Not Even 0.1% Vote Yes, Meta’s $72 Billion Treasury Is Still Devoid of Bitcoin after the Shareholder’s Vote

Key Takeaways:

- The Bitcoin plan is rejected by the majority of Meta shareholders: Keeping Bitcoin in the treasury was chosen by less than 1% of the population.

- As a whole, the board and its members preferred to hold on to the $72 billion in liquid assets and securities.

- Despite Bitcoin’s success and its fixed supply, crypto remains on the sidelines because institutions are wary of investing in it.

Shareholders of Meta voted nearly unanimously against a plan to investigate the possibility of adopting Bitcoin as a reserve for the company’s treasury, aligning with current institutional sentiment on digital assets. Even if crypto is becoming more popular, big IT companies like Meta are still cautious when it comes to managing their corporate treasuries.

Bitcoin Treasury Proposal: Crushed at the Polls

A proposal to investigate the potential advantages of investing part of Meta’s $72 billion in marketable securities, cash, and equivalents into Bitcoin was resoundingly rejected during the company’s annual shareholder meeting on May 28, 2025.

Ethan Peck of the National Center for Public Policy Research filed the motion, which asked the board to think about Bitcoin as a way to protect against inflation and falling real rates on traditional investments. Peck said that Bitcoin could be a better store of value than government bonds and other low-yielding investments since it has a fixed supply and has been going up in value over time.

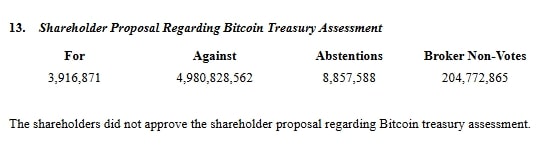

However, the vote tally made it clear: institutional investors and Meta’s leadership aren’t ready to make the leap. According to SEC filings, only 3.9 million votes supported the proposal, while nearly 5 billion votes rejected it, with over 204 million broker non-votes recorded. The backing for Bitcoin amounted to less than 0.1% of all votes cast.

Read More: Texas Proposes Strategic Bitcoin Reserve Amid Push for Crypto Sovereignty

Meta’s View: No Need for Bitcoin, Yet

Meta’s board voted against the request and gave a clear reason: there is no strategic purpose to get into Bitcoin right now. The company said that its strong cash management procedures and enough liquidity framework were enough to meet its operating and growth needs.

In their recommendation against the proposal, the board stated:

“Meta’s treasury strategy is designed to preserve capital, maintain sufficient liquidity, and earn a return appropriate to its risk profile. Bitcoin does not align with this strategy due to its volatility and regulatory uncertainty.”

This posture is in line with the conservative attitude observed at leading technology corporations. Take Microsoft and Amazon as examples; in years past, they too have rejected comparable suggestions.

Read More: Solana’s Titan Meta-DEX Aggregator Launches Beta Platform for ELITE Users

Institutional Resistance to Bitcoin: Three Core Issues

1. Volatility Risk Remains a Dealbreaker

Because Bitcoin is so volatile, big companies still don’t use it. Even though Bitcoin’s price has gone up by more than 130% in the last year, treasurers who are worried about the safety of their money still won’t accept the big drops that the cryptocurrency has witnessed, such the 70% drop in 2022.

Bitcoin’s daily returns have a standard deviation of more than 4%, which is much higher than U.S. Treasuries’ standard deviation of less than 0.5%. Most company finance departments want things to stay the same, not change.

2. Lack of Regulatory Clarity

Recent occurrences, like the debut of U.S. spot Bitcoin ETFs in early 2024, have made the asset class more respectable, but there is still a lack of regulatory clarity. The IRS and SEC are continuously modifying the way they group crypto assets. This could make it hard for firms to keep track of their money and meet the rules.

3. Conservative Treasury Norms Dominate

Big Tech’s refusal shows how they all feel: Companies won’t show Bitcoin on their balance sheets until the rules are clear and the market grows. Despite the potential benefits of cryptocurrency, institutional conservatism remains more popular.

Comparing to Other Tech Giants

Meta is not alone. Similar shareholder proposals were voted down at Amazon and Microsoft in the past two years. Apple, Alphabet, and Nvidia also continue to avoid digital assets as treasury options.

Since 2021, when Tesla made news for adding $1.5 billion in Bitcoin on its bank sheet, it has sold off a lot of its assets. The corporation hasn’t bought any more Bitcoin since the first quarter of 2021, and it just owns a little amount right now.

Bitcoin is worth almost $1.5 trillion, yet institutions still don’t use it as a common treasury asset. This tendency shows a bigger fact about the market.

The Crypto Angle: Market Reaction and Industry Response

The vote didn’t have a major effect on the markets, but it did highlight that Bitcoin still has a long way to go before institutions will adopt it. BTC prices stayed at $68,200 after the vote, which showed that traders had already predicted the verdict.

Experts in cryptocurrency remarked that while if Meta’s choice wasn’t a surprise, it still highlights how different crypto fans and business people are.

Some people who favor the project, on the other hand, warn that these conservative ideas could mean missing out on long-term benefits. Bitcoin has gone up more than 5,000% since Meta’s IPO in 2012, making it better than almost all other traditional financial assets.

The post Not Even 0.1% Vote Yes, Meta’s $72 Billion Treasury Is Still Devoid of Bitcoin after the Shareholder’s Vote appeared first on CryptoNinjas.

CryptoNinjas