Coinbase Launches the First U.S. Futures Trading Tied to Tech Giants and Crypto

Key Takeaways:

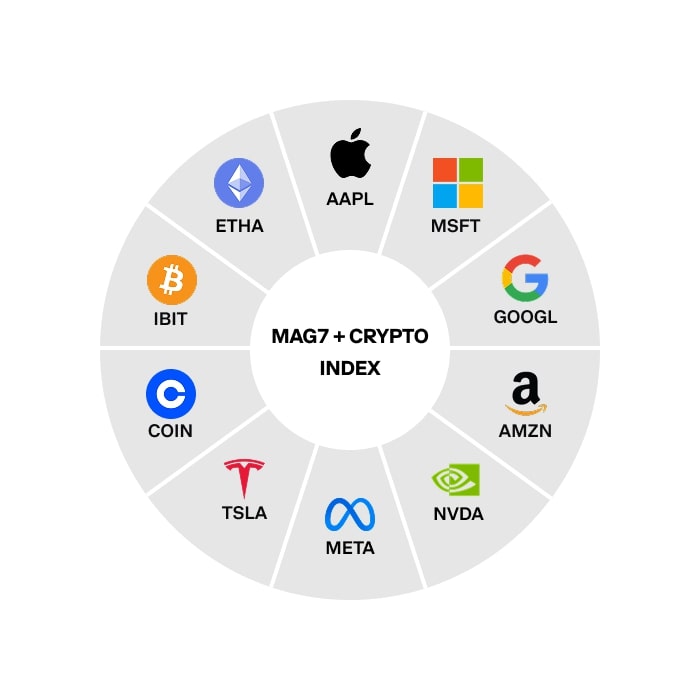

- Coinbase will launch the Mag7 + Crypto Equity Index Futures on September 22, blending exposure to seven top U.S. tech stocks with leading Bitcoin and Ethereum ETFs.

- The index introduces a first-of-its-kind U.S. futures product that equally weights 10 components, including Apple, Microsoft, Amazon, Tesla, and Coinbase itself.

- Institutional clients will get early access, with retail rollout planned in the coming months through partner platforms.

Coinbase is preparing to make derivatives history with the debut of a futures contract that unites Wall Street’s biggest technology names with blockchain’s flagship assets. Coming September 22, the Mag7 + Crypto Equity Index Futures will allow investors to trade a single instrument that combines Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta, Tesla, Coinbase stock, and two crypto ETFs: BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA).

It is the first time a U.S.-listed derivative product has offered exposure to both equities and cryptocurrencies in one cash-settled contract.

Read More: Coinbase Unveils Bold Crypto Push: $1.5B Revenue, Samsung Pay Deal, and 700K+ Waitlist

A New Chapter for U.S. Derivatives

For years, American exchanges have offered Bitcoin and Ethereum futures, but these have always been siloed from equity markets. Coinbase’s new index aims to break down that barrier by creating a multi-asset benchmark that appeals to both traditional finance and digital asset investors.

The “Mag7” component of the index references the so-called “Magnificent Seven” tech giants – companies that dominate U.S. equity markets and account for much of the S&P 500’s growth. By pairing them with ETFs that track Bitcoin and Ethereum, Coinbase is offering a vehicle that reflects two of the most powerful drivers of innovation: Big Tech and blockchain.

The contracts will be listed on Coinbase Derivatives, with MarketVector serving as the official index provider. Each component carries a 10% weighting, and the index will be rebalanced quarterly to maintain equal distribution. At an index level of $3,000, for example, one futures contract will represent a notional value of $3,000.

Strategic Significance for Coinbase

A Move beyond Single-asset Products

This launch underscores Coinbase’s ambition to transform its U.S. derivatives platform into a multi-asset hub. Until now, the exchange has primarily focused on single-asset offerings like Bitcoin or Ether futures. By expanding into equity index futures that blend digital and traditional assets, Coinbase is pursuing what CEO Brian Armstrong has described as the “everything exchange” – a marketplace where investors can access stocks, crypto, payments, and even social features in one integrated platform.

In a post on X, Armstrong highlighted the product’s role in reshaping investor access: “We’re launching the first U.S. futures that give exposure to the top U.S. tech stocks and crypto at the same time. We’ll launch more products like this as part of the everything exchange.”

Read More: Coinbase Acquires Deribit to Boost Stablecoin and Crypto Derivatives Business

Why It Matters for Investors

The introduction of Mag7 + Crypto Equity Index Futures addresses several long-standing demands from institutional and retail traders:

- Diversification in one trade: Investors no longer need to balance separate positions across stocks and crypto. One contract provides built-in exposure to both.

- Capital efficiency: Combining equities and crypto into a single product helps traders manage margin more effectively.

- Strategic risk management: Portfolios can now be hedged against multiple asset classes at once, reducing the need for separate instruments.

- Access to innovation themes: The product captures the performance of companies shaping cloud computing, AI, and digital assets, all within one basket.

This dual exposure could appeal strongly to institutions seeking simplified hedging strategies, while retail traders may find it an easier way to speculate on the broader innovation economy.

Competitive Landscape

Coinbase is not alone in pushing deeper into derivatives. Rival exchange Kraken has also invested heavily in this space, acquiring NinjaTrader for $1.5 billion earlier this year and launching a U.S. crypto derivatives platform in July. Binance and Bybit remain dominant globally, but Coinbase’s move represents a bid to secure a leadership position in regulated U.S. markets.

The timing is notable. Global crypto derivatives volume grew by more than 130% last year, and 2025 is already on pace to surpass $20 trillion in traded value across the first two quarters. Coinbase has seen daily derivatives volumes top $5 billion in recent weeks, peaking at nearly $10 billion in late August. With spot trading revenue under pressure, derivatives have become a critical growth driver for the exchange.

The post Coinbase Launches the First U.S. Futures Trading Tied to Tech Giants and Crypto appeared first on CryptoNinjas.

CryptoNinjas