Bitcoin Price Crashes Below $110,000 After Whale Sold 24,000 BTC

Bitcoin Magazine

Bitcoin Price Crashes Below $110,000 After Whale Sold 24,000 BTC

The price of Bitcoin has plunged below $110,000 in the past 24 hours, marking one of its steepest corrections in weeks. According to data from Bitcoin Magazine Pro, the world’s largest cryptocurrency dropped to $108,890 and remains below the $110,000 threshold at the time of writing. The decline represents a sharp sell-off from just last Friday, when Bitcoin traded as high as $117,000, before tumbling to $109,894 over the weekend.

The downward momentum was accelerated by a massive whale sale. Over the weekend, a single Bitcoin holder offloaded 24,000 BTC worth more than $2.7 billion, sparking additional selling pressure and driving the price lower. The large transaction caused heightened volatility and weighed heavily on market sentiment.

Despite the sharp move down, sentiment has not yet tipped fully into fear. The Bitcoin Fear and Greed Index, a widely watched market sentiment tool, currently sits at 48/100, which is categorized as “neutral” but hovers just above “fear.”

The Fear and Greed Index is a tool that helps investors and traders analyze the Bitcoin and Crypto market from a sentiment perspective. It identifies the extent to which the market is becoming overly fearful or overly greedy. Hence why it is called the Fear and Greed Index.

Bitcoin Magazine Pro explains that the Index helps investors separate their emotions from broader market reactions, offering insights into when assets may be overbought or oversold. Scores near zero reflect “extreme fear,” while scores close to 100 represent “extreme greed.” With Bitcoin currently at 48, sentiment is edging toward concern but has not yet fully entered bearish territory.

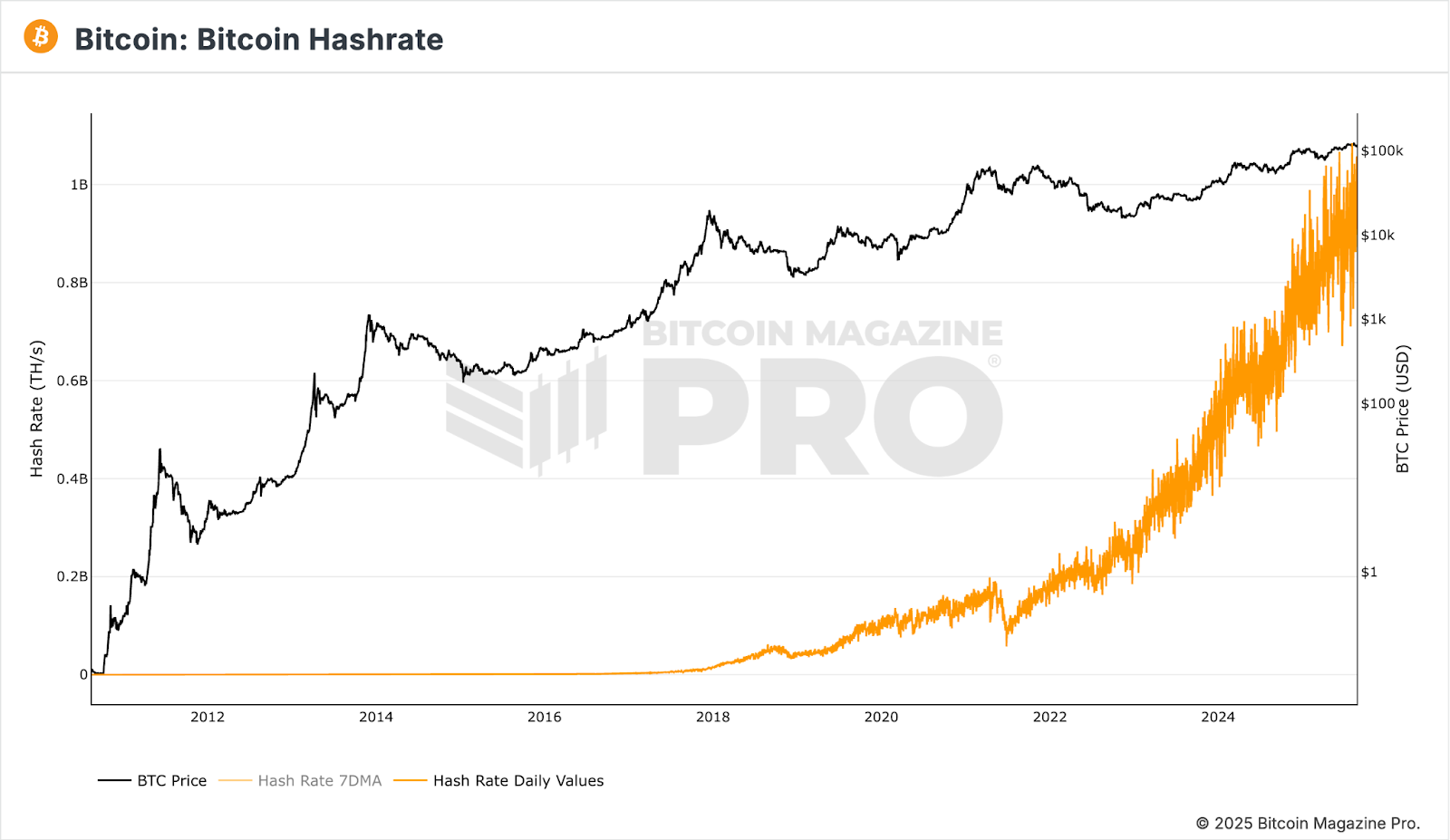

Meanwhile, underlying network fundamentals remain strong despite price weakness. Bitcoin’s hash rate—a measure of the total computational power securing the network—is approaching a new record high. The current daily value stands at 909,080,589 Th/s, just shy of the all-time high of 1,084,828,947 Th/s set on August 4 when Bitcoin was trading at $115,149.

Long-term holders may find reassurance in historical profitability data. Bitcoin Magazine Pro notes that holding Bitcoin has been profitable for 99.1% of its existence:

- Number of profitable days: 5,437

- Total number of days tracked: 5,487

- Percent of profitable days: 99.1%

While the recent drop below $110,000 has rattled short-term traders, Bitcoin’s track record and network strength suggest resilience. Investors will be closely watching whether the Fear and Greed Index shifts further into fear territory, and if whales continue to unload large holdings, potentially adding more turbulence to the market in the coming days.

This post Bitcoin Price Crashes Below $110,000 After Whale Sold 24,000 BTC first appeared on Bitcoin Magazine and is written by Nik.

Bitcoin Magazine