XRP Whales Reallocate Funds to Emerging Payment Projects Like Digitap

For years, XRP was the go-to token when talking about bank rails and cross-border settlement. But lately, whales have been shifting capital toward newer payment projects that offer consumer products, easy onboarding, and more precise token mechanics. This trend is visible in whale behavior across wallets, as they look for the best altcoins to invest in today.

One project front and center in this rotation is Digitap ($TAP), a live omni bank. Unlike many early-stage tokens, Digitap already has a live app, visa integration, and $1M in presale traction. That combination is changing how investors evaluate payment plays. Where XRP depends on institutional corridors, Digitap focuses on getting real people to use payment rails today.

XRP’s Weak Momentum and The Whale Rotation

From a price perspective, XRP could be described as maxed out. It traded under $0.50 for much of 2024, before shooting above $3.0 in 2025. It presently trades at around $2.50 and is likely to require a long period of consolidation if it ever hopes to reach another 5x multiplier. It’s also not trading far from its ATH, a possible signal of limited upside compared to newer tokens.

XRP still has utility. The token trades with solid liquidity and has benefited from institutional tests. Yet whales care about momentum. When adoption stalls or on-chain growth remains flat, large holders look for faster growth opportunities. XRP’s score for immediate user adoption is weaker than that of newer alternatives that combine payments with card spending.

Because of this, many whales are reallocating a portion of long-held XRP into presales that show concrete retail results.

These buyers track active app installs, card usage, and on-chain burns. When a presale ties token value to revenue, large buyers become far more comfortable moving significant funds. That is the pattern currently unfolding.

Why Digitap Attracts Whale Liquidity

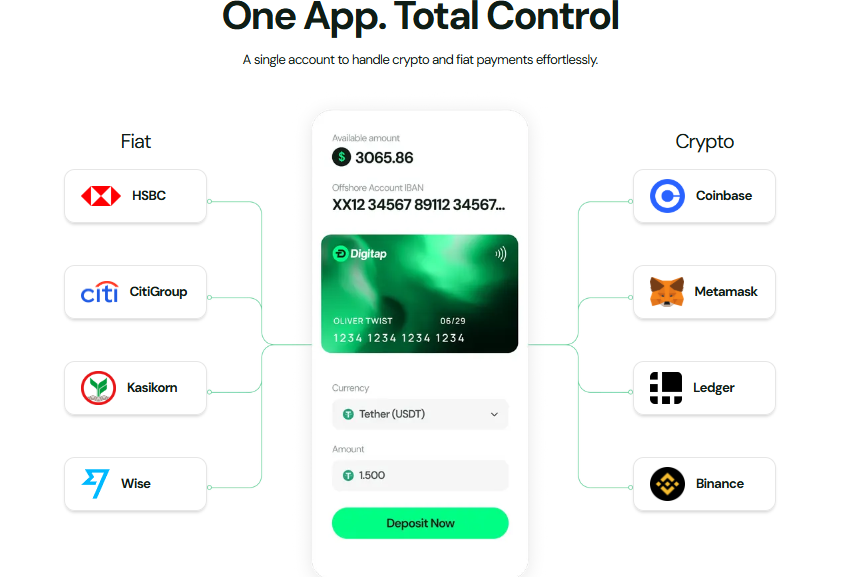

Digitap is a live omni bank that provides a comprehensive suite of services for citizens worldwide. This includes instant fiat-to-crypto conversions, one-tap PoS payments, Visa integration, 24/7 support, zero-KYC access, a crypto exchange, complete privacy, international IBANs, and more.

It’s a unified solution for banking, payments, and invoicing: one app, total control.

Digitap’s presale has crossed $1M and shows strong early demand. The current $TAP price is $0.0194, rising to $0.0268 in the next presale stage —an increase of nearly 40%. The app is live on Google and Apple stores, and users can onboard, move between stablecoins and fiat, and spend with a card. These are functions whales can measure and test before committing.

Token mechanics also matter. 50% of platform profits are used to burn tokens and reward stakers. That creates a direct link between usage and scarcity. For whales, that reduces the execution risk tied to pure speculation. They want tokens that can benefit from real revenue flows, and Digitap’s structure supplies that.

These USPs indicate why whales view $TAP as one of the best altcoins to invest in today — as demonstrated by capital reallocation.

Security & Market Adoption Advantages

Digitap’s onboarding is designed to be fast and accessible. It supports stablecoins and offers low-friction spending paths. This contrasts with the enterprise-first model that XRP often follows.

Consumers in many regions prefer immediate access and low friction. That difference drives adoption one user at a time. It’s also audited, verified, and certified by two respected third parties — Solidproof and Coinsult.

Whales see the difference in market penetration here. Digitap is likely to have massive appeal to the growing digital nomad and remote work population, who are fed up with banking bureaucracy, extortionate fees, and invasive KYC. It also targets the 1.4 billion globally unbanked people, denied access due to the same strict KYC requirements.

Whales watch adoption curves more closely than marketing hype. When a product begins to generate daily volume, whales often increase their positions ahead of broader retail interest. That behavior explains why money is leaving older payment plays and entering newer, consumer-focused tokens.

The World Needs a Next-Gen Payments App

The world needs a next-generation payments application. The traditional banking model is dead and incapable of meeting market preferences.

People are demanding a unified payments app that combines the best of crypto and fiat finance with minimal privacy intrusions, low fees, and full user ownership. Digitap is a clear example of a project that meets those criteria.

With over $1M raised, a live app, and strong token utility, it is no surprise that whales are reallocating capital. For the next wave of payment token winners, early product adoption combined with token scarcity appears to be the winning formula.

This shift does not mean XRP is dead. It remains a core infrastructure token for certain corridors. But when capital rotates, it favors projects that can show user adoption now, not promises in the future.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Read more: BNB Momentum Slows, Digitap Reports Strong Early Adoption

Disclaimer

Please be advised that all information, including our ratings, advices and reviews, is for educational purposes only. Crypto investing carries high risks, and CryptoNinjas is not responsible for any losses incurred. Always do your own research and determine your risk tolerance level; it will help you make informed trading decisions.

The post XRP Whales Reallocate Funds to Emerging Payment Projects Like Digitap appeared first on CryptoNinjas.

CryptoNinjas