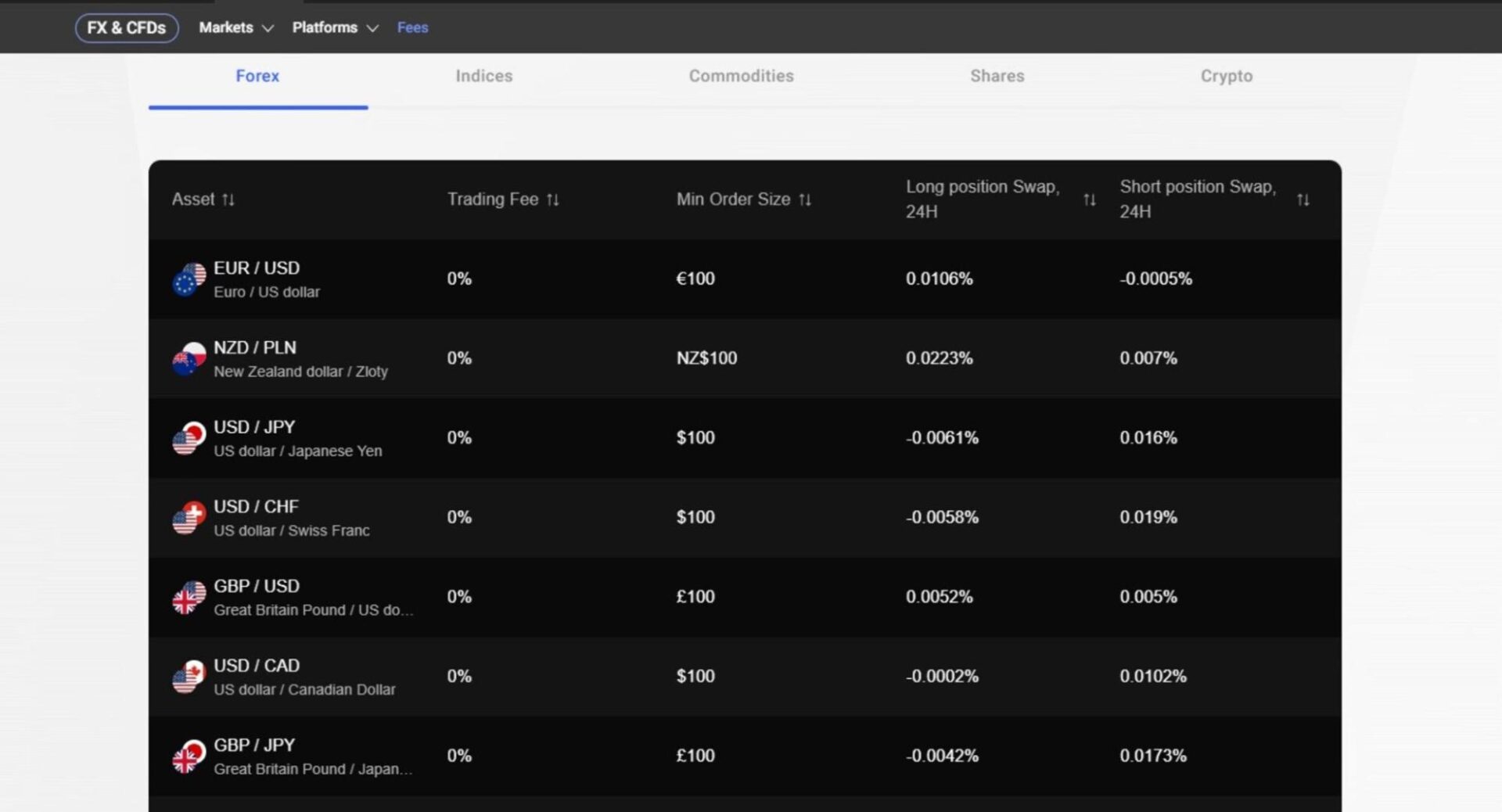

- Forex and CFD Fees: For forex and CFD pairs, PrimeXBT charges a 0.0% flat rate per trade with spreads as low as 0.1 pips. The exchange also charges a fee for overnight trades. Overnight financing costs vary by currency pair and position (long or short). Below is a breakdown of how much forex and CFD traders should expect to pay in overnight fees.

- Copy Trading Fees: PrimeXBT’s copy trading fees involve a profit-sharing model rather than traditional commission fees. For profit distribution,

- Strategy Manager (Trader Being Copied): Receives 20% of profits generated by followers.

- Platform: Takes 20% of profits.

- Copy Trader (Follower): Keeps 60–75% of profits from each copied trade.

Fees are deducted from profits only when trades are successful. Additionally, there are no extra transaction costs; only the standard PrimeXBT fees (e.g., futures, spreads, overnight financing) apply to positions opened through copy trading.

- Funding Rates: PrimeXBT charges funding fees every 8 hours for open positions, varying by asset. These rates are not fixed and vary based on the cryptocurrency and market conditions; therefore, you will need to log in to view the actual funding rate for the contract you wish to trade. That said, here is an overview of the funding rate you should expect to pay for different assets.

PrimeXBT Deposit Fees

PrimeXBT deposit fee is free. The platform offers free deposits for cryptocurrencies and bank cards. However, using third-party payment providers like Perfect Money to buy crypto or other assets incurs a minimum fee of 1.99% (imposed by the payment provider, not PrimeXBT). The minimum deposit is approximately $1, subject to updates; check their official website for current requirements.

PrimeXBT Withdrawal Fees

PrimeXBT withdrawal fees are free for internal withdrawals. However, traders withdrawing to an external wallet must pay a fixed fee for each cryptocurrency withdrawal to cover the transaction costs of the blockchain network. These fees, set by blockchain networks, are not determined by PrimeXBT.

The specific fee amount depends on the cryptocurrency you wish to withdraw and can vary due to network congestion and transaction volume at the time of your withdrawal request. For fiat currency withdrawals processed through third-party platforms, a fee will be incurred, starting at $5 for withdrawals of $10,000 or more. This fee is also dependent on the third-party platform.

What is the Withdrawal Limits on PrimeXBT?

The withdrawal limit on PrimeXBT is $20,000 or equivalent in other currencies. Each account on PrimeXBT has a standard 24-hour withdrawal limit. However, if you wish to increase your limit above $20,000, you must complete the KYC verification process.

What Cryptocurrencies are Supported on PrimeXBT?

PrimeXBT supports over 40 crypto assets, including major coins such as BTC, Ethereum, and SOL, as well as stablecoins like Tether (USDT) and USDC, and memecoins like DOGE and SHIB. In addition to cryptocurrencies, PrimeXBT enables users to trade various asset classes, including forex, commodities, and indices.

What are the Best Features on PrimeXBT?

The best features on PrimeXBT are copy trading (Covesting), PrimeXBT Futures & Margin Trading, and the PrimeXBT Mobile App.

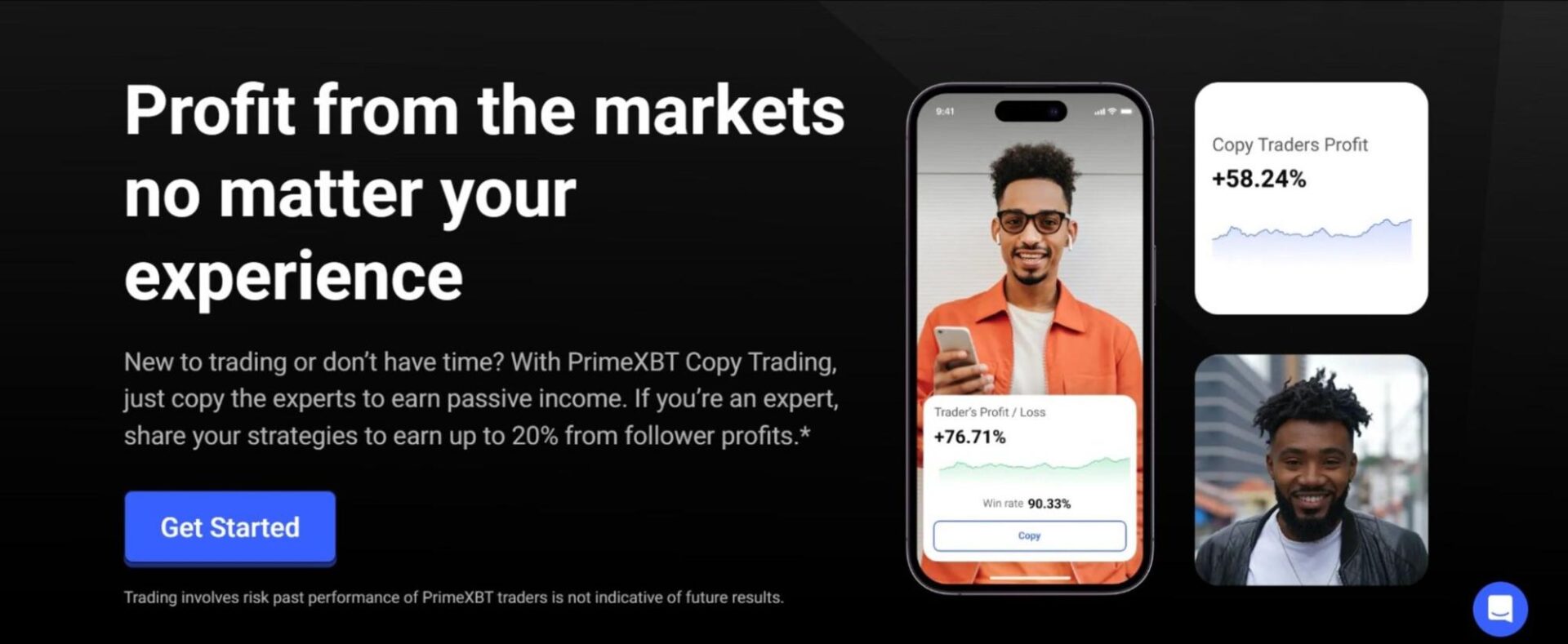

PrimeXBT Copy Trading (Covesting)

The PrimeXBT Copy Trading (Covesting) is a copy-trading module of the PrimeXBT trading platform that enables beginners or less-experienced traders to replicate the trading strategies of leading traders without advanced trading skills or actively managing their own positions.

Through the Covesting software, PrimeXBT makes the trading strategies of experienced traders public in a performance-based leaderboard. Followers can evaluate and choose which traders to copy based on a range of metrics, including return on investment (ROI), total profit, risk score, number of followers, and other relevant factors.

For followers, Covesting simplifies the trading process. Once you subscribe to a strategy, your funds are automatically aligned with the actions of the strategy manager, who is the trader being copied. If they make a profit, you will also make a proportional profit, minus a trading performance fee shared between the successful trader and PrimeXBT.

One advantage of the PrimeXBT copy trading feature is that followers have account management tools at their disposal to control their level of market exposure by choosing how much capital they want to allocate to a particular strategy. Unlike some locked-in investment products, followers can also exit the strategy at any time.

Covesting supports trading across a wide range of markets, including cryptocurrencies, forex, commodities, and stock indices, allowing you to diversify your investment portfolio.

Additionally, Covesting introduced a token-based system through the COV utility token, which unlocks several benefits for users, including reduced transaction fees and increased profit shares. With this, users holding COV tokens can enhance their trading experience, earn passive income by staking COV, and potentially improve profitability.

PrimeXBT Futures & Margin Trading

PrimeXBT supports margin and futures trading on over 100 assets, including cryptocurrencies, forex pairs, indices, and commodities. PrimeXBT platform offers leverage up to 200x on select pairs via cross-margin and isolated margin accounts. This means traders can control larger positions and potentially increase their profit using a relatively small deposit.

However, the maximum leverage varies across assets. For instance, Bitcoin (BTC) and Ethereum (ETH) support up to 200x, while XRP is capped at 175x, BNB at 75x, and assets like LTC, MATIC, and ATOM at 50x. Traders can check available leverage for each trading pair on the platform before opening a position.

As discussed earlier, the PrimeXBT platform supports cross-margin accounts, which use your entire account balance as collateral. This can reduce the chance of immediate liquidation, especially during market swings; however, it also increases the risk of losing money rapidly if trades go sideways.

Alternatively, isolated margin trading limits your risk to the specific position you’re trading. Leverage here is capped at 100x, offering more control and protection against broader account loss. This is ideal for traders who want to manage their exposure better.

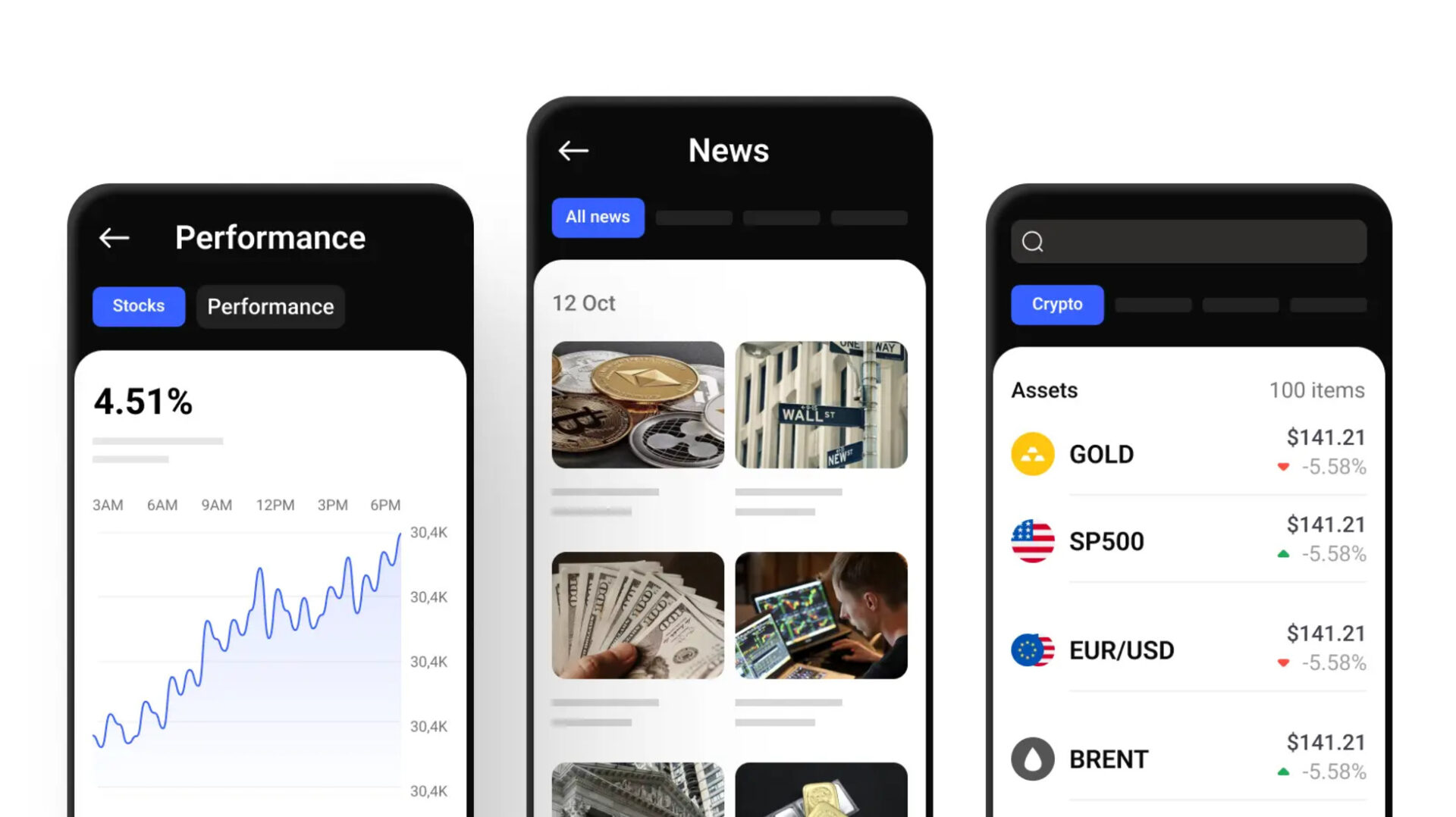

PrimeXBT Mobile App

The PrimeXBT mobile app is designed to mirror the full functionality of the desktop trading platform, providing users with seamless access to various trading instruments from their smartphones or tablets. The app is available on both Android and iOS and delivers a comprehensive trading experience for users while they are on the go.

With support for over 100 financial markets, the app enables users to trade a wide range of assets, including more than 40 cryptocurrencies, forex pairs, indices, and commodities such as gold and crude oil, all of which can be managed from a single user friendly interface.

The mobile app also offers high-leverage options of up to 200x for crypto futures and margin trading, and up to 1000x for forex. To support in-depth market analysis, the PrimeXBT app features a suite of advanced tools, including real-time market data, customizable charts, and technical indicators.

Additionally, account security is a top priority on the PrimeXBT mobile platform. The app supports two-factor authentication (2FA), withdrawal address whitelisting, and strong data encryption to safeguard user information and assets. The company also offers biometric login options, like fingerprint or facial recognition, adding another layer of protection and convenience for mobile users.

How to Open a New PrimeXBT Trading Account?

To open a new PrimeXBT trading account, you will need to visit the platform’s official website and provide the required information. Here is a step-by-step guide to opening an account.

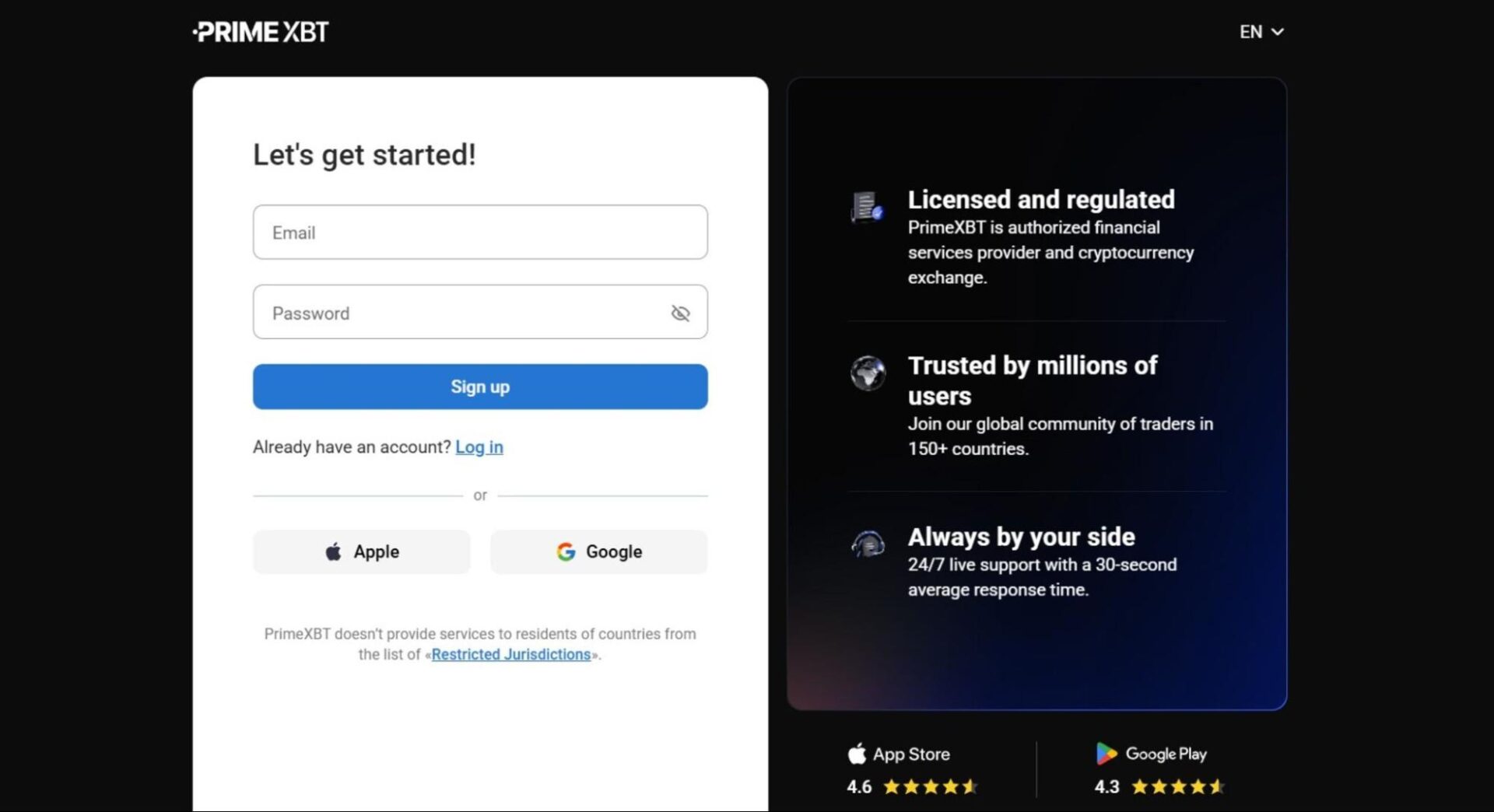

Step 1: Register

Visit the official PrimeXBT website and click “Register” in the upper right corner or select “Sign up”. On the page that opens, you can choose to input your email and a strong password manually, or you can sign up using your Apple ID or Google account.

Next, verify your email by entering the 4-digit PIN that was sent to the email address you used. Select your country and click “Continue.” You now have a crypto trading account with PrimeXBT.

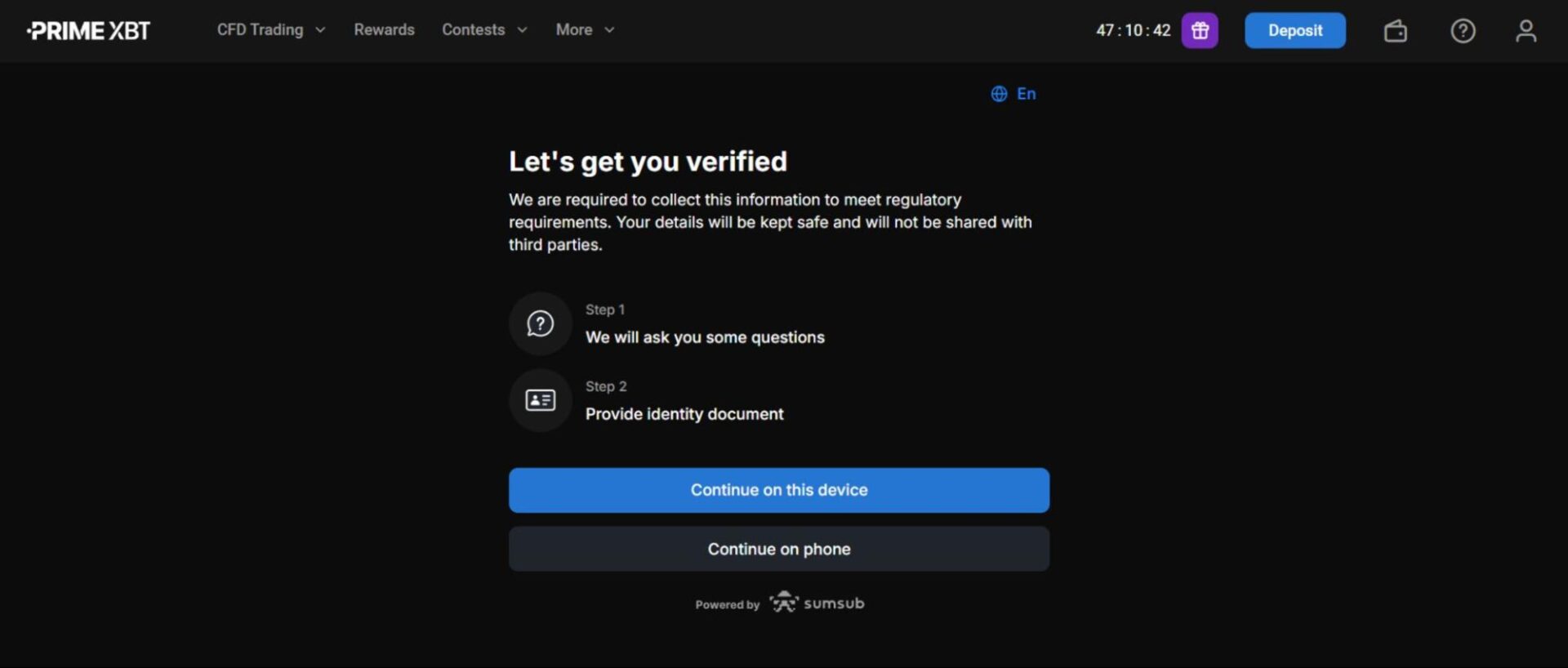

Step 2: Identity Verification (KYC)

Click on your account icon, select “Verify account,” and check the box to confirm that you have given PrimeXBT permission to process your personal information, then click “Continue.” Next, provide the required personal details and confirm that you are not a U.S. citizen or resident. Then, click “Continue.”

For identity document verification, you can upload a photo already saved on your computer or switch to using your phone to take a live image of your government-issued identification document. Select “Continue,” verify that the information you have provided is correct, and click “Next”. Wait for the exchange to verify the documents.

Step 3: Depositing Funds

Once your account is verified, you can deposit funds to start trading on PrimeXBT. To do this, click “Deposit” and choose whether you want to deposit crypto or fiat. To transfer crypto from another wallet to your PrimeXBT account, click “Deposit Crypto.

Next, select the cryptocurrency you want to deposit and the network. Copy the generated wallet address and paste it into the wallet you are transferring crypto from to complete your trade.

Claiming the Deposit Bonus on PrimeXBT

The PrimeXBT trading platform welcomes new traders with a bonus of up to $500 upon completion of their first deposit. This bonus is only available if you signed up using a PrimeXBT referral code or link. You can use our referral link to sign up and become eligible for rewards.

To claim the $500 bonuses, navigate to the first menu after “PrimeXBT” on the upper left corner of the home page and select “Rewards” or go to the “Promotions” page and claim if you’ve met all the criteria.

Step 4: Start Trading (Crypto Futures)

Traders must transfer funds from their main wallet to a margin trading account to begin trading. From your PrimeXBT dashboard, click on “Trade.” This will lead to the futures trading interface, where you can view charts, order books, trading pairs, and positions.

Choose a crypto futures pair you wish to trade from the left-hand side (e.g., BTC/USD, ETH/USD). You can also search for it in the top-left search bar and choose your order type (market or limit order).

Next, fill in the other details, such as the amount of the base currency you want to buy or sell, the leverage, and set the take-profit/stop-loss (optional but recommended). Once you are satisfied with your parameters, click “Buy/Long” if you are betting on the price to rise or click “Sell/Short” if you believe the cost of the cryptocurrency will fall.

Does PrimeXBT Require KYC?

Yes, PrimeXBT requires KYC before you can deposit and trade. Traders can open accounts without KYC, but cannot deposit crypto or use PrimeXBT trading services without identity verification. PrimeXBT platform also requires KYC if you wish to use fiat services, such as depositing fiat currencies or buying crypto with fiat. The optional KYC for registration makes it one of our top choices for the best no KYC crypto exchanges.

Is PrimeXBT Safe and Legit to Use?

Yes, PrimeXBT is safe and legit to use for crypto and commodity trading. The exchange employs robust security measures to safeguard user assets and has not experienced any significant security breaches since its launch in 2018. However, traders should note PrimeXBT’s limited regulation, which may concern those prioritizing oversight.

Some of the security features that the PrimeXBT platform uses to safeguard traders include hardware security modules, segregated accounts, negative balance protection, a compensation fund, and advanced encryption. In addition, they use two factor authentication, withdrawal address whitelisting, and cryptographically hashed passwords to protect users’ accounts.

- Hardware Security Modules (HSMs) Rated FIPS PUB 140-2 Level 3 or Higher

Hardware Security Modules (HSMs) are dedicated devices designed to securely generate, store, and manage cryptographic keys. FIPS PUB 140-2 is a US government standard (Federal Information Processing Standard Publication 140-2) used to validate the strength and effectiveness of cryptographic modules. HMS has four levels, with Level 3 offering high security.

PrimeXBT uses HSMs rated FIPS PUB 140-2 Level 3 or higher to safeguard users’ funds and sensitive operations. These hardware devices are built to protect against physical tampering, unauthorized access, and data leakage. With this, PrimeXBT ensures that even if a server is compromised, essential data sets, such as private keys, will remain inaccessible.

- Cold Storage With Multisignature Technology

PrimeXBT keeps a significant portion of users’ funds in cold wallets, which are offline storage systems that are not vulnerable to hacking since they are not connected to the internet. In addition to cold wallet storage, PrimeXBT platform uses a system that requires multiple registered signatures to process transactions.

- Segregated Accounts

PrimeXBT keeps client funds in segregated accounts, meaning they are kept separate from the company’s operational funds. This ensures that your capital is protected and never used for business expenses, giving you peace of mind that your assets are under your control and accessible at all times.

- Negative Balance Protection

Crypto and forex trading are risky, especially with the high leverage that the trading platform offers. PrimeXBT’s Negative Balance Protection ensures that your account balance never falls below zero. In the event of extreme market movement, this feature automatically closes your positions to prevent debt, saving you from owing more than your initial investment.

- Compensation Fund

PrimeXBT is a member of The Financial Commission, an independent external dispute resolution body. This membership gives PrimeXBT platform users access to a Compensation Fund of up to €20,000 per claim if the trading platform fails to meet its obligations and the Financial Commission rules in your favour.

- Advanced Encryption

PrimeXBT uses advanced encryption protocols, including full SSL encryption for all personal information and cryptographically hashed passwords, to protect users further. Every login, withdrawal, and action is encrypted, ensuring that your trading account remains safe from malicious access and cyber threats.

As discussed earlier, PrimeXBT also encourages users to activate these features to add protection to their accounts.

- Two-Factor Authentication (2FA)

2FA adds a second layer of protection by requiring an additional verification, such as an authenticator app code, in addition to your password. This adds a layer of protection to your account that prevents unauthorized users from having access to your account even if they have your password.

- Withdrawal Address Whitelisting

PrimeXBT offers its customers the option to whitelist withdrawal addresses they trust or frequently use for asset transfers. Once this security feature is activated, no one can move your assets to any unlisted wallet. Any attempt to proceed with that transfer will be blocked until you update the withdrawal list.

PrimeXBT Regulation and Licensing

PrimeXBT is licensed by various entities across multiple jurisdictions, ensuring compliance with international financial standards and providing a secure trading environment for its users. Although we do not consider PrimeXBT a regulated exchange because it lacks regulation from major bodies, the trading platform is licensed under the following authorities.

- Financial Services Authority (FSA), Seychelles: PrimeXBT Trading Services LTD is a licensed Securities Dealer under License No. SD162, authorized by the Seychelles Financial Services Authority. This license enables the company to provide a range of trading services, including cryptocurrency futures and Contracts for Difference (CFDs).

- Financial Sector Conduct Authority (FSCA), South Africa: Stack Advisory (PTY) LTD, the entity behind PrimeXBT in South Africa, is an authorized financial services provider.

- Comisión Nacional de Activos Digitales (CNAD) & Banco Central de Reserva (BCR), El Salvador: PrimeXBT Trading Services, S.A. de C.V. holds a Digital Asset Services Provider (DASP) license from the CNAD and a Bitcoin Services Provider (BSP) license from the BCR. These licenses authorize the company to operate within El Salvador’s digital asset framework.

- Financial Services Commission (FSC), Mauritius: PXBT Capital Ltd is incorporated in Mauritius and holds an Investment Dealer license from the FSC. This license enables the company to offer investment services, thereby further expanding PrimeXBT’s regulated operations.

What are the PrimeXBT Alternatives?

The best alternatives to PrimeXBT are eToro, Bybit, and FXopen. These exchanges share similarities with PrimeXBT platform in terms of tradeable assets, KYC requirements, and other features. For instance, Bybit offers an extensive copy trading tool for crypto, FX, and gold copy trading, placing it on our ranking of the best crypto copy trading platforms, just like PrimeXBT.

Besides copy trading, these alternative exchanges offer similar products and trading options, like a mix of traditional trading instruments and cryptocurrencies, robust security features, and margin trading.

Despite similarities, each alternative offers unique features, such as eToro’s regulation or Bybit’s broader crypto selection. For more details on their similarities and differences, the top PrimeXBT alternatives are summarized in the comparison table below.

| Exchange | PrimeXBT | eToro | Bybit | FXopen |

| Founded | 2018 | 2007 | 2018 | 2005 (officially as a broker) |

| Headquarters | Seychelles | Isreal | United Arab Emirates | Cyprus |

| Key Features | Copy trading (Covesting), futures and margin trading, and a mobile app. | Smart portfolio, social trading, CopyTrader, and demo account. | Automated trading bots, Launchpad, copy trading, and Bybit Web3. | Forex demo account, PAMM accounts, and multiple trading platforms (MT4, MT5, TradingView, and TickTrader) |

| Supported Cryptocurrencies | 40+ | 85+ | 500+ | 40+ |

| KYC Requirements | Mandatory | Mandatory | Mandatory | Mandatory |

| Security Measures | Multisig cold wallet storage, segregated accounts, negative balance protection, and compensation fund. | Segregated accounts, negative balance protection, 2FA, and biometric login. | Withdrawal confirmation, 2FA, cold storage, and IP whitelisting. | Multi-factor authentication and encryption for data transmission. |

| Trading Options | Futures, margin, copy trading, forex, CFDs, indices, and commodities. | Stocks, crypto, commodities, indices, and ETFs. | Spot, futures, options, forex, CFDs, and copy trading. | FX, Commodities, Indices, Cryptocurrencies, ETFs, and Shares. |

| Leverage Trading | Yes (up to 200x for crypto and up to 1000x for forex). | Yes (up to 10x) | Yes (up to 200x) | Yes (up to 500x) |

| Spot Market | No | Yes | Yes | No |

| Automated Trading Bots | No | Yes | Yes | Yes |

| Earn Products | Refer a friend, trading contests, promotions (new user sign-up, trade and earn, etc.) | Learn and earn, crypto stacking, stock lending, and more. | Savings, referral program, liquidity mining, and more. | Forex contests |

| Trading Fees (Futures) | Maker: 0.01% Taker: 0.045%. | Commission fees Index futures: $3 Commodity futures: $5 | Maker: 0.0200% Taker: 0.0550% | Commission fees Starting at $3.50 |

| Minimum Deposit | Crypto: $1 Fiat currencies: $10 | $10 (depending on your location). | $2 (depending on the cryptocurrency). | 1 USD |

| Payment Methods (Deposit and Withdrawal) | Credit/debit card, crypto, and third-party payment processors. | eToro Money, credit/debit cards, and third-party payment processors. | Card, crypto, third-party companies, and P2P. | Online bank transfer, credit/debit card, and wire transfer. |

| Customer Support | Email and Live Chat | Chatbot and Live Chat. | Live chat, email, and social media. | Email, phone, and online chat. |

| Available in the US | No | Yes | No | No |

Pro Tip: Besides the aforementioned PrimeXBT alternatives, other exchanges offer comprehensive crypto trading tools and sign-up bonuses, making them suitable for beginners and seasoned traders.

If you are considering exchanges that are designed for cryptocurrency trading because of your trading preferences, check out our compilation of the best crypto sign-up bonuses. The codes from this article can help you get exclusive rewards worth up to $30,000 to start your trading journey on some of the top exchanges in the crypto trading industry.

The post PrimeXBT Review 2025: Is This Crypto Broker Legit, Safe, and Worth Using? appeared first on CryptoNinjas.

CryptoNinjas