Copy Trading in Crypto: What Is It?

Crypto copy trading is a simple way to follow expert traders and automatically copy their trades into your own account. You don’t need to know technical analysis or spend hours watching the market. It makes crypto trading easy, especially for beginners or people with less time.

The benefits of crypto copy trading include passive income, expert strategies, risk control, time-saving, learning opportunities, reduced stress, and easy entry for beginners.

In this guide, you’ll learn what copy trading in crypto is. You’ll understand how it works, how much money you need to start, and which strategies are the most effective. Plus, we’ll give you the rundown on how to find the right traders to copy and, of course, the straightforward steps to actually start copy trading yourself.

What Is Copy Trading in Crypto?

Copy trading in crypto is a method that allows you to follow and replicate the exact same trades of experienced crypto traders. So basically, you don’t need to do your deep market research or spend time learning technical analysis. You just have to pick a skilled trader, and then your account will copy their trades automatically. It means when they buy or sell a coin, your account will also do the same.

This is really useful for beginner traders as they don’t have much knowledge about trading. And it can also help you learn trading strategies over time by seeing what others do. Most of the best crypto exchanges now offer copy trading features, like Binance, Bybit, Bitget, or KuCoin.

It’s pretty simple to start. You need to find a platform that offers copy trading. Then, you can choose traders by looking at their performance, past profit rate, risk level, and number of followers. Also, you can control how much money you want to invest, and you can stop copying anytime you want. In simple terms, copy trading meaning is that you automatically copy the trades of other successful traders into your own account.

Are you exploring copy trading but not sure where to begin? Bitget offers a smooth and beginner-friendly platform where you can copy top-performing traders and manage risk with ease. Join now!

How Does Copy Trading in Crypto Work?

Copy trading in crypto works through a system that automatically mirrors the trading actions of a chosen expert trader into your own trading account. At its most basic level, the process is based on Application Programming Interfaces (APIs). So, when a user wants to copy a lead trader, they normally link their cryptocurrency exchange account to the copy trading platform through secure API keys. Now, these keys enable the platform to make certain actions, such as buy and sell orders, but importantly, they do not allow withdrawals.

After linking, the platform’s algorithmic engine keeps track of the real-time trading activity of the chosen lead trader. When the lead trader makes a trade, whether it’s an order placement (buy/sell), setting stop-loss/take-profit levels, or position closing, the platform immediately receives this notification. It then makes the very same trade on the follower’s account.

For example, if the lead trader is opening a position worth 10% of their portfolio, the follower’s account will open a proportionate position with 10% of their available copy trading funds.

Most of the platforms allow flexible control. You can set your maximum investment amount, daily loss limit, stop-copying conditions, and leverage settings. Lead traders are usually encouraged to share their strategies by way of profit-sharing mechanisms or subscription fees, where they get a cut of the profits made for their followers.

Which Copy Trading Strategy Is the Best?

There isn’t one “best” copy trading strategy for everyone, because what works best depends on what you want and how much risk you’re okay with. But here are some common and good strategies:

- Diversify Your Traders: This means don’t start automated trading with all your money with just one trader. Instead, pick a few different traders to copy. So, if one trader has a bad day, your whole investment isn’t hit too hard because you have others doing well. This helps in risk management.

- Follow Traders with Consistent Performance: Don’t just look for traders who made a lot of money very fast. You have to look for traders who have been making steady, good returns over a longer time. They might not have huge, quick wins, but they are more reliable and less risky in the long run.

- Start with Low-Risk Traders: If you are new, it’s a good idea to begin by copying traders who don’t take big risks, like high leverage. These traders usually aim for smaller, more regular profits rather than trying to get rich quickly. This is a key part of copy trading for beginners who want safer and steadier growth.

- Monitor Performance Regularly: Even when you copy traders, it’s important to keep an eye on how they are doing. Check their results often. Markets change, and a trader who was good yesterday might not be doing so well today. So, if a trader starts losing money often, you should think about stopping copying them and finding a new one.

What Are the Pros and Cons of Copy Trading?

Pros of Copy Trading

The pros of copy trading include being good for beginners, saving time, offering a chance to learn from experts, making diversification easy, an opportunity to earn passive income, and good customer support.

- Good for Beginners: If you’re new to trading, this is a big plus. You just don’t need to know all the technical details about markets or how to pick investments. All you have to do is follow someone who does. It makes getting started much easier and less scary.

- Saves Time: Trading can take a lot of time. You need to research, watch the news, and look at charts. With copy trading, you don’t have to do any of that. The expert trader does the work on your behalf, and your account just follows along.

- Learn from Experts: By watching what experienced traders do, over time, you can start to understand their strategies and why they make certain choices. It’s a practical way to learn about the market and trading without going to school for it.

- Diversification Made Easy: You can copy different traders who use different strategies or trade different coins. This is called diversification in copy trading. So, if one type of your investment isn’t doing well, another might be, which can make your overall results more stable.

- Passive Income Possibility: If the traders you follow perform well, you can earn profits without active trading. It can easily become a source of passive income.

- Good Customer Support: The best copy trading platforms offer 24/7 customer support. If anything goes wrong, you can contact support through live chat or email. It gives you quick help and better confidence.

Cons of Copy Trading

The cons of copy trading involve the risk of losing money, a lack of control over trades, potential fees, and the fact that past performance doesn’t guarantee future results.

- You Can Still Lose Money: Just because you’re copying an expert doesn’t mean you can’t lose money. Even the best traders have bad days or make mistakes. If they lose money, you lose money too. There’s no guarantee of profits.

- Lack of Control: When you copy someone, you are basically giving your funds for trading. You don’t decide what to buy or sell, or when. The trader you copy makes those decisions for you. This can be tough if you like to be in charge of your own investments.

- Potential for Fees: Most of the crypto copy trading platforms or even the traders themselves might charge you fees. This could be a small percentage of your profits or a fixed monthly fee.

- Past Performance Doesn’t Guarantee Future Results: Basically, you decide a copy trader based on their past performance. So, a trader might have done really well in the past, but that doesn’t mean they will keep doing well. Maybe the market volatility works in his favour. Market conditions change, and a strategy that worked yesterday might not work tomorrow. It’s risky to rely only on past success.

What Is an Example of Copy Trading?

Let’s say you have signed up on a popular copy trading crypto exchange like Binance, Bitget, or Bybit. These are among the best platforms that offer copy trading features. Now, after creating your account, you go to the copy trading section, and there, you see a list of expert traders. This list of each trader shows details like their win rate, profit percentage, risk level, and number of followers.

For copy trading, you have chosen a trader named “CryptoMax”. He has had a 90% win rate and steady profits for the last three months, and now you want to copy his trades. You need to click on his profile, then click “Copy.” Here, you can decide to invest $500 and set your own limits, like stop-loss and daily loss cap.

Now, whenever CryptoMax opens a trade, for example, he buys $1,000 worth of Ethereum using 10% of his account. Your account will do exactly the same and also buy Ethereum using 10% of your $500, which is $50. If he makes a profit, you also make a profit. If he loses, of course, you take the same loss.

Also, you don’t need to place trades yourself. Everything is automatic. You can stop copying anytime, change your trader, or adjust the amount. This is a simple and clear example of how copy trading works in real life, using real-time trades of an expert.

How to Copy Trade?

Step 1: Choose a Copy Trading Platform and Create an Account

To start, you’ll need to select the best crypto copy trading platform. There are quite a number of them, some popular ones being Binance, Bitget, Bybit, BingX, or even eToro if you’re interested in the larger markets beyond crypto.

After selecting one, you will need to register for an account. This typically entails registering with your email or phone number, creating a password, and then undergoing a “Know Your Customer” (KYC) procedure.

Are you new to copy trading and looking for the best exchange to start? Try Bitget copy trading and follow top traders easily with full control over your funds.

Step 2: Deposit Funds

Once your account is set up and verified, the next step is to fund it. This is the money you will use for copy trading. Most crypto sites have a couple of methods for depositing funds. You can typically connect your bank account for a direct deposit, use a credit or debit card, or even deposit cryptocurrency if you hold some.

Just choose the method that’s easiest for you. There will be a minimum deposit amount, which varies from platform to platform, but it’s often quite low. Now, make sure you deposit enough to meet the platform’s minimum and what you plan to allocate to the traders you’ll copy. This can be anywhere between $50-$150.

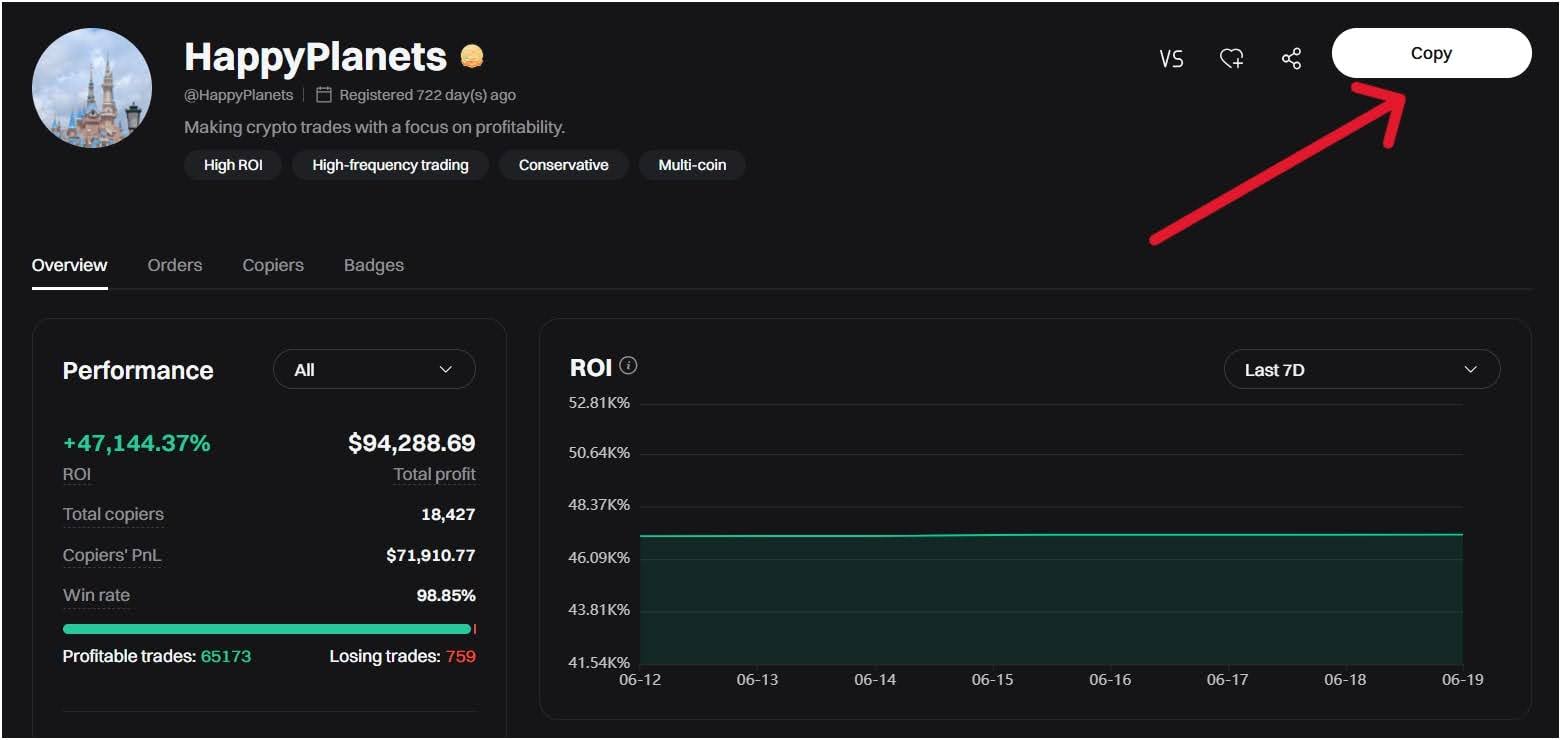

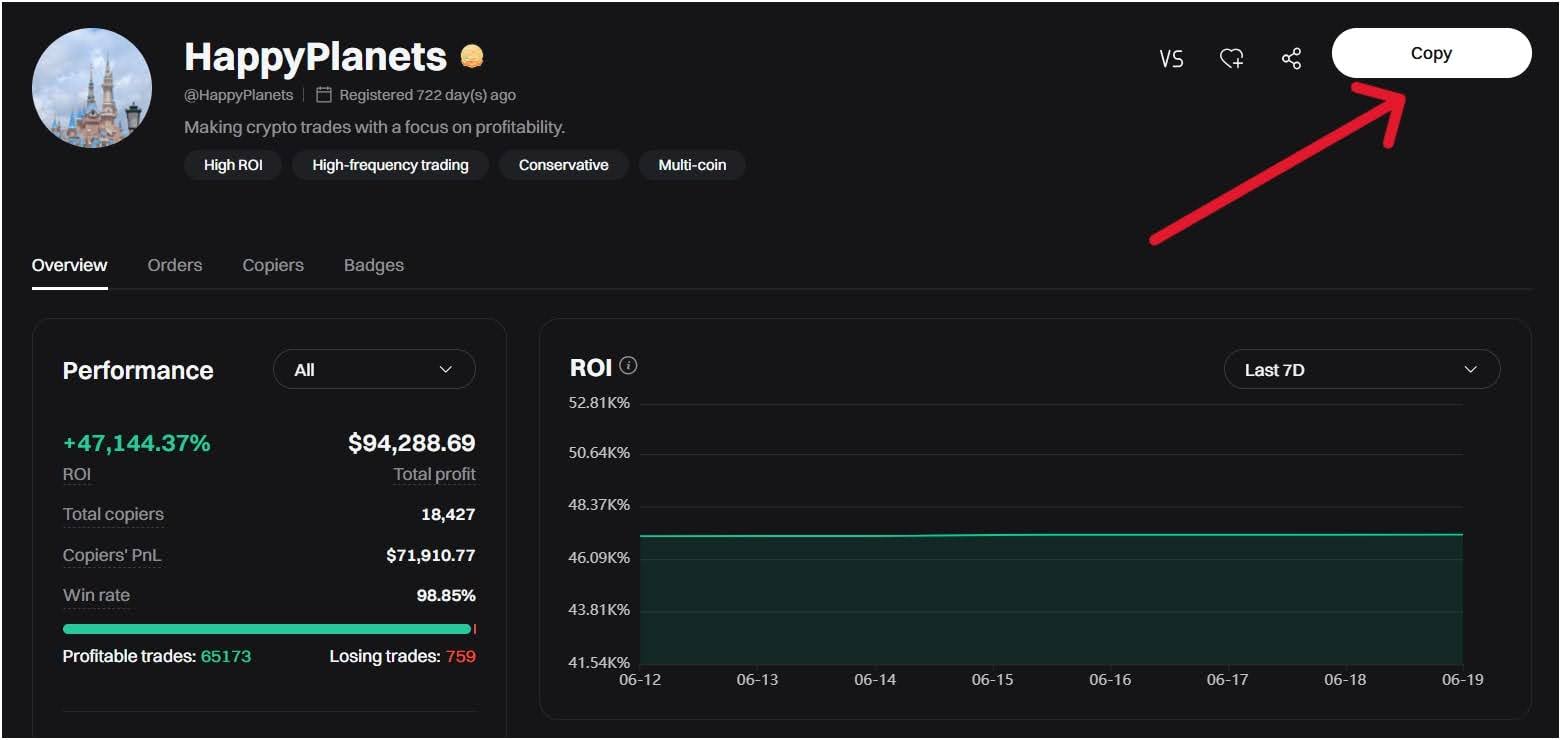

Step 3: Go to the Copy Trading Section and Pick a Trader

Now, once your funds are in your account, go to the copy trading section of the platform. Here, you’ll see a list of traders you can potentially copy. This is where you need to be a bit picky. Don’t just click on the first person you see; but you have to look at their profiles carefully.

You’ll typically find key information such as their previous profits, how much risk they are willing to take (usually displayed as a “risk score”), how many other traders are following them, and their trading history. Now you have to find traders who have steady profits for the long term, not merely a few massive wins.

Step 4: Follow an Elite Trader and Start Copying Trades

Once you’ve done your research and picked a trader you like, you’ll see an option to “Copy” them. Click that button. The platform will then ask you how much money you want to allocate to copy this specific trader.

Remember, you don’t need to invest all your money in a single trader; you can typically split your overall deposit across multiple traders. Once you accept the amount, your account will automatically begin replicating trades done by that top trader. If they buy Bitcoin, your account buys Bitcoin (proportionally to the amount you allocated). If they sell, you sell. It’s all automatic.

How to Find Copy Crypto Traders?

To find copy traders, you need to use a trusted crypto exchange or trading platform that offers copy trading features. The most popular platforms today are Binance, Bitget, Bybit, BingX, and MEXC, have a built-in copy trading section. After signing up, go to their copy trading tab, where you will see a list of traders available to copy.

Each trader’s profile will show many types of important data, like win rate, total profit, number of followers, risk score, trade history, and average return. You should not just pick the one with the highest profit; you need to look for a trader with steady performance, low drawdowns, and a clear trading style. Also, check how long they’ve been trading and how consistent their results are.

Avoid traders with very short-term big gains or those using extreme leverage. They may win fast, but also lose fast. Choose stable traders with long-term performance and those who do proper market analysis. At last, take your time to review at least 3-5 good profiles before selecting.

How Much Money Is Needed to Start Copy Trading?

The money needed to start copy trading is between $50-$150, and usually, it’s pretty accessible for beginners. Most platforms require you to start with a relatively small sum, often as little as $50 to $150 USD. Some copy trading sites may even allow you to start with less, or they may not enforce a minimum deposit for copying trades. Also, fees, slippage, and market conditions can affect your profit. So, it is better to start with at least $150 if you want more realistic returns and smoother trade copying.

Hence, the amount varies depending on the particular copy trading platform or broker you use, since they each have varying rules and minimum deposit requirements.

Does Copy Trading Work?

Yes, copy trading can work, but it doesn’t guarantee profits, and success depends on several key factors. When it “works,” it means you can potentially make money. But, it’s also important to understand that the past performance of a copied trader does not promise future results, and market conditions can change, so even the best traders can have losing periods.

Hence, for copy trading to “work” for you, you need to carefully select reliable traders with a proven track record, manage your own risk, and sometimes diversify by copying multiple traders.

Is Copy Trading Safe?

Copy trading is not entirely “safe” in the sense that no form of trading or investing is completely risk-free, and you can lose money. But again, you can make it safer by taking certain steps.

The main risk is that if the trader you copy makes a losing trade, your account will also take a loss. This risk is always there. To make it safer, you should choose a regulated and reputable copy trading platform like Binance and Bybit. Now, carefully research the traders you plan to copy, and start looking at their risk tolerance levels and long-term performance, not just short-term gains. It’s also wise to diversify by copying several traders and to set risk limits, like a “copy stop loss,” to automatically stop copying if your losses reach a certain point.

The post Copy Trading in Crypto: What Is It? appeared first on CryptoNinjas.

CryptoNinjas