Coinbase’s 24/7 XRP and Solana Futures Trading Will Change the Crypto Markets with a Daily Volume of $3.3B

Key Takeaways:

- Starting on June 13, 2025, Coinbase will trade XRP and Solana futures all day, every day. This would let U.S. traders trade all the time.

- With this development, Coinbase becomes the first U.S. CFTC-regulated exchange to let people trade these big altcoins’ futures all the time.

- The goal of the launch is to take advantage of the $3.3 billion in daily trading volume of XRP and Solana, which will make the market more liquid and efficient.

Cryptocurrency markets are always open, but many U.S.-regulated futures platforms only let people trade during work hours. Coinbase is going to change that by letting anyone trade XRP and Solana futures 24 hours a day, seven days a week. These are two of the most actively traded cryptocurrencies. This project is a response to the growing need for derivatives trading alternatives that are flexible and available in real time, especially for institutional traders and investors around the world.

Read More: Coinbase Breaks Barriers: First-Ever Crypto Company Added to the S&P 500 Index

The Move to Continuous Altcoin Futures Trading

Coinbase’s plan to let anyone trade XRP and Solana futures throughout the clock is in line with the growing demand in cryptocurrency derivatives. Coinbase used to only let people trade Bitcoin and Ethereum futures 24 hours a day, seven days a week. Adding XRP and Solana futures is a strategic move to reach the next level of heavily traded cryptocurrencies.

Starting June 13, we’re enabling 24×7 trading for $XRP and Solana ( $SOL ) futures, unlocking real-time access to U.S. traders, reflecting the always-on nature of crypto markets.

— Coinbase Institutional

(@CoinbaseInsto) May 29, 2025

This option for round-the-clock trading bridges the gap between the hours of the U.S. market and trading sessions across the globe. Because of this, traders can respond quickly to market changes, global events, or breaking news. The market responds faster and investors have more tools to manage their positions all day long when futures trading is allowed at any time.

In making XRP and Solana futures tradeable throughout the clock, Coinbase caters to a crucial demand from market participants who require convenient access to these liquid markets. Users/investors can hedge, speculate, and engage in arbitrage on the futures markets for these altcoins because of their high trade volume and market capitalization.

Read More: 8 Hot Tokens Just Dropped on Coinbase — But Only One Country Can Touch Them

Understanding the Market Size and Trading Mechanics

XRP and Solana are two of the most popular altcoins in terms of market cap and trading volume. XRP’s daily spot volume is sometimes more than $1.5 billion around the world, and Solana is not far behind. The futures markets for these assets have been going up steadily, and derivatives trading now accounts up a substantial part of all crypto trading activity throughout the world.

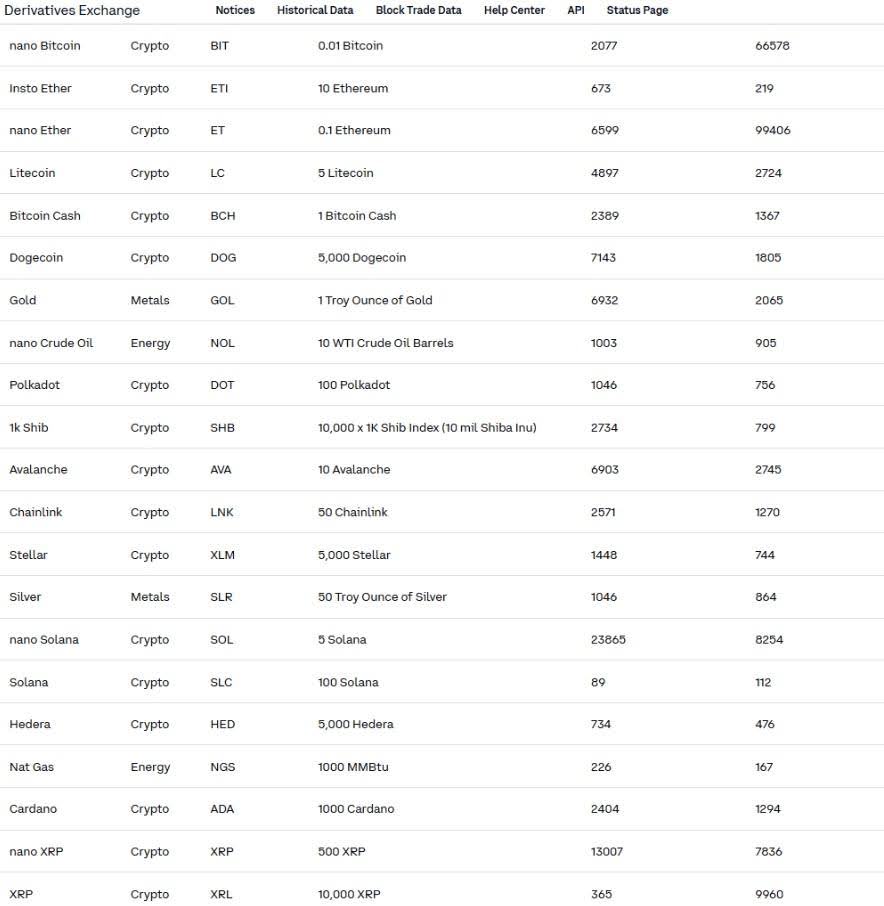

Since the XRP and Solana futures contracts on Coinbase pay in USD currency, settlement is streamlined, and token transportation is avoided. A single XRP futures contract can be purchased for 10,000 XRP, allowing you to fine-tune the magnitude of your investment. Similarly structured, but tailored to the asset’s volatility and liquidity, are Solana futures contracts.

As a precaution against the usual dangers of the cryptocurrency market, Coinbase has instituted an automated trading suspension in the event that the price of a cryptocurrency experiences a 10% hourly price change. By regulating volatility, the platform and traders are shielded from market manipulation and large price fluctuations.

Regulatory Framework and Institutional Confidence

The fact that Coinbase is monitored by the Commodity Futures Trading Commission (CFTC) distinguishes it from other exchanges. Oversight of the United States. derivatives markets and makes sure that the rules for how they work, how clear they are, and how well they follow the law are all followed.

This kind of government control makes big traders and institutional investors feel safer than they would in a lot of offshore or uncontrolled locales. Customers are safeguarded, market integrity is maintained, and fraud is eradicated by the CFTC’s regulations. If you want major investors to put their money into it, you need all of these things.

Competitive Landscape: Where Coinbase Stands

Rivalry among futures markets is heating up as more platforms see the value in offering cryptocurrency derivatives. The CME, or Chicago Mercantile Exchange, has just begun to trade XRP futures. The first day of trading saw notional volumes of more than $19 million.

CME, on the other hand, is only open for a short time each day. In a constantly improving world for the crypto industry, Coinbase allows users to trade futures at any moment. Traders seeking liquidity and flexibility outside of regular market hours will likely find this service appealing because it is open all the time.

Coinbase also wants to introduce contracts for other potential cryptocurrencies, like Cardano (ADA) and Hedera (HBAR), to its futures portfolio. These new features will provide traders more ways to spread out their derivative exposure.

Market Benefits and Trader Impact

There are several real benefits for the crypto trading community that come with this change to continuous futures trading:

- Greater Market Liquidity: Continuous access leads to more trade, which narrows bid-ask spreads and makes prices more efficient.

- Improved Price Discovery: Getting rid of trading gaps makes price formation more accurate and timely, which shows how much supply and demand there is throughout the world.

- Risk Mitigation: Traders can dynamically control risk by promptly entering or leaving positions when the market changes.

- Increased Market Participation: More overseas traders are joining the futures market because it is available all the time and anyone may trade.

Adding new ideas like 24/7 futures trading to the crypto world, which is getting more intricate and connected all the time, is a significant step toward maturity. They assist markets better show how spot trade and economic activity throughout the world are always happening.

The post Coinbase’s 24/7 XRP and Solana Futures Trading Will Change the Crypto Markets with a Daily Volume of $3.3B appeared first on CryptoNinjas.

CryptoNinjas

(@CoinbaseInsto)

(@CoinbaseInsto)