BlackRock’s $547M Ethereum Bet Signals Bold Pivot, 5x Heavier ETH Focus Than Bitcoin

Key Takeaways:

- BlackRock invested $547 million in Ethereum in a single day, outpacing its Bitcoin buy by $50 million.

- ETH purchases are 5x larger than BTC when adjusted by market cap, according to Arkham Intelligence.

- ETF staking proposals and institutional demand are pushing Ethereum ahead in the battle for Wall Street’s crypto attention.

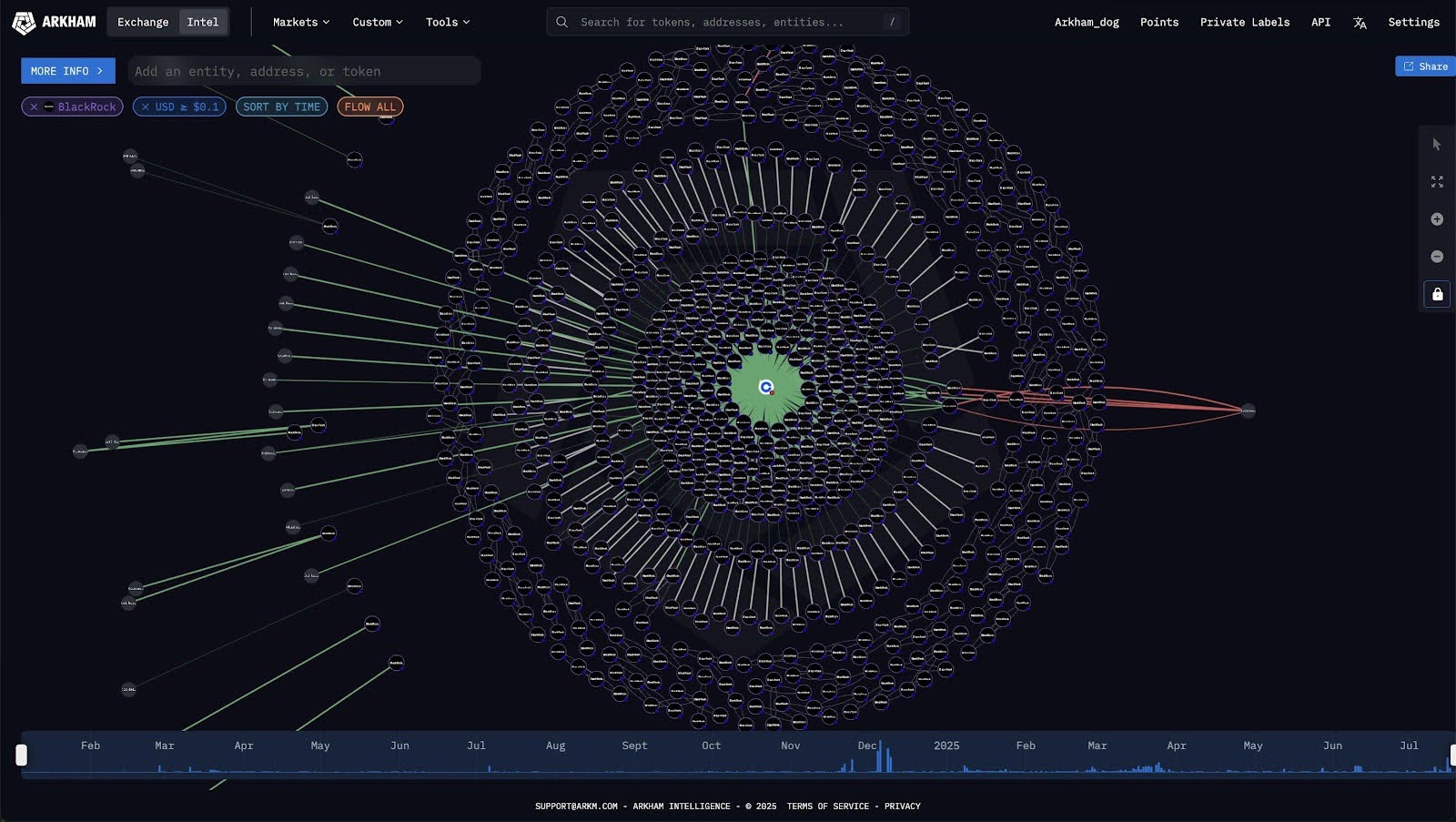

In a move that sent ripples through institutional crypto markets, BlackRock has significantly increased its Ethereum exposure, acquiring $547 million worth of ETH, surpassing its Bitcoin inflows by $50 million on July 17. The purchase, tracked by Arkham Intelligence, signals a growing strategic preference for Ethereum over the long-dominant Bitcoin.

Read More: BlackRock’s Bold $85M Ethereum Buy Hints at Crypto Confidence Surge Post-ETF Turnaround

Ethereum Dominates BlackRock’s Crypto Allocation

BlackRock’s Ethereum acquisition now totals over $547 million, while Bitcoin inflows trail at $497 million, data from Arkham Intelligence confirms. When adjusted for market cap, this equates to a fivefold higher ETH allocation, a striking reversal in institutional crypto norms.

The pattern appears deliberate. Rather than opportunistic buying, the firm’s systematic accumulation of ETH over July suggests long-term positioning. On July 16 alone, BlackRock added $499.2 million worth of ETH, increasing its total ETH holdings to 2.02 million, valued at $6.94 billion.

“Weighted by market cap, BlackRock is buying over 5 TIMES the amount of ETH compared to BTC,” Arkham noted in a post on X.

A Broader Shift in Institutional Sentiment

BlackRock ETH plan is not taking place in a vacuum. Institutional flows into ETH-focused products have increased 32% month-over-month, according to CoinShares. Meanwhile, BTC fund inflows have stagnated, despite a generally bullish market.

In early July, BlackRock held $156 million in ETH, surpassing its $125 million BTC position. That gap has since widened to $50 million, and the current positions indicate that ETH could soon be the top crypto exposure in BlackRock’s portfolio.

It could also be an inflection point for regulators. The regulatory front is gradually turning in Ethereum’s favor as the SEC eases from its stance from ETH-related products & staking could be approved in ETFs.

Why Ethereum Is Winning the Institutional Race

Ethereum is emerging as the preferred crypto asset among institutional investors, and BlackRock’s aggressive shift toward ETH confirms this trend. Several key factors are driving this institutional pivot:

- Staking potential: Ethereum’s proof-of-stake model allows asset managers to earn passive rewards, unlike Bitcoin’s energy-intensive mining model.

- ETF staking clause amendment: Nasdaq recently filed a proposal to enable ETH staking within BlackRock’s iShares Ethereum ETF, pending regulatory approval.

- Smart contract flexibility: Ethereum’s use in DeFi, NFTs, and tokenization provides a broader investment narrative than Bitcoin’s store-of-value pitch.

According to SoSoValue data, BlackRock’s Ethereum ETF received $546.7 million in inflows on July 17, compared to $497.3 million for the Bitcoin ETF, confirming sustained institutional momentum.

Price Performance Adds to Ethereum Momentum

Ethereum’s market surge has further fueled investor confidence. At the time of writing, ETH trades at $3,624, up 46% in the last 30 days, with a 21% weekly gain. Increased whale activity and dormant wallet reactivation indicate that long-term holders are re-entering the market.

Analysts see more upside. According to market strategist Cas Abbé, Ethereum is entering a Wyckoff accumulation phase, projecting a possible breakout past $4,000. Abbé believes BlackRock’s purchases are mirroring technical accumulation patterns, aligning with smart money movements.

“The synchronized spike in institutional inflows and technical strength suggests ETH is poised for leadership in the next bull cycle,” Abbé stated.

ETH Staking, A Game-Changer for Institutional Crypto

Ethereum’s move to proof-of-stake is changing the way institutions look at crypto assets. With ETFs set to enable staking rewards sooner than later, we’re not simply talking about a volatile asset but a yield-producing asset and this is an important factor for pension funds, endowments and asset managers.

This potentiality is also increasing the demand of Ethereum focused financial products. Nasdaq’s amendment to the filing indicates that the staking ban would be waived so that ETF-held ETH could be used for consensus. If approved, it would allow institutions to get exposure to staking rewards via regulated ETFs and potentially propel more adoption.

BlackRock’s aggressive buying could be a pre-positioning bet on this shift. Assuming staking for ETFs is permitted, the firm could realize the asset appreciation alongside yield, effectively turning it into a two-income investment for investors.

Read More: BlackRock Quietly Amasses Over 3.25% of Bitcoin Supply; What It Signals for Crypto’s Future

The post BlackRock’s $547M Ethereum Bet Signals Bold Pivot, 5x Heavier ETH Focus Than Bitcoin appeared first on CryptoNinjas.

CryptoNinjas