Bitcoin bulls charge at $90K as traders eye CME gap for BTC price dip

Bitcoin (BTC) approached $90,000 into the first Wall Street open of 2026 with a new CME futures gap in focus.

Key points:

Bitcoin attempts a breakthrough at $90,000 as markets brace for the first US trading session of the year.

A new CME futures gap and long liquidations provide grounds for a BTC price dip.

Gold bounces back after a correction from all-time highs ends on New Year’s Eve.

Bitcoin CME gap sets stage for “messy” week

Data from TradingView showed a BTC price breakout attempt gathering momentum during the Asia trading session.

As TradFi markets returned, Bitcoin produced a new “gap” to the downside on CME Group’s futures market, providing a potential near-term target.

“Good one to keep an eye on in the week ahead,” trading account Daan Crypto Trades commented on X.

“Obviously it’s also almost weekend so we might be getting a few gaps and a bit of a messy chart to start the year off.”

As Cointelegraph reported, price tends to rise or fall to “fill” newly formed gaps within days or even hours of futures reopening.

Amid new January highs, trading platform TheKingfisher warned that prices may dip to take out late BTC long positions around $88,000.

A long liquidation cluster in building up on the $BTC high leverage liquidation map

If your liq price falls around 88k, we’d suggest adjusting your leverage/position

There’s a high likelihood you’ll get picked up 🎣 pic.twitter.com/WwbDRhWlkM

— TheKingfisher (@kingfisher_btc) January 2, 2026

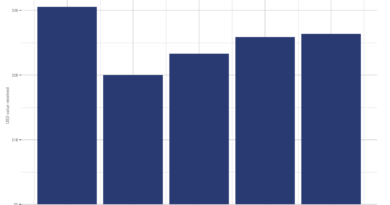

Data from monitoring resource CoinGlass showed liquidity on either side of the price building into the Wall Street open.

Cross-crypto liquidations for the 24 hours to the time of writing totaled more than $200 million as markets edged higher.

Gold creeps higher after new year cool-down

After dipping to end the year, gold rebounded to push toward a rematch with all-time highs on the day.

Related: Bitcoin RSI demands breakout as exec says ‚RIP‘ to 4-year BTC price cycle

XAU/USD was being held in check by $4,400 after becoming the winning major asset of 2025.

“Gold (+64%) was the best performing major asset in 2025 while Bitcoin (-6%) was the worst. Something we haven’t seen before in any calendar year (the inverse of 2013),” Charlie Bilello, chief market strategist at wealth manager Creative Planning, noted.

This week, Cointelegraph included Bitcoin’s relationship with gold and silver in four key charts to watch next.

Analysis argued that BTC’s relative underperformance was not a sign of a new bear market, but the “calm before the storm,” based on historical patterns.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.