Are Retail Investors Behind The Bitcoin Price Surge This Bull Run?

As Bitcoin once again finds itself in price discovery mode, market watchers and enthusiasts are curious: has retail FOMO set in yet, or is the retail surge we’ve seen in past bull cycles still on the horizon? Using data from active addresses, historical cycles, and various market indicators, we’ll examine where the Bitcoin market currently stands and what it might signal about the near future.

Rising Interest

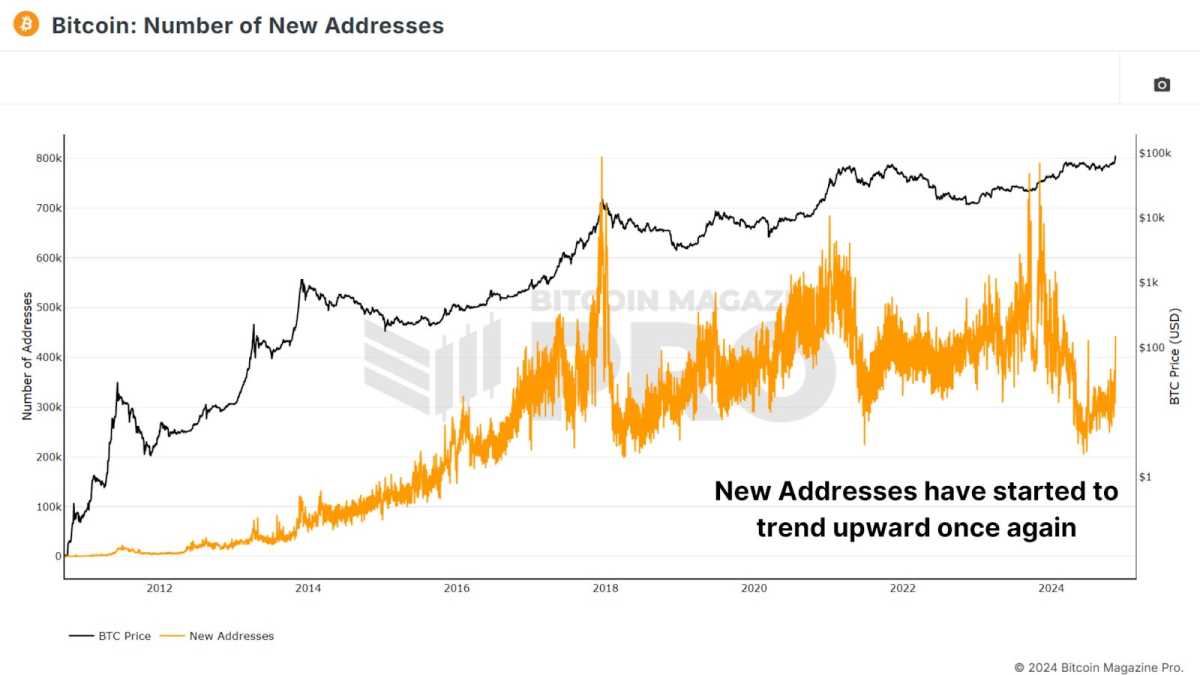

One of the most direct signs of retail interest is the number of new Bitcoin addresses created. Historically, sharp increases in new addresses have often marked the beginning of a bull run as new retail investors flood into the market. In recent months, however, the growth in new addresses hasn’t been as sharp as one might expect. Last year, we saw around 791,000 new addresses created in a single day—a sign of considerable retail interest. In comparison, we now hover significantly lower, although we have recently seen a modest uptick in new addresses.

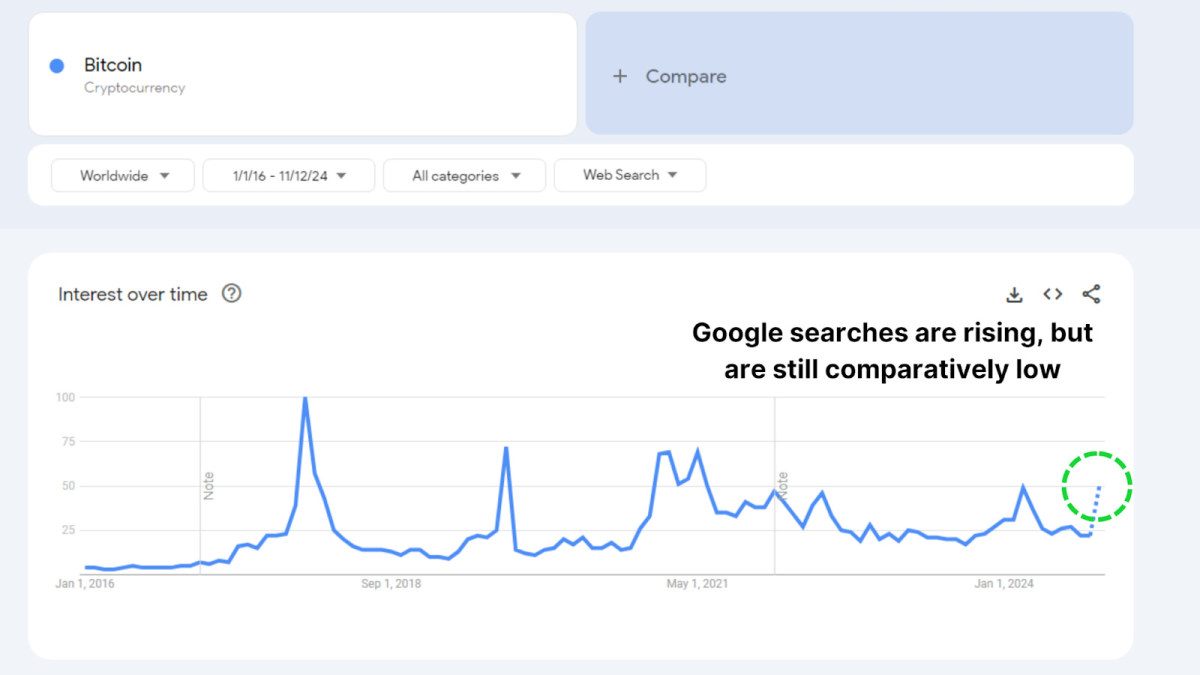

Google Trends also reflects this tempered interest. Although searches for “Bitcoin” have been increasing in the past month, they remain far below previous peaks in 2021 and 2017. It seems that retail investors are showing a renewed curiosity but not yet the fervent excitement typical of FOMO-driven markets.

Supply Shift

We are witnessing a slight transition of Bitcoin from long-term holders to newer, shorter-term holders. This shift in supply can hint at the potential start of a new market phase, where experienced holders begin taking profits and selling to newer market participants. However, the overall number of coins transferred remains relatively low, indicating that long-term holders aren’t yet parting with their Bitcoin in significant volumes.

Historically, during the last bull run in 2020-2021, we saw large outflows from long-term holders to newer investors, which fueled a subsequent price rally. Currently, the shift is only minor, and long-term holders seem largely unfazed by current price levels, opting to hold onto their Bitcoin despite market gains. This reluctance to sell suggests that holders are confident in further upside potential.

A Spot-Driven Rally

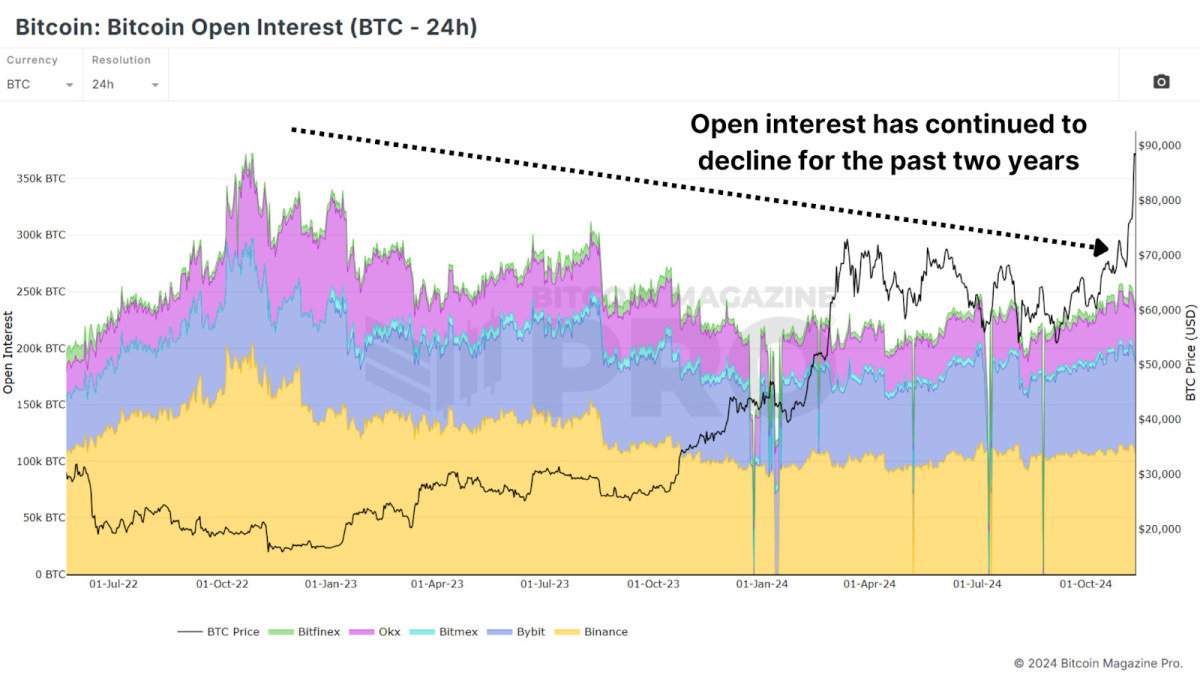

A key aspect of Bitcoin’s latest rally is its spot-driven nature, in contrast to previous bull runs heavily fueled by leveraged positions. Open interest in Bitcoin derivatives has seen only minor increases, which stands in sharp contrast to prior peaks. For instance, open interest was significant before the FTX crash in 2022. A spot-driven market, without excessive leverage, tends to be more stable and resilient, as fewer investors are at risk of forced liquidation.

Big Holders Accumulating

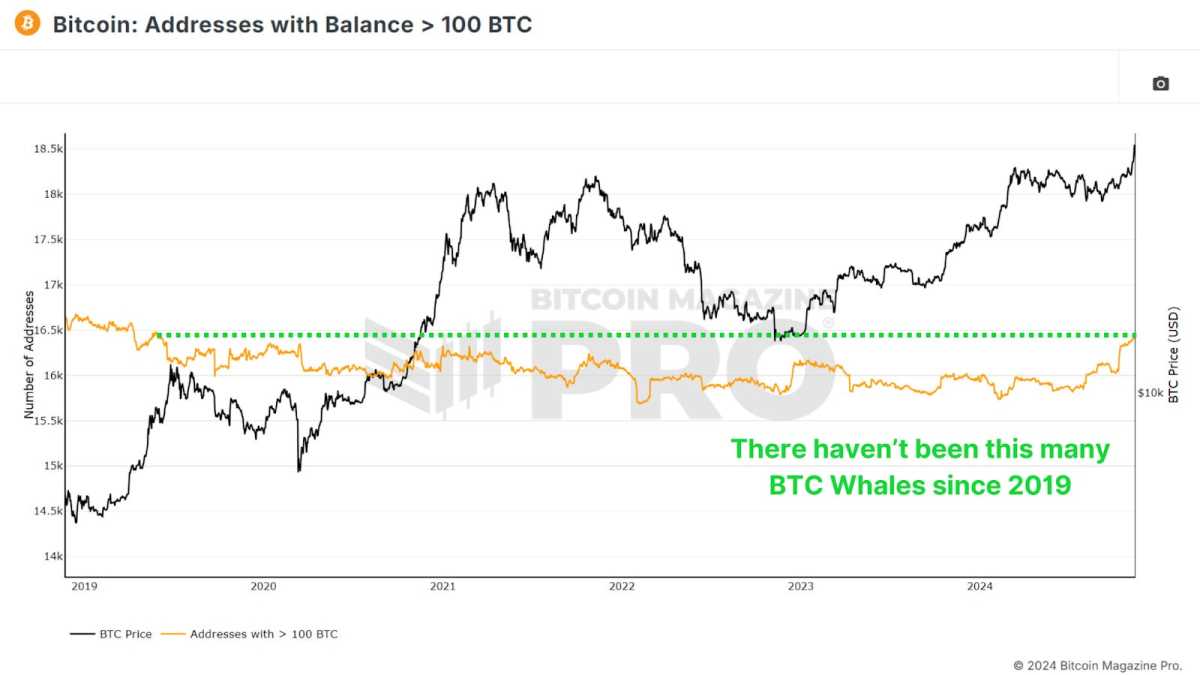

Interestingly, while retail addresses haven’t increased substantially, “whale” addresses holding at least 100 BTC have been rising. Over the past few weeks, wallets with large BTC holdings have added tens of thousands of coins, amounting to billions of dollars in value. This increase signals confidence among Bitcoin’s largest investors that the current price levels have more room to grow, even as Bitcoin reaches all-time highs.

In past bull cycles, we saw whales exit or decrease their positions near market peaks, a behavior we’re not seeing this time. This trend of accumulation by experienced holders is a strong bullish indicator, as it suggests faith in the market’s long-term potential.

Conclusion

While Bitcoin’s rally to all-time highs has brought renewed attention, we’re not yet seeing the telltale signs of widespread retail FOMO. The subdued retail interest suggests we may be only in the beginning phase of this rally. Long-term holders remain confident, whales are accumulating, and leverage remains modest, all indicators of a healthy, sustainable rally.

As we continue into this bull cycle, the market’s structure suggests that the potential for a larger retail-driven surge remains ahead. If this retail interest materializes, it could propel Bitcoin to new heights.

For a more in-depth look into this topic, check out a recent YouTube video here: Has Retail Bitcoin FOMO Begun?

Bitcoin Magazine – Bitcoin News, Articles and Expert Insights