How to Manage Risk in Copy Trading

Copy Trading on BitMEX allows you to replicate the moves of the best crypto traders, ensuring that your portfolio mirrors their profits instantly without the burden of time constraints or the need to master complex trading strategies. However, like all forms of trading, it comes with inherent risks. To truly benefit from copy trading while safeguarding your capital, knowing how to implement effective risk management strategies are crucial.

This guide will walk you through the essential steps to manage your risk while copy trading on BitMEX.

Understand the Risks Involved

Before you begin, it’s vital to acknowledge that copy trading does not guarantee profits. While you’re mirroring experienced traders, past performance is never an indicator of future results. Here are some key risks to be aware of:

- Market Volatility: Crypto markets are highly volatile. Sudden price swings can lead to rapid losses, even for experienced traders.

- Copy Leader Performance: The success of your trades is directly linked to the performance of the Copy Leader you choose. They can experience losing streaks or make miscalculations.

- Slippage and Fees: Differences in execution prices (slippage) and standard trading/funding fees can lead to your PnL differing from your Copy Leader’s.

- Liquidity Risk: In illiquid markets, exiting positions quickly at your desired price might be challenging, leading to greater losses. BitMEX mitigates this by carefully selecting liquid trading pairs for copy trading.

Key Risk Management Strategies for Copiers

While copy trading automates the execution, your active participation in risk management is non-negotiable.

1. Control Your Allocation Wisely

One of the most fundamental risk management tools is deciding how much capital you allocate to each copy trade.

- Start Small: Especially as a beginner, begin with a smaller portion of your total portfolio. For instance, if you have 1,000 USDT, allocate only 10-20% (100-200 USDT) to your initial copy trades. The minimum deposit for Copy Trading on BitMEX is USD$100 in USDT, BTC, or BMEX.

- Gradual Increase: As you gain confidence and observe consistent performance from a Copy Leader, you can gradually increase your allocation.

- Never Overcommit: Only trade with funds you can genuinely afford to lose without impacting your financial stability.

2. Implement Stop Loss (SL) and Take Profit (TP) Orders

BitMEX allows you to set your own Stop Loss (SL) and Take Profit (TP) percentages for each copy trade, overriding the Copy Leader’s inherent settings. These are your most powerful tools for automated risk control:

Term | What It Means (Definition) | Example |

Stop Loss (SL) | A predefined percentage at which your copied trade will automatically close if the market moves against you. This helps to limit your potential losses. | If you commit $100 to a trade and set a 10% Stop Loss, your position will automatically close if its value drops by $10, preventing further losses. Please note that the stop loss is only a trigger. The final amount of capital to be received is subject to market conditions. |

Take Profit (TP) | A predefined percentage at which your copied trade will automatically close if the market moves in your favour. This helps to secure your gains. | If you commit $100 to a trade and set a 20% Take Profit, your position will automatically close if its value increases by $20, locking in your gains. Please note that the take profit is only a trigger. The final amount of capital to be received is subject to market conditions. |

How to Set Them on BitMEX: When setting up a new copy trade, you’ll find options to input your desired Stop Loss and Take Profit percentages. These can often be adjusted from your “Copied Traders” dashboard later.

3. Diversify Across Multiple Copy Leaders

Don’t put all your eggs in one basket! A core principle of investing, diversification, applies strongly to copy trading.

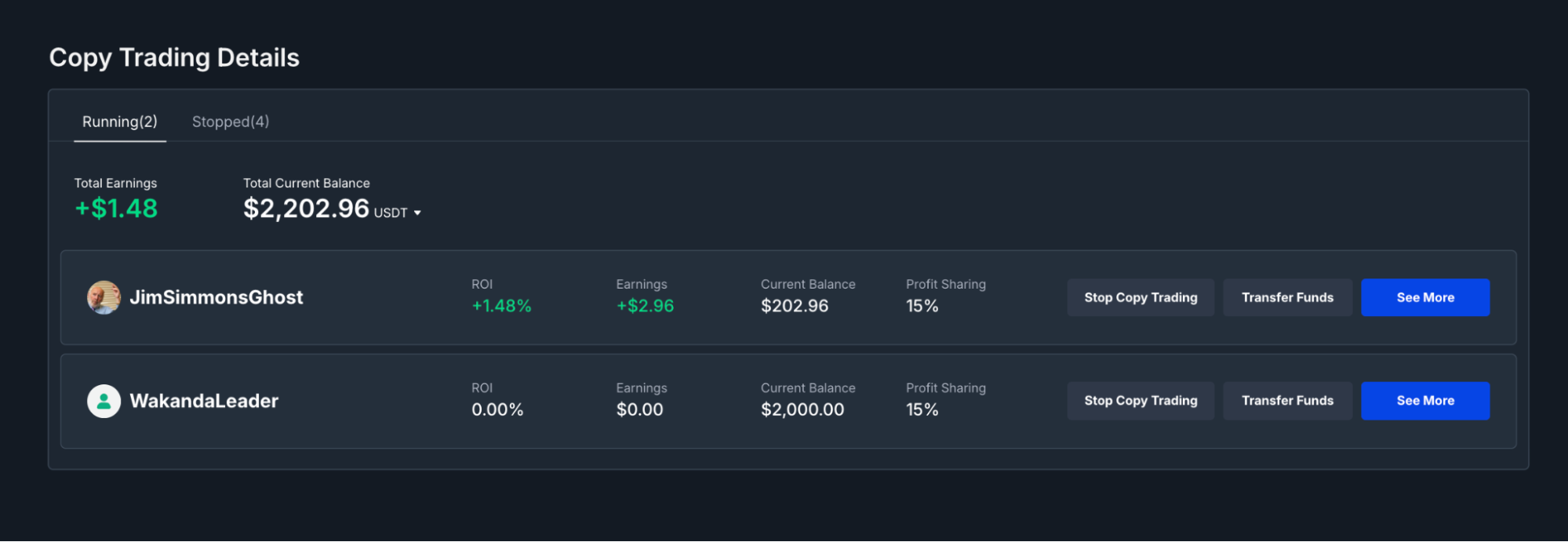

- Spread Your Capital: Instead of allocating all your copy trading funds to a single Copy Leader, consider following multiple leaders (up to five on BitMEX).

- Vary Strategies: Look for leaders with different trading styles, risk appetites, and preferred assets. One might focus on short-term scalping, while another on longer-term swing trades. This helps balance out the risk if one leader underperforms.

- Reduce Exposure: By diversifying, you reduce the impact of a single Copy Leader’s poor performance on your overall portfolio.

Read more about how to choose the right copy leader for your portfolio here.

4. Regularly Monitor Your Performance

Copy trading automates execution, but it doesn’t mean you can set and forget. Regular monitoring is essential:

- Review Performance Metrics: On your “Copied Traders” dashboard, keep an eye on your overall balance, PnL, and the individual performance of each Copy Leader you’re following.

- Assess Copy Leader Behaviour: If a Copy Leader consistently underperforms or adopts a riskier strategy than you’re comfortable with, be prepared to adjust your settings or even stop copying them.

- Stay Informed: Keep an eye on overall market conditions and major news events that could impact your positions.

Managing Your Funds While Copy Trading

- Dedicated Sub Accounts: On BitMEX, when you start copying or leading, funds are automatically transferred to a dedicated Copy Trading Sub Account or Copy Leader Sub Account. This mechanism helps keep your copy trading capital separate from your main account.

- Deposits/Withdrawals: While possible, it’s generally not recommended to frequently deposit or withdraw from the same account you’re actively using for copy trading, as it can interfere with open positions and daily calculations.

- Funds Return Automatically: If you stop copying a Copy Leader and all positions are closed, the funds in that specific Copy Trading Sub Account will automatically be returned to your main BitMEX account.

The Bottom Line

Copy trading on BitMEX offers an accessible way to engage with crypto derivatives and potentially amplify your earnings. By actively applying these risk management strategies – controlling your allocation, using Stop Loss and Take Profit orders, diversifying your Copy Leaders, and regular monitoring – you can navigate the markets more confidently and protect your capital. Remember, smart risk management is about consistency and control, not just chasing quick profits.

Looking for more information? We’ve got a range of educational resources to guide users through topics such as Copy Trading and more. You can find them under the Copy Trading section of this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.

The post How to Manage Risk in Copy Trading appeared first on BitMEX Blog.

BitMEX Blog