Has The Bitcoin Price Already Peaked?

Bitcoin’s price movements have always been a subject of debate among investors and analysts. With recent market retracements, many are questioning whether Bitcoin has already reached its peak in this bull cycle. This article examines the data and on-chain metrics to assess Bitcoin’s market position and potential future movements.

For an in-depth complete analysis, refer to the original Has The Bitcoin Price Already Peaked? full video presentation available on Bitcoin Magazine Pro’s YouTube channel.

Bitcoin’s Current Market Performance

Bitcoin recently faced a 10% retracement from its all-time high, leading to concerns about the end of the bull market. However, historical trends suggest that such corrections are normal in a bull cycle. Typically, Bitcoin experiences pullbacks of 20% to 40% multiple times before reaching its final cycle peak.

Analyzing On-Chain Metrics

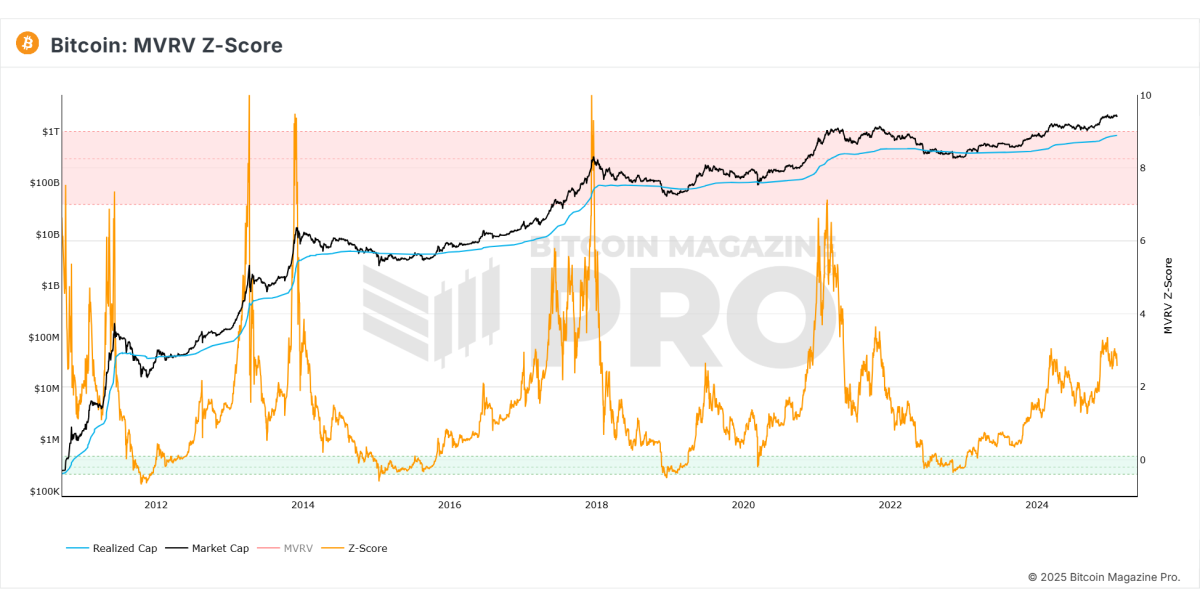

MVRV Z-Score

The MVRV Z-score, which measures the market value to realized value, currently indicates that Bitcoin still has considerable upside potential. Historically, Bitcoin’s cycle tops occur when this metric enters the overheated red zone, which is not the case currently.

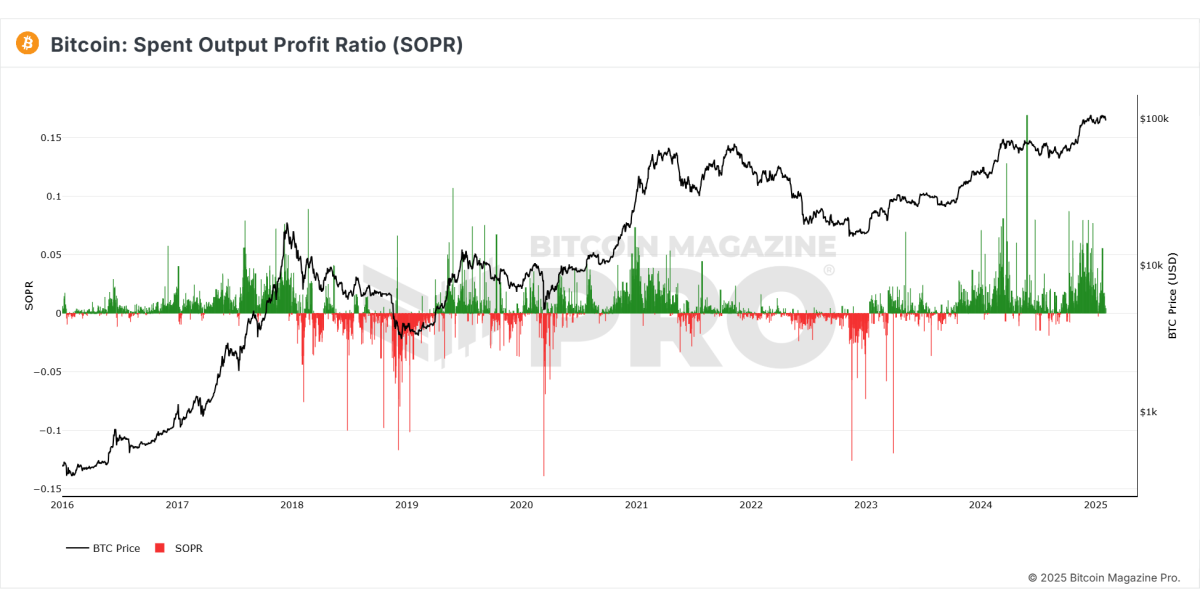

Spent Output Profit Ratio (SOPR)

This metric reveals the proportion of spent outputs in profit. Recently, the SOPR has shown decreasing realized profits, suggesting that fewer investors are selling their holdings, reinforcing market stability.

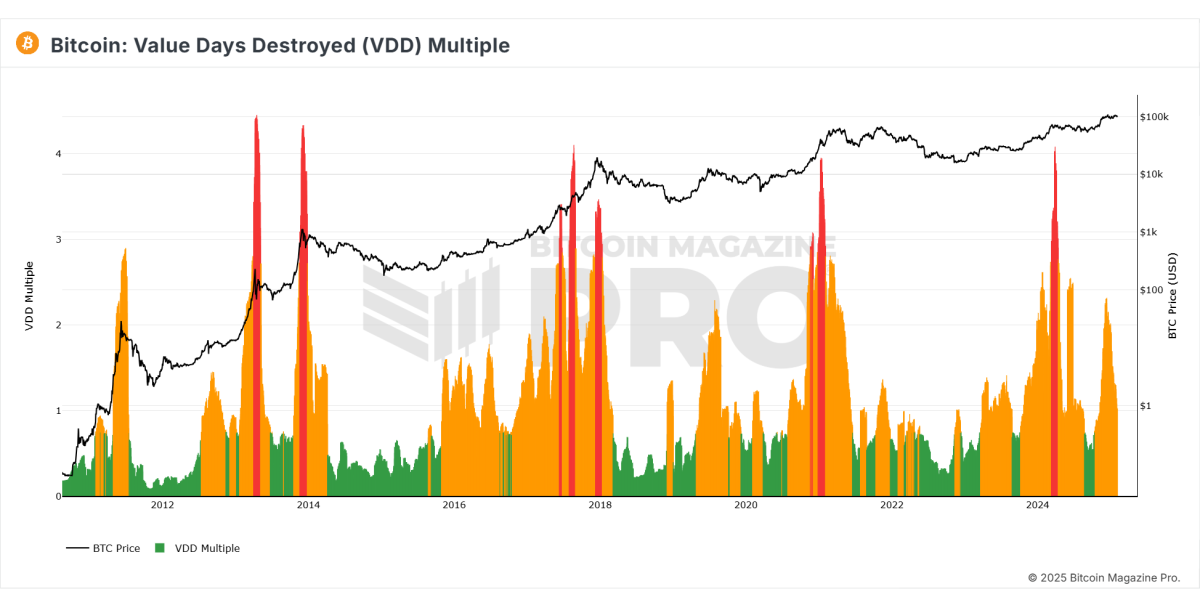

Value Days Destroyed (VDD)

VDD indicates long-term holders’ sell-offs. The metric has shown a decline in selling pressure, suggesting that Bitcoin is stabilizing at high levels rather than heading into a prolonged downtrend.

Institutional and Market Sentiment

- Institutional investors such as MicroStrategy continue accumulating Bitcoin, signaling confidence in its long-term value.

- Derivatives market sentiment has turned negative, historically indicating a potential short-term price bottom as over-leveraged traders betting against Bitcoin may get liquidated.

Macroeconomic Factors

- Quantitative Tightening: Central banks have been reducing liquidity, contributing to the temporary Bitcoin price decline.

- Global M2 Money Supply: A contraction in money supply has impacted risk assets, including Bitcoin.

- Federal Reserve Policy: There are indications from major financial institutions, including JP Morgan, that quantitative easing could return by mid-2025, which would likely boost Bitcoin’s value.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Future Outlook

- Bitcoin’s price action is showing signs of entering a consolidation phase before another potential rally.

- On-chain data suggests there is still significant room for growth before reaching cycle peaks seen in previous bull markets.

- If Bitcoin experiences further pullbacks to the $92,000 range, this could present a strong accumulation opportunity for long-term investors.

Conclusion

While Bitcoin has experienced a temporary retracement, on-chain metrics and historical data suggest that the bull cycle is not over yet. Institutional interest remains strong, and macroeconomic conditions could shift in favor of Bitcoin. As always, investors should analyze the data carefully and consider long-term trends before making any investment decisions.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Bitcoin Magazine – Bitcoin News, Articles and Expert Insights