Crypto Mining Pools 101: Types, Rewards and How They Work

Mining cryptocurrencies has become far more competitive than in Bitcoin’s early days. Instead of working alone, individual miners often join “mining pools”—groups that combine their computing power to find valid blocks faster and share mining rewards. This guide explains what a mining pool is, how the mining process works, and what to watch for when miners participate, from reward models to fees and operator policies.

What Are Crypto Mining Pools?

A crypto mining pool is a collective of miners who combine their computing power to increase the chances of successfully mining a block. Instead of working alone and competing against the entire network, miners in a pool share resources and rewards. When the pool finds a block, the payout is distributed among participants based on their contribution, usually measured by hashrate.

Mining pools emerged as block difficulty and competition grew, making solo mining less profitable. They allow smaller miners to earn more predictable rewards, turning mining into a steadier income stream rather than a rare, high-value event.

Fun fact: The first mining pool, Slush Pool, was launched by Marek “Slush” Palatinus in November 2010, establishing today’s standard of pooled coordination for Bitcoin miners.

How Crypto Mining Pools Work

A mining pool acts like a cooperative “super-miner.” It combines the processing power of many participants and connects to the blockchain as a single node. Individual miners run mining clients or specialized firmware that connects their hardware to the pool’s server.

The pool’s server assigns each miner a small slice of the cryptographic work, validates the results, and submits successful block solutions to the network. That cryptographic work mostly consists of running a hash function many trillions of times per second to try to find a valid block header.

When a block reward is earned, the payout is shared among members according to their contribution. This turns the rare, unpredictable rewards of solo mining into a steadier income stream.

Read more: Is Bitcoin Mining Legal?

The Role of Hashrate in Pool Mining

Hashrate is the measure of how many cryptographic calculations a miner performs per second. Inside a pool, this figure determines your weight in the payout. A rig that contributes 2% of the total pool hashrate can expect about 2% of the reward after fees. The more valid shares your machine submits, the clearer your contribution and the larger your cut.

Mining Pool Fees

Pools aren’t free. Typical charges range from 0.5% to 3% of earnings. For example, the ViaBTC Bitcoin mining pool charges a 2% fee rate, on the PPLNS payout model.

In general, you should look out for:

- Infrastructure fees that keep servers running.

- Transaction-fee policy, with some pools passing block fees to miners (FPPS), and others keeping them.

- Hidden costs like minimum payout thresholds or withdrawal fees.

Lower fees don’t always mean higher net income if uptime or support is weak.

How Work Is Divided

The pool breaks each block candidate into “jobs” and hands them out to miners:

- The server creates a modified block header with a lower “pool difficulty.”

- Each miner hashes until it finds a valid share at that difficulty.

- The pool tracks shares to measure contribution.

- When a share also meets the full network difficulty, the pool submits the block and distributes rewards.

This system lets even small rigs participate effectively without competing head-on at full network difficulty.

Occasionally, two miners find valid blocks at nearly the same time. Only one ends up in the longest chain; the other is called an “orphan block” (or stale block). Orphan blocks don’t earn the full block reward, so pools track and report them separately.

Slow block propagation (when news of a newly found block spreads slowly through the network) increases the chance that another miner finds and broadcasts a competing block first, which can create orphan blocks and lost rewards.

What Is the Purpose of Mining Pools

Mining pools exist to reduce payout variance across proof-of-work networks. Instead of waiting a long time for a solo block, miners combine hashrate so blocks are found more frequently and rewards can be split proportionally. This delivers steadier cash flow for electricity and hardware costs, whether you’re doing Bitcoin mining (SHA-256), mining Monero (RandomX), Litecoin/Dogecoin (Scrypt), or other PoW coins.

Read more: What is Proof-of-Work?

Beyond smoothing income, mining pools operate the coordination layer: they assemble block-candidate “jobs,” verify shares, and handle accounting and payouts (e.g., PPS, FPPS, PPLNS). Pools can also unlock extra revenue or broader participation.

The trade-off is concentration. Large pools make payouts predictable but can centralize hashrate under a few operators, which the community watches closely and addresses with protocol and market choices. Miners’ selection of pools (and diversification across them) helps maintain network health.

How Mining Pools Differ from Solo Mining

Solo mining means you run your own mining operations end-to-end: you connect hardware to a node, build block templates, and compete alone. Meanwhile, in a pool, many miners coordinate under one operator that handles the mining process, from job assignment and share accounting to payouts.

The choice is about variance, control, and operational complexity—but more importantly, profits. The question ‘Is mining worth it?’ has been asked for a while now, and it becomes more and more pressing every year. Pool mining definitely eases the upfront and upkeep costs on a singular miner, and, though it divides profits among more miners, it can still come out ahead in some cases.

Read more: Most Profitable Crypto To Mine

Types of Mining Pools

Mining pools fall into two broad models: operator-run (centralized) and peer-to-peer (decentralized).

There is no single “best mining pool.” The right choice depends on fees and payout method, uptime, transparency, geography/latency, and your tolerance for variance and operator risk.

Learn how to spot scams and protect your crypto with our free checklist.

Centralized Mining Pools

Centralized mining pools are operator-run services that coordinate many miners as one large “virtual miner.” The operator builds block templates, sets share difficulty, tracks shares, and pays miners by a stated method. In a pool of this type, your rigs connect to pool endpoints. The pool assigns work, verifies submitted shares, and submits blocks it finds to the network. Rewards are credited at fixed intervals per the pool’s payout policy.

Pros. Simple setup, frequent payouts, detailed dashboards, broad coin/firmware support.

Trade-offs. Operator fees and policy risk; hashrate concentration can create systemic concerns (e.g., GHash.io briefly exceeded 51% in 2014).

Best for. Most miners, who want a predictable cash flow and minimal overhead.

Decentralized / P2Pool Mining

Decentralized mining pools are a peer-to-peer alternative with no central pool operator. Miners run nodes that form a network and mine to a shared “sharechain.” When a block is found, payouts are made directly based on recent shares, without a custodial pool wallet. Each node builds/relays block templates and validates shares roughly every ~30 seconds. Contribution is accounted on-chain (the sharechain), so you keep custody and avoid an operator bottleneck.

Pros. No single point of failure, stronger miner sovereignty, transparent accounting.

Trade-offs. More setup and bandwidth; slightly higher short-term variance than large centralized pools.

Best for. Miners who value decentralization and custody over convenience.

Cloud Mining Pools

Cloud pools are operator-run services that sell hashrate. You rent a set amount of power (e.g., TH/s) and the provider points hardware to a pool, then credits your account per the chosen payout method. You don’t manage machines, power, or cooling.

Here, you pay an upfront or ongoing fee plus maintenance. The provider aggregates customers’ rentals and mines via their own or third-party pool infrastructure. Payouts depend on contract terms, network difficulty, and hashprice.

Pros. Zero on-site operations; fast start.

Trade-offs. Counterparty and solvency risk, opaque fee stacks, frequent underperformance; the sector has a history of scams, so due diligence is essential.

Best for. Users who cannot host hardware but accept elevated provider risk.

Read more: What Is Cloud Mining?

Common Reward Distribution Methods

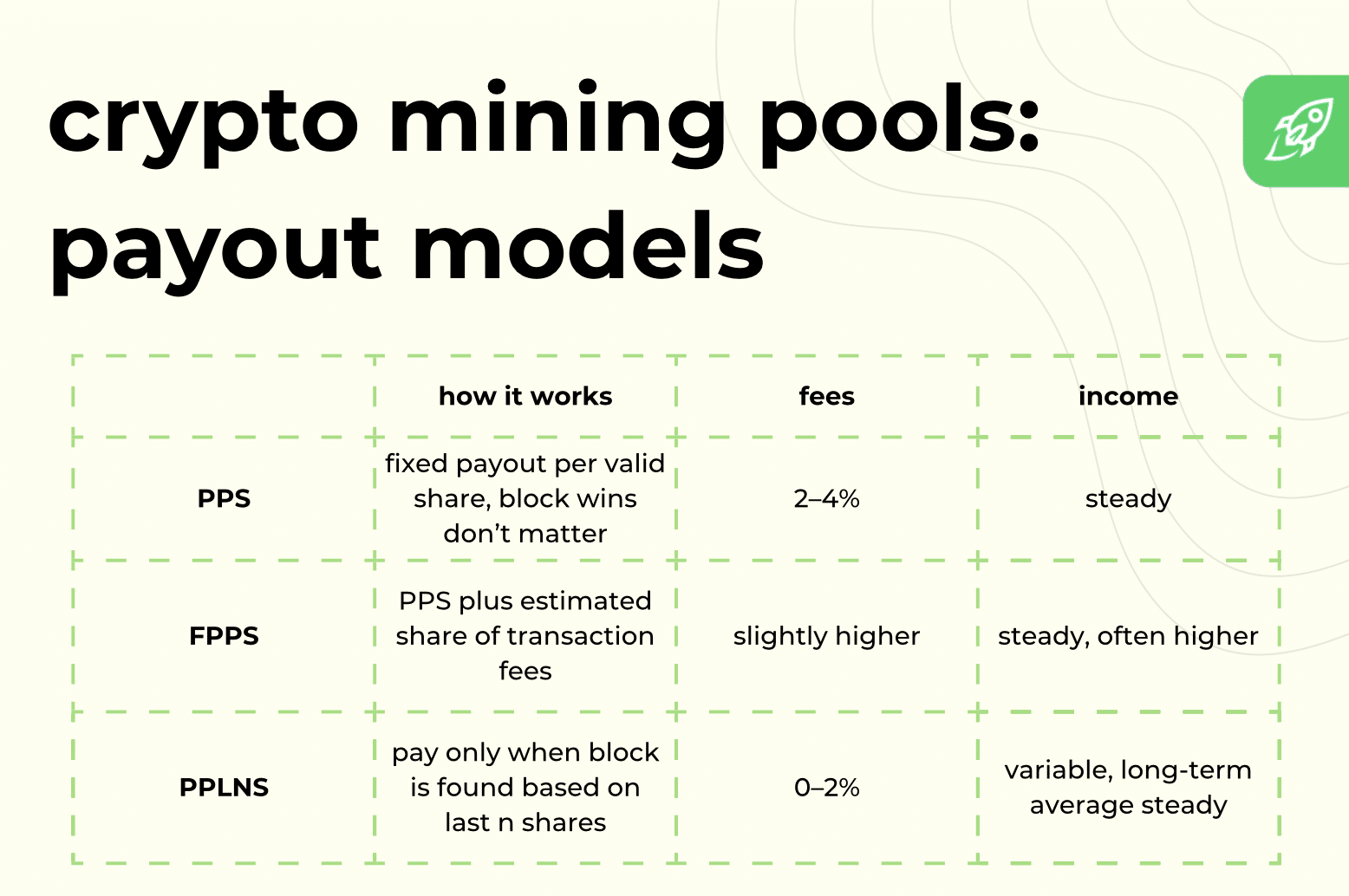

Mining pools use different formulas to turn your submitted “shares” into payouts. Understanding these methods is critical for predicting cash flow and comparing pools. The most common models are below.

Pay-Per-Share (PPS)

PPS gives miners a fixed payout for every valid share they submit, regardless of whether the pool actually finds a block. The operator assumes the variance risk and charges a higher fee (often 2–4%) to cover it. This model provides predictable, steady income, which is ideal for miners who want stability and simple accounting.

Full Pay-Per-Share (FPPS)

FPPS is like PPS but adds a calculated portion of transaction fees to the fixed payout. The pool estimates average block fees over time and pays miners for both block subsidy and fees, even if the pool didn’t win a block that round. Fees are usually slightly higher than PPS but net returns are often higher and more consistent.

Pay-Per-Last-N-Shares (PPLNS)

PPLNS ties rewards to actual blocks found. When the pool mines a block, the reward is distributed based on each miner’s contribution to the last N shares before the find. This lowers the operator’s risk and typically has lower fees (0–2%), but your income varies with the pool’s “luck” and may be zero if no block is found during your window. Over the long term, earnings converge to your share of hashrate but with more short-term volatility.

Proportional Method

This older method pays miners proportionally to all shares submitted during a single round (the time between two blocks found by the pool). When a block is found, rewards are divided by the proportion of shares you submitted in that round. Like PPLNS, this exposes miners to variance but with simpler accounting.

Hybrid Models

Many pools mix features. Examples:

- PPS+: pays block subsidies PPS-style but distributes actual transaction fees PPLNS-style.

- Score-based systems: weigh recent shares more heavily to discourage “pool-hopping.”

Hybrid models aim to balance steady payouts for miners with manageable risk for operators. When evaluating a pool, always check its reward scheme, fee rate, and how it handles fees, as these directly affect your net revenue and payout variance.

Pros and Cons of Mining Pools

Joining a mining pool reduces payout variance and offloads coordination. The trade-offs are operator fees, reliance on the pool, and less control over block templates.

Top Bitcoin Mining Pools in 2025

This section looks at the top five Bitcoin mining pools: Foundry USA, AntPool, ViaBTC, F2Pool and Luxor. They were chosen because they consistently command the largest share of the network’s hashrate and represent a cross-section of today’s leading operators.

Please note that hashrate changes constantly. These values represent typical mid-2025 ranges rather than fixed numbers.

Selecting the Right Mining Pool

Picking the right mining pool is very important—after all, you’ll be dedicating a lot of resources so you can receive your payouts. That’s why it’s also important to look beyond just hashrate.

Uptime and Reliability

Consistent server availability ensures that your rigs stay connected and submit valid shares without interruption. Even brief outages can lead to lost revenue, especially at high difficulty. Look for pools that publish uptime statistics or have a long track record of stable operation.

Transparency of Operations

Clear reporting of hashrate, block finds, payout calculations and fees helps miners verify earnings. Pools that provide real-time dashboards, share templates, and detailed accounting reduce the risk of hidden losses or manipulation.

Minimum Payout Thresholds

Every pool sets a minimum amount before payouts are sent. High thresholds can delay cash flow for smaller miners, while very low thresholds may incur higher transaction fees. Check that the threshold aligns with your expected output.

Pool Fees and Hidden Costs

Published fee rates (e.g., 1% PPS or 2% FPPS) are only part of the equation. Some pools deduct transaction fees, charge withdrawal fees, or impose penalties for stale shares. Factor these into your net revenue calculation rather than focusing only on the headline rate.

Reputation and Community Feedback

A pool’s history and miner reviews provide early warning about policy changes, delayed payouts or technical issues. Forums, Telegram groups, and independent dashboards are good places to gauge sentiment and operator responsiveness.

Supported Coins and Algorithms

Multi-asset pools can point your rigs to different coins or merged mining opportunities without reconfiguring hardware. Verify that your algorithm (e.g., SHA-256 for Bitcoin, Ethash for Ethereum Classic, Scrypt for Litecoin/Dogecoin) is fully supported and that payout methods are clear for each asset.

Pool Size and Its Impact on Rewards

Large pools find blocks more frequently, resulting in steadier payouts but potentially greater network centralization. Smaller pools may deliver higher variance in rewards but can support decentralization and sometimes, lower fees. Match your risk tolerance and payout needs to the pool size.

Geographic Considerations (Latency, Server Proximity)

Physical distance between your miners and the pool’s servers affects latency. Lower latency reduces rejected or “stale” shares and improves effective hashrate. Some pools offer regional endpoints to minimize delay; choose the closest reliable server to your operation.

The Future of Mining Pools

Bitcoin’s total network hashrate crossed 1 zettahash per second in 2025, a record that strengthens security but also raises costs for miners and the pools that serve them. At the same time, just a handful of operators now control nearly half of all hashpower, drawing scrutiny from regulators and the community over potential centralization risks.

To counter this, developers and researchers are pushing decentralized pool designs such as FiberPool and wider adoption of the Stratum V2 protocol, which gives miners more control over block templates and reduces reliance on a single operator.

As block rewards continue to shrink and difficulty rises, pools that can minimize stale shares, run reliably, and offer flexible payout structures are likely to stand out. In short, the future of mining pools looks more competitive, more transparent, and increasingly shaped by decentralization and sustainability trends.

Final Words

Mining pools are now the backbone of proof-of-work networks. Pool operators coordinate vast amounts of contributed processing power so miners can earn steadier payouts and reduce variance. Understanding how these pools work, what fees they charge, and how they handle block rewards helps miners decide where to direct their computing power. By choosing carefully and monitoring performance, participants can make the most of mining cryptocurrencies while maintaining control over their own hardware and strategy.

FAQ

Can you make money with mining pools?

Yes. By combining computational resources with other individual miners, participants earn a share of each block reward and transaction fees, turning cryptocurrency mining into steadier mining rewards than solo efforts.

Is mining bitcoin illegal?

Bitcoin mining pools and the mining process are legal in most countries, but regulations differ. Miners should check local laws before participating.

Is it better to solo mine or pool mine?

Mining pools spread the work of finding a valid block across many miners, so rewards arrive more often and predictably. Solo mining offers full control but requires far greater computational power and patience.

Do I need expensive mining hardware to join a pool?

No. Miners join pools precisely to offset limited computational power; even small rigs can contribute shares and receive proportional rewards, though revenue scales with hashrate.

Can I switch mining pools easily if I’m unhappy with one?

Yes. The mining process simply points your hardware to a different pool server, so individual miners can change pools quickly without special permissions.

How do mining pools handle transaction fees from blocks?

Pools include transaction fees along with the block reward. Depending on the payout model (PPS, FPPS, PPLNS), those fees are either added to or shared separately in miners’ rewards.

Are mining pools legal in my country?

In most jurisdictions, cryptocurrency mining, including participation in bitcoin mining pools, is legal. Always verify current regulations before miners join.

What happens if the mining pool is hacked or shuts down?

If a pool’s server fails or is hacked, miners lose the central coordination point but keep their own hardware and can redirect computational resources to another pool to resume earning mining rewards.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post Crypto Mining Pools 101: Types, Rewards and How They Work appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

Cryptocurrency News & Trading Tips – Crypto Blog by Changelly