Best No KYC Crypto Exchanges to Buy Crypto & Bitcoin (BTC) in 2025

The best no KYC crypto exchanges are MEXC, Bybit, dYdX, Uniswap, Pancakeswap, Changelly, CoinEx, PrimeXBT, Pionex, and ProBit. These platforms allow traders to buy, sell, swap, and invest in crypto without identity verification. Generally, these anonymous trading platforms are significant for users who prioritize privacy and want to avoid lengthy registration processes.

This article outlines ten of the best no KYC crypto exchanges in 2025 using criteria like security, trading options and supported cryptocurrencies, trading fees, and deposit/withdrawal options. We will also explain what KYC is in crypto. How to choose the best no KYC crypto exchange? And cover how to buy crypto and Bitcoin (BTC) without verification.

The best no KYC crypto exchanges are highlighted in the comparison table below:

| Exchange | Security | Trading Tools | Trading Fees | Deposit & Withdrawal Options |

| MEXC | 2FA Cold storage Address whitelisting | Copy trading Demo trading TradingView chart | 0.1% for makers and takers. The fees go as low as 0%. | Cryptocurrency transactions Third-party payment providers SEPA Bank transfers. |

| Bybit | Cold storage Two-factor authentication Insurance fund | Automated trading tools (bots) Spot, futures, and margin TradingView chart | 0.1% maker and taker orders in the spot market. 0.02% makers and 0.055% takers for futures. | Cryptocurrency transactions Credit/debit cards Bank transfers P2P trading. |

| dYdX | Ethereum protocol Self-custodial security measures Third-party audited. | Margin trading Perpetual contracts | 0.02% makers and 0.05% takers. | Crypto, credit and debit cards, and bank transfers. |

| Uniswap | Smart contract audits Cold storage Insurance. | Basic crypto swaps | Standard fee is 0.3%. | Bank cards, crypto, and third-party payment platforms. |

| Pancakeswap | Regular security audits 2FA Bug bounty program | Basic swaps | 0.25% for spot trading. | Credit card, debit card, and bank transfer. |

| Changelly | Withdrawal address whitelisting 2FA | Swaps and crypto trading (spot, margin, and futures). | Flat fee of 0.5% for crypto trading. | Credit cards, bank transfers, and Apple Pay. |

| CoinEx | Two factor authentication Regular security audits Multi-sig cold wallet storage. | Spot, margin, and futures trading. CET token benefits. | 0.120% maker and 0.20% taker (depending on 30-day trading volume). | Credit/debit cards, crypto, bank transfers, and third-party platforms. |

| PrimeXBT | Regular security audits Cold wallet storage Mandatory Bitcoin address whitelisting. | Futures trading Forex Stock indices No spot trading. | 0.05% | Direct crypto deposits and credit/debit cards. |

| Pionex | 100% reserves Multi-factor authentication Withdrawal address whitelisting. | Trading bots | 0.05% | Cards, bank transfers, and third-party payment platforms. |

| ProBit | 2FA FIDO security keys Cold wallet storage | Margin trading | 0.2% | Direct crypto deposits, bank transfers, and credit/debit cards |

1.MEXC

MEXC is a global centralized exchange that is available to crypto traders in over 100 countries to buy, sell, and invest in crypto without KYC verification. With only your email, you can register a new account on MEXC and deposit or withdraw funds at any time.

You can also buy and sell 2900+ cryptocurrencies, trade over 3000 pairs, and explore all of MEXC’s best features anonymously, including MX Token, MEXC launchpad, Kickstarter events, and various trading options. Here is a rundown of MEXC’s pros and cons.

The pros of MEXC Exchange are;

- Futures Demo Trading: The exchange offers a Demo Trading interface for new crypto traders to practice before investing their own money.

- Earning Options: Traders who want to earn passive income on MEXC can stake their crypto assets through Savings, Simple Earn, and New Token Mining with fixed and flexible terms for rewards.

- Copy Trading Tools: MEXC helps new users make the most of their investments by copying the trading strategies of more experienced traders.

The cons of MEXC Exchange are;

- Complaints About Locking User Funds: MEXC has been facing backlash for claims of locking user funds. This experience is not consistent among multiple users. However, most complaints from crypto users are related to account bans or freezes without prior notice.

- Might be Complicated for New Users: Due to MEXC’s large coin offerings and extensive features, trading crypto on MEXC might be challenging for beginners.

Register on MEXC today to get a 10% discount on trading fees and exclusive $1000 bonus rewards

2. Bybit

Bybit is the second largest centralized exchange in the crypto market by trading volume, with up to eight billion dollars. The exchange offers crypto trading services to over 60 million users globally and employs robust security measures to protect users’ assets.

Bybit is also a gateway to the web3 ecosystem, offering an in-built wallet option for users who want to mint, buy, or sell NFTs, explore DeFi projects, and other decentralized applications (dApps).

Additionally, Bybit offers various crypto trading products and services, including NFT marketplace, Bybit Earn, debit cards, crypto loans, and automated trading tools (bots, TradeGPT, and copy trading).

The pros of Bybit are;

- Advanced Trading Features: Besides the basic trading tools, ByBit offers advanced trading tools, like its AI-powered TradeGPT, which automates trading activities by giving users access to real-time market analysis and answers to technical questions.

- High Liquidity and Trading Volume: The crypto exchange has good liquidity and volume for crypto trading pairs. This allows traders to open and close positions easily, reducing.

- High Leverage Trading: Bybit offers leverage trading options up to 100x for spot, 50x for futures, and 10x for margin. This allows experienced traders to amplify their positions and boost their profits.

The cons of Bybit are;

- Restricted Access: Bybit is not available for users in the US, Mainland China, Singapore, Crimea, Cuba, Sevastopol, North Korea, Sudan, Iran, and Syria due to regulatory issues.

- No Direct Fiat Deposits or Withdrawals: Direct fiat deposits and withdrawals are unavailable in currencies like the USD (US Dollar), MXN (Mexican pesos), HKD (Hong Kong Dollar), and ZAR (South African Rand).

Sign up on Bybit now to unlock exclusive trading perks and claim up to USD 30,000 in new user bonuses

3. dYdX

dYdX derivatives exchange is a decentralized exchange that offers perpetual futures, margin and spot trading, crypto borrowing, and lending. Unlike some non KYC crypto exchanges on this list offering tiered verification, dYdX is a fully anonymous crypto exchange.

dYdX is the largest decentralized exchange by trading volume, and it is ideal for:

- Perpetual Futures Traders: Users who want to trade futures contracts without expiry dates. It offers leverage up to 25X, allowing crypto traders to go beyond simple crypto buying and selling.

- Experienced Margin Traders: dYdX allows users to trade on Ethereum, offering up to 5X leverage. For margin trades, dYdX offers isolated and cross-margin options to cater to various traders’ needs.

The dYdX crypto derivatives exchange is easy to use. However, it will be a better fit for advanced users and traders wanting to earn interest in long or short positions.

The pros of dYdX derivatives exchange are;

- Low Fees: dYdX offers low trading fees for average users whose 30-day trading volume is below $100,000.

- Crypto Lending: Traders can earn interest on dYdX by lending their crypto assets to other crypto traders.

- Fast Transactions and Low Gas Fees: dYdX uses ZK-Rollups to process transactions off-chain and finalize them on-chain, reducing transaction processing time and gas fees.

- Margin and Perpetual Futures Contracts: dYdX is recognized as the first DEX to provide contracts for margin and perpetual futures trading.

The cons of dYdX derivatives exchange are;

- Not Beginner-friendly: While dYdX provides simple swap services, the advanced trading tools for perpetual futures and margin might be a little complicated for beginners. Therefore, newbie traders should start with the spot market if they are looking to engage in more than crypto swaps.

- Limited Margin Pairs: Unlike other no KYC exchanges on this list, dYdX offers fewer trading pairs for margin trading.

4. Uniswap

Uniswap is a decentralized exchange, operating on the Ethereum network. The platform offers permissionless access, meaning that anyone can use it to swap ERC-20 tokens without an account or undergoing any form of verification.

Uniswap is perfect for large volume traders because it attracts large liquidity pools. This high liquidity allows traders to make more significant swaps with a lower price impact than exchanges with smaller liquidity pools. In addition, Uniswap has a smart router designed to split trades across multiple pools to get the best price possible.

The pros of Uniswap are;

- Intuitive Interface: Uniswap has a beginner-friendly web interface and mobile app.

- Low Entry Barriers: The exchange does not require registration or identity verification, making it easy for anyone to start trading crypto.

- Earn: Liquidity providers can earn fees by contributing to liquidity pools.

- Multiple Blockchain Networks: Uniswap supports about 12 blockchain networks, like Zora, Polygon, Arbitrum, and Ethereum.

The cons of Uniswap are;

- Additional Fees for Third-party Payments: Traders using third-party platforms like MoonPay pay more transaction fees.

- High Gas Fees: The transaction fee for swapping tokens on Uniswap is higher than normal ETH gas fees on crypto exchanges.

- Supports Ethereum Tokens: Uniswap supports only Ethereum tokens, so you can not trade BTC and other non-ERC-20 tokens.

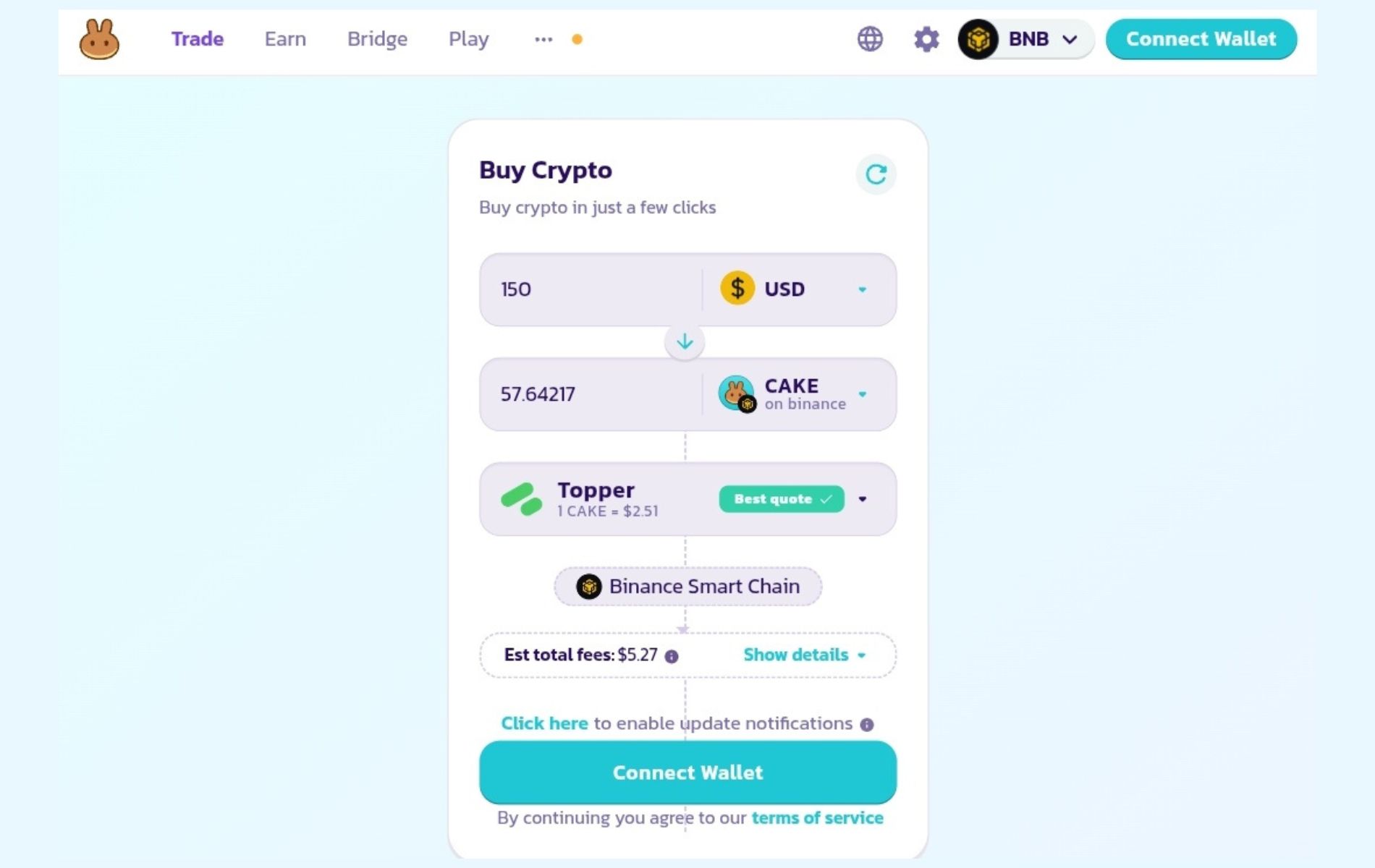

5. Pancakeswap

PancakeSwap is a decentralized exchange (DEX) built on the BNB Chain, launched in 2020. Similar to other DEXs, trades on Pancakeswap are completed through liquidity pools. In addition to providing liquidity, Pancakeswap users can stake their tokens and engage in yield farming.

Traders can also participate in the Pancakeswap lottery where they purchase tickets for a chance to win CAKE (the platform’s native token) based on random number draws.

The pros of Pancakeswap are;

- Liquidity Pools: Users can contribute to liquidity pools by depositing pairs of tokens. In return, they receive LP tokens representing their pool share, entitling them to a portion of the generated fees.

- Autonomy: As a decentralized exchange, Pancakeswap gives you complete control of your private keys.

- Supports Staking: Users can stake CAKE tokens to earn other tokens or additional CAKE.

The cons of Pancakeswap are;

- No Mobile App: Pancakeswap does not have a mobile app, but you can access the platform on your mobile phone.

- Supports Only BEP20 Tokens: You can not trade Bitcoin or other non-BEP20 tokens.

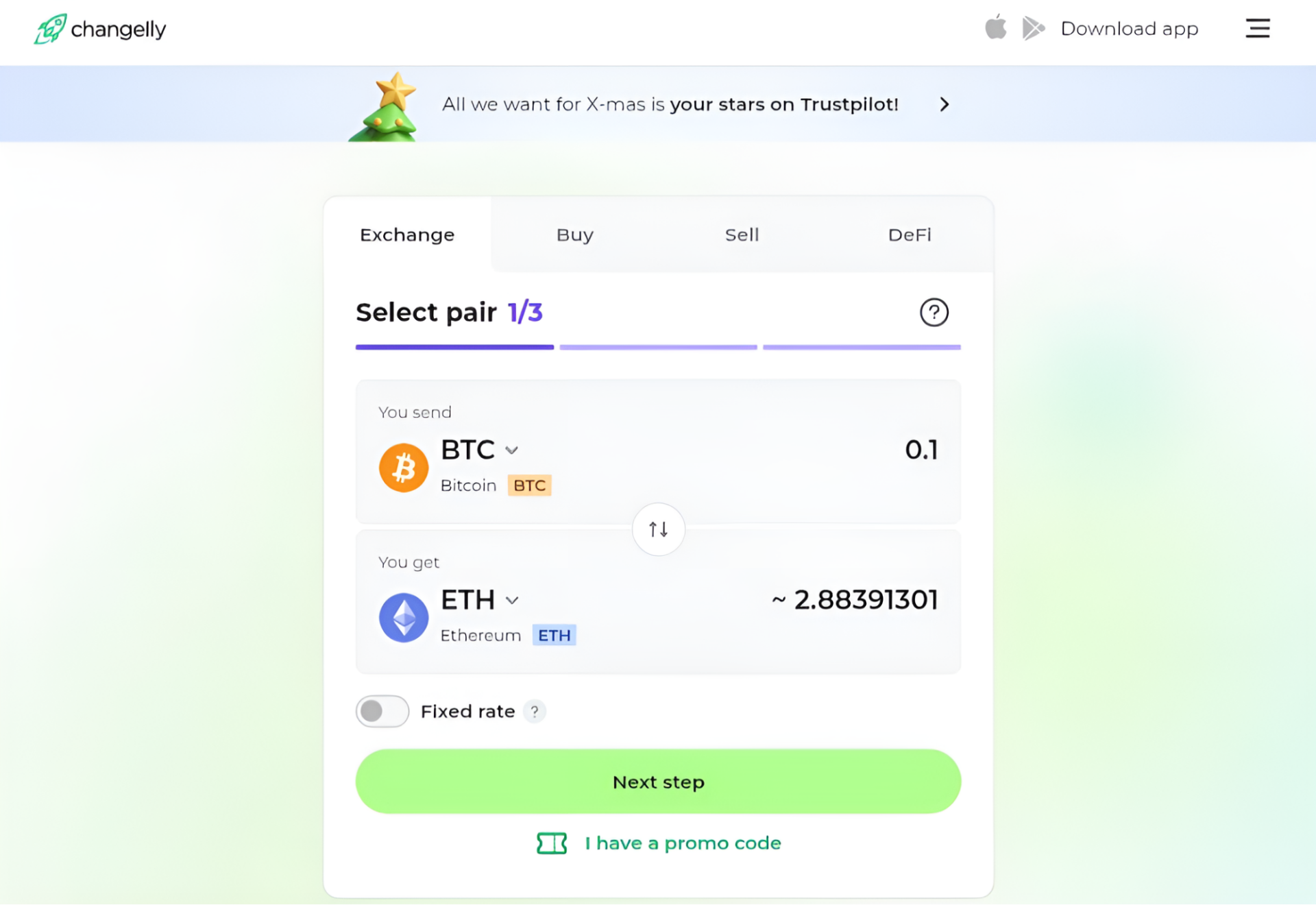

6. Changelly

Changelly is a non-custodial crypto exchange designed for users who value speed, simplicity, and privacy. Its standout feature is the ability to let users swap crypto for crypto and complete other transactions within minutes without an account or KYC verification.

You only have to provide a wallet address to receive crypto that you buy through the platform. Changelly partners with top wallet brands, like Trezor and Ledger, to offer crypto swaps directly from the user’s wallet without the funds ever landing on the platform.

The pros of Changelly are;

- Intuitive Interface: The mobile app is easy to use and packed with all the features available on the web interface.

- 24/7 Support: Changelly provides round-the-clock customer support.

- Easy Blockchain Network Identification: Tokens on Changelly are labeled with the corresponding Blockchain network for easy identification.

- Hybrid Platform: Changelly combines centralized and decentralized solutions for new and advanced traders who want to balance the features of CEXs and DEXs.

The cons of Changelly are;

- High Fees: Transaction fees on Changelly are higher than those of traditional exchanges.

- Hidden fees: Changelly could do better by offering more upfront clarity on all transaction costs.

- Limited Crypto-to-fiat Transactions: Traders in some locations have limited access to crypto-to-fiat pairs on Changelly.

7. CoinEx

CoinEx is a global cryptocurrency exchange that supports trading in various cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and Ripple. It has a user-friendly interface and offers advanced trading features, like advanced charting tools and multiple order types for spot, margin, and futures trading.

The no KYC crypto exchange particularly stands out for its robust and advanced security measures, including a high-speed matching engine, full-dimension protection, and 100% reserves to ensure the safety of user funds. In addition, CoinEx has a native cryptocurrency, CET, which traders can use to reduce trading fees.

The pros of CoinEx are;

- Robust Security: CoinEx offers advanced security features to protect unverified and verified users’ assets.

- Quick Withdrawals: Withdrawals on PrimeXBT have a fast processing time. There’s no need to wait long for the money to reach my wallet.

- Free Trading Contests: They have free trading contests that are fun to join and require no capital.

- Crypto Swaps: CoinEx has a separate section for instant and beginner-friendly crypto swaps. This feature makes it easier for traders to quickly and easily exchange their cryptocurrencies.

The cons of CoinEx are;

- Poor Customer Service: CoinEx customer support could be better

- High Fees for Crypto Deposits: Direct crypto purchases on CoinEx are expensive (between 2% and 8%).

8. PrimeXBT

PrimeXBT is a top contract for difference (CFD) exchange that offers a comprehensive suite of services to traders looking to trade various assets. These assets include cryptocurrencies, stocks, forex, commodities, indices and more.

However, these product offerings do not include spot trading, so if you are looking to trade assets in spot markets, please consider other exchanges.To ensure the safety of users’ assets, PrimeXBT conducts regular security audits, stores digital assets in cold wallets, and they require a mandatory white-labelling of Bitcoin withdrawal addresses

The pros of PrimeXBT are;

- Low Fees for Futures Contracts: PrimeXBT offers low trading fees for futures contracts.

- Copy Trading: They provide a copy trading interface for new users to copy the trades of experienced investors and maximize their investments.

- Free Deposits: PrimeXBT offers free deposits for fiat currencies and crypto.

The cons of PrimeXBT are;

- Limited Trading Options: No support for spot, margin, or options trading.

- High Withdrawal Fees: Fiat currency withdrawals on PrimeXBT are relatively expensive.

9. Pionex

Pionex is a cryptocurrency exchange that provides users with built-in and free access to bots for trade automation. This exchange has more than 12 bots that you can easily add to your account. The goal of Pionex bots is to simplify automated trading and cater to advanced traders and those with little to no experience.

While Pionex is most popular for its user-friendly and efficient bots, it also offers numerous features, including spot, futures, and leveraged trading. Pionex traders also enjoy low trading fees, good liquidity, and support for more than 250 coins.

The pros of Pionex are;

- Free Trading Bots: Pionex bots are free and easy to use. They have 12 free integrated bots with no coding or programming requirements.

- Low Fees: Pionex charges low transaction fees even for users with low trading volumes.

- Liquidity: Excellent liquidity engines aggregated from Binance and Huobi.

The cons of Pionex are;

- Limited Deposit/Withdrawal Options: No fiat currency deposit and withdrawal options.

- High Entry Barrier for Referral Program: Only users with a trading volume of USD 20,000 or more receive referral awards on Pionex.

10. ProBit

ProBit is a popular cryptocurrency exchange because of its user-friendly interface and strong security features. The KYC verification process on Probit is not mandatory, but it is tiered, meaning that you can use some of its features by registering with only your email verification.

The platform allows traders to use margins and increase their earnings. It also supports over 500 cryptocurrencies and initial coin offerings (IEO). It also provides earning opportunities, including staking through its native token, PROB, and arbitrage.

The pros of Probit are;

- Intuitive Interface: Probit offers a user-friendly layout and features for various trading activities.

- Rewards: Traders can earn rewards by holding PROB utility tokens.

- Passive Income: Probit offers users opportunities to earn passive income while trading.

The cons of Probit are;

- No Fiat Withdrawals: Probit does not support fiat withdrawals

- No Insurance Fund: Probit does not have insurance for customers’ funds.

What is KYC in Crypto?

The KYC in crypto is regulations that require crypto exchanges and other financial institutions to verify their customers’ identities since they facilitate financial transactions. Most centralized exchanges use KYC verification to prevent illegal activities like money laundering, scams, and terrorist financing.

KYC requires users to provide personal information, such as:

- Full Name

- Government-Issued ID (Passport, Driver’s License, etc.)

- Proof of Address (Utility Bill, Bank Statement, etc.)

- Selfie for Facial Verification (on some platforms)

Why Choose No KYC Crypto Exchanges?

There are many reasons why some traders prefer to use no KYC crypto exchanges.

- No Mandatory KYC: Users can trade without undergoing KYC verification and revealing personal information, like their date of birth, driver’s license, and other government-issued identification. This reduces the risks of identity theft if the exchange faces security issues.

- Quick Registration: Unlike regulated exchanges, you can register on no KYC platforms in under a minute and start trading immediately. All you need is your email or phone number, referral code (optional), and the unique verification code the exchange will send to your email.

- Avoid Local Regulations: No KYC exchanges allow users in restrictive regions to buy, sell, and trade crypto easily. For efficient trading, users in some regions may need to use a VPN anytime they want to trade on some non KYC crypto exchanges.

The good thing is that these crypto exchanges not only allow users to trade anonymously, but they also offer robust security measures to ensure that the optional KYC laws does not make your account vulnerable.

Are No KYC Exchanges Safe and Legal?

No KYC crypto exchanges are generally safe and legal because they implement strong security measures to keep user assets safe. Also, they are legal in the majority of the countries that they support but illegal in banned countries.

However, there are more risks when trading on such exchanges than on regulated crypto exchanges. For instance, the exchange reserves the right to seize digital assets or freeze accounts if they realize that you are trading from an unsupported country.

Also, there is a chance of encountering fraudsters or scammers, as lack of KYC procedures reduces accountability. Still, many no KYC crypto exchanges offer a tiered identity verification process, so they may be vulnerable to the same risks as KYC crypto exchanges.

Can the IRS Track my Crypto if I Use a Non-KYC Exchange?

No, the IRS can only track your crypto if you trade on KYC exchanges. This is because the IRS can follow your transactions and associate them with you through the personal information you provided during the verification process.

How to Choose the Best No KYC Crypto Exchange?

Consider the following factors when choosing a no KYC crypto exchange;

1. Security

When selecting a non KYC exchange to buy Bitcoin and crypto, carefully evaluate security concerns to protect your funds and data. While these platforms prioritize user privacy by allowing anonymous cryptocurrency trading, security risks and regulatory compliance are common in crypto exchanges, especially for centralized exchanges.

Ensure the exchange you choose has robust security features to protect your funds. The best centralized crypto exchanges should offer features like two-factor authentication, whitelist withdrawal addresses, offline fund storage, and undergo regular security audits. If you go for DEXs like Uniswap or Pancakeswap, check their smart contract audits and support for cold wallets.

2. Trading Tools and Supported Cryptocurrencies

Different exchanges provide various tools and markets for trading crypto. For centralized exchanges, opt for exchanges that support futures, margin, spot trading, and more. If you are going for decentralized exchanges, ensure their tokens swap and other features are seamless and easy to use.

Also, check if the exchange offers the cryptocurrencies you wish to trade because some non KYC crypto exchanges have limited options compared to their KYC counterparts. For instance, MEXC supports about 2900 cryptocurrencies while Bybit supports only 600+. Still, both cryptocurrency exchanges are among the best crypto exchanges for Bitcoin trading without verification.

3. Trading Fees

Some non KYC exchanges charge higher fees to compensate for the added risk of anonymous trading. Over time, these fees can reduce your profits, especially if you trade frequently. Compare Blockchain transaction fee structures across multiple non KYC crypto exchanges, depending on what you prefer. The best crypto exchanges have low or competitive trading fees, withdrawal charges, and deposit fees.

4. Deposit and Withdrawal Options

Some non KYC exchanges only allow crypto withdrawals, meaning you would need secondary cryptocurrency exchanges to convert your funds to fiat. So, ensure the no KYC exchange you select supports your preferred payment method. Common methods that most exchanges offer are direct crypto transfers, SEPA, debit/credit cards, and peer-to-peer transactions.

How to Buy Crypto and Bitcoin (BTC) Without Verification?

You can buy crypto and Bitcoin without verification from no KYC crypto exchanges. Exchanges like MEXC allow users to buy crypto and Bitcoin without verification. All you have to do is download the app and register a new account using your email and this MEXC referral code, then place quick buy orders for crypto and Bitcoin.

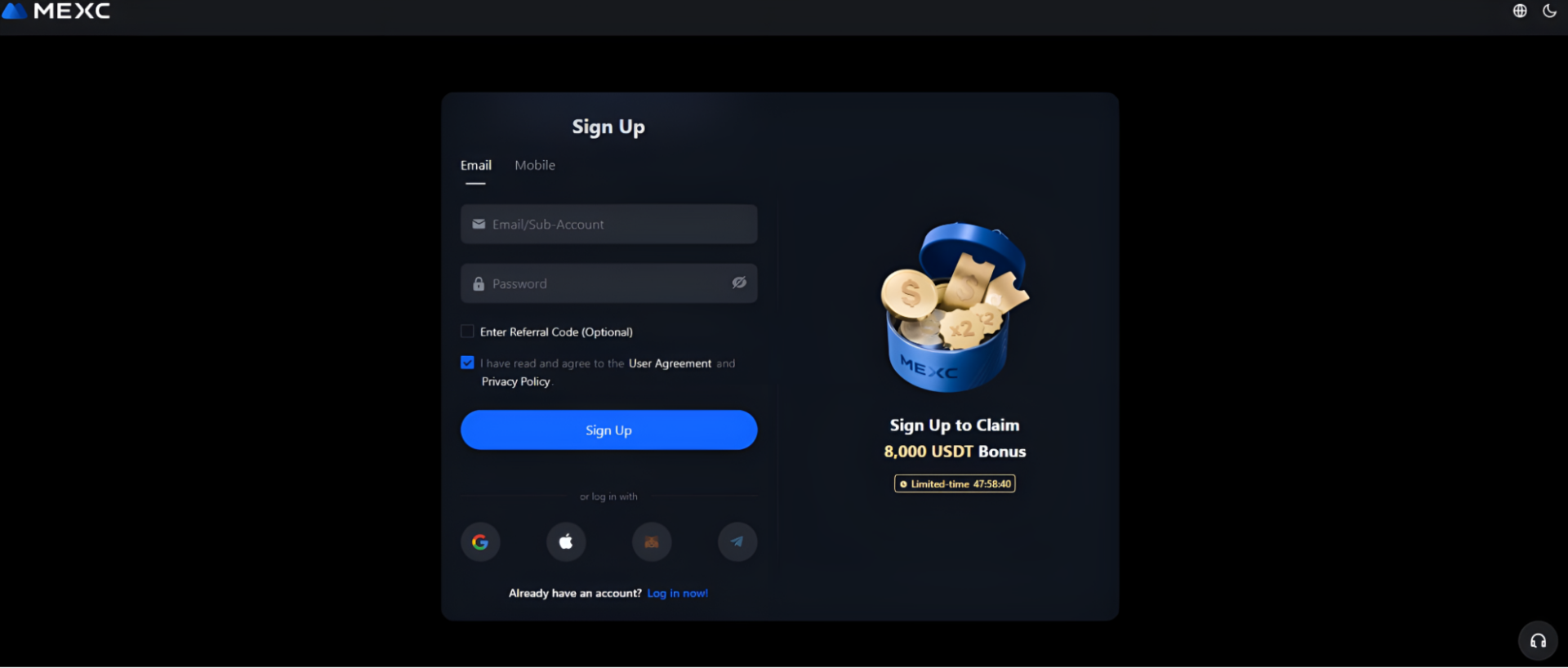

Here’s a straightforward process to register on MEXC and buy crypto and Bitcoin without verification:

- Go to the MEXC homepage or download the app on Play Store or App Store.

- Fill out your email or phone number in the registration form.

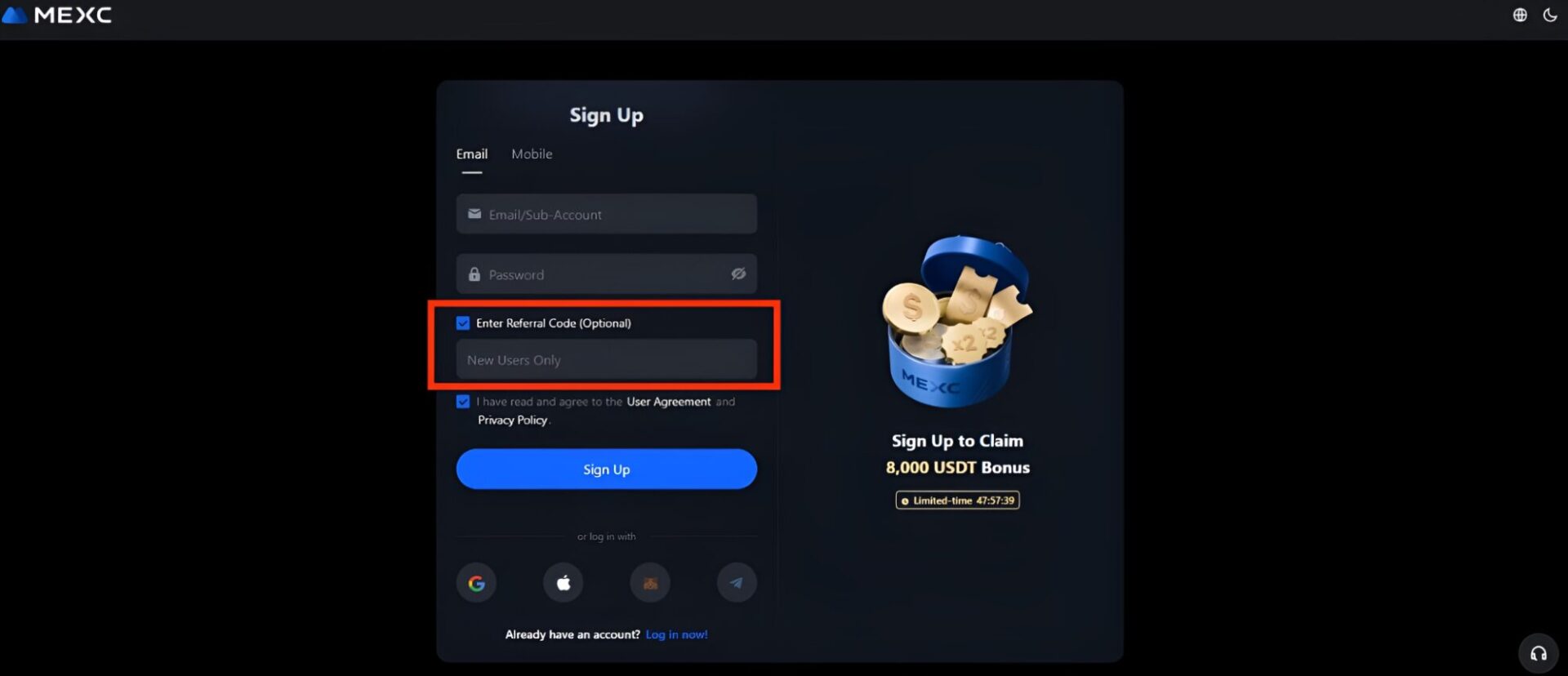

- Add this MEXC refferal code, CNJMEXCREF and click “Sign Up.”

- Verify your email or phone number with a 6-digit code or the link sent to your email and you are in.

- You can also log in to MEXC Exchange using a third-party account, like Google, Apple, MetaMask Wallet, or Telegram.

You only need an email to open an account on MEXC. Once your account is set up, you can buy your first crypto and Bitcoin.

Use this referral code, CNJMEXCREF, to open a new account on MEXC and get up to 8,000 USDT sign up bonus and exclusive rewards.

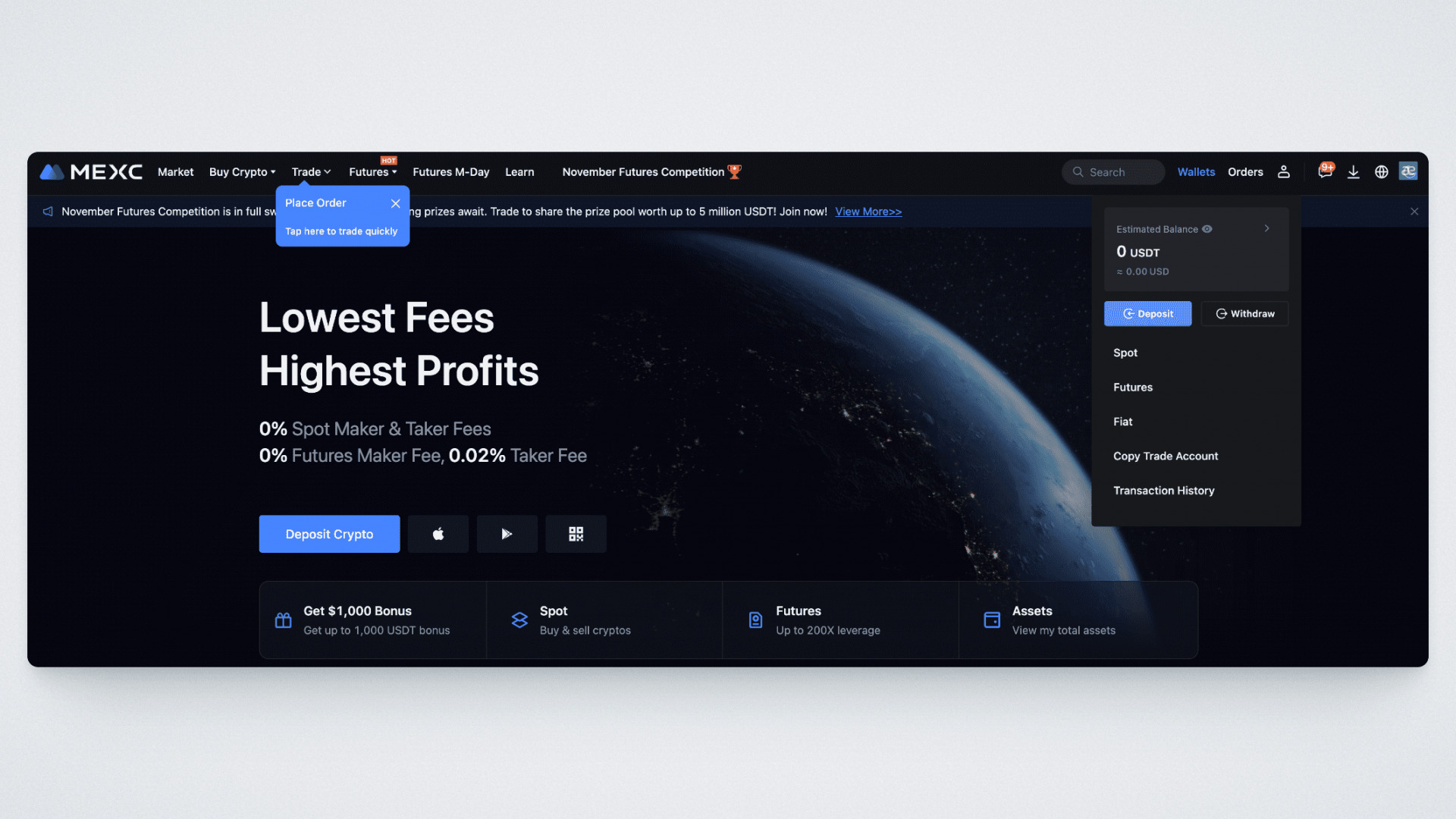

Login to your MEXC account and follow these steps to buy your first crypto or Bitcoin on MEXC Exchange without verification:

- Choose the “Deposit” tab, select the fiat currency to pay with (EUR, USD, JPY, etc), and select the cryptocurrency you wish to receive.

- Then, enter the amount you want to pay or wish to receive.

- Click (Buy Bitcoin or the crypto you selected) and use a suitable payment method to make payment.

- Once your payment is confirmed, the crypto you bought will automatically deposit into your MEXC account.

We do a detailed breakdown of MEXC and how to register a new account and start Bitcoin trading in this MEXC review article; check it out for more guidance. Also, if you want more centralized crypto exchanges to carry out crypto and Bitcoin transactions, you can explore our comprehensive list of the best crypto exchanges to broaden your search.

The post Best No KYC Crypto Exchanges to Buy Crypto & Bitcoin (BTC) in 2025 appeared first on CryptoNinjas.

CryptoNinjas