How Long Does It Take to Mine 1 Bitcoin in 2025?

Bitcoin mining is a competitive process where specialized computers solve complex math puzzles to validate network transactions and release new coins onto the blockchain. Now, the definitive answer to how long it takes to mine 1 Bitcoin is that it would take an individual decades, mainly because of the constantly rising network hash rate and high mining difficulty.

Today, because of challenges like huge electricity costs, price volatility, and regulatory risks, basically every miner now joins a mining pool to get small and frequent payouts instead of waiting forever for one whole BTC.

In this guide, we will cover exactly how long it takes to mine 1 Bitcoin, from understanding the technical process of a block being mined to calculating your expected costs and profits. We will also dive deep into the real-world risks, such as mining scams, so you can decide if mining is really right for you.

What Is Bitcoin Mining?

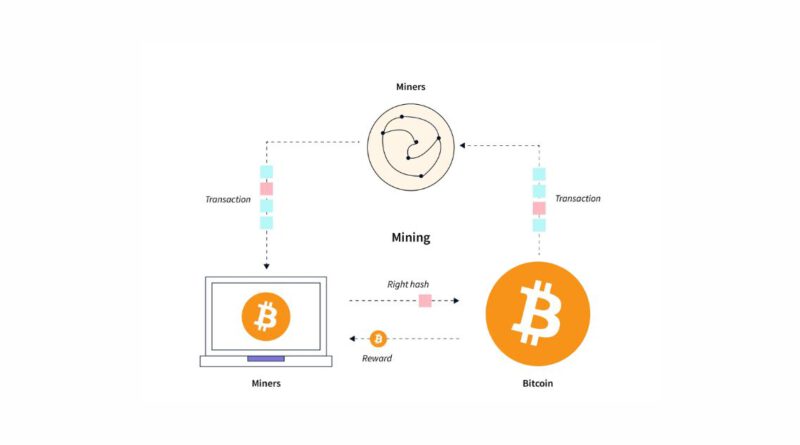

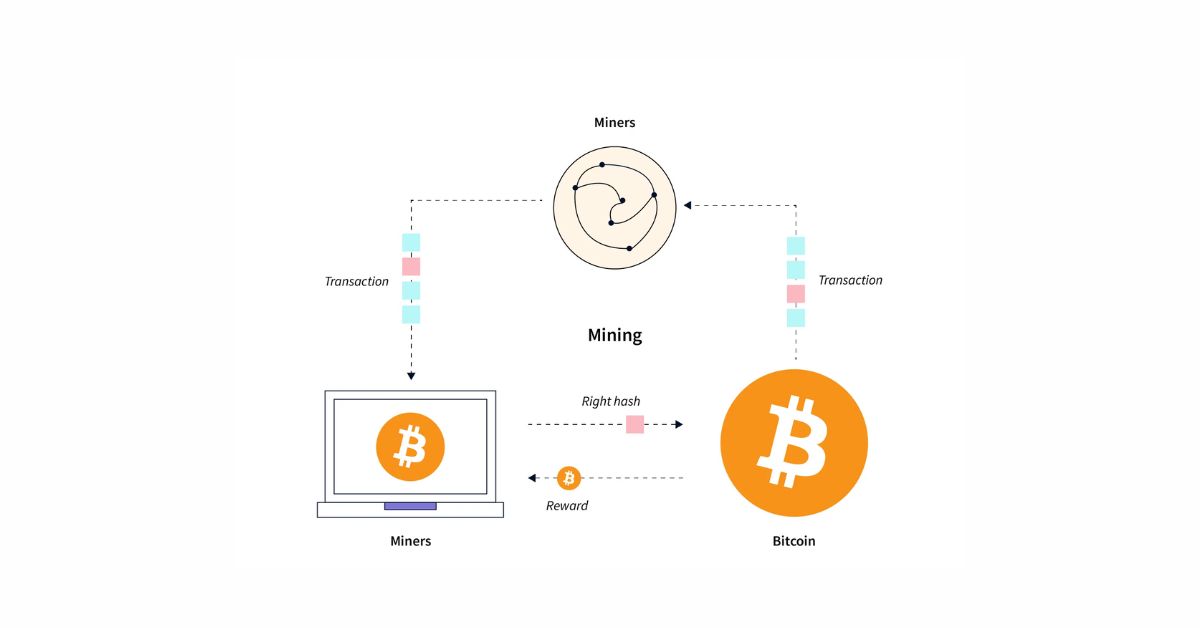

Bitcoin mining is the process that validates new transactions on the Bitcoin network and adds them to a permanent record called the blockchain. You see, the Bitcoin system is decentralized, meaning no single bank or government runs it. So, basically, the people who are miners are the ones who keep the entire system honest and moving forward.

Here, miners use specialized computers called application‑specific integrated circuits (ASICs) to perform these proof‑of‑work calculations, and then they take all of the transaction data, combine it with a variable number called a nonce, and eventually run it through a cryptographic hash function.

Now, the main goal here is to find a 64‑digit hexadecimal number that is lower than a target value set by the network. Hence, the first miner who is gonna find a valid hash broadcasts the solution, the block is added to the chain, and at last, that miner receives the block reward plus transaction fees.

Put simply, mining Bitcoin means the process of adding new blocks to the blockchain and introducing new coins into circulation.

Is Bitcoin Mining Legal?

Yes, Bitcoin mining operations are generally legal in most parts of the world, but you really need to check your local rules. You know, the legality of mining is something that can change a bit from country to country, so you have to be careful.

Look, in many major places like the United States and most of Europe, mining Bitcoin is completely legal, and in fact, after countries like China basically banned it in 2021, most of the world’s biggest mining operations moved to places like the U.S., which now has the largest share of the global hash rate. Well, this shift has made it a much more established industry in the West.

But again, some countries have put in place strict regulations or even outright bans. And the reasons are usually because of the high amount of electricity that mining uses. So, can you mine Bitcoin? Yes, you can mine BTC depending on your location and the country’s legal rules.

Also, if you’re new to crypto and not ready to mine yet, you can easily learn here: how to buy Bitcoin safely through trusted crypto exchanges.

How does Bitcoin Mining Work?

Bitcoin mining mainly works by having miners compete with each other to solve a very complex mathematical puzzle. And then this proves they have done the work to secure the network.

Here is the simple breakdown of the main steps you’ll be doing.

- Gathering Transactions: First, your mining software collects a bunch of unconfirmed Bitcoin transactions, like someone sending BTC to a friend, or a business paying a supplier.

- Creating a Block: You then need to put these transactions into a new bundle called a block.

- Adding the Nonce: Now, this is where the actual “mining” part starts. You need to turn this block of transactions into a valid block that can be added to the chain, so you have to find a specific number called the nonce (which stands for “number only used once”).

- Hashing: Then, you have to combine the block’s data with the nonce and run it through Bitcoin’s hashing algorithm. It is called SHA-256. Well, this gives you a short and fixed-length output string of letters and numbers called a hash.

- The Target: The Bitcoin protocol has a constantly changing target. Hence, for your block to be valid, the hash you generate must be less than or equal to this target. Basically, the hash needs to start with a certain number of zeros.

- Guessing Game: Since you can’t guess the right nonce to get the right hash, your computer has to guess billions, even trillions, of nonces per second until one of them creates a hash that meets the target. Basically, this is why you need super-powerful machines. We mean to say ASICs.

How Is a Block Mined?

A block is mined when one miner or a pool of Bitcoin miners successfully find the unique number, the nonce, that results in a block hash starting with enough zeros. Here, you are not really “solving” a math problem, as you might think, but you are actually trying different inputs until you get the specific output the network wants.

This guessing game’s difficulty is automatically readjusted by the network every 2,016 blocks, about two weeks. Well, this adjustment ensures that, on average, a new block is found every 10 minutes, regardless of how many miners join or leave the network. Hence, if blocks are being found quicker than ten minutes, the difficulty increases, which raises the bar for the hash to need even more starting zeros.

How Many Bitcoins Are Left to Be Mined?

There are only 21 million Bitcoins that will ever be created, and most of them have already been mined into existence. Today, as of late 2025, you should know that about 19.94 million Bitcoins have already been successfully mined. Well, this means there are approximately 1.06 million Bitcoins left to be mined. But mining these would not be easy.

It is because of the halving event that happens every 210,000 blocks (or about every 4 years). The latest halving was in April 2024, and this event basically slashed the block reward from 6.25 BTC down to 3.125 BTC.

Eventually, this halving process will continue until the last piece of a Bitcoin is mined around the year 2140. And of course, you won’t be around to see it. So, while the number of unmined coins is getting smaller, the rate at which they are released is also getting slower and slower, which is what makes Bitcoin so scarce and, basically, why people think it’s so valuable.

How Long Does It Take to Mine 1 Bitcoin?

The phrase “mine 1 Bitcoin” often confuses newcomers, and it is because the network doesn’t grant whole coins on demand. But instead, new coins mainly enter circulation through the block reward, and individual miners earn proportional shares based on their hash rate.

So, the amount of time it takes to mine 1 Bitcoin depends entirely on whether you are talking about the network-wide average or your individual estimate. You need to look at both sides to understand the whole picture.

Network-Wide Average

As discussed above, blocks are produced roughly every 10 minutes (9.8 min to be exact), and each block currently gives you 3.125 BTC in reward. Now, if you divide the block time by the block reward, you will get the time it takes the entire network to create one full Bitcoin.

Average time for 1 BTC = block time / block reward = 9.8/ 3.125 = 3.1min

Individual Mining Estimates

Now, for you as an individual miner or even a small operation, the time it takes to mine 1 whole Bitcoin is going to be incredibly long. Actually, it really depends on your hardware’s power, and you can also say the hash rate.

Well, to give you an idea of just how hard it is, let’s look at a popular and modern ASIC miner. Let’s say you have one of the best miners available today, one that gives you a hash rate of around 300 Terahashes per second (TH/s).

Today, the global network hash rate is incredibly high, well over 1.142 ZH/s, and just so you know, it’s very high. Hence, your 300 TH/s machine is really a tiny drop in that massive ocean of computing power.

So, let’s calculate:

- Your hashrate: 300 TH/s = 3 × 10^14 H/s

- Network hashrate: 1.1 ZH/s = 1.1 × 10^21 H/s

- Your share of network hashrate: (3 × 10^14) / (1.1 × 10^21)

- Bitcoin block reward: 3.125 BTC

- Blocks per day: 144

- Total BTC mined per day: 144 × 3.125 = 450 BTC/day

Hence, your expected BTC per day: 450 × ( (3 × 10^14) / (1.1 × 10^21) ) = 0.0001227 BTC/day

Time to mine 1 BTC: 1 / 0.0001227 = 8148 days = 8148 days / 365 = 22.3 years

Hence, it would take about 22.3 years to mine 1 BTC at 300 TH/s with a 1.1 ZH/s Bitcoin network hashrate.

How Hard Is It To Mine Bitcoin?

It is incredibly hard to mine Bitcoin on your own. The difficulty is actually high because of three main things you need to worry about: the rising hash rate, the mining difficulty adjustment, and your costs.

Hash Rate & Hardware Power

The total hash rate is the amount of computing power directed at the Bitcoin network globally. Well, this number is actually always increasing as more large-scale companies invest in newer and even more powerful hardware, like the super-efficient machines that can give you 300 TH/s or more.

You see, the goal for these massive mining firms is generally to buy the most efficient Application-Specific Integrated Circuit (ASIC) miners. These kinds of machines are built only to calculate the SHA-256 hash. So, as the network hash rate goes up, the probability of your small machine finding a block goes down.

Mining Difficulty

The Bitcoin mining difficulty is directly tied to the hash rate, and as we mentioned before, the network automatically adjusts the difficulty every 2,016 blocks. Remember, as more miners join or deploy more powerful hardware, the difficulty is going to increase. Hence, a higher difficulty means the target hash needs to start with more zeros, and that forces miners to perform exponentially more guesses per second.

Electricity Costs & Uptime

You can have the best hardware in the world, but if you can’t run it cheaply and constantly, you won’t make any money. You should know, electricity costs are a massive factor in mining profitability.

Since the block reward was cut in half (from 6.25 BTC to 3.125 BTC), your revenue per block is half of what it used to be. Basically, you need your machine to be twice as efficient or your electricity price to be half as much just to stay in the same place.

So, it’s kinda like a factory, the more reliable your operation is, the more money you make. Hence, finding a reliable power source with a cost under about $0.05 per kilowatt-hour (kWh) is what most of the big companies aim for.

How Much Does It Cost To Mine One Bitcoin?

The cost of mining one Bitcoin is really volatile, and it depends on where you are located and what equipment you use. You are seeing estimates that the average cost to mine a single Bitcoin can be anywhere from $50,000 to over $120,000.

Hardware and Energy Costs

Your total cost to mine a Bitcoin includes both capital expenditures (hardware) and operating expenses (electricity). Now, a modern and high-efficiency ASIC miner can cost you anywhere from $5,000 to over $20,000 per unit. You need to buy the best one you can afford because efficiency is everything.

Honestly, energy is the biggest expense by far. You know, these machines run 24 hours a day, 7 days a week, consuming huge amounts of electricity. So, if you are paying the high residential electricity rates in many cities, you won’t make any money. It’s that simple.

| Mining Hardware | Hashrate | Power Consumption (Watts) | Price (USD) |

| Bitmain Antminer S21e XP Hyd 3U | 860 Th/s | 11,180 W | $17,210 |

| Bitmain Antminer S21 XP+ Hyd (500Th) | 500 Th/s | 5,500 W | $12,700 |

| Auradine Teraflux AH3880 | 600 Th/s | 8,700 W | $7,800 |

| Bitdeer SealMiner A2 Pro Hyd | 500 Th/s | 7,450 W | $3,958 |

| MicroBT WhatsMiner M66S++ | 356 Th/s | 5,518 W | $8,660 |

Regional Differences

Look, where you mine Bitcoin actually matters a bit more than the machine you use sometimes, because the price of power changes so much from one place to another.

In places with cheap and surplus energy, like certain parts of the United States (especially Texas or Washington State) or countries with hydroelectric power, the costs are actually pretty low. Hence, it’s obvious, these regions attract the big mining farms because they can keep their operating costs down.

On the other hand, I guess if you live in a place with expensive residential electricity, you eventually might find that your cost to mine 1 BTC ends up being $100,000 or $120,000. And, totally agree, that doesn’t make any financial sense for you.

Does Bitcoin’s Price Affect Mining Fees?

Bitcoin’s price does not directly affect the standard block reward of 3.125 BTC, but it certainly affects the total value of the reward and, therefore, the economics of mining. Actually, the original creator of Bitcoin, Satoshi Nakamoto, set up the system with a brilliant idea: the marginal cost of mining should align with Bitcoin’s market value over time.

So, when the block reward drops from 6.25 BTC to 3.125 BTC, miners lose half their income from the fixed reward. But if the price of BTC doubles, then the dollar value of that 3.125 BTC stays the same, or even increases. Hence, this keeps miners profitable and incentivized to secure the network.

Now, about fee Importance. As the block reward gets smaller with each halving, the transaction fees become a more important part of a miner’s income. So, when Bitcoin’s price is high and the network is busy, people are willing to pay higher fees to get their transactions confirmed faster. That will help boost the income for miners, even when the fixed reward is low.

How Much Can You Make Mining Bitcoin?

How much you can make mining Bitcoin really depends on four things: the price of Bitcoin, the global hash rate, your electricity costs, and your machine’s uptime. You need to calculate all of these things perfectly to figure out Bitcoin mining profitability.

Basically, even with the halving, mining can still be profitable, but mainly for operations that are optimized for cost.

A good rule of thumb is that older machines running on expensive energy rarely make money, and some modern ASICs deliver better returns, but again, even they require careful cost management. So, you can make around $200-$400 per month mining Bitcoin, depending on these factors.

Challenges and Risks of Bitcoin Mining

The challenges and risks of Bitcoin mining are outdated or expensive hardware, heat and noise, price volatility, rising energy costs, regulations, mining scams, and cloud mining risks.

Rising Energy Costs and Regulations

Mainly, the biggest threat to profitability is the rising cost of energy and changing government rules. Energy prices have been going up in many places, and if your local power company raises its rates, your mining operation can stop being profitable instantly. Also, you might have to shut down your machine because the cost of running it is more than the Bitcoin you get back.

Also, governments around the world are looking more closely at how much power Bitcoin mining uses. You have seen headlines about environmental concerns, and even some governments have started putting in regulations to restrict mining or add special taxes on the electricity miners use.

Mining Scams and Cloud Mining Risks

Today, because mining hardware is expensive and difficult to source, many people look to cloud mining services that promise returns without the hassle. Cloud mining Bitcoin is where you pay a company to rent computing power (hash rate) from their large mining farms. Basically, they do the maintenance, and you will get a share of the Bitcoin they mine.

But unfortunately, the industry has seen numerous Ponzi schemes and fraudulent platforms. They take your money, pay you small amounts back from new investors’ money, and then disappear when they can’t find enough new people.

So, if you are thinking about cloud mining, do your homework, or just avoid it altogether. It’s much safer to buy your own machine, even if it’s just a bit more expensive upfront.

Also, Bitcoin isn’t the only mineable asset. Today, depending on your setup, other altcoins may offer higher returns. Check out our guide on the best cryptos to mine for more profitable alternatives

Conclusion: Can You Mine Bitcoin?

In a nutshell, we have covered a lot here, from what mining is to how long it takes to mine 1 Bitcoin to how much it costs and the risks involved. So, the main takeaway for you is that yes, you can mine Bitcoin, but it is extremely challenging, very expensive, and mostly profitable only for large and optimized operations.

You now know that trying to mine one whole Bitcoin on your own could take you decades because you are competing against the entire global network, which finds a new block every 10 minutes. Also, the difficulty level of this task is constantly rising because professional miners keep pouring billions of dollars into newer and more powerful hardware.

Hence, your ability to profit is tied directly to these three things:

- Hardware: You are going to need the most efficient ASIC miner you can afford.

- Electricity: You need access to power that costs less than $0.05 per kWh, or your profits will turn into losses really fast after the last 2024 halving.

- Network Difficulty: Well, this factor is outside your control, and it always goes up when the price of Bitcoin is doing well.

Ultimately, the Bitcoin mining process is quite complex, so always do your own research (DYOR) before investing any serious money.

The post How Long Does It Take to Mine 1 Bitcoin in 2025? appeared first on CryptoNinjas.

CryptoNinjas