Metaplanet Raises ¥30B via 0% Bonds to Acquire 1,005 BTC

Key Takeaways:

- Metaplanet issues ¥30 billion ($208M) in 0% bonds to finance more Bitcoin purchases

- Acquires additional 1,005 BTC, pushing total holdings to 13,350 BTC—surpassing Galaxy Digital

- Buyback of ¥1.75B in older secured bonds reduces liabilities and increases capital flexibility

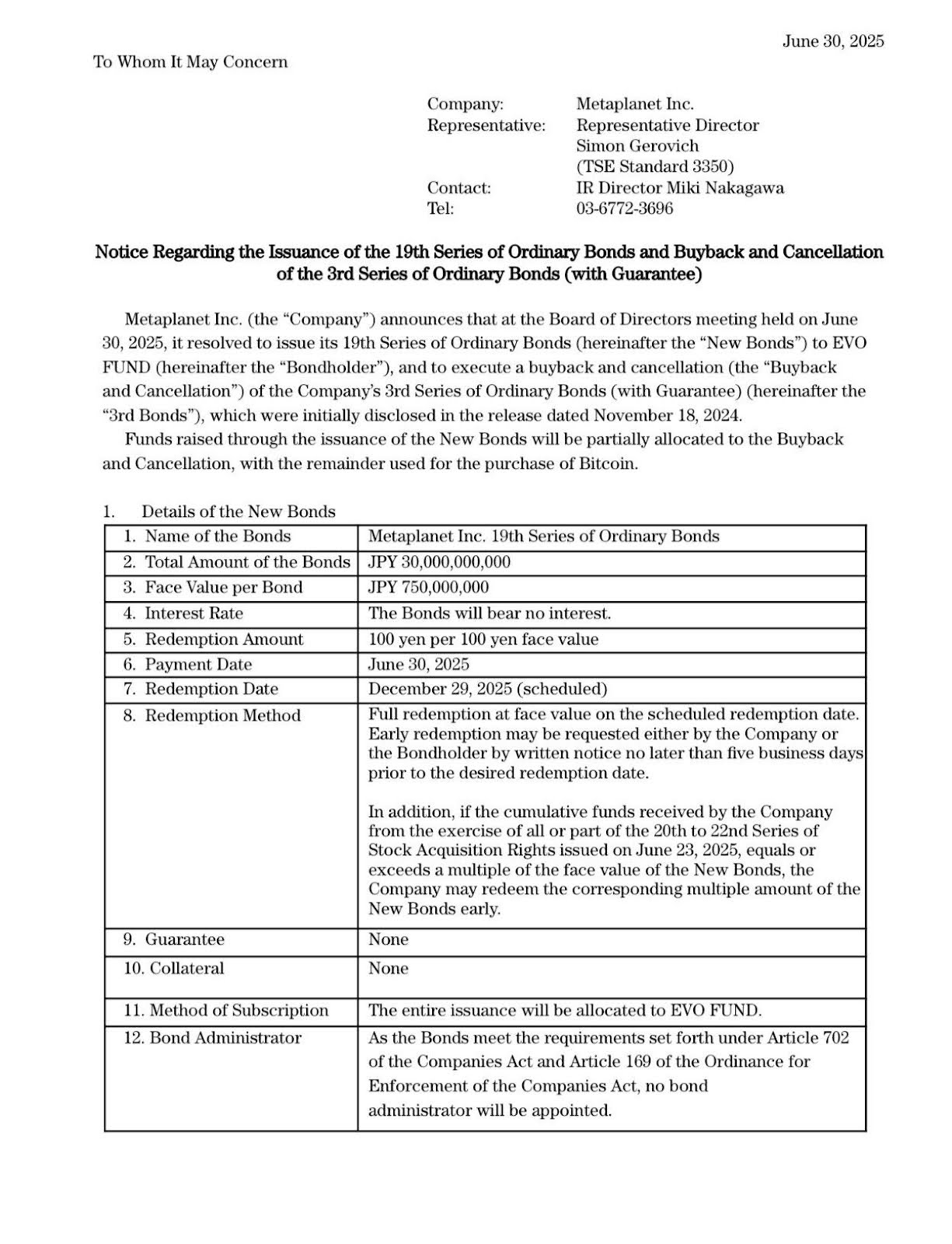

Japanese investment firm Metaplanet Inc. is rapidly establishing itself as one of the most aggressive corporate Bitcoin buyers globally. The company announced it has completed the issuance of its 19th series of zero-coupon bonds worth ¥30 billion ($208 million), with the bulk of proceeds allocated toward acquiring more Bitcoin. With its latest purchase of 1,005 BTC, Metaplanet’s total Bitcoin holdings now stand at 13,350 BTC, pushing it past institutional giants like Galaxy Digital and CleanSpark.

Read More: Metaplanet’s Bold BTC Play: 1,111 More Bitcoins Added, Total Holdings Hit 11,111 BTC

From Debt Refinancing to BTC Accumulation

Metaplanet’s latest corporate move is twofold: a fresh round of non-interest-bearing, unsecured debt issuance paired with the retirement of higher-cost, collateral-backed bonds.

The Tokyo-listed company confirmed that the entire bond issuance was fully subscribed by EVO FUND, a private institutional investor, allowing Metaplanet to refinance its 3rd series of secured bonds—valued at ¥1.75 billion—while allocating the remainder of the capital directly toward Bitcoin accumulation.

Inside the Bond Details

- Bond Size: ¥30,000,000,000 (approx. $208 million)

- Coupon Rate: 0% (zero-coupon)

- Collateral: None

- Buyback Target: ¥1.75 billion 3rd Series Bonds (interest-bearing at 0.36%, secured by hotel mortgage)

- Balance Allocation: To be used for Bitcoin acquisition

- Redemption Date: December 29, 2025

- Subscription: 100% allocated to EVO FUND

By eliminating interest costs and freeing its real estate collateral (previously backing the 3rd series bonds), Metaplanet has streamlined its balance sheet, reduced liabilities, and added significant room for capital mobility—positioning Bitcoin at the center of its treasury strategy.

Surpassing Galaxy Digital and CleanSpark

With the acquisition of an additional 1,005 BTC for approximately $108.1 million, Metaplanet now holds 13,350 BTC at an average price of $97,832 per coin, according to CEO Simon Gerovich.

This milestone puts Metaplanet ahead of major U.S.-based firms:

- Galaxy Digital: 12,830 BTC

- CleanSpark: 12,502 BTC

Only a few months earlier, Metaplanet held 3,350 BTC. Its recent surge in Bitcoin purchases represents a quadrupling of its BTC holdings in under one quarter, signaling an aggressive commitment to Bitcoin-centric corporate strategy.

According to BitcoinTreasuries.net, the move makes Metaplanet the fifth-largest publicly listed corporate holder of BTC, trailing behind MicroStrategy, Marathon Digital, Hut 8, and Coinbase. Notably, MicroStrategy, led by Michael Saylor, still dominates with over 592,000 BTC.

Read More: Metaplanet’s $28M Bitcoin Buy Signals Rising Institutional Confidence in Crypto

Market Response and Shareholder Reaction

Metaplanet’s bold strategy has not escaped attention in Japanese equity markets. On the day of the announcement:

- The company’s stock jumped 9.9%, according to Yahoo Finance Japan

- Shares are up 53.5% in the last month

- Year-to-date, Metaplanet’s stock has surged over 370.7%

These gains are emblematic of market confidence in Metaplanet’s Bitcoin-as-treasury strategy, especially as inflation hedges and crypto adoption are growing in Asia.

Metaplanet’s debt raising is unusual in that it is zero interest, but it seems like investors are betting the upside of Bitcoin will outperform traditional debt interest rates. With an increasing amount of investors adopting crypto treasury models, Metaplanet is asserting itself as a leader in the Japanese corporate crypto strategy space.

Bond Market and Regulatory Implications

Issuance of Metaplanet’s unsecured zero-coupon bonds is unusual in Japan, where the bond market is generally conservative. Bonds with no interest are highly unusual, particularly on this scale. However, the fact that institutional capital—via EVO FUND—was willing to underwrite the full offering suggests strong institutional conviction in Metaplanet’s crypto-driven approach.

At present, Japan has a relatively favorable regulatory climate for Bitcoin and digital asset holdings by corporations. The Financial Services Agency (FSA) continues to recognize Bitcoin as a legitimate financial instrument, giving Metaplanet a green light to expand its BTC holdings under a compliant framework.

Bitcoin as Treasury Reserve: A Trend in Motion

Metaplanet belongs to a growing global phenomenon, wehre companies store their reserves in Bitcoin instead of fiat and other traditional types. It joins the likes of:

- MicroStrategy

- Marathon Digital

- Hut 8 Mining

- Tesla (historically, though it reduced its holdings)

In a landscape that is dominated by U.S. companies — think MicroStrategy — Metaplanet is on pace to be the Asian version of Bitcoin maximalism at a corporate level.

The unique aspect about Metaplanet is its financing structure, to borrow non-dilutive debt capital at no cost to stack BTC. This is the same strategy that can be born out of the most sophisticated trading views, but also out of risk tolerance, in a high volatile asset class like Bitcoin.

Should Metaplanet continue its momentum, the company’s announced target- to have 210,000+ BTC by 2027— would be making it position itself trans-formative power in both the crypto-industry and the tradition-finance world.

The post Metaplanet Raises ¥30B via 0% Bonds to Acquire 1,005 BTC appeared first on CryptoNinjas.

CryptoNinjas