Gemini nabs US license to offer prediction markets

Crypto exchange Gemini, founded by billionaire twins Tyler and Cameron Winklevoss, has scored a license from the Commodity Futures Trading Commission to offer prediction markets in the US.

Gemini said on Wednesday that its affiliate, Gemini Titan, received a designated contract market license from the CFTC and “plans to enter into the prediction markets space.”

The company said that “starting shortly,” its US users would be able to trade event contracts on its web platform. Gemini also said it would expand its US derivatives offerings to include crypto futures, options and perpetual contracts.

Gemini joins a number of crypto companies that have begun to offer prediction markets, allowing users to bet on the outcomes of a range of events, including sports and geopolitics.

Shares in Gemini (GEMI) shot up 13.7% in after-hours trading on Wednesday to $12.92 after ending the day’s trading session down 0.7%.

The license could be a major boost for Gemini, whose stock is down 64.5% since its public debut on Sept. 12 as the crypto market has struggled to sustain a rally.

Related: ‘Elite’ traders hunt dopamine-seeking retail on prediction markets: 10x Research

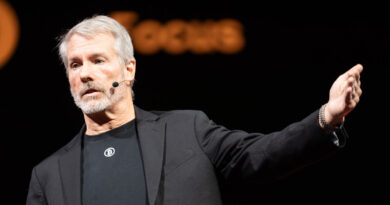

“Prediction markets have the potential to be as big or bigger than traditional capital markets,” said Gemini’s president, Cameron Winklevoss.

Prediction markets have surged in popularity this year, with major platforms Polymarket and Kalshi both seeing record monthly trading volumes in November. Kalshi also closed a $1 billion funding round at a valuation of $11 billion earlier this month.

Critics of prediction markets liken the offering to gambling, and multiple US state regulators have launched enforcement actions against CFTC-regulated platforms over their event contracts, claiming they’re offering unlicensed sports betting.

Gemini CEO Tyler Winklevoss said the exchange first applied for the license in March 2020, and the approval “marks the culmination of a 5-year licensing process and the beginning of a new chapter for Gemini.”

The prediction markets offering is part of Gemini’s plan to create a “super app” of multiple crypto products, which Cameron Winklevoss detailed on an earnings call last month amid the company’s first quarterly results, which showed losses due to the expense of going public.

The company is in a race with other crypto apps that have expanded beyond offering trading, with crypto wallet Trust Wallet launching prediction markets earlier this month and Coinbase seemingly creating a website for a prediction markets platform backed by Kalshi.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?