Crypto Whale Exits Bitcoin Shorts, Pockets $1.4M Profit – Then Re-Opens Position

Key Takeaways:

- A major crypto whale has partially closed a significant Bitcoin short position.

- After closing 387.02 BTC, the whale booked $1.4 million in profit, causing a brief fluctuation in Bitcoin’s price.

- Despite taking profits, the whale increased their short position again, this time with even larger volume, signaling continued bearish sentiment.

Whale Profits from Bitcoin, Then Reloads – Tactical Move or Market Signal?

A well-known trader in the cryptocurrency community made waves in the market on March 16th. A whale strategically closed part of their short positions on Bitcoin (BTC) and Ethereum (ETH), securing a $1.4 million profit. Following this closure, the market saw a brief positive reaction, with Bitcoin making a slight uptick before stabilizing.

According to on-chain analyst @ai_9684xtpa, the whale liquidated 387.02 BTC and withdrew 6 million USDC from the Hyperliquid platform. This came after an earlier withdrawal of 12 million USDC, of which 10.6 million USDC was collateral for short positions. It appears that the whale wisely took advantage of changing market conditions to lock in their profits.

Short Positions Still Held and the Possible Influence on the Market

But that is not where the story ends. About 72 hours after covering, this whale opened a massive new short position to the surprise of many. This brave move confirms a bearish directional stance. The rest of the portfolio consists of a 20x short position on BTC, containing 125.62 BTC, opened at $94,371.3, with a liquidation price of $105,730. Also, there is a 20x short position on ETH with 365 ETH at $2,658 entry price, with a liquidation price of $9,375.4. The total for these positions is quite large at $11.275 million.

The initial profit-taking by the whale, and the price fluctuation that resulted from the whale’s actions, followed by a re-entry might give rise to some speculations around their motives. There is a highly possible situation where the whale expects a more widespread correction of the markets, thanks to macroeconomic factors or regulatory developments. They could have closed their initial position to lock in profits ahead of this expected correction, seeking to short the now lower prices with an even larger short position. Another possibility is that the whale is trying to manipulate the market, leveraging their significant capital to generate fear and uncertainty, and profiting from the ensuing volatility. The rapid expansion of the whale’s short position strengthens speculation that they may be attempting to influence market sentiment through short selling.

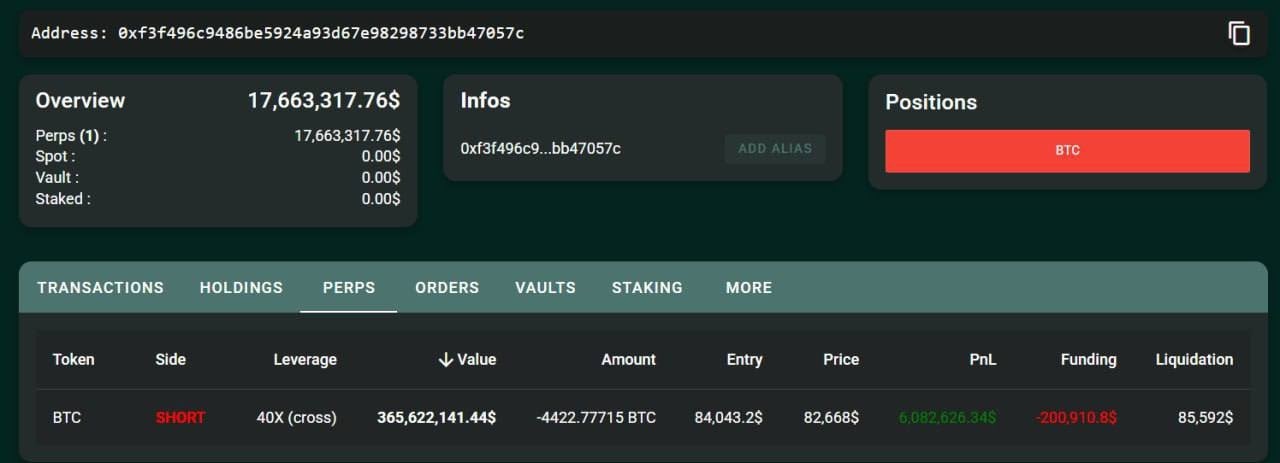

Whale Doubles Down on Bearish Bets: Short Position Soars to $365 Million

Perhaps even more surprising now, this same whale has reportedly expanded their short position to a massive $365 million, with a liquidation price of $85,592. This is a massive increase from their previous position, and further solidifies their bearish stance on Bitcoin. This audacious step has sent shockwaves through the crypto world, stirring speculation and concern.

As one analyst put it, “What does he know that we don’t?”. The sharp and sudden rise in the short position indicates a very high conviction in an imminent correction, no matter what the exact trigger may turn out to be.

Large traders wield enormous influence over market dynamics, often shaping sentiment and driving price volatility. This is why tracking “whale” activity is important for any crypto investor. The first closing of the short position gives us a real example of this influence and a minor yet brief increase in the price of Bitcoin due to the same thing.

More News: Solana Shorts Surge: Are Memecoin Scandals Crashing the Party?

The post Crypto Whale Exits Bitcoin Shorts, Pockets $1.4M Profit – Then Re-Opens Position appeared first on CryptoNinjas.

CryptoNinjas