Bitcoin Eyes New All-Time Highs: A Deep Dive into the Bullish Outlook for 2025

Bitcoin Magazine

Bitcoin Eyes New All-Time Highs: A Deep Dive into the Bullish Outlook for 2025

This article is based on research and analysis originally presented by Matt Crosby of Bitcoin Magazine Pro.

Bitcoin has made waves in recent weeks, with the bitcoin price surging past $95,000 after months of lackluster performance. For many traders and investors, this shift marks the return of the bull market that’s been long-awaited. The question on everyone’s mind: Can Bitcoin finally break its previous all-time high of $108,000, or is this just another fleeting rally?

In this article, we’ll examine the factors driving Bitcoin’s recent momentum, dive into the technical and on-chain data, and discuss the broader macroeconomic context to gauge whether the leading cryptocurrency can sustain this bullish run.

A Rapid Rebound: Bitcoin’s Recent Surge

Bitcoin’s price had previously experienced a significant dip of over 30%, falling from its all-time high of $100,000+ into the $70,000 range. However, after a period of uncertainty, the king of cryptocurrencies has regained its footing and surged back into the $90,000s. This price recovery comes after a multi-month consolidation phase, which many saw as a bearish market structure. But recent developments suggest that Bitcoin could be on the cusp of a major breakout, supporting a renewed wave of bitcoin price prediction models entering the discussion.

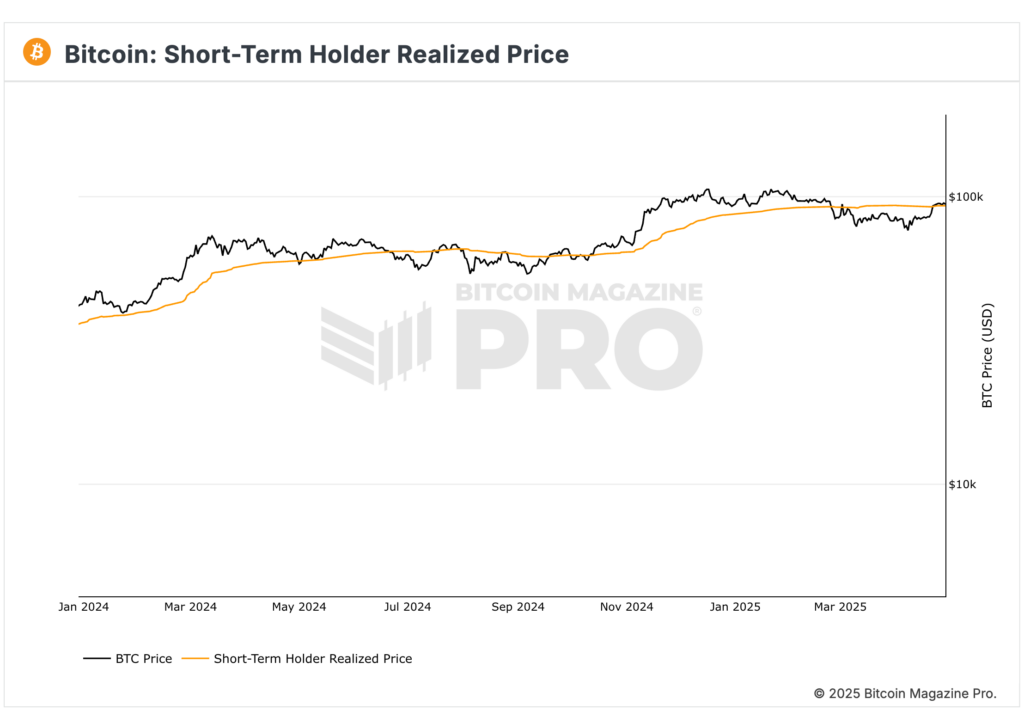

Bitcoin’s price action has recently reclaimed several key levels, including the critical short-term holder realized price (STH realized price), which is often seen as a major signal of market strength. Historically, during bull markets, the short-term holder realized price acts as a level of support. When this metric flips from resistance to support, it typically indicates a robust foundation for further upward movement.

Over the past few weeks, the bitcoin price (BTC) has reclaimed the level of around $93,000 to $95,000, signalling that the market could be gearing up for a more substantial rally. Given that previous bull cycles have seen similar behavior after reclaiming key price levels, many are starting to feel increasingly bullish about the potential for a new all-time high in 2025.

On-Chain Data: The Bullish Signs of Market Strength

When analyzing Bitcoin, it’s not just the price action that matters—it’s also the on-chain data. This data helps us understand the behavior of market participants and provides insight into the health of the network. The recent shift in the long-term holder supply is one such indicator that points to Bitcoin’s strengthening outlook.

For the past few months, Bitcoin had been experiencing an unusual pattern where long-term holders (those who have held Bitcoin for over a year) were actively selling their holdings, potentially locking in profits. This had led many to worry that Bitcoin’s price was near its peak. However, recent data shows a reversal in this trend. Long-term holders have started accumulating again, which is often a strong bullish signal in a Bitcoin market cycle. Historically, when long-term holders shift to accumulation mode, it typically marks the beginning of a new bull phase.

Additionally, the presence of ETF inflows further bolsters this optimistic outlook. In the past few weeks, Bitcoin ETFs have seen hundreds of millions of dollars flow into them, which indicates growing institutional confidence in Bitcoin. These inflows come amid a period where traditional markets, like the S&P 500, have faced volatility, but Bitcoin has managed to hold its ground and even rally despite broader market corrections.

The Role of Market Fundamentals: Why This Move Feels Different

There’s a fundamental shift taking place in the Bitcoin market right now, one that suggests this is not just another brief rally. Bitcoin’s current upward momentum appears to be driven primarily by spot-driven buying, rather than over-leveraged trading. When Bitcoin’s price rises due to increased spot demand rather than excessive leverage, the move is typically more sustainable and less prone to sharp reversals.

One of the key drivers of this more organic upward pressure of the bitcoin price is the decline of the US dollar strength index (DXY). Over the past few weeks, the DXY has been dropping, signaling a decrease in demand for the dollar. This trend has made risk-on assets like Bitcoin more attractive. As global liquidity has increased due to various monetary policy actions, Bitcoin stands to benefit from this broader market trend. The reduction in the dollar’s strength also signals a potential shift in investor sentiment, with more capital flowing into assets that could outperform in a weaker dollar environment.

Moreover, Bitcoin’s correlation with traditional equity markets, particularly the S&P 500, has been a key factor to monitor. For much of 2023, Bitcoin has shown a strong positive correlation with the stock market. This means that when the S&P 500 rallies, Bitcoin tends to follow suit. Recent price action has shown that Bitcoin has been able to hold its ground despite a temporary dip in equity markets, further suggesting that the bullish sentiment in Bitcoin could be sustained, especially if traditional markets continue to rebound.

Macro Factors: The State of Global Liquidity

The broader economic context cannot be ignored. Massive amounts of liquidity were injected into global markets from 2020 to 2022 by central banks. While this liquidity initially drove asset inflation across all markets, it is now showing signs of positively influencing Bitcoin as well.

Bitcoin has historically correlated with global liquidity trends, and recent data suggests that the increased liquidity in the financial system is finally starting to impact the cryptocurrency market. Bitcoin’s recent surge coincides with this rising liquidity, further strengthening the case for a more prolonged bullish phase.

However, there is still a crucial factor to consider: the state of global equities and their potential to affect Bitcoin’s price. The S&P 500, while showing a strong rebound, is still facing resistance at key levels. Bitcoin’s price has been closely linked to the broader performance of equities, and if the stock market faces further turbulence, it could dampen Bitcoin’s prospects as well.

What’s Next for Bitcoin: $100,000 and Beyond?

The $100,000 level is the immediate target for the Bitcoin price, but the real question is: can it break through this resistance and push into new all-time high territory? The recent reclaiming of key levels, such as the short-term holder realized price and the moving averages (100-day, 200-day, 365-day), shows that Bitcoin is in a strong position to test $100,000 again.

From a technical perspective, Bitcoin is currently at a defining juncture. If it can hold above the $90,000-$95,000 range and continue to build support, the path toward new all-time highs becomes increasingly likely. The next big resistance will likely be around $108,000, which is the current all-time high. If Bitcoin can break through that level, we could see a rapid move towards higher levels—potentially reaching as high as $130,000 in the next cycle.

However, there’s always the possibility of a retracement. If Bitcoin fails to hold its support levels or if global market conditions turn bearish, we could see the price fall back into the $80,000 range. A bearish retest would be a critical moment for the market, as failure to reclaim support could set the stage for more significant downside.

Conclusion: A Bullish Outlook with Cautious Optimism

All signs point to a potential Bitcoin rally, with strong on-chain data, a favorable macro environment, and positive sentiment in the derivatives markets. However, the key to sustaining this bullish momentum lies in Bitcoin’s ability to hold its current support levels and navigate potential market corrections. The strong correlation with the S&P 500 remains a crucial factor to watch, as any downturn in equities could impact Bitcoin’s price action.

In the coming weeks, all eyes will be on Bitcoin’s ability to reclaim $100,000 and set the stage for new all-time highs. While there’s plenty of room for optimism, traders should remain vigilant and prepared for any potential volatility. As always, the key to success in the crypto market is to remain data-driven and adjust to the market conditions as they evolve.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Bitcoin Eyes New All-Time Highs: A Deep Dive into the Bullish Outlook for 2025 first appeared on Bitcoin Magazine and is written by Conor Mulcahy.

Bitcoin Magazine