Binance Margin Trading Guide: How It Works and Key Tips for Crypto Traders

Binance margin trading is a trading strategy on Binance that allows traders to borrow crypto to trade with more capital than they currently own. Here, you use the crypto in your account as collateral and borrow extra funds to open larger trades with up to 20x leverage.

Using margin on Binance allows you to increase your trade size, take advantage of price movements, and manage positions without needing to sell your long-term holdings.

It also gives you more room to hedge or adjust your trades quickly. This means you can earn more from a good setup, but you also carry the risk of losing borrowed funds. For instance, if your margin level drops too low, Binance can forcibly close your trade to recover the loan.

For a better understanding of Binance margin trading, this guide explains how Binance margin trading works, the fees and interest rates of margin trading on Binance, and how it compares to spot and futures trading. You will also learn how to set up your margin account, move funds, and place your first trade.

What is Binance Margin Trading?

Binance Margin Trading is a feature on the Binance cryptocurrency exchange that allows users to borrow funds against their existing holdings to trade with leverage, to potentially increase profits. Maximum leverage varies by trading pair and account type. While Cross Margin can go up to 20x and Isolated up to 10x, many pairs have lower caps based on risk level and liquidity.

While leveraged trading enables traders to amplify profits, it also carries a high risk of potential loss due to leverage and potential liquidation if margin levels fall below thresholds.

To simplify margin trading, Binance offers tools like auto-transfer, auto-borrow, and auto-repay. Auto-transfer automates fund transfers between Spot and Margin wallets, auto-borrow automates borrowing funds when placing margin orders, and auto-repay repays loans with proceeds from closed trades.

Start margin trading on Binance today and earn monetary rewards to boost your trading capital.

What are the Pros and Cons of Margin Trading on Binance?

The pros of margin trading on Binance are listed below:

- Access to More Capital: You can trade with more than what you have. Once you move assets into your margin account, you get access to borrowed funds. This lets you enter bigger trades with less capital.

- Wide Range of Trading Pairs and Options: You’re not limited to one or two coins. Binance supports 600+ margin trading pairs, so traders are not stuck waiting for one market to move.

- Updates Borrowing and Margin Level: The platform updates everything while you trade. You see your margin level, how much you’ve borrowed, and how close you are to liquidation as the price changes. It keeps you informed without needing extra tools.

- Built-in Risk Management Tools Like Stop Loss (SL) and Take Profit (TP): You can set stop loss and take profit on every margin trade. Stop loss and take profit are limits set on trades (market or pending) so that they are automatically closed at an expected gain or a minimal loss. This helps you manage risk and plan exits.

- Direct Integration: Margin trading happens right inside the Binance ecosystem. Whether you are trading through the Binance app or website, there is no need to use third-party tools or open multiple tabs. Everything from transferring funds to repaying loans is handled in Binance Exchange.

- Customer Support: Binance offers 24/7 support through live chat and email. If you need answers to frequently asked questions, you can get help through the live chat or the FAQ section. However, if you need help with more complex issues, you can contact the support team via email.

In addition to these channels, Binance is popular for providing users with extensive learning tools, including articles, videos, tutorials and other educational content through Binance Academy. With these materials, you can easily learn how to trade on the exchange and get answers to your questions at all times.

The cons of margin trading on Binance are listed below:

- Potential Losses and Risk of Liquidation: When the trade moves against you and your margin level drops, Binance starts to close your position. This can lead to losing more than you expected. Also, if the margin level drops below the set range, Binance can forcibly close (liquidate) your position.

- Borrowed Funds are Not Free: As long as you keep the position open, interest is added to what you owe. The longer you hold, the more it costs. Nevertheless, this won’t be much of a problem if your trades are profitable.

- Crypto Markets Move Mast. A sudden dip can bring your margin down before you have time to act. Even if the price recovers later, your position might already be gone.

- Leverage Goes Both Ways: While it can help grow profits, it also means small mistakes can turn into large losses. So, you need to keep an eye on your trades at all times.

How Does Margin Trading Work in Binance?

Margin trading on Binance works by allowing users to borrow funds to increase their trading capital and amplify potential returns. First, you transfer funds into your margin wallet. That becomes the base Binance uses to calculate how much you can borrow. And the higher the value of your deposit, the more leverage you can access, up to 10x leverage on Isolated Margin and up to 20x on Cross Margin.

Next, you choose the trading pair and open a position. You can go long if you believe the asset will rise, or short if you expect a drop. Now, you’re trading with more than you own; both your original deposit and the borrowed funds are combined in that trade. If the price moves in your favor, you close the trade, repay the borrowed amount with interest, and keep the profit.

However, if the market turns against your position, your margin level starts to fall. If it drops too far, Binance can liquidate your position automatically. This means your assets will be sold off to recover the loan.

Binance offers different modes for margin trading orders. You can either borrow and repay funds manually or allow the system automatically borrow the required assets based on maximum leverage when placing an order. For the automated repayment, the system automatically uses the proceeds to repay the borrowed amount after closing the trade.

Please note: Borrowed funds accrue interest charged hourly. Additionally, when repaying loans, you must repay the same asset borrowed (e.g., if BTC was borrowed, repayment must be in BTC).

What are the Types of Margin Trading on Binance?

The two types of margin trading on Binance are Cross Margin and Isolated Margin. Here is a rundown of the difference between Cross vs. Isolated Margin.

- Cross Margin: In Cross Margin mode, all the balances in your margin account are pooled together as collateral for all your open margin positions. This means that if one position is losing, other assets in your margin account can be used to cover margin requirements, potentially preventing the liquidation of a single position.

However, the risk of Binance Cross Margin trading is that losses in one trade can affect all your margin positions since the collateral is shared across all trades. This mode is suitable for traders who want to maximize the use of their total margin balance and are comfortable with the risk spreading across positions.

- Isolated Margin: In Isolated Margin mode, each trading pair has its own separate margin account with a specific amount of collateral allocated to it. Here, only specific cryptocurrencies can be transferred in, held, and borrowed in a specific isolated margin account. For instance, if you want to invest in ETHUSDT isolated margin account, only ETH and USDT are accessible.

If the market moves against a particular trade, only the collateral allocated to that trade is at risk of liquidation, protecting the rest of your margin balance from being affected. Unlike the Cross Margin mode, this mode allows better risk management on individual trades and is suitable for traders who want to limit their risk exposure per position.

What are the Fees and Interest Rates for Binance Margin Trading?

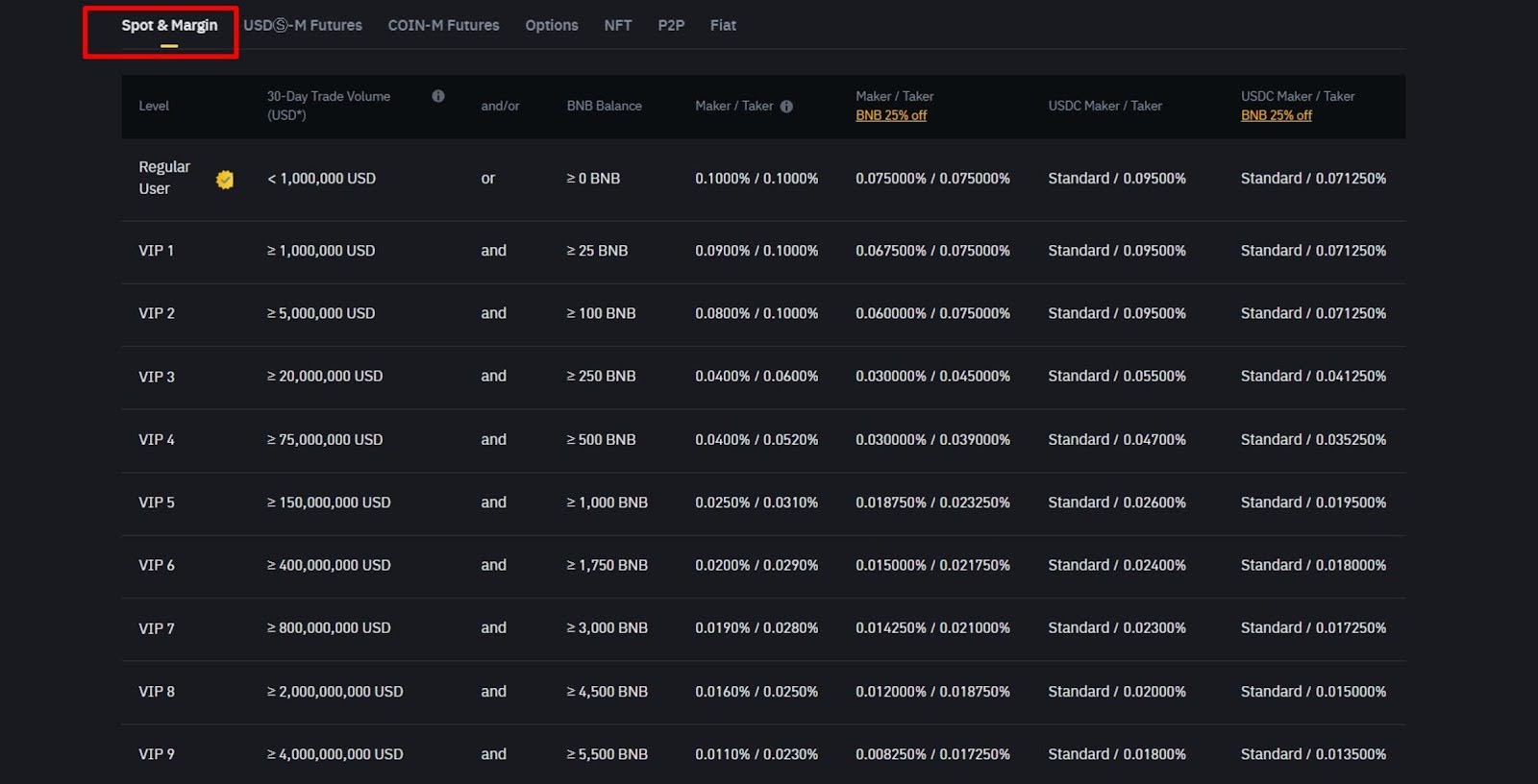

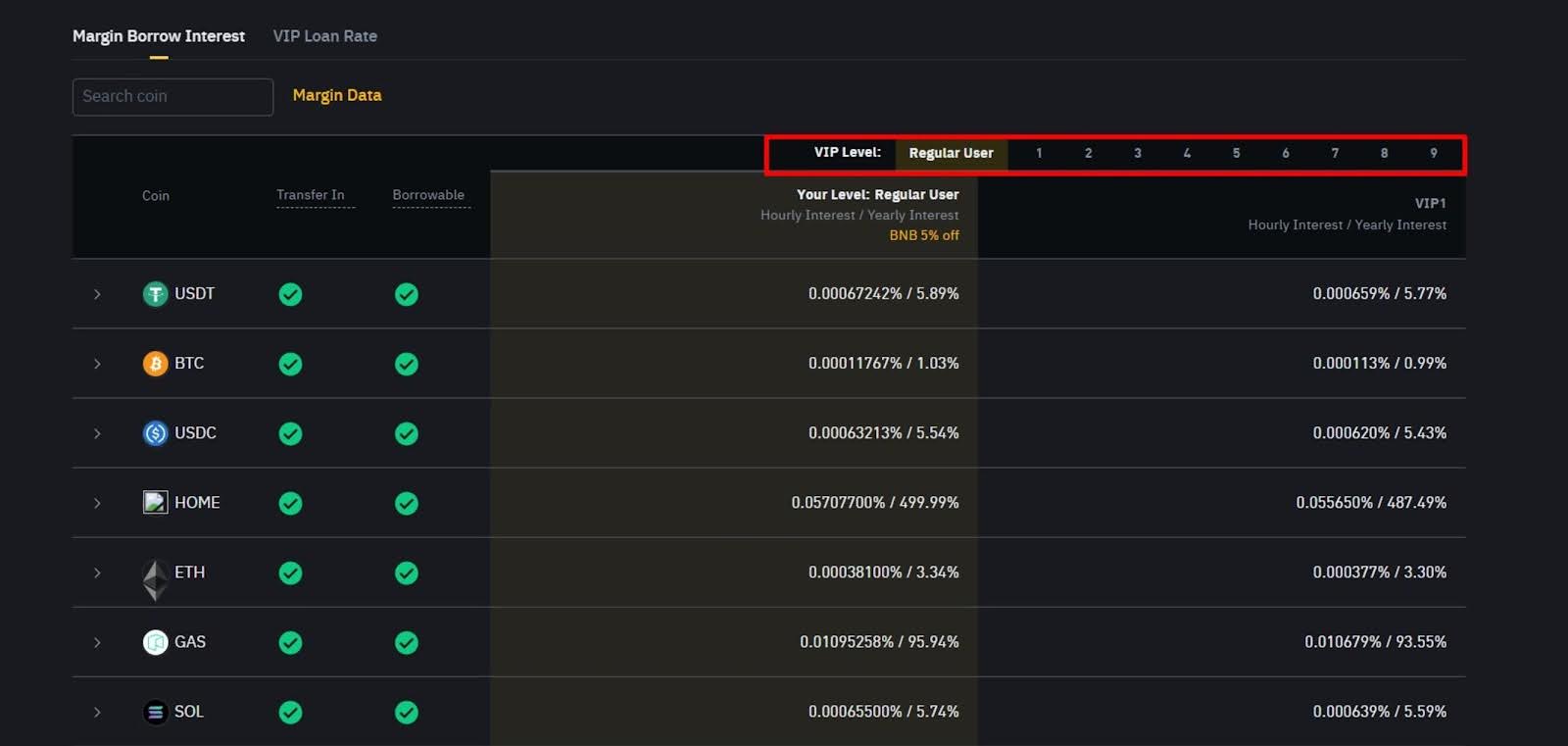

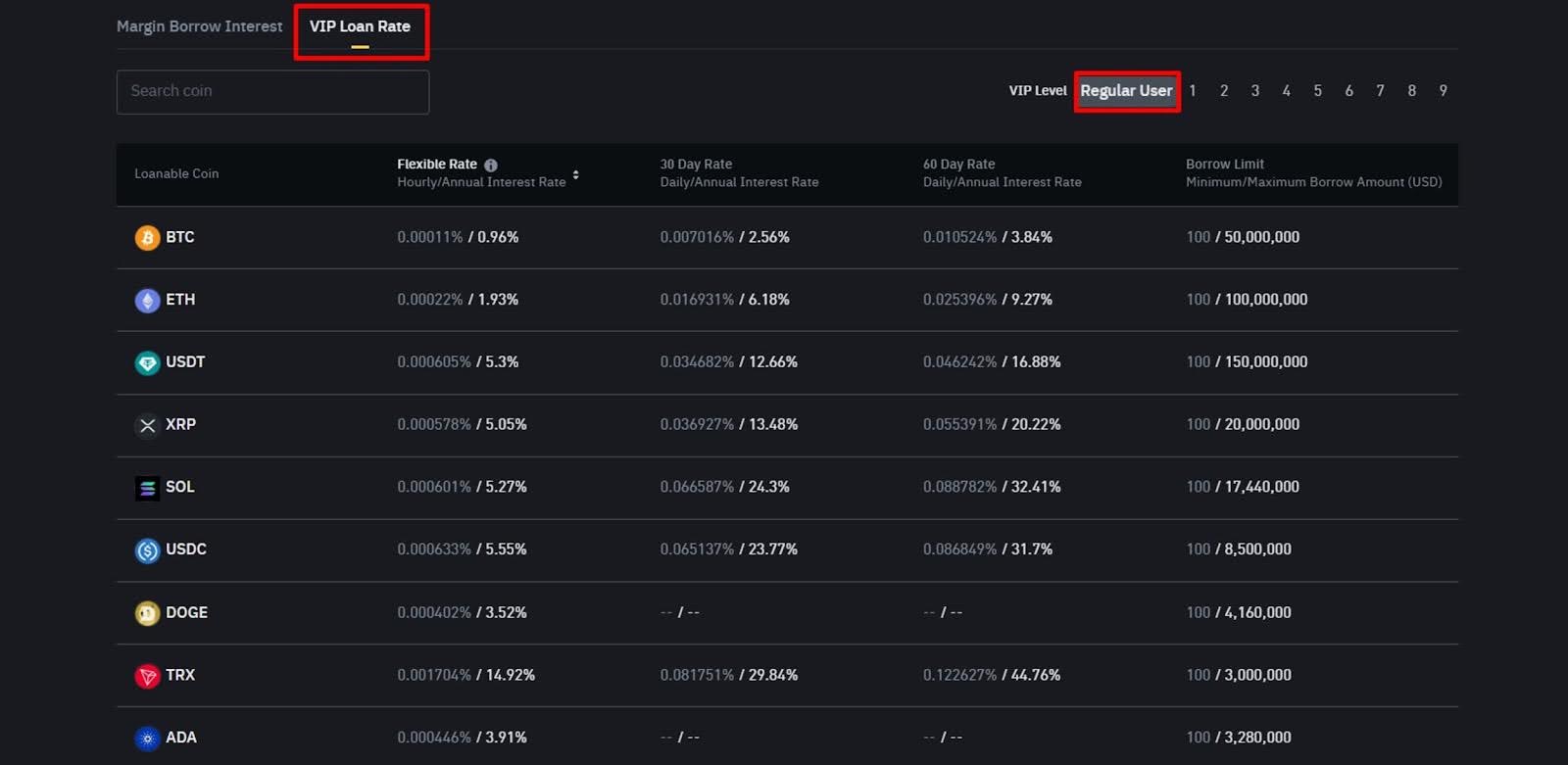

Binance charges two main costs when trading on margin, the regular trading fee and interest on the borrowed funds. The trading fee depends on your VIP level and whether the order is a maker or taker. Most users on a basic account pay around 0.1 percent per trade. That amount can drop with higher trading volume or if there’s enough BNB in the account to qualify for up to 20% BNB holders discount.

However, interest is charged separately and only applies to the amount borrowed. The rate depends on the coin, your VIP level, and can change depending on market activity. Interest starts the moment the loan is active and continues until the balance is fully repaid. The longer the trade stays open, the more interest builds up.

Access a $100 welcome bonus, live interest rates, and flexible borrowing with Binance margin trading.

What Are the Borrowing Limits for Binance Margin Trading?

Borrowing limits in Binance margin trading depend on the asset, the margin mode, and your VIP level. Traders with more trading volume (high VIP status) are eligible for more borrow limits compared to regular users. Below is the loan rate and borrowing limit for regular traders.

Aside from the VIP level, each coin available for margin has a set borrowing cap. Assets that are traded more often and have more liquidity typically allow higher limits, while smaller or less liquid coins cap borrowing at lower levels.

In cross margin, all assets in the margin wallet work together as collateral. That means borrowing power is based on the total value of everything in that wallet. As long as the combined balance holds up, larger positions are possible. However, if one position starts losing, it puts pressure on the entire account.

Now, the isolated margin treats each trade separately. When opening a position, only the funds assigned to that trade back the loan. That keeps risk limited to that one position, but the borrowing room is smaller because it’s tied only to that pair.

The actual borrowing amount also depends on your margin level, the ratio between your assets and what you’ve borrowed plus interest. If your margin level drops near liquidation, Binance may restrict additional borrowing to protect the platform and reduce your exposure. The platform adjusts limits in real time when the market moves sharply.

To know exactly how much you can borrow, the Margin Data page on Binance shows live limits for each asset.

What is the Difference Between Spot and Margin Trading on Binance?

Spot trading on Binance is a straightforward transaction where you buy or sell cryptocurrency using your own funds. When you place a spot order, you exchange one asset for another immediately or when your limit is filled. For example, if you want to buy Bitcoin using USDT, the full amount must already be in your wallet. Once the order is executed, the asset becomes yours without any debt or additional obligations.

Margin trading, on the other hand, involves borrowing funds from Binance to increase your buying power. You still start with your own capital, but the platform allows you to borrow more and open a larger position than your actual balance would allow. This means if your trade goes in the right direction, the gains and losses can be much bigger than in spot trading.

Another key difference is the way positions are managed on spot vs. margin trading. Spot trades do not require monitoring beyond their entry and exit strategy. There’s no debt, no interest, and no liquidation risk. In margin trading, each open position is tied to the loaned funds and is constantly monitored by the system. If the margin level falls too low, Binance can automatically liquidate your position to recover the borrowed amount.

Spot trading is for users who want direct ownership of crypto and less risk. Margin trading is designed for those who are confident in market direction and want to trade with leverage. The risk is higher, but so is the reward.

What is the Difference Between Futures and Margin Trading on Binance?

Margin trading on Binance involves borrowing funds to trade larger amounts than your actual balance allows. You put down a portion of the trade’s value as collateral and borrow the rest from the platform. You are charged interest on the borrowed funds, and your assets serve as security. You still own the assets you buy, and the trades happen on the spot market. That means you’re buying or selling real cryptocurrencies.

Binance Futures trading works differently. You are not trading actual coins. Instead, you are trading contracts that track the price of cryptocurrencies. You don’t own the asset, but you can still profit from its movement. These contracts allow you to bet on future prices of crypto assets.

There’s no interest charged like in margin trading, but there is a funding fee that shifts between buyers and sellers based on market conditions. One similarity you will see in Binance margin or futures, is leverage and liquidation risk. Futures contracts also offer leverage, which is often higher than margin trading (up to 125x), but the risk of liquidation is greater too.

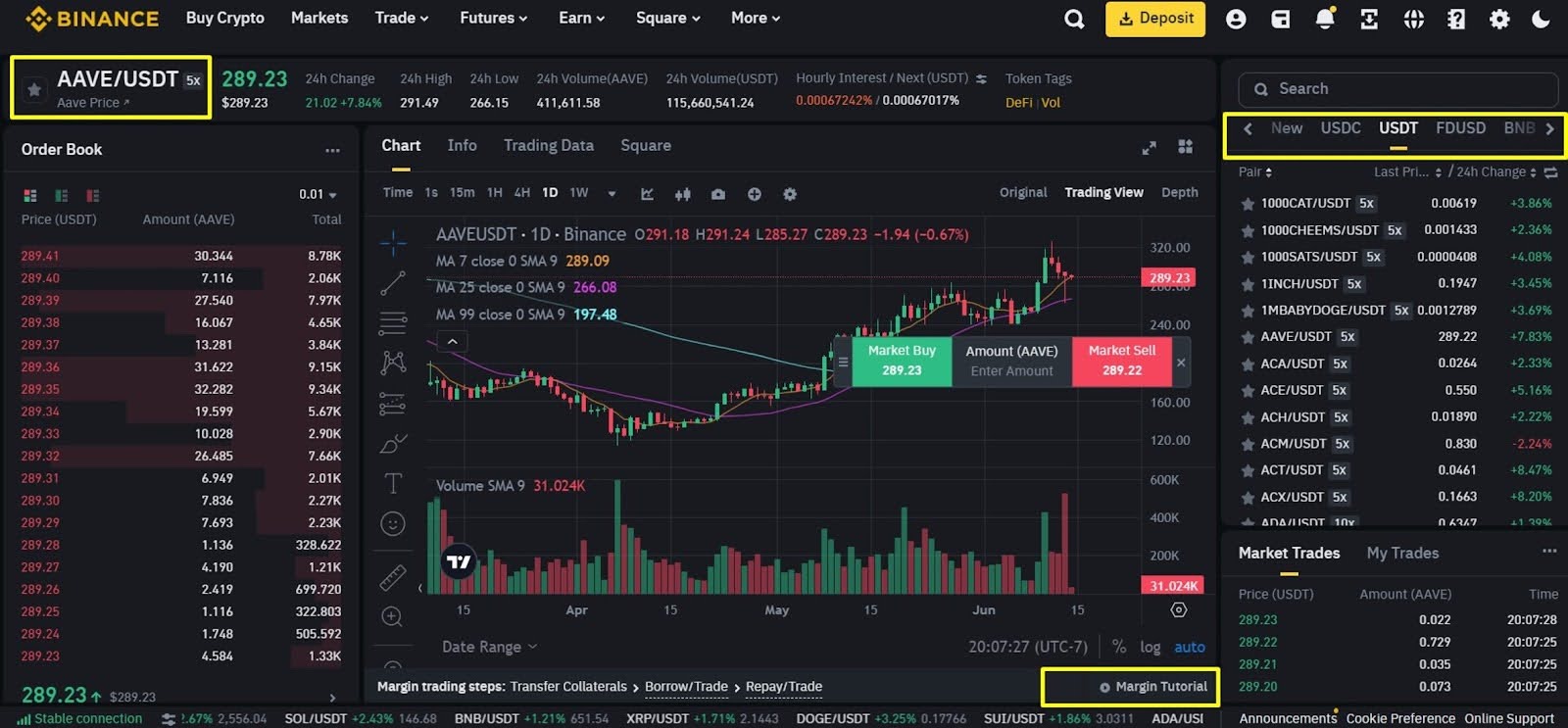

How to Margin Trade Crypto on Binance?

Here is a step-by-step guide on how to margin trade crypto on Binance.

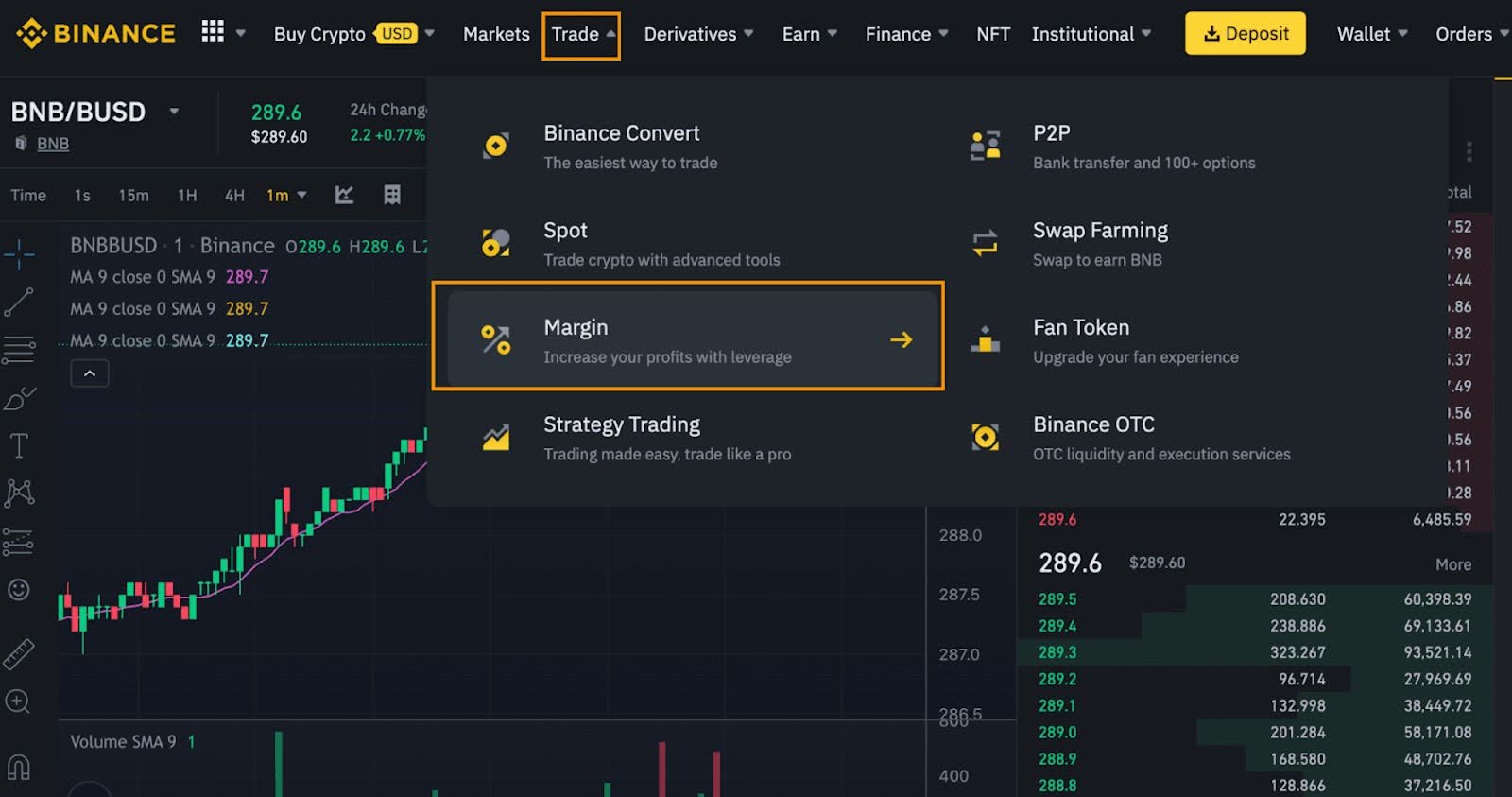

Step 1: Enable Margin Trading on the Binance App or Website

Start by logging in to your Binance account. From the main dashboard, navigate to your wallet and click on the margin section. If you haven’t, you will be prompted to complete identity verification and accept Binance’s margin trading terms.

Step 2: Transfer Funds into Your Margin Wallet

To begin trading, move funds from your spot wallet into your margin wallet. This amount will serve as your collateral. Based on your deposit value, Binance calculates how much you can borrow. The more you fund your wallet, the higher your borrowing power.

Step 3: Borrow and Choose a Trading Pair

With funds in your margin wallet, select the crypto pair you want to trade. Binance allows you to borrow additional assets to increase your position size. You can then decide whether to go long or short depending on the market direction. If you expect the asset to rise in value, you go long. If you expect it to fall, you go short.

Step 4: Place Your Order and Monitor Your Margin Level

After choosing your trading pair and borrowing funds, place your order. Binance gives you the option to use either cross or isolated margin. Cross margin uses all the funds in your margin wallet to protect open trades, while isolated margin limits risk to the specific trade.

Once your position is open, monitor your margin level closely to avoid liquidation. If it falls below the required threshold, Binance will liquidate your position to recover the borrowed funds.

How to Set Up a Margin Account on Binance?

To use Binance Margin for trading, you need to activate margin trading on your account. Here’s a step-by-step guide on how to set up a margin account on Binance from scratch.

Step 1: Log In and Complete Identity Verification: Start by signing in to your Binance account. If you don’t have one yet, create an account via the Binance app or official website using a valid email address and a strong password.

Then, complete the KYC verification process. This step is necessary before you can access any margin-related features. If you’re new to the platform, consider checking out a detailed Binance review first to understand how it works and whether it fits your trading goals.

Now is the moment to join Binance and try margin trading.

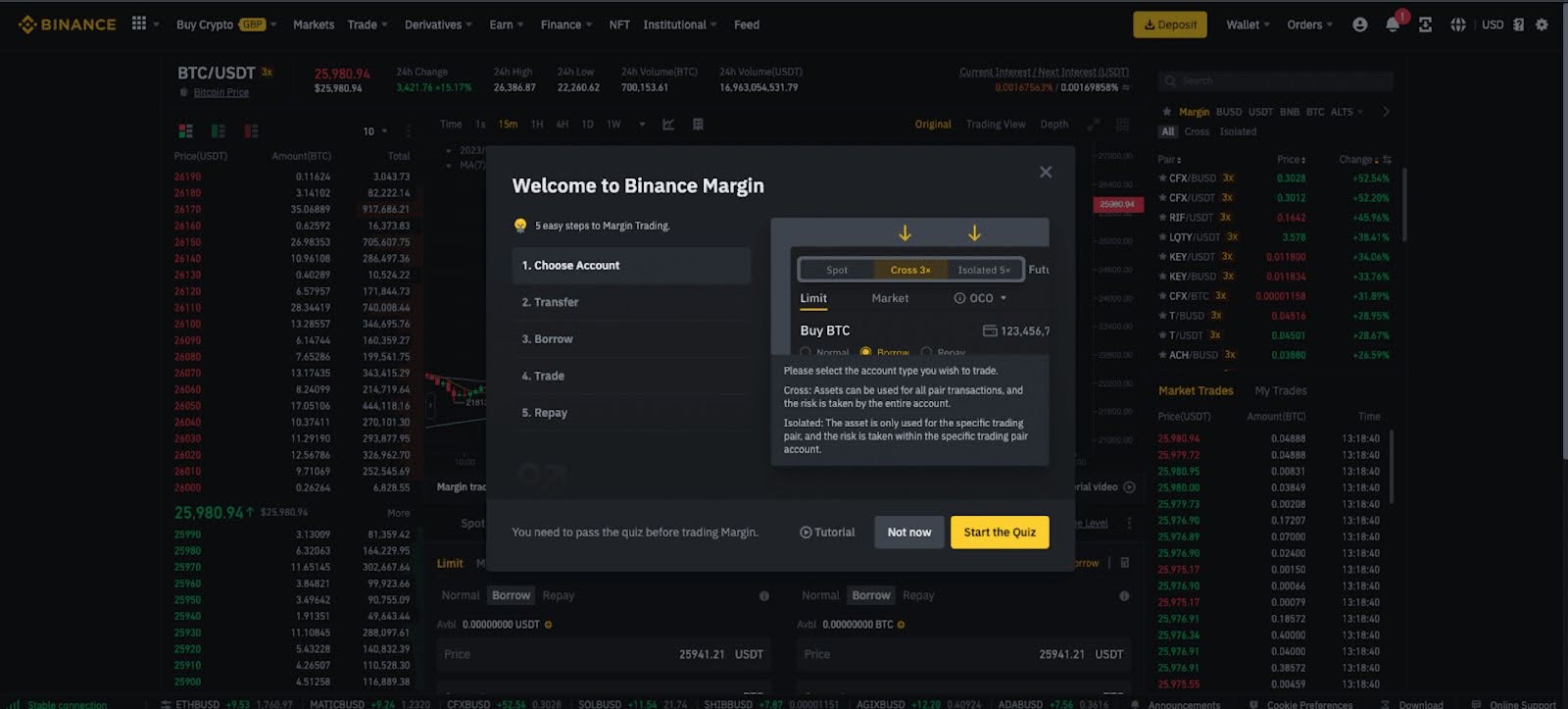

Step 2: Navigate to the Margin Trading Section: Once your identity has been verified, head to the “Wallet” section at the top of the screen. From there, select “Margin” and you will be taken to the Binance Margin interface. You’ll be required to complete a short quiz about the risks of margin trading before continuing.

Step 3: Enable Margin Trading: After completing the quiz, you can enable your margin wallet. Binance will ask you to confirm that you understand the risks involved. Once you accept the terms, your margin wallet becomes active, and you can start transferring funds into it.

Step 4: Transfer Funds and Begin Trading: Move funds from your spot wallet into your margin wallet to begin trading. Once the funds reflect, you can borrow assets and start margin trading across supported pairs.

If you’re opening your first margin account, Binance occasionally offers exclusive bonuses to new users, including lower trading fees and rewards on your first trades. Check out this Binance referral code article to see how these bonuses work and how to qualify.

How to Qualify for Binance Margin Trading?

Before you can borrow funds or place trades using leverage on Binance, you need to meet a few key requirements. These steps help protect your funds and ensure that you understand the risks involved.

- Complete Identity Verification

This is the first and most crucial step. Binance needs to know who is using the platform. You’ll be asked to upload a government-issued ID and a clear photo of yourself. The identity verification process enables Binance to comply with international regulations and provides an additional layer of security for your account.

- Pass the Margin Trading Quiz

After your identity has been verified, Binance will prompt you to take a short quiz. The questions focus on how margin trading works, the risks of using borrowed funds, and what can happen when the market turns against you. The purpose of this quiz is to check that you understand the basics before you start trading with leverage. You’ll need to pass this quiz before Binance will unlock margin trading features for your account.

- Agree to the Margin Account Terms

Once the quiz is done, you will be shown a set of terms and conditions. This is where Binance outlines how the margin system works, what happens during liquidation, and how interest is calculated on borrowed funds. Accepting these terms means you are aware of your responsibilities and the platform’s policies.

- Check for Regional Restrictions

Binance does not offer margin trading in every country. Specific locations are blocked due to legal or regulatory reasons. Even if your identity is verified, you won’t be able to activate margin trading if Binance has restrictions in your region. To avoid confusion, it’s a good idea to check Binance’s list of supported countries before opening a margin trading account.

- Keep a Clean Account Record

Binance may withhold margin access if your account has unresolved issues. This could include suspicious activity, incomplete verification, or flagged transactions. If you’ve used the platform for a while, keeping your account history clean can help avoid delays when applying for margin access.

Take advantage of new user rewards and start trading with 10% fee discounts on Binance margin pairs.

How to Transfer Collateral on Binance Margin?

Below is a step-by-step guide on how to transfer collateral on Binance margin

Step 1. Log in to Your Binance Account: Begin by signing in and navigating to the Wallet section. From the available options, select Margin Wallet. This is where you’ll find your available balance, borrowed funds, and margin level.

Step 2. Click the Transfer Button: Inside your margin wallet, locate and click the Transfer button. This will open a short form that allows you to transfer funds internally from your Spot Wallet to your Margin Wallet.

Step 3. Choose the Crypto You Want to Use: Choose which asset you want to transfer. Binance allows you to use coins like Bitcoin, Ethereum, USDT, or BNB as collateral. Your choice here depends on what you already own and what you’re comfortable using.

Step 4. Enter the Amount and Confirm: Type in how much you’d like to transfer. The more you transfer, the more you can borrow, so keep your risk level in mind. After checking everything, confirm the transfer.

Step 5. Wait for Instant Confirmation: Your collateral will reflect in your margin wallet almost right away. Since the funds are being moved within Binance, there’s no fee or delay. Once the transfer is done, you’re ready to borrow and begin margin trading.

What Are the Best Margin Trading Tips for Binance Beginners?

Here are six beginner-friendly tips to help you manage risk and build confidence while margin trading on Binance.

- Start Small and Observe: Margin trading offers leverage, which can multiply both profits and losses. That’s why it’s better to begin with a small trade and invest only an amount you’re willing to lose. Use this early stage to observe how price movements affect your borrowed position and how quickly markets can change.

- Use Isolated Margin Mode: For new traders, using isolated margin is a safer starting point. It allows you to contain your risk in one position, rather than tying multiple trades together. If things go wrong, you only lose the funds assigned to that trade. That’s different from cross margin, where one bad trade could drain your entire margin account.

- Don’t Borrow the Maximum Limit: Just because you can borrow more doesn’t mean you should. Margin gives you access to extra funds, but it’s smart to borrow only what you can manage. Going all-in reduces your cushion and increases your risk of liquidation. Keep your leverage low, especially in the beginning, until you’re more comfortable managing price swings.

- Watch Your Margin Level: Your margin level tells you how healthy your position is. If it falls too low, Binance will automatically liquidate your trade to recover the borrowed amount. That’s why it’s essential to monitor your open position often.

- Set Clear Stop-Losses: Markets can move fast, and it’s easy to get caught off guard. A stop-loss acts as your safety brake; it closes your trade when prices fall below a certain point. This tool is especially helpful when you’re not watching the charts 24/7. Always plan your exit before you enter the trade.

- Reflect on Every Trade: After closing a trade, take time to go back and review it. Ask yourself what worked, what didn’t, and what you would do differently in the future. These small reflections help you spot patterns and avoid repeating mistakes.

Explore Binance’s built-in margin trading tools while earning from exclusive deals.

Does Binance U.S Offer Margin Trading?

No, Binance US does not offer margin trading. This is mainly due to stricter financial regulations in the United States. Margin trading involves borrowing funds to trade larger amounts, which adds a higher level of risk. US regulators have tighter rules around this kind of trading to protect retail and institutional investors.

Can I Withdraw Margin Money?

No, you cannot withdraw borrowed margin funds on Binance. The money is strictly for trading and stays in your margin account until you repay it. However, any unused funds you personally deposited, not borrowed, can be moved back to your spot wallet and withdrawn.

The post Binance Margin Trading Guide: How It Works and Key Tips for Crypto Traders appeared first on CryptoNinjas.

CryptoNinjas