KuCoin Passes 32nd Consecutive PoR Audit With Over 114% Reserves Backing User Funds

Key Takeaways:

- 32 consecutive months of Proof of Reserves (PoR) reports—no other major exchange comes close.

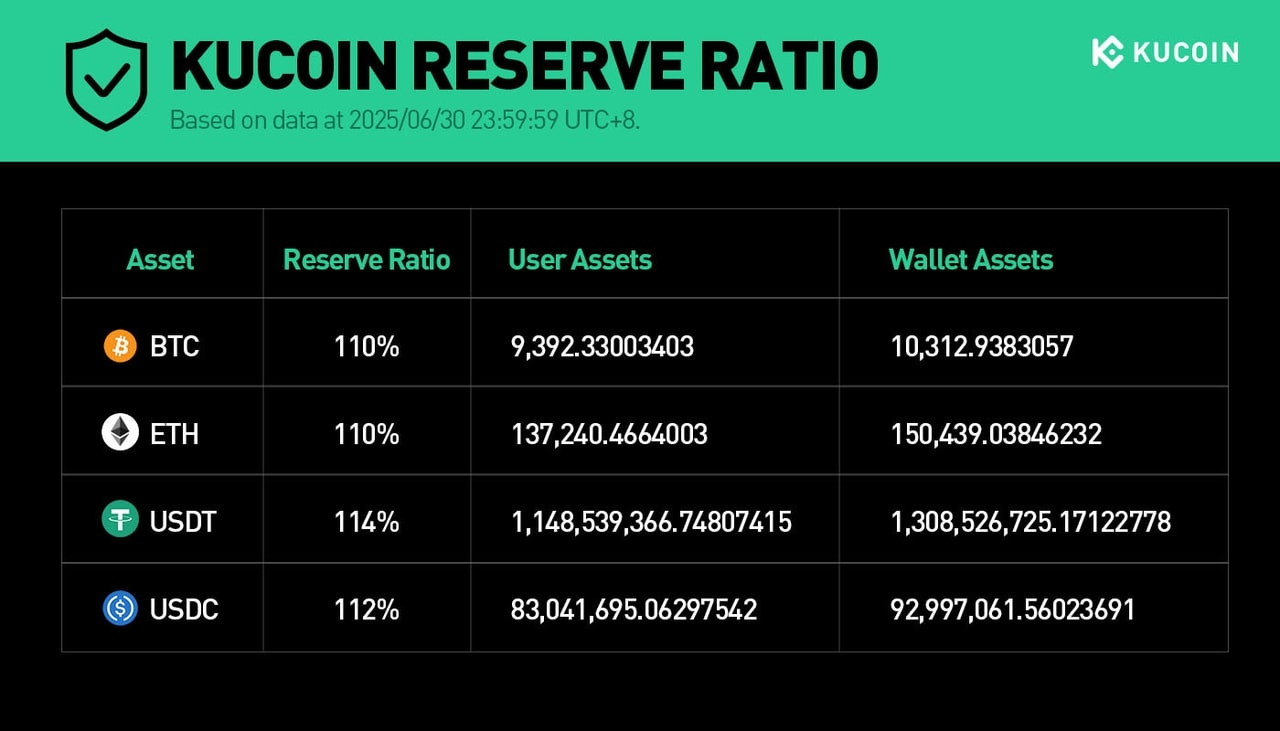

- KuCoin’s holdings exceed user assets: BTC and ETH at 110%, USDT at 114%, and USDC at 112%.

- Audit conducted by cybersecurity firm Hacken confirms wallet ownership and full user fund coverage.

As regulatory scrutiny tightens and user skepticism grows, KuCoin is pushing hard on transparency. Backed by its latest third-party audit, the exchange has not only met industry reserve expectations—it has surpassed them. The message is clear: in a volatile market, KuCoin is positioning itself as a fortress of financial integrity.

Proof of Reserves: Why It Matters Now More Than Ever

In the wake of crypto collapses like FTX and Celsius, the phrase “fully backed” is no longer a buzzword—it’s a survival requirement. KuCoin is responding by doubling down on Proof of Reserves (PoR), a method used to verify that all customer deposits are matched by actual assets held by the exchange.

What sets KuCoin apart isn’t just that it conducts PoR audits—it’s that it’s been doing so for 32 consecutive months. That consistency speaks volumes about its internal asset management discipline and operational maturity.

Audit Results That Go Beyond the Bare Minimum

BTC, ETH, and Stablecoins All Over-Collateralized

KuCoin’s latest audit—completed by Ukraine-based blockchain security firm Hacken—shows overcollateralization across all major assets. According to the report (as of June 30, 2025):

- Bitcoin (BTC): 110%

- Ethereum (ETH): 110%

- Tether (USDT): 114%

- USD Coin (USDC): 112%

In real terms what this means, is that KuCoin holds more of each particular asset than users have deposited. For example, if users deposited a total of 9,392 BTC, the exchange holds 10,312 BTC in reserve. This shields the platform from price oscillations, liquidity shortfalls and unexpected withdrawals.

The Hacken Process—Full-Scope Verification

The third-party audit was not simply a rudimentary checkbox exercise. Hacken Method A mix of Proof of Liabilities, Proof of Ownership, and Reserve Calculation methods on more than 30 blockchain networks:

- Ethereum

- Solana

- zkSync

- TON

It’s important to note that Hacken discovered no discrepancies, verifying KuCoin’s internal accounting and confirming that all wallets are indeed part of the exchange.

User Transparency in Practice

Not just like other platforms where it’s dark to the community but KuCoin allows their community to validate its reserves themselves through the Merkle Tree-based tool available in their Proof of Reserves page. This function allows users to verify that their specific balances are part of the reserve calculations — without a privacy breach.

Transparency like this is rare, even at the top of the industry. Indeed, several exchanges postpone or simply refuse to publish PoR reports– because of “operational reasons” or “legal complications” as they are quick to say.

Read More: KuCoin Exchange Review: Pros and Cons, Fees and Safety

The $2 Billion Trust Project and What’s Next

The recent audit is far more than a one-off event–it is part of KuCoin’s larger $2 billion Trust Project, a concerted effort to:

- Strengthening third-party verification

- Increasing reserve transparency

- Enhancing wallet-level security

- Upgrading internal infrastructure

This plan puts KuCoin ahead in the race of credibility and long-perspective ways. According to CEO BC Wong, “This audit isn’t just about compliance—it’s about setting a precedent. Trust, transparency, and user protection must define the next era of crypto.”

Global User Base and Recognition

Currently, KuCoin has over 41 million users on board all around the world and it also provides a variety of services beyond spot trading, including:

- Crypto wallets

- Payment infrastructure

- Wealth management tools

- AI-based trading systems

The exchange has also been praised by Forbes and Hurun Media, who have noted the user-first nature of its security policies.

Read More: KuCoin Surpasses 40 Million Users, Securing Global Expansion and Compliance Commitment

Toward Industry Self-Regulation

Beyond compliance, KuCoin is helping drive what many believe will be the industry’s next evolution: self-regulated security standards.

By going above and beyond what regulators currently demand—and doing so consistently—KuCoin is setting a new standard that others may soon be forced to follow.

Audits such as the one carried out by Hacken could someday be regulated, like if the EU or Singapore made them a requisite. But for the moment, KuCoin is taking the lead willingly — and reaping the reputation benefits.

The post KuCoin Passes 32nd Consecutive PoR Audit With Over 114% Reserves Backing User Funds appeared first on CryptoNinjas.

CryptoNinjas