Treasury Company Advisory Agreements

Abstract: We take a look at some of the crypto treasury companies and talk about the structure of some of the latest deals and why people choose to invest in them. We look at how PIPE investors can make handsome profits when the treasury companies trade at a significant premium to mNAV. We briefly review some of the advisory agreements, asset management agreements and management incentives in place to grow the mNAV premium. We analyse the impact passive funds could have on the sector and how Vanguard could be the final bagholder for the successful treasury companies.

Overview

In 2017 it was the ICO bubble, in 2021 it was NFTs and the crypto lending bubble and in 2025, this cycle’s equivalent is now becoming clear. It is the “crypto treasury company” mania. If one wants to take big risks and potentially get rich quick by getting in early, these NASDAQ listed treasury companies are the way to go. The deals can be structured in various ways, however to oversimplify it, one can say there are two popular methods: a reverse takeover and a SPAC transaction.

The typical reverse takeover approach often works as follows: A small NASDAQ listed zombie company is found as the target, ideally the company does not have debt, the core business is failing, the market cap is below $40m, there is a low risk of lawsuits/contingent liabilities and there is a small number of insiders who own a large percentage of the equity. PIPE investors to participate in the equity offering are then lined up, who sometimes consist of some of the same investors who used to specialise in ICO offerings eight years ago. The target company then issues new shares, diluting existing shareholders down to a small minority and these newly issued shares go to the PIPE investors as the deal completes. These PIPE investors then become ordinary shareholders and a new management team is put in place, to focus on the treasury strategy. The company then spends the proceeds of the capital raise buying the chosen cryptocurrency. The capital raise is in US dollars and there is also often the possibility of in-kind subscriptions in the relevant coin.

The objective is that after the deal completes, the stock then trades at a 2x to 5x multiple of the value of the underlying crypto. The company can then start issuing new shares in the market and then purchase more coins with the proceeds, MSTR style. Since the shares are sold at a premium to mNAV, this drives up the number of coins per share. This could also then drive the coin price up even more, further increasing the share price in a virtuous cycle.

The PIPE investors participate at a valuation of around 0.8x to 1.0x, as in c1.0x the value of the coins the company is expected to buy at launch. The PIPE investors hope to make a significant profit in the short term, if the shares trade at a large premium when the deal completes.

The Compelling Nature of the Investment

Many have asked us why people participate in these offerings. Afterall, the justification for the premium to mNAV depends on circular reasoning, “premium justifies premium” type logic. This shares characteristics with ponzi schemes. However, at the PIPE level, these deals can be very attractive when looked at in a certain way. Consider the reasoning below:

You are a Bitcoin OG and have 1,000 BTC in a cold wallet, it has been sitting there for over a decade. You then have the following decision tree in front of you:

- Keep the 1,000 BTC

- Participate in a treasury company PIPE deal. This will have one of the following potential outcomes:

- The deal is a success and the stock trades at a large premium to mNAV. You can then sell your shares in the company at a premium and buy back even more BTC.

- The deal is somewhat of a failure and the stock trades at a discount to mNAV. However, this isn’t a problem. You trust the management team and you have a significant percentage of the voting power in the company. The management team has assured you that if this happens, they will close the discount by selling the BTC and buying back stock or paying dividends. This is why the management team is important, if you hold a lot of Bitcoin, you are likley to respect and trust at least one of Adam Back, Jack Mallars, Anthony Pompliano or Michael Saylor. You can take your pick.

This is a kind of heads you win, tails you don’t lose situation. However much people like “BitMEX Research” talk about “circular reasoning”, the fact is there are tens of treasury companies actually trading at a premium right now. Why not try it? In reality, it’s not completely a “tails you don’t lose” situation. There are some fees and dilution involved. These fees can be large, but when one considers the option value method of reasoning about these deals, the fees can be worth it.

Passive Funds

If this treasury company strategy is successful and treasury company stock gets large enough, the stock starts getting into more indexes. Then passive index funds, such as products provided by Vanguard, then start buying the stock. For example, in the case of MSTR, Vanguard is already the single largest shareholder, owning 7.0% of the outstanding shares in 66 of their fund products, as at the end of June 2025, according to data from Bloomberg.

The MSTR treasury company scheme can therefore be considered successful at this stage, in our view. The early buyers made handsome profits and now, ironically, Vanguard, who is famously anti-Bitcoin, is the final bagholder. Vanguard, the company that hates Bitcoin so much, that they reportedly won’t even let their American customers choose to purchase Blackrock’s Bitcoin ETF, using Vanguard’s execution only service.

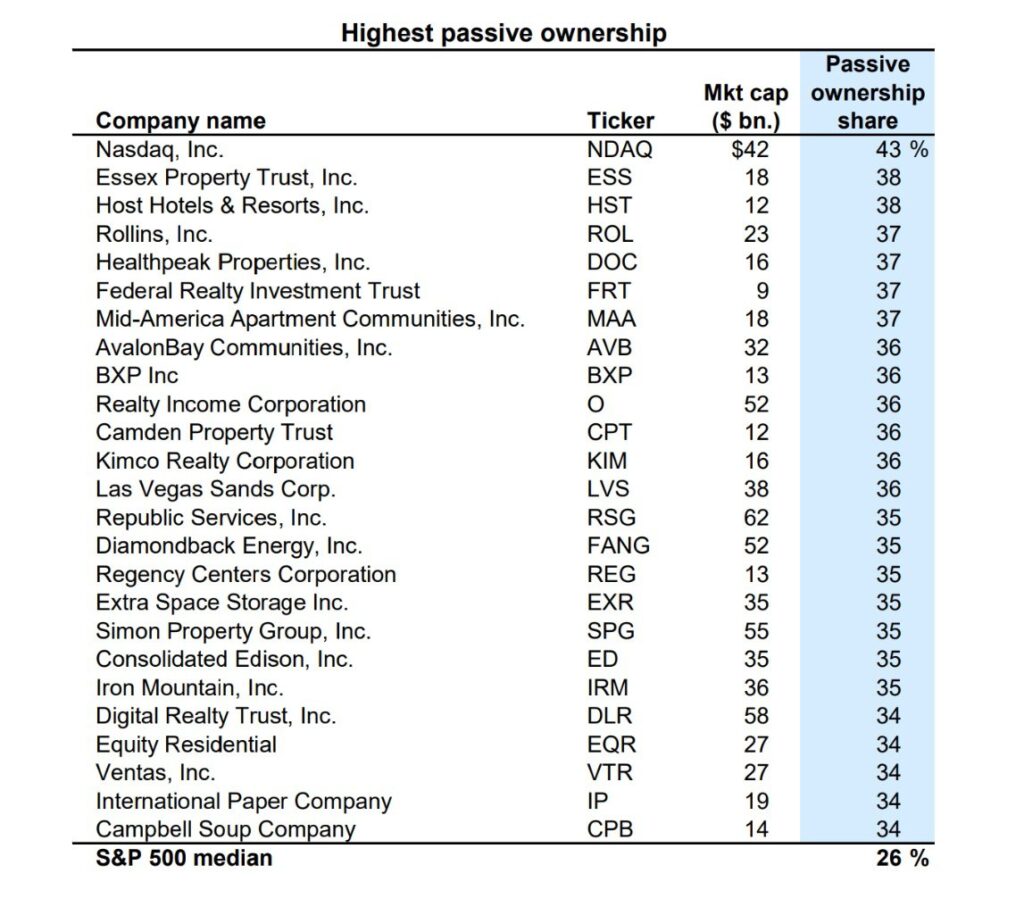

According to a November 2024 report from Goldman Sachs, the median ownership of stocks in the S&P 500 by passive funds is 26%. In yet another irony, NASDAQ itself, the home of the crypto treasury companies, is at the very top of this particular list, with 43% ownership from passive funds.

Passive funds have become more popular in the last few decades and there is potential for further growth, as they win market share from active managers. It’s not hard to see how they can be an appealing prospect to existing shareholders of crypto treasury companies. If a treasury company becomes large enough, it can get passive index fund holders. Then, when the company issues new shares to purchase more crypto, it’s almost as if the passive funds become forced buyers, required to subscribe in the offerings. If passive funds continue to grow, they could eventually reach over 50% of a single company, perhaps even a crypto treasury company. One can then speculate on the maths. If MSTR reaches a 50% passive fund threshold and trades at a 2x premium to the underlying Bitcoin, Saylor’s “infinite money glitch” could become even more preposterous. In a way, Saylor really has hacked the legacy financial system.

Strategic Advisors and Asset Managers

Another key element in these newer treasury companies is the promoter, the asset manager, the management team or the “strategic advisor”. This is essentially the people behind the offering. The role of the advisor differs from deal to deal, but typically involves the following:

- Appointing the CEO or being the CEO

- Managing the treasury strategy, by deciding when and if to purchase more coins, as well as possibly executing the transactions, and

- Perhaps most importantly of all, marketing and promoting the stock of the company to potential investors

In general these advisors are extremely important and without them the viability of the company may be in question, in some cases. Please note that these strategic advisors have a different role to the “Sponsor” or “Placement agent”. The Sponsor is typically the investment bank who structures the deal, such as Cantor Fitzgerald, while the advisor is often the entity who contracts with the Sponsor to arrange the deal. The Sponsor is normally paid a handsome set-up fee and the advisor or management team is also often potentially paid well, as an incentive to increase the premium to mNAV. The set-up fees are typically in the range of 1% to 8% of the deal size, from what we have seen. We are not focusing on the sponsor or placement agent fees in this report, as these are not specific to crypto treasury companies. Instead we focus on the advisory services agreements, which can last for many years.

The below table summarises some of the key incentives and payments to the “strategic advisors” in some of the deals, which encourage the management or advisors to increase the market cap or premium to mNAV. Please note that each deal is different and the comparisons we make in the below table may not be appropriate. There is also sometimes an entity in the “asset manager” role, often in addition to the strategic advisor. Also, companies are included in the below table only if we can find the relevant details from the SEC filings and therefore the data in the table is subject to selection bias to some extent. For some cases, we believe details about any advisory agreements may emerge later as the deal completes.

| Ticker | Coin | Initial deal size | Advisory Fee Incentive Structure | Who is the advisor? | Contract Term | Source |

| $BNC | BNB | $1,250m | Seven year options to purchase a certain percentage of the outstanding share capital of the company, for an exercise price of $0.00001 per share. The current market price is around $27. The awards for the advisors is as follows: 10x: 4.8% In addition to the advisory services agreement, there is also an Asset Management Agreement, with 10X Capital. This contains options to buy another 2% of the stock, plus a fee that we were not able to determine | 10X Holdings and YZI Labs (Changpeng Zhao related entity) | 20 years for asset management and 6 months for the advisor | SEC |

| $TRON | Tron | $100m | Five year options to purchase 5.4 million shares of the Company at an exercise price of $0.50 per share. The current stock price is c$10. We believe this represents around 2.5% of the company. There is also a separate advisory agreement with Mr Justin Sun, although we could not find terms related to Sun’s compensation (if any) in the published part of the agreement. | American Ventures LLC, a Soo Yu fund | 1 year | SEC |

| $TLGYF | ENA | $260m | Over the first seven years: 0.5 million shares if the company achieves ENA per share growth of 25%; This is a total of 3.6 million shares, which we believe represents around 1% of the company | Ted Chen and Young Cho | 4 years | SEC |

| $UPXI | Sol | $500m | This is an asset management agreement, rather than an advisory agreement. There is a 1.75% fee on the assets held. There are also options to purchase 2.2 million shares at various prices. | GSR | 20 years | SEC |

| $MCVT | Sui | $450m | Tiered asset-based fee based on the Assets under management: 0%, if the assets are less than or equal to $100m; There is also a minimum annual fee of $1m. The advisor also has options on 3.1 million shares, as does the Sui foundation The asset manager also has a very similar fee schedule, 0.6% to 0.8% of the assets and a $1m per annum minimum | Karatage as the advisor and Galaxy as the asset manager | 10 years for the advisor and 5 years for the asset manager | SEC |

| $VERB | Ton | $558m | An annual advisory fee equal to 2.0% of the company’s market capitalization | Kingsway | 20 years | SEC |

| $BMNR | Ethereum | $250m | 5 year options to buy 5% of the company for $5.4 per share. It appears as if the advisor also earns an annual 1% fee on the assets, however, this is not entirely clear to us. The company’s chairman, Mr Thomas Lee, is former supporter and promoter of BSV, the Bitcoin spin-off coin of CSW (AKA Faketoshi) | Ethereum Tower LLC | 10 years | SEC |

| $SBET | Ethereum | $425m | The strategic advisor has warrants over 3.4 million shares at various exercise prices for three years For the asset manager, a tiered scheme ranging from 0.25% to 1.25% per annum of each Asset Manager’s AUM. The minimum annual fee shall be $1.25 million to each manager | Consensys as the strategic advisor Galaxy Digital and ParaFi as asset managers | 3 years | SEC |

| $ATNF | Ethereum | $425m | Options to purchase 45.5 million shares at $2.77 for the advisors The asset manager is paid an annual fee of 2% of the assets, with a minimum of $2m per annum. | Pink Sands Group, Cyber, Moode, Moon Cat, Zorba Investments, Purple Poseidon, Tentacle, PCAO, Johnny Foxtrot and New Island. Electric Treasury Edge is the asset manager | 30 months for the advisors and 5 years for the asset manager | SEC |

| $BRR | Bitcoin | $750m | 10 million shares in the company, which we believe is around 5% of the outstanding share capital There also appears to be an arrangement, where only 85% of the gains in the Bitcoin price between the signing of the deal and completion go to equity investors, with 15% going to Inflection Points Inc. | Inflection Points Inc (An Anthony Pompliano affiliated entity) | 4 years | SEC |

Please note: We apologise for any inaccuracies in any data in relation to payments for advisory services. We are not liable for any errors. Please contact us immediately if you believe we have made an error and we will correct it as soon as possible.

The payment terms for the advisor vary from deal to deal. In some cases, there is often an incentive or payment linked to the market capitalisation or premium to mNAV. Therefore, from the perspective of the investor, the option like value of the deal is exploited again, in somewhat of a similar win or don’t lose situation:

- If the stock trades at a large premium to mNAV, the company may pay large fees to the strategic advisor and the investor wins

- If the stock does not trade at a large premium, lower fees are paid to the strategic advisor and the investor does not lose

In a way these fees are sometimes somewhat appropriate, as the key people involved in these deals need to be paid well and they are often linked to the mNAV premium, so incentives are aligned with shareholders. However, the fees are often significant enough to put to bed the argument that some have made, that treasury companies are better than crypto ETFs, because they have lower fees.

Conclusion

The fees payable to the advisors may seem large in some cases, however they may be necessary to get the deals completed and the advisors are often large investors in the companies themselves. In many cases the advisors are absolutely necessary to help attract investors, which is a key part of the strategy. While the market is hot, investors may not care too much about the fees to the strategic advisors or management teams. However, there may be some parallels here to the Grayscale Bitcoin Trust [$GBTC] and its 2.5% management fee on the value of the underlying assets. This fee was acceptable for many years to investors, however, as the Bitcoin ETFs were approved in January 2024, the market became more competitive and fees declined to around 25 bps. GBTC then saw massive redemptions, but the fund is still a massive fee earner today. In several years time, when perhaps investors are more patient and picky, treasury company fees may come down to some extent.

In our vies, the end game here is that many of these companies eventually trade at a significant discount to mNAV and become zombies once again, potentially still paying significant fees, just like $GBTC. However a select few may make it. By “make it” it likely means that the companies achieve significant scale such that passive funds such as Vanguard and State Street become the largest shareholders, before the premium to mNAV eventually potentially declines to near 1.0x or lower.

Another more simple takea way from this report, is just to buy the ETFs.

The post Treasury Company Advisory Agreements appeared first on BitMEX Blog.

BitMEX Blog