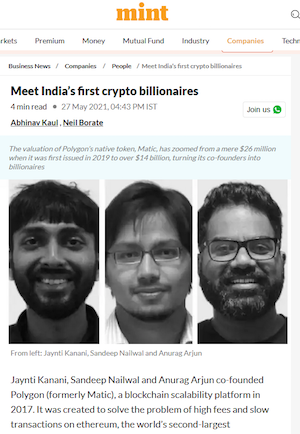

Slumdog billionaire 2: ‘Top 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

Read Part 1 here: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

Growing up in poverty in a Delhi ghetto with an alcoholic father and an illiterate mother, Sandeep Nailwal has always had a fire in his belly to achieve something better.

He wants to go big or go home — middling success is not an option.

“I am not doing something small,” he tells Magazine. “Okay, we build some network, and it has a token. It does well for one cycle and then fades into the dawn, and I make a few million dollars for myself and retire or whatever — this was not the plan.”

“We were very clear that we will build this, we will grow the community, and we’ll make it one of the biggest projects in the space.”

And that’s why, in his mind, Polygon — formerly Matic Network — is yet to truly succeed, despite nudging a $19-billion market cap at one point and joining the top 10 cryptocurrencies by market capitalization (it’s currently No. 13 with a $6-billion market cap).

“Being in the top 10, top 15 projects brings no satisfaction to me. It’s very clear in my mind that I want Polygon to have that kind of impact which Ethereum and Bitcoin have had. We have to go to the top three projects in the space. And that’s only when I would say that ‘OK Polygon has made it.’”

Part 1 of this feature told the story of Nailwal’s rise from grinding poverty to going all-in on Bitcoin with $15,000 he’d borrowed to fund his wedding and the difficult early days of Matic Network, where the threat of running out of funds was ever-present.

By mid-2019, Matic Network had raised $5 million in a Binance initial exchange offering to keep itself afloat and had launched the alpha version of its Ethereum layer-2 sidechain. But it was slowly becoming clear that the Plasma technology it was pursuing was not the answer the market was looking for.

Ideas around scaling had begun to change, and Plasma’s shortcomings (TLDR: complicated, better at transferring assets than running smart contracts) had seen it lose favor. Seeing which way the wind was blowing, the research-oriented Plasma Group decided to ditch the framework altogether in favor of building an Optimstic rollup and renamed the project “Optimism” in early 2020.

But the Matic Network white paper had outlined a Plasma-based solution with fraud proofs and a proof-of-stake checkpoint layer, and the team was determined to follow through and build it in 2019 and 2020, despite waning interest in the tech.

Mainnet market crash and resurrection

Just as the project was gearing up to launch its mainnet in May 2020, a worldwide pandemic and the March Black Thursday market crash intervened. Around 70% was wiped off the already paltry sub-3-cent price of MATIC within the space of 10 days. With fears of a new Great Depression gripping the world, Matic Network’s future again looked in doubt.

“Suddenly, everything felt like it will go to zero. That shock was there for two to three months. We survived that, but what we realized is that, you know, we started with Plasma technology, and now plasma is dead. And now we are launching our mainnet. People are, like, ‘Plasma is dead; there is no interest from the community.’”

Nailwal says the team came to two conclusions.

The first is they’d try and get as many developers and builders as possible. This was a success, as they launched their Ethereum layer 2 just in time for DeFi Summer’s ludicrous gas fees on layer 1.

The second conclusion was to never again put their eggs in one basket.

“We realized that we need to be multichain; we can’t be relying on one particular technology,” he says.

Long-term Ethereum community insider Mihailo Bjelic was also thinking about a multichain future and joined the project to become something of a bridge to markets and communities from which the team felt excluded at the time. Nailwal says the project’s roots in India meant it had a low profile in the Western world, where some considered it to be “just like another internet scam.”

Also read: Beyond crypto — Zero-knowledge proofs show potential from voting to finance

In early 2021, Matic Network rebranded as Polygon to highlight the change in direction. At the time, Nailwal told Cointelegraph the idea was to become “Polkadot on Ethereum” and to add Optimistic rollups, zero-knowledge (ZK) rollups and StarkWare-style Validiums alongside the PoS network.

But Nailwal says they quickly realized that Optimistic rollups were at best an “intermediate solution” that wouldn’t be able to scale up to have 50 chains working in the ecosystem.

“With ZK, you can imagine a world with […] 100,000 chains; each of them has 1,000 transactions per second (TPS); all of them combined together could be tens of millions of TPS in the whole network. And the architecture will still survive and keep scaling.”

“Infinite scalability, unified liquidity and that is the main point for why we bet on ZK because ZK is the endgame for blockchain scaling.”

Polygon bull-run fever

At the dawn of 2021, MATIC’s market cap was just $87 million. By mid-year, it had surged to almost $14 billion, and it was nearly $19 billion by year’s end. That’s in no small part due to its surging user numbers and ability to scale Ethereum.

At the end of 2020, it had fewer than 1,000 daily active users, but by October that year, it had surpassed Ethereum for the first time with 566,000 users in a day and had flipped ETH’s daily transactions, too, thanks to high gas fees on the L1.

Suddenly, the founders were very wealthy individuals, and the project itself had the funds to embark on a major acquisition spree.

In August, it snapped up the entire Hermez network for 250 million MATIC. The project became Polygon Hermez, an Ethereum Virtual Machine-compatible ZK solution focused on decentralization and a proof-of-efficiency consensus.

In December, it spent another $400 million in MATIC to buy the Mir team of ZK-proof experts to build Polygon Zero (ZK recursive scaling). And the acquisitions kept coming.

“We reached out to all of them. We said, ‘You want to work with us?’ And I think at that point in time, whatever was like number three, number four, number five, like we acquired all of them, because number one, number two did not come with us. (But) the talent in number three, four, five teams is super, super good.”

The venture capital seemed to think the new plan was a winner, with Polygon raising another $450 million in early 2022, selling MATIC tokens in a raise led by Sequoia Capital India and including Tiger Global and Softbank Vision Fund.

The advantages of having multiple teams taking different approaches became pretty clear.

“We initially kept them completely autonomous so they could pursue their own research, and they collaborated with each other. Due to that collaboration, suddenly, we got a ZK EVM, which people have thought is four or five years away.”

Read also

He says the ZK EVM took just 12 months to develop “because of the cross-pollination of ideas between these teams.”

Other ZK flavors developing under the Polygon umbrella include Miden (a StarkWare-like system with its own virtual machine) and Nightfall (Optimistic rollups meet zero-knowledge cryptography).

Bets each way on ZK, JavaScript is for midwits

The other big advantage of having multiple teams building different solutions is it doesn’t force Polygon to make the same hard choices other projects have had to make.

For example, StarkWare is betting that the additional performance provided by its Cairo virtual machine will make up for the fact that it’s much harder to port existing Ethereum projects over to StarkEx.

Most of the other projects — zkSync, Linea, Scroll, etc. — are making the opposite bet that less performance but easier compatibility with the Ethereum Virtual Machine will attract projects and see their solutions win market share.

Polygon is the only team with bets each way, with Polygon Miden following StarkWare with a ZK-optimised virtual machine. For his part, Nailwal thinks EVM will win in the short term, but other solutions will come into their own in the years ahead.

“I almost feel like EVM is like JavaScript right?” he says. “I remember when I was in first or second year of my engineering college… JavaScript was considered to be a programming language of the midwits! But today, JS is everywhere; maybe 80% of the web is powered by JavaScript. So, EVM kind of has those effects no matter how much you say, ‘These are the problems.’”

Nailwal adds, however, “Our plan is a 10-year-long plan. So, we have the ZK EVMs, we have Polygon Zero, but we also have Polygon Miden, which we believe is highly performant, has privacy features inbuilt […] and it will support all the programming languages.”

Miden founder Bobbin Threadbare told Magazine earlier this year that the Miden VM will enable users to do things like run high-quality video games and generate ZK-proofs on their home PCs they can send into the network.

“What they are doing, it gives me goosebumps,” Nailwal says. “But Miden will start blossoming in around one year. By that time, we, as the Polygon community, need to win the ZK EVM.” He hints that a new token and airdrop are being considered to help with this.

Ethereum upgrades to turbocharge Polygon L2s

Ethereum’s next big upgrade, EIP-4844, which is supposed to happen sometime before the end of the year, introduces proto-danksharding to make life easier for rollups, which Nailwal says is welcome but not a game changer.

“I think some estimates were saying up to 200–300 TPS only for the rollups. So, not a huge advantage, but it’s going to reduce the (gas) cost of the transactions.”

Full danksharding, which is “several years away,” according to the Ethereum Foundation, however, will multiply that improvement by the number of shards, currently expected at around 64.

“So, you can imagine that 64 multiplied by 200. So, there will be, like, you know, 12,000 TPS, all the rollups can support.”

In June this year, the project unveiled its Polygon 2.0 roadmap to become the “Value layer of the internet.” The vision is for a network of ZK-powered L2s that will seem like using a single chain to users thanks to a cross-chain coordination protocol. Builders can knock up their own ZK-powered L2 chain in a flash using Polygon’s Chain Development Kit.

The existing PoS blockchain will become a Validium, which is one approach to dealing with the data availability problem of how to affordably store stuff on Ethereum.

The roadmap will also see MATIC tokens upgraded to a new token called POL (short for Polygon) and introduce the controversial concept of restaking, which enables token stakers to earn additional rewards by helping secure other networks.

“The POL token is basically the hyper-productive, third-generation token. You can validate on multiple chains, and you can validate for multiple roles: You can be an aggregator, you can be a sequencer, you can be a data availability provider, and you can be a prover. So, with the same token, you can actually stake on multiple layers.”

Restaking is controversial in the Ethereum community, with critics arguing it could turn into an unstable house of cards. But Nailwal says POL will be natively integrated into the ecosystem rather than added by third parties on top, as with Ethereum’s EigenLayer, which will mitigate the risks.

“With Polygon, risk-taking is more enshrined in the protocol; this is part of the protocol; this is how the protocol behaves,” he says.

“If you’re a validator and you are running 100 chains, and of those 100 chains you falter or you do fraud on one chain, you get slashed from all of them,” he continues, adding he’s not sure EigenLayer could implement that — “especially when they are building on top of something.”

“I think there are a lot of nuances where ours is much simpler and easier to do.”

Polygon 2.0 is like the internet of money

For Nailwal, the ultimate aim of Polygon 2.0 is to evolve crypto networks in the same way the internet evolved. The forerunner of the internet was ARPANET in the 1970s, then the invention of TCP/IP in 1983 allowed multiple networks to connect, forming an inter-network, which grew into the internet thanks to additional technologies like the Domain Name System and the World Wide Web.

“It’s interconnectivity of all the networks,” he says. “This is exactly what you see is happening on blockchains.”

“It’s very hard to move your money trustlessly from one chain to another; you use these bridges, which get hacked all the time. That’s why Polygon 2.0 is not only about having infinite scalability […] But it should also make sure that that value that is being created on these hundreds of thousands of chains also is connected and seamlessly movable.

He says the interoperable layer will enable value to flow between L2 chains, as well as Ethereum and potentially other layer-1 chains as well in the future if they join in.

“So, with this Polygon 2.0, we can achieve the same characteristics as the web has,” he says. “The Web3 network, whichever will win, should have infinite scalability and seamless transfer of value between these chains.”

“That’s why Polygon 2.0 architecture has got a lot of critical acclaim.”

Read also

Future for Polygon and Sandeep Nailwal

Even as the founder of a multibillion-dollar blockchain and living in luxury in Dubai, Nailwal still feels unsatisfied, as if he has yet to make the impact he feels he should. He looks up to world changers like Mark Zuckerberg, Satoshi and Vitalik Buterin — “a truly remarkable man.” So, mere wealth is not enough. He wants to make a lasting impact.

“I’ve never felt that Polygon has made it,” he says. “That part is very relentless in my mind, like there is no middle ground like this.”

“I think Bitcoin, Ethereum only can say that they have made it — nobody else, no other protocol can say that they’ve made it; they can die in a matter of six to 12 months.”

So, Nailwal won’t be happy until the Polygon ecosystem truly deserves to stand along Bitcoin and Ethereum as the bedrock of the entire industry

“We have to go to the top three projects in the space,” he says.

Read Part 1 here: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

Subscribe

The most engaging reads in blockchain. Delivered once a week.