Hong Kong Unveils “ASPIRe” Roadmap: A Bold Vision to Become a Global Crypto Hub

Key Takeaways:

- Hong Kong aims to become a global crypto hub through its “ASPIRe” roadmap.

- The roadmap addresses challenges like fragmented liquidity and regulatory arbitrage.

- Institutional adoption and technological innovation are central to the strategy.

In a big step towards the establishment of Hong Kong as a leading international hub for virtual assets, the city’s government is cementing its status and showcasing its determination to become a major power in the evolving landscape of digital finance. The Securities and Futures Commission (SFC) recently introduced the “ASPIRe” roadmap, which is the singularly developed, all-inclusive and future-proof initiative of Hong Kong’s virtual asset ecosystem. The roadmap addresses these critical issues to ensure long-term stability and growth.

This strategic initiative by Hong Kong highlights a burgeoning global trend: the acknowledgment of digital assets as an actual valuable and fast-developing class of assets with potential that can change our life. The “ASPIRe” system is designed to be a disciplined and yet flexible strategy to encourage the crypto industry and at the same time protect investors effectively. This indicates that Hong Kong believes in the bright future of crypto as a new asset class and aims to be one of the pioneers.

Grasping the Root Cause of the Issue: Taming Volatility and Fragmented Markets

“ASPIRe”, a roadmap for the future, is the solution to some of the most stressful things that are happening in the cryptocurrency space right now. These are crucial issues that must be addressed to ensure long-term stability and growth:

- Fragmented Liquidity: The continuous availability of an asset facilitates seamless transactions. Digital assets are generally fragmented. Most platforms, especially those that lack access to liquidity pools, suffer from low trading activity or near-zero liquidity. Before the emergence of innovations like DeFi and NFTs, the market was less fragmented. These technologies introduced new ecosystems that created liquidity silos.

- Regulatory Arbitrage: The absence of a universal regulatory framework all over the world is the main reason for avoiding regulatory arbitrage, because it often makes businesses look for jurisdictions that have the most lenient or at times, loose regulations. As a result, businesses may prioritize cost reduction over risk management, creating an unfair competitive advantage.

- Market Volatility: Cryptocurrencies’ erratic nature as an asset class is the primary issue for both single and ultra-high-net-worth individual investors. Extreme fluctuations in value can result in investors withdrawing their funds, which, in turn, will slow down the mass adoption of cryptocurrencies as an alternative to traditional cash transactions.

The roadmap’s ambition is to mitigate these challenges through a holistic approach that prioritizes both the encouragement of innovation and the implementation of robust regulatory oversight, aiming to create a more mature and stable market environment.

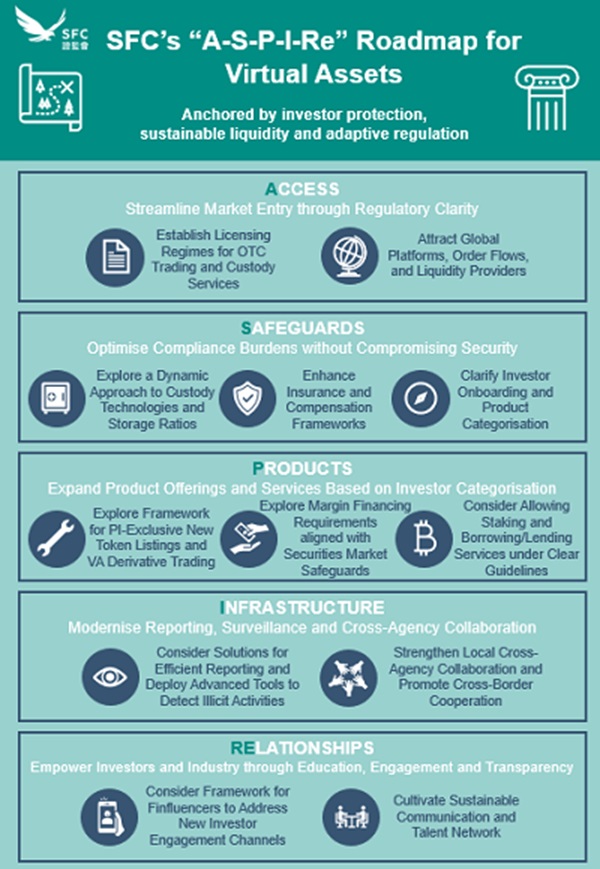

The Five Pillars of the “ASPIRe” Roadmap: A Foundation for Growth

Hong Kong’s ASPIRe roadmap for crypto assets. Source: Hong Kong SFC

The “ASPIRe” roadmap includes five base tenets which inform a diversified and functional virtual asset ecosystem.

- Access: This pillar concentrates on radical modifications to the entry of virtual asset businesses. It implies that “The Regulator” even now, the developer of a new and clear licensing framework specifically for OTC trading as well as custody services is the actual focus of the entire activity. Furthermore, The absence of clear regulation and compliance policy has always been a major concern, so a great deal of uncertainty in the markets is created because of that. It is akin to creating a clear regulatory pathway for crypto companies, replacing the complexity of a fragmented system with a well-defined framework.

- Safeguards: This pillar is all about incorporating measures that increase investor privacy. The “Safeguards” pillar deals with formalizing the new legislative framework to translate it into administrative requirements, compliance regulations, and protection of the rights of the stakeholders. The company may also encourage the creation of financial instruments that mimic the behavior of digital currency but are fully collateralized by traditional assets i.e., stocks and corporate bonds to attract more investors.

- Products: A wide variety of innovative virtual asset products can attract a whole host of investors because variety is the food of life. This pillar aims to diversify virtual asset offerings, including various types of tokens, derivatives, and innovative blockchain-based financial products. It is different from what the present functions and a development to be there for users who will find what fits them during the search of a coin to use: either people that are new in the market or those who have a lot of assets.

- Infrastructure: A well-functioning infrastructure is essential for financial institutions to operate efficiently and securely. This pillar is centered around the introduction of the modernized market oversight system and implementation of the newest compliance and oversight technologies. Such an alternative could be to engage blockchain analytics tools to check the movement of the transactions, apprehend doubtful business, and thus, safeguard the market from manipulation. The implementation of cyber infrastructure is an integral part of it that is aimed at securing from hacks and data leakages. It’s a job performing that job by building through the crypto market with a solid and secure foundation.

- Relationships: Transparency and partnership are the most significant elements for a successful regulation. This pillar has a focus on maintaining a good relationship with the industry through constant communication like regular consultations, and being ready to change the rules and regulations according to the developments. Transforming this is the creation of a close loop that will ensure the regulation framework is informed by practical knowledge and can adapt to the constantly reshaping demands of the industry.

The “ASPIRe” roadmap is designed to be flexible, explicitly rejecting a one-size-fits-all approach. The SFC recognizes the fast-changing nature of the industry and has designed the roadmap to be adaptable and continuously refined. That is the reason why the roadmap is composed of consultation and refinement mechanisms that are meant to be in charge and thus are relevant and fit the standard over time. Dr. Eric Yip, Executive Director of Intermediaries at the SFC, stressed the adaptability of this principle by describing the roadmap as “a living blueprint,” which, in turn, is the Hong Kong government’s new vision, attracting common cooperation.

Dr. Eric Yip, Executive Director of Intermediaries at the SFC

The Convergence of Worlds: Institutional Interest and the Bridging of TradFi and Crypto

A direct mention of the SFC newly accepted institutional investors’ control in the market can be recognized as the catalyst of this trend, which reshaped the crypto sector and gave it a dimension of legitimacy and maturity. The arrival of this kind of capital on the market and the corresponding benefits it can bring to the market including more liquidity and stability and a push to the development of the products and the infrastructure are very important news.

Although the prevalence of institutional investors is an indicator of progress and growth in the cryptocurrency market, developments in this area also raise new challenges. The SFC applauds that uneven regulations across key financial hubs, such as Singapore, Europe, the United States, and mainland China, indeed might become a challenge in terms of compliance and as a result end the market’s stability unless regulation is taken into consideration.

Not ignorant of the trend that emerged from the cryptos entering the boundaries of the established financial system (TradFi), SFC judges that the merging of two is a process that “presents dual opportunities: applying TradFi’s compliance rigor to virtual assets and leveraging blockchain-driven innovations to modernize TradFi.” In other words, Goldman Sachs, a major actor in the world of finances, has extended its spectrum in recent years by Kumming Bitcoins at a rate of 2%.

Clearly, the growing integration of traditional finance (‘TradFi’) and cryptocurrency requires forward-looking legislation that harmonizes policies across both sectors. It is of utmost importance to reinscribe or judiciously update the rules in order to cover tokenized securities and innovate hybrid models as well as maintain wholesome standards when it comes to smart contracts and decentralized platforms being developed.

The Race is On: Hong Kong vs. Singapore and the Quest for Crypto Supremacy in Asia

Even though Hong Kong has achieved some success and is undoubtedly showing its readiness to become the reference digital asset center, it has to fight among the other exciting Asian centers like Singapore. Singapore has also been actively cultivating its digital asset ecosystem, attracting major players from around the world, including Robinhood, signaling a fierce regional competition.

Robinhood, a very well known trading application for cryptos, stocks, and other assets, is making a move to enter the market in Singapore by 2025 to get its first crypto services in the country. This is just an additional situation that is escalating the competition between companies and it shows Asia in general as the best space for fintech and especially digital assets.

One of the points that Chengyi Ong, Chainalysis’ Head of Policy APAC, has made is that the winner of the contest in the region won’t be able to be selected by law only. Instead, success will hinge on “their efficiency in assessing licence applications, and their agility in adjusting requirements in line with technological developments and industry feedback.”

An insight in quotations punctuates the fact that success, in all accounts, depend largely on the fact that a clear and well-defined regulatory framework, a reduced red tape by the licensing authority, and an openness to learning are maintained.

Concrete Actions: Examples of Hong Kong’s Commitment to Crypto

To realize this vision and achieve its goal of becoming a leading crypto hub, Hong Kong has taken significant steps and begun implementing concrete measures.

- The Virtual Asset Trading Platform (VATP) Licensing Regime: Created in 2023 along with clear and concise registration rules, this licensing regime makes it easier for a virtual asset organization to form and function in Hong Kong.

- Licensed Platforms: Up to February 2025, the SFC has given licenses to 10 entities including well-known players like Bullish and HashKey, showing that the licensing regime is effective, and Hong Kong is the most attractive place for launching crypto projects.

Hong Kong’s proactive strategies help to convey exactly the message that it is aiming to be a regulated, transparent, and a vibrant crypto ecosystem that not only lures both national and international investments but also provides a platform for growth.

Looking Ahead: The Future of Hong Kong’s Crypto Ambitions

The “ASPIRe” roadmap is not a rigid document but a “living blueprint” that will evolve alongside developments in the crypto sector. The anticipated triumph of the innovative roadmap can only be realized if participatory rulemaking, the private sector, and the community come together effectively.

Lastly, the goal of Hong Kong to become a top world-wide digital assets center is a challenging and visionary plan that can considerably influence the future of digital assets. The “ASPIRe” roadmap lays out multiple pathways to achieve its objectives, but its success ultimately depends on the synergy between regulation, innovation, and stakeholder collaboration.

The post Hong Kong Unveils “ASPIRe” Roadmap: A Bold Vision to Become a Global Crypto Hub appeared first on CryptoNinjas.

CryptoNinjas