Identifying Alpha Post-Meltdown: Are Bullbacks Still the New Pullbacks?

On 11 October 2025, the crypto market underwent one of the most violent deleveraging events in its history. What began as a shockwave from the geopolitical arena—a threatening post from Donald Trump regarding trade tariffs—quickly morphed into a systemic contagion. The result was a record-shattering $19.35 billion in liquidations, impacting over 1.6 million traders.

On 11 October 2025, the crypto market underwent one of the most violent deleveraging events in its history. What began as a shockwave from the geopolitical arena—a threatening post from Donald Trump regarding trade tariffs—quickly morphed into a systemic contagion. The result was a record-shattering $19.35 billion in liquidations, impacting over 1.6 million traders.

This wasn’t a simple price collapse; it was a catastrophic failure that highlighted the limitations of trading infrastructure on multiple major platforms. The chaos was led by a systemic breakdown at Binance, where flawed price oracles relying on illiquid internal spot markets created a death spiral. Assets like wbETH were marked at fractions of their real value, triggering unjust liquidations. The damage cascaded across the ecosystem, wiping out over 1,000 wallets on the derivatives DEX Hyperliquid, which saw a staggering $10.31 billion in liquidations alone.

In stark contrast, BitMEX weathered the storm with remarkable stability. Recording only $38.50 million in liquidations—a mere 0.2% of the market total—the platform performed exactly as designed. This resilience was not accidental – it was the direct result of a robust risk management framework, including:

- Fair Price Marking: Using a composite index from 16 major spot exchanges, which prevented the localised de-pegging spirals seen elsewhere.

- Operational Integrity: The trading engine remained fully performant with 100% uptime, and withdrawals continued without interruption.

- Human Oversight: An intentional “human-in-the-loop” system prevented the automated chaos caused by flawed oracles on other exchanges.

This event served as a powerful litmus test – not just for assets, but for the exchanges they trade on. In the wake of the crash, the assets that rebounded strongest did so in an environment where true price discovery was still possible.

If you believe the recent flash crash was a wick, and that the broader bull market still has legs, then the prevailing wisdom remains clear: Buy The F*cking Dip (BTFD). Since the start of the bull run in 2023, each major market flush has consistently reinforced this lesson. Historically, each ~20% drawdown acted as a powerful catalyst, sparking a fresh narrative that propelled the market’s next leg up, as seen with:

- May 2023: Telegram bots narrative

- June 2023: Bitcoin ETF + GambleFi

- July 2023: Friend.tech

- Aug 2023: Chinese coins

- Nov 2023: Memes

- Dec 2023: DEX + GameFi

- Jan 2023: LSD + L2

- Mar 2024: AI memes

… and so on.

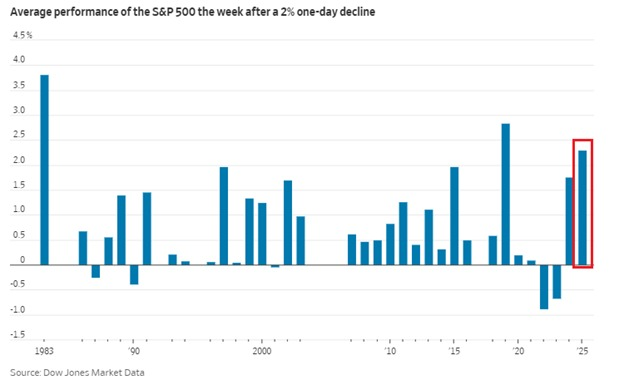

In fact, the Buy-the-Dip strategy has rarely been more effective in traditional markets like the S&P 500. In 2025, the S&P 500 averaged a +2.3% return in the week following any single-day drop of -2%. If you’re looking to BTFD, choosing the strongest post-crash narrative is your best bet. Our analysis filtered for assets that demonstrated the most explosive upside momentum, revealing the projects where market conviction remained unshaken.

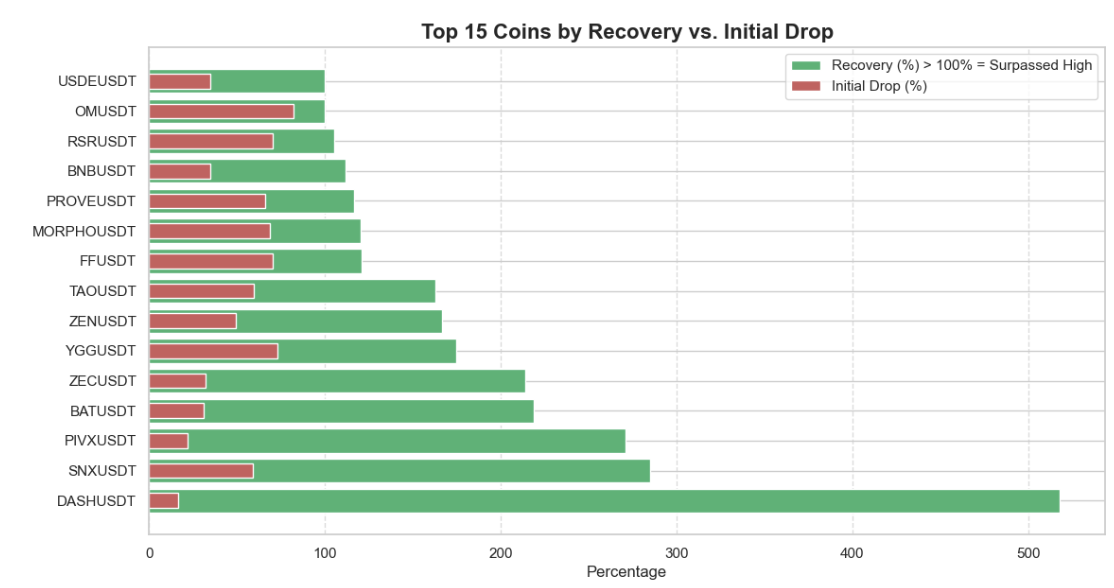

The Top 3 Recovery King Tokens to Look Out For

1. SNX (Synthetix): The DeFi OG Powerhouse Awakens with a New Perp DEX

Synthetix demonstrated a classic high-beta response to the market shock, enduring a deep 58.77% correction before mounting a fierce 284.73% rebound from its low of $0.51 to a new high of $2.58. The immediate catalyst for this aggressive recovery is a highly anticipated perp trading competition, which has galvanised the community and attracted elite traders, driving both volume and speculative interest. This short-term momentum is built upon its upcoming perp dex launch and its relatively low valuation as a once blue-chip OG DeFi protocol.

From a trading perspective, SNX remains a high-risk, high-reward asset. Its price action is notoriously volatile, with market makers known for engineering sharp moves that hunt stop-losses. Once the hype from the trading competition fades, the market’s attention will turn to the project’s ability to generate sustainable, real yield and expand its market share. For traders with a high-risk tolerance, SNX presents an interesting long opportunity particularly with the anticipated launch of its perp DEX. With a fully diluted valuation (FDV) of $500m, it still has significant room for growth compared to other perp DEXs like Hyperliquid and Aster, which boast $10bn FDVs.

2. TAO (Bittensor): The Convergence of AI and BTC Like Supply-Shock

TAO’s market performance is a case study in extreme volatility, executing a remarkable 162.98% recovery after a punishing 59.77% crash. This resilience is fueled by a potent mix of near-term catalysts and a powerful, long-term narrative in AI. Recent fundamental developments, such as the asset management features rolled out on the Yuma subnet and Grayscale’s public filing for a TAO trust, have provided a strong institutional tailwind. However, the most significant driver is the upcoming halving event in December. By algorithmically reducing token emissions, this event is designed to create supply scarcity, and the market is pricing in the potential for a “BTC-style” post-halving rally, creating a strong speculative floor.

Bittensor’s fundamental value lies in its ambitious goal to create a decentralised, open-market for artificial intelligence. By incentivising participants to contribute and rank machine learning models, it fosters a permissionless environment for AI innovation that stands in stark contrast to the closed ecosystems of tech giants. With the AI narrative only accelerating in the traditional finance field and a major supply shock imminent, TAO’s upside potential is immense for those who can stomach the volatility.

3. ZEC (Zcash): The Ultimate Insurance in Digital Privacy

Zcash cemented its status as the market’s premier privacy asset with a powerful 213.96% rally after a relatively contained 32.28% pullback. Its recovery speaks to a clear and growing market demand for its core function. The core catalyst remains its unwavering value proposition, perfectly captured by the mantra: “Bitcoin is insurance against fiat. Zcash is insurance against Bitcoin.” In an era of increasing on-chain surveillance and regulatory scrutiny, the “privacy premium” is becoming a tangible factor in asset valuation. This is not a cyclical trend but a secular one, driven by a fundamental need for financial confidentiality that a transparent ledger like Bitcoin cannot provide.

The fundamental strength of Zcash lies in its pioneering use of zero-knowledge proofs (zk-SNARKs), which remain the gold standard for enabling fully shielded, untraceable transactions. Recent developments, including the rollout of the Zashi wallet to improve user experience and ongoing research into a potential transition to a Proof-of-Stake consensus mechanism, signal a project that continues to innovate. The powerful rebound following the crash indicates that sophisticated capital flows into ZEC during times of uncertainty, viewing it not as a speculative tool, but as essential digital insurance. For traders, this positions ZEC as a unique portfolio hedge and a long-term play on the enduring demand for on-chain privacy.

Conclusion: Bullbacks are the New Pullbacks

The 11 October flash crash was a brutal event. It served as a stark reminder that in a market defined by leverage and volatility, counterparty risk is paramount. The catastrophic failures of several major exchanges underscored a critical truth: the alpha you capture is only as real as the stability of the platform you trade on.

The explosive recoveries of some of these altcoins amid the largest liquidation event may present a clear long signal, where capital aggressively sought out assets with clear catalysts, durable narratives, and indispensable roles within the crypto ecosystem. From DeFi infrastructure to AI innovation and digital privacy, these altcoins demonstrated that deep market conviction persists even in the face of panic.

The post Identifying Alpha Post-Meltdown: Are Bullbacks Still the New Pullbacks? appeared first on BitMEX Blog.

BitMEX Blog