Laos and Bitcoin: The Big Struggles of a Small Nation

Bitcoin Magazine

Laos and Bitcoin: The Big Struggles of a Small Nation

A few weeks ago, a notification on Nostr caught my attention, thanks to a small Laos flag emoji in the poster’s username. Intrigued, I followed him back, and soon we exchanged Signal IDs. Not long after, I met him in Chiang Mai, Thailand. It was an unexpected encounter with Ted, the first Laotian Bitcoiner I’d ever come across. That moment felt special, sparking my curiosity about how Bitcoin is taking root in a place like Laos.

Laos, striving to become the “battery” of the region, sits landlocked in the heart of Southeast Asia, bordered by Thailand, Cambodia, Vietnam, China, and Burma (Myanmar). Known for its lush, rolling landscapes and the serene flow of the Mekong River, it’s a country of striking beauty.

Beyond its geography, Laos grapples with deeper struggles. The 2024 World Press Freedom Index ranks it 153, reflecting severe media restrictions, while the 2024 Corruption Perceptions Index places it 114 out of 180 countries, signaling widespread corruption. With a population of 7.3 million facing censorship, soaring inflation, and economic hardship, life in Laos blends scenic charm with stark realities. These challenges, as I’d soon learn, are pushing some toward unconventional solutions.

Over a drink in Chiang Mai, Ted shared his story. “I spent 6 months as a shitcoiner before switching to Bitcoin, just before the 2021 bull run,” he said. “Many of my friends were beginners too, learning alongside me from podcasts, online articles, and forums.” A former developer, Ted adapted quickly to new technology.

“Back in 2014, I wrote blog posts on Medium, and before that, on Blogspot. Then a realization struck me: I didn’t truly own my work. If I left or the platform shut down, everything would vanish. That’s why Nostr resonates with me now.”

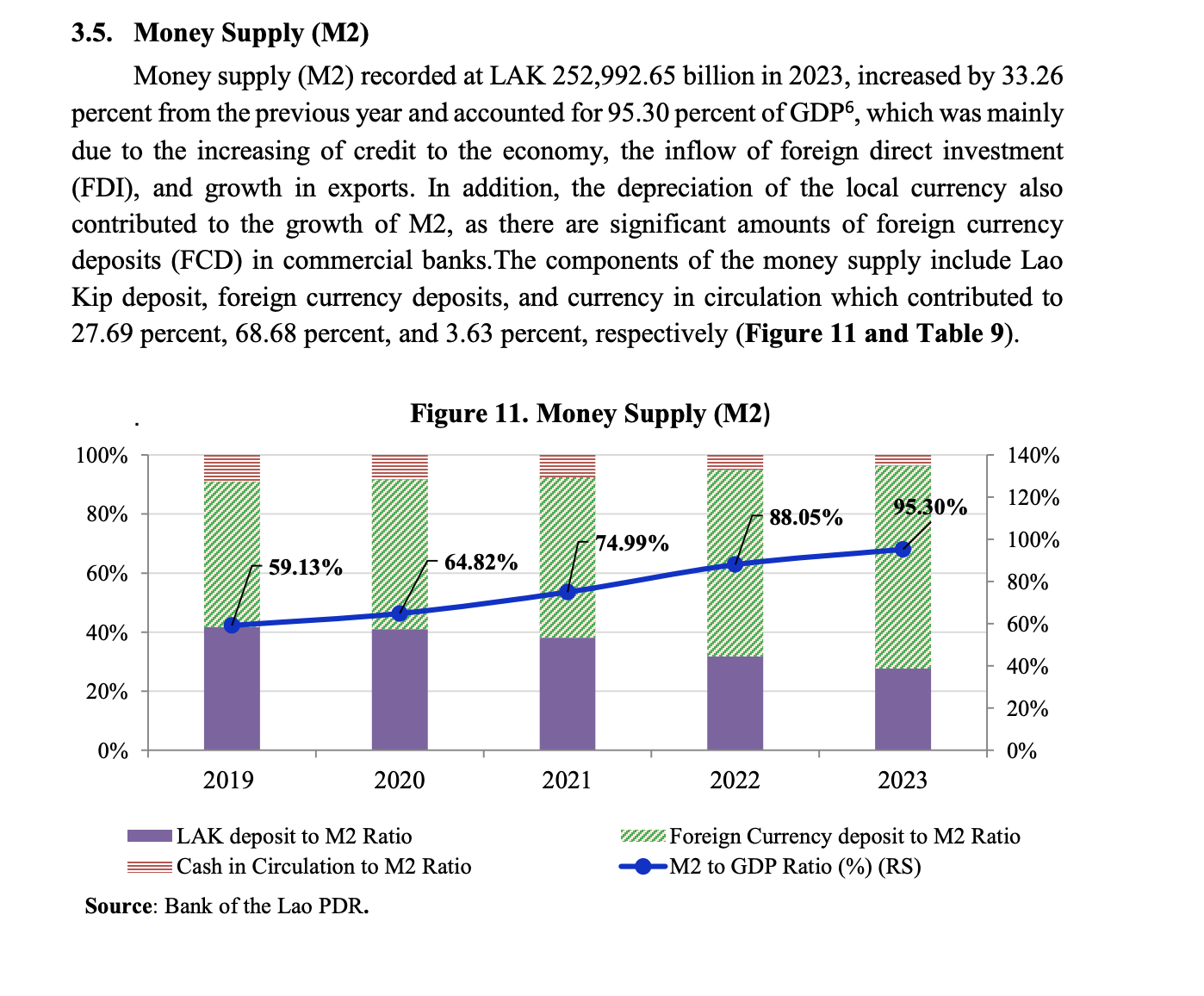

Laos’s economic woes provide the backdrop for this shift. A few years ago, the country launched its first high-speed railway, connecting to China under the Belt and Road Initiative (BRI). Over half of the $6 billion project was funded by loans from the Export-Import Bank of China, contributing to an already staggering debt load: About half of Laos’ national debt, 66.2% of GDP, is owed to Beijing. Given its size, location, and economic condition, Laos hasn’t attracted a flood of foreign investors, making China’s offers a no-second-best opportunity. After COVID-19, Laos’ M2 money supply shot up quite a bit; the M2-to-GDP ratio sits at 95%, having hovered around 60% just a few years ago.

Laos permits Bitcoin mining using its surplus hydropower. Rather than mining itself, the government licenses private miners and taxes them, earning roughly USD 27 million, according to the Laotian Times.

When I asked Ted if Laos holds bitcoin like Bhutan does, he replied, “I doubt they hold any or even understand it. They do not understand IT and they are not smart. For example, they sell electricity to Thailand cheaply, then buy it back at double the price.” I nodded. Growing up in Burma, I’d seen similar absurdities, with the military regime exporting power to neighboring countries while we lacked 24-hour electricity in the country. If you asked people to vote on something like “buy high, sell low,” I’m sure everyone would reject it, no matter who was proposing it.

Ted then described a local version of the Cantillon effect. He explained. “Many medium-sized and large enterprises typically secure projects from the Laos government. Someone I know always lands a government contract, but by the end, they report a financial loss. Still, they make up for it in logistics or retail of their other businesses. Working on government projects gets them closer to the right people, and sometimes, they even gain influence over them.”

Curiously, I wondered how the government effectively manages that. Ted answered, “They just print more money.” Then he added, “One of the best jobs in Laos is having the power to sign off on loans. People will come to you and slip cash under the table just to get your signature. Even if you’ve got no credit history, if you’ve got a connection like your cousin on the inside, you’re all set. Those closer to the government do this all the time. The banks do not dare to touch them to repay the loans. They’re too powerful, tied up with the government somehow.”

In Laos, the official currency kip, as well as the Thai baht and the U.S. dollar, can be used in trade, but bitcoin is steadily gaining traction as a store of value for regular people. Ted and other Bitcoiners regularly organize Bitcoin meetups in the capital city of Vientiane, with two events already held, he noted. “On Facebook, I meet crypto traders,” he said, “but on Nostr, I found three Laotian Bitcoiners by chance, searching Laos-related keywords.”

Though the decentralized movement may have arrived later in Laos than in most countries, tools and platforms like Nostr, Bitcoin educational content, and P2P networks are now openly accessible for them. With fewer than 10 known Lao users on Nostr, Ted and his peers are creating Bitcoin content in the Lao language on Nostr and Facebook. “Content matters,” he stressed.

The most striking moment came when Ted reflected, “Ten years ago, only a few people used Facebook; now, everyone does.” He pointed out how centralized social media let people in his country see beyond government-controlled local media. “Bitcoin could bring an even bigger change,” he argued, “helping wealth preservation and free speech through cyberspace.” In Laos, facing debt traps and corruption, Bitcoin offers not just hope but a practical path forward.

Ted’s words stayed with me. I hope the world will soon recognize the emergence of a new grassroots Bitcoin movement in Southeast Asia, where bitcoin is steadily becoming a vital lifeline for its people.

Win Ko Ko Aung is a global bitcoin adoption fellow at the Human Rights Foundation. This is an Opinion piece, and statements made do not necessarily reflect BTC Inc.

This post Laos and Bitcoin: The Big Struggles of a Small Nation first appeared on Bitcoin Magazine and is written by Win Ko Ko Aung.

Bitcoin Magazine