Bitcoin Is Decoupling—and It Doesn’t Care About Tariffs or Earnings Reports

Bitcoin Magazine

Bitcoin Is Decoupling—and It Doesn’t Care About Tariffs or Earnings Reports

Bitcoin’s decoupling from traditional markets is becoming more visible as global capital stress intensifies. A resurgence of tariffs, elevated interest rates, and softening corporate earnings have introduced renewed volatility across equities and credit markets. Many large-cap companies are underperforming, weighed down not by fundamentals alone, but by geopolitics, trade policy, and policy uncertainty.

And yet—Bitcoin price is gaining ground.

Its movement is not erratic. It is not detached from reality. It is increasingly independent—not just in terms of asset performance, but in the forces that drive it. Bitcoin is beginning to behave less like a high-beta equity instrument and more like a structurally differentiated asset.

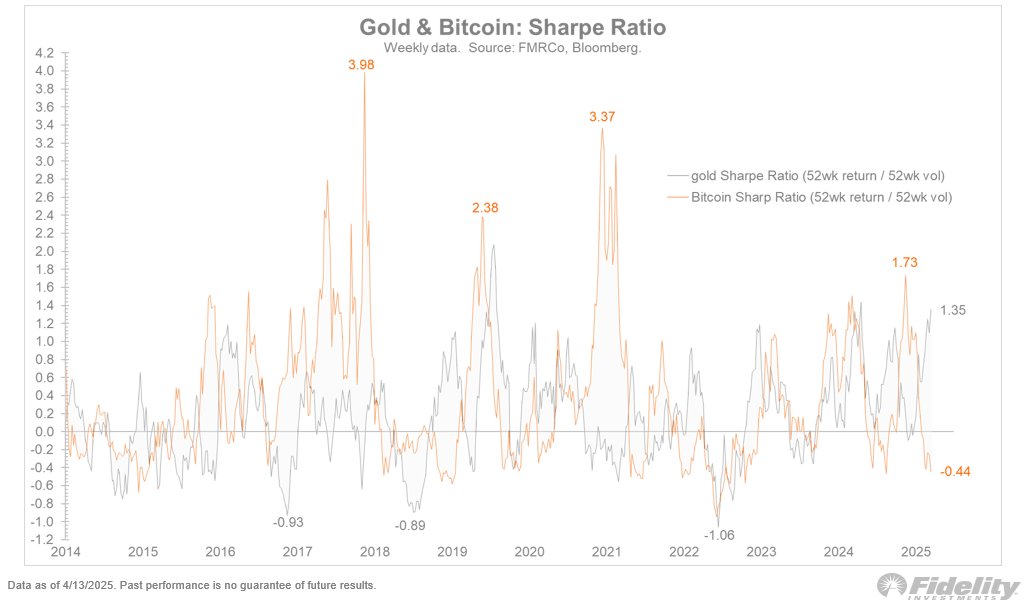

As Jurrien Timmer, Director of Global Macro at Fidelity, posted recently gold remains a stable store of value, while bitcoin’s volatility makes a strong case for holding both, as shown by their sharpe ratios:

For corporate finance leaders, that evolving risk/reward profile—and its growing divergence from traditional assets—warrants serious attention.

A High-Sharpe, Moderately-Correlated Outlier

Bitcoin remains volatile—but that volatility has delivered results. Its Sharpe Ratio now exceeds most traditional asset classes, including U.S. equities, global bonds, and real assets. This suggests that, on a risk-adjusted basis, Bitcoin continues to outperform—even through cycles of stress and recovery.

At the same time, Bitcoin’s correlation to the S&P 500 has declined to moderate levels. In practical terms, this means that while it may still respond to shifts in global liquidity or investor sentiment, it is increasingly influenced by structurally distinct factors:

- Sovereign-level accumulation

- Spot ETF inflows

- Supply-side compression events (e.g. halving cycles)

- Global demand for neutral reserve assets

This shift in behavioral profile—from risk-on correlation to structurally differentiated performance—underscores why Bitcoin may be maturing into a strategic reserve asset, not just a speculative asset.

Bitcoin’s Core Structure Is Decoupled by Design

Even when Bitcoin traded in lockstep with tech stocks in past cycles, its underlying characteristics remained distinct. It does not generate earnings. It is not valued based on cash flow projections, product cycles, or regulatory guidance. It is not subject to tariffs, labor cost shocks, or supply chain constraints.

Today, as U.S. equities face pressure from rising protectionism and fragile earnings growth, Bitcoin remains structurally unaffected. It is not exposed to trade friction between major powers. It does not rely on quarterly performance. It is not vulnerable to monetary tightening, corporate taxation, or sector rotation.

Bitcoin’s independence from these forces is not a temporary dislocation. It is the consequence of how the asset is built.

It is globally liquid, censorship-resistant, and politically neutral. These attributes are what make it increasingly attractive—not as just a growth asset, but as a strategic capital reserve.

Bitcoin’s Risk Is Uncorrelated to the Corporate Operating Model

This distinction is often missed in treasury discussions. Most corporate risk exposure is concentrated within the same system:

- Revenues are denominated in local currency

- Reserves are held in short-term sovereign debt or cash equivalents

- Credit lines are priced according to domestic interest rates

- Equity is valued based on business cycles and central bank guidance

These exposures create layers of correlation between a company’s income, reserves, and cost of capital—all driven by the same set of macro conditions.

Bitcoin operates outside of this loop. Its volatility is real—but its risk is not derived from corporate earnings, GDP trends, or the policy cycle of any single nation. Its value is not impaired by negative earnings surprises or declining consumer confidence. Its performance is not diluted by monetary expansion or politicized monetary policy.

For this reason, Bitcoin introduces a type of capital exposure that is orthogonal to the typical treasury framework. This is what makes it useful—not just as an asset with asymmetric upside, but as a true diversifier within a corporate balance sheet.

Conclusion: Independence Is the Feature, Not the Flaw

Bitcoin’s decoupling from traditional markets is not perfect, nor is it permanent. It will still respond to major liquidity shocks and macro stress events. But its growing independence from trade policy, earnings seasons, and policy expectations is structural, not speculative.

It has no earnings. No tariffs. No boardroom. No monetary authority.

It is, in effect, a monetary instrument that is immune to many of the systemic pressures facing public companies.

For corporate leaders focused on long-term capital strategy, this independence is not a bug—it is the feature. And as capital becomes more politicized, inflation more entrenched, and traditional reserves more correlated, Bitcoin’s differentiated profile becomes not just defensible—but strategically necessary.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post Bitcoin Is Decoupling—and It Doesn’t Care About Tariffs or Earnings Reports first appeared on Bitcoin Magazine and is written by Nick Ward.

Bitcoin Magazine