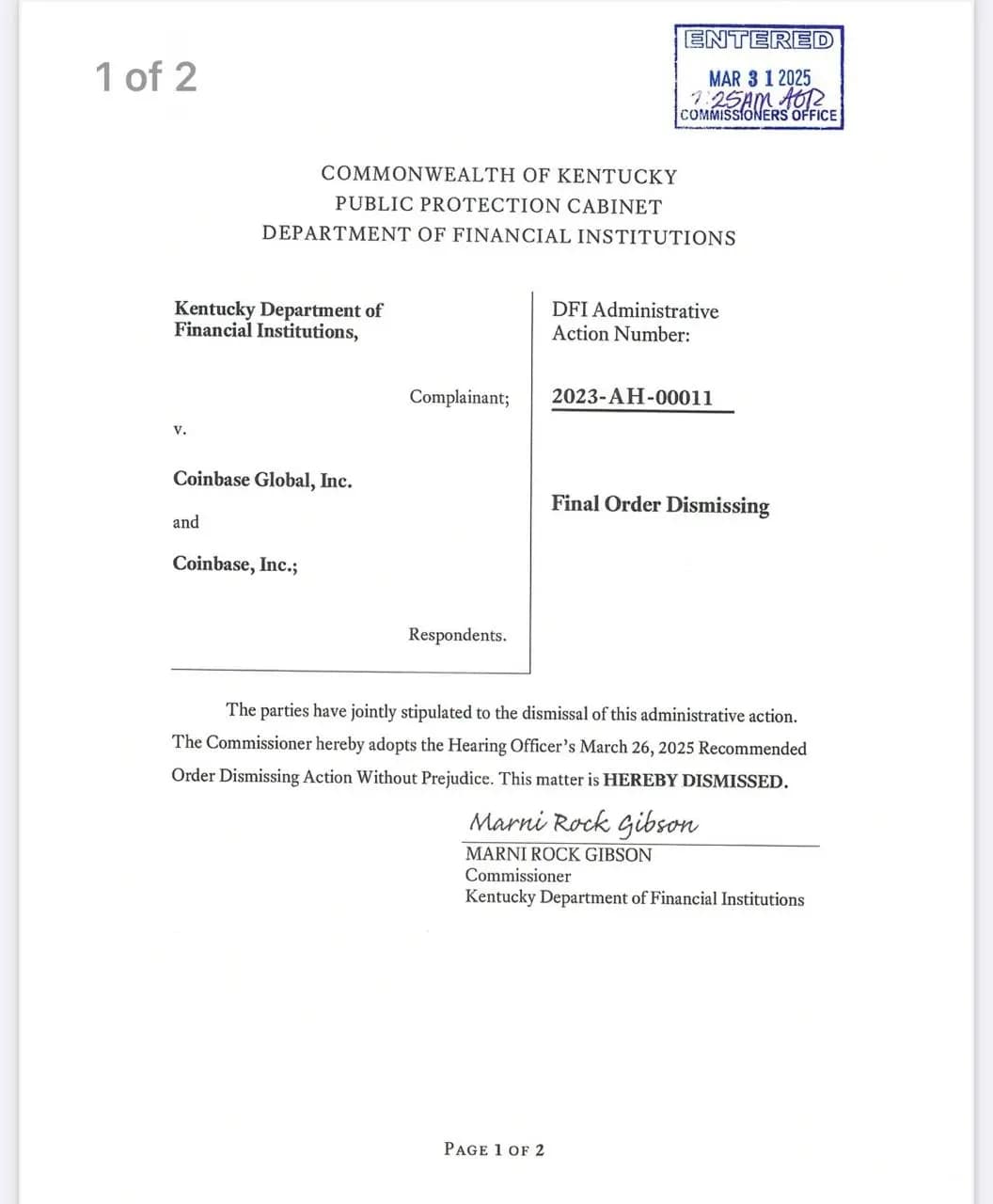

Kentucky Dismisses Lawsuit Against Coinbase’s Crypto Staking Service

Key Takeaways:

- The Kentucky Public Service Commission (PSC) has officially dropped its lawsuit against Coinbase regarding its staking service.

- The lawsuit had been filed to determine whether Coinbase’s staking program was violating state securities laws.

- The decision comes as several other states continue with similar lawsuits against the platform.

- Though this is a minor win for Coinbase, the exchange continues to have major legal fights with the U.S. Securities and Exchange Commission (SEC).

Background of the Lawsuit

In early 2023, the Kentucky Public Service Commission (PSC) sued Coinbase, claiming that its staking product could be an unregistered investment contract under state securities laws.

Regulators in a number of states, along with the SEC, have argued that staking services constitute investment contracts and, as a result, need to be registered as securities. If Coinbase failed to register the services, it would be breaking securities laws.

Why Did Kentucky Drop the Lawsuit?

On March 31, 2025, the Kentucky PSC unexpectedly announced that it was dropping the lawsuit against Coinbase without commenting on the reasons. The decision could reflect a shift in the state’s regulatory stance on staking or indicate that the authorities lacked sufficient cause to proceed with the case.

There might be different possible reasons for such a decision:

- Lack of tangible evidence to qualify staking as a security – Staking, as opposed to traditional financial products, does not guarantee fixed returns but is dependent on blockchain protocols.

- Variety of state opinions – Even while some states like New York and California persist with prosecuting staking, Kentucky’s reversal shows that there is no consensus between states to consider staking a security.

- Pressure from the crypto industry – Coinbase has consistently defended its staking service, arguing that it does not amount to a securities offering but a platform that allows users to participate in blockchain validation.

Although the dismissal of the lawsuit does not completely eliminate Coinbase’s regulatory risks, it sends a positive signal for the crypto industry.

Implications for Coinbase and the Crypto Industry

Kentucky’s decision may have significant repercussions for Coinbase and the crypto ecosystem as a whole:

Impact on the SEC Lawsuit

Despite this small victory, Coinbase still has to fight a major lawsuit from the SEC, which argues that staking is an unregistered investment contract.

Reaffirming Staking as a Viable Service

Most in the crypto industry are of the opinion that staking services should not be treated as securities. Others view staking as an essential blockchain function that allows users to assist with network security and decentralization. Kentucky’s decision does not change federal policy but can potentially impact other states’ strategies for handling the same legal challenges.

Ongoing Legal Troubles for Coinbase

While this dismissal is a short-term relief for Coinbase, the exchange remains engaged in various legal tussles, including:

- The SEC lawsuit – The United States Securities and Exchange Commission continues to sue Coinbase on the grounds that its staking services are unregistered securities.

- Other state-level lawsuits – Although Kentucky dropped its case, the likes of California and New York are continuing to pursue examining Coinbase’s staking operations.

- Regulatory ambiguity – The lack of clear federal direction on crypto staking is a gray area that continues to plague exchanges like Coinbase.

The Future of Staking in the U.S.

Several possible outcomes could arise from these legal battles:

- A regulatory victory for Coinbase – If the courts rule in Coinbase’s favor, it would have the implication of setting a precedent that staking services are not securities, thereby reducing regulatory risks to crypto companies.

- A settlement or regulatory agreement – Coinbase and regulators can reach an agreement where staking services can be restarted under new compliance requirements.

- Stricter regulatory environment – If the SEC and other regulators win their cases, exchanges may be required to register staking programs as securities offerings, which would lead to higher compliance costs and reduced access for United States users.

More News: Kentucky Set to Become a Bitcoin Paradise as Landmark Self-Custody Bill Clears Senate

The post Kentucky Dismisses Lawsuit Against Coinbase’s Crypto Staking Service appeared first on CryptoNinjas.

CryptoNinjas