MEXC vs Binance (2025): Fees, Security, and Trading Comparison

MEXC vs Binance are two popular cryptocurrency exchanges that offer traders worldwide a wide range of trading options, features, and services. Both platforms also provide competitive tools and functionalities.

MEXC provides a highly comprehensive crypto trading platform. The exchange supports over 2,800 cryptocurrencies and allows users to trade anonymously without KYC verification. MEXC offers the lowest fees (sometimes as low as 0%) for spot and futures trading.

On the other hand, Binance is known for its extensive features, deep liquidity, and massive trading volume. This crypto exchange offers crypto loans and even a crypto debit card. It supports over 1,300 trading pairs and provides many features, including spot, margin, futures trading, staking, and earning opportunities.

However, these are not the only differences between MEXC and Binance. This MEXC vs. Binance review will include a complete overview, what are the fees of MEXC and Binance? What are their best trading features?

In addition, we will cover what are the number of supported cryptocurrencies on MEXC and Binance? What are their security levels? While highlighting, who should pick MEXC over Binance? And who should pick Binance over MEXC? Let’s get started!

MEXC vs Binance: A Complete Overview

Unlike Binance, which uses a tiered fee structure in which the high-volume traders will pay lower fees, MEXC has low trading fees even for low-volume traders. The table below provides a complete overview of MEXC and Binance.

Since they are both top-tier crypto exchanges with certain similarities, we summarized their features to help you spot their differences easily.

| Exchange | MEXC | Binance |

| Founded | 2018 | 2017 |

| Headquarters | Victoria, Seychelles. | No global headquarters currently. |

| Supported Cryptocurrencies | 2800+ | 400+ |

| Trading Fees | Low fees (0.1% – 0%) | Low fees. (0.1% – spot trading) and 0.5% for instant buy and sell. |

| Liquidity | High | Very High |

| Leverage | 300X | 150X |

| Security | Two factor authentication (2FA), cold storage for crypto, regular security audits, futures insurance fund, and address whitelisting. | Insurance fund, two factor authentication, address whitelisting, and cold storage of crypto. |

| KYC Requirements | Optional | Mandatory |

| User Experience | Fast order execution but is not the most beginner-friendly. | Beginner-friendly and advanced tools. |

| Trading pairs | 3,000+ | 1,300+ |

| P2P Trading | Yes | Yes |

| Listed Digital Assets | 3,000+ | 400+ |

| Trading markets | Margin, spot, and future trading | Futures, margin, options, and spot trading |

| Accepted Payment Methods | Cryptocurrencies only | Crypto, Direct Bank deposit, Debit/Credit Card, Apple Pay, and Google Pay. |

| Trading Volume | USD 6+ billion (Top 10) | USD 76 billion (World’s largest). |

Maximize your profits! Sign up on MEXC using our referral and save 10% on fees while unlocking amazing bonus rewards

What are the Fees of MEXC and Binance?

In this section, we’ll explore the fees associated with crypto trading on MEXC and Binance, including trading fees, withdrawal fees, and deposit fees. Understanding these fee is essential, as they impact your overal profit. Let’s compare how these two exchanges structure their fees and what traders should expect.

MEXC vs Binance: Deposit Fees

MEXC allows its users to deposit most cryptocurrencies for free and doesn’t impose any limits on deposit amounts. Binance also does not charge fees for cryptocurrency deposits. However, fees for fiat deposits vary based on the payment method and the fiat currency.

Join Binance today and enjoy a $100 fee rebate, permanent 10% trading fee discount, and exclusive perks!

MEXC vs Binance: Trading Fees

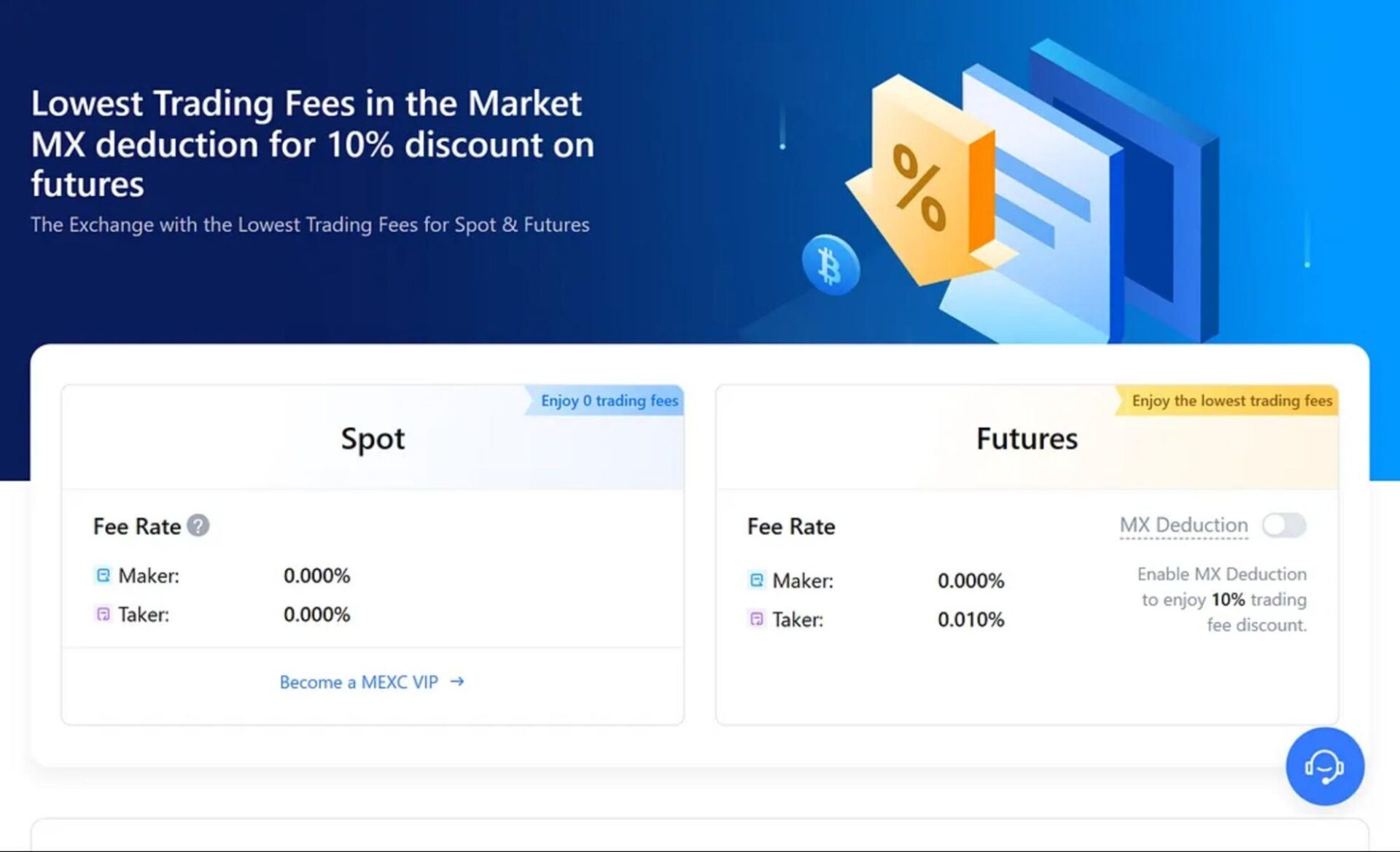

MEXC offers competitive trading fees to its users. The MEXC maker fee is 0.00% for spot trading, and the taker fee is 0.20%. For futures trading, MEXC charges a maker fee of 0.00% and a taker fee of 0.02%.

The crypto exchange also has “special trading pairs.” These are pairs that futures and spot traders can trade at 0% maker and taker fees. MEXC is the best zero-fee crypto exchange due to its rates, which can be further reduced based on your trading volume and by holding the platform’s native token, MX.

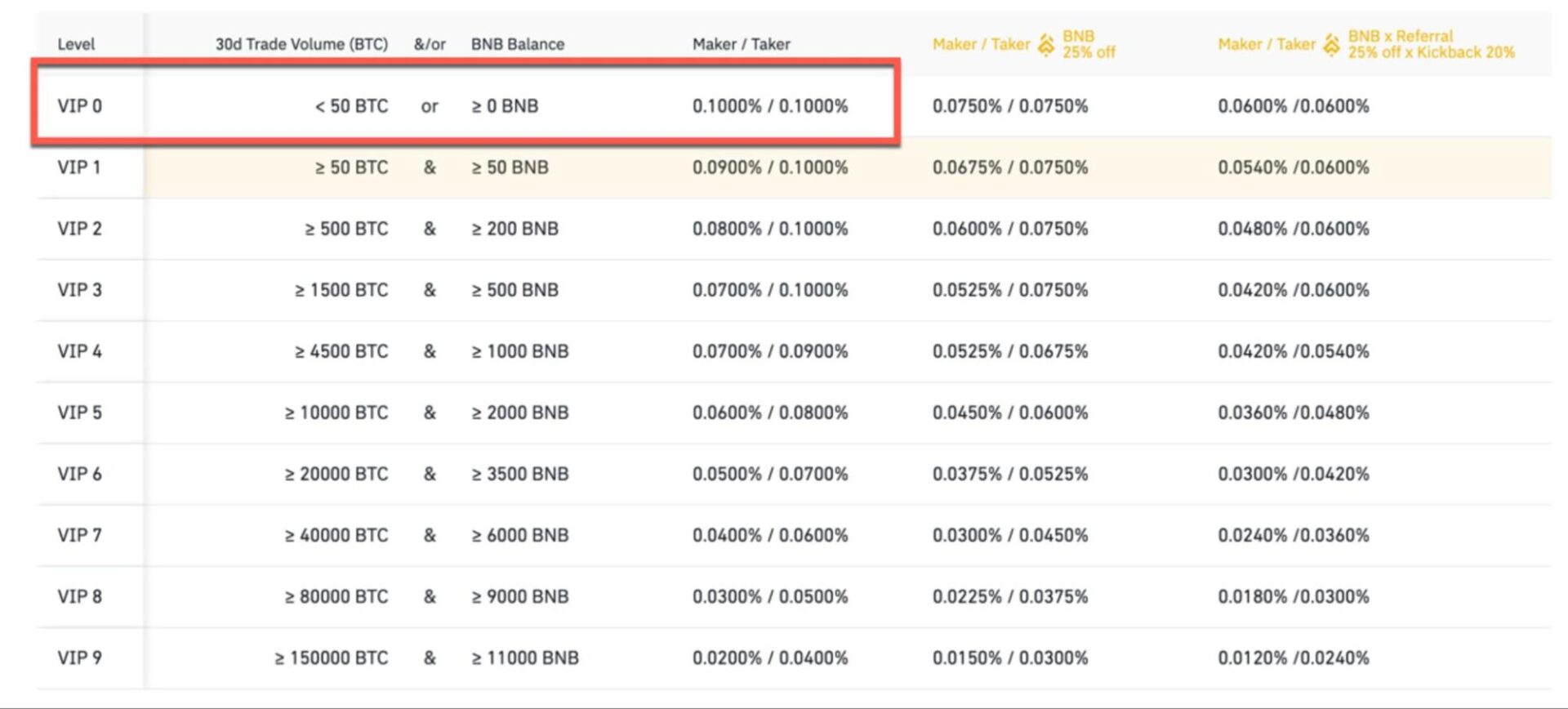

Conversely, Binance uses a tiered fee system based on a trader’s 30-day trading volume. If you’re a regular user with less than $15 million in trading volume, you will pay a standard spot trading fee of 0.10% for both makers and takers.

For futures trading, the fees start at 0.02% for makers and 0.04% for takers. The platform offers users a 25% discount on trading fees by paying with Binance’s native token, BNB, and further reductions are available for high-volume traders.

The fees for Binance USD-M Futures are 0.0200% for makers and 0.0500% for takers when using USDT. However, if you are trading with BUSD, the maker fee drops to 0.0180%, while the taker fee is 0.0450%. Meanwhile, Coin-M Futures traders are charged a 0.0200% maker fee and a 0.0500% taker fee.

MEXC vs Binance: Withdrawal Fees

Withdrawal fees on both platforms vary depending on the specific cryptocurrency you withdraw. For example, MEXC charges 0.0003 BTC for Bitcoin withdrawals and 1 USDT for Tether (USDT) withdrawals.

Binance’s withdrawal fees are generally competitive and depend on the cryptocurrency and network used; for instance, the fee for Bitcoin withdrawals is 0.0002 BTC.

It’s important to note that withdrawal fees are subject to change based on the blockchain network and the network conditions. So, verify the current fees on the respective platforms before initiating a withdrawal.

Your trading journey starts here! Register on MEXC now and grab exclusive rewards up to $1,000, plus a 10% fee discount!

MEXC vs Binance: What are Their Best Trading Features?

MEXC’s best features are its deep liquidity for altcoins, low trading fees, MEXC Launchpad and Kickstarter, MEXC Futures M-Day, copy trading, and a solid selection of futures trading options, including leveraged ETFs.

The best features of Binance are the Binance web3 wallet, NFT marketplace, high liquidity, BNB vault, advanced charting tools, and Binance Launchpad and Launchpool. It also offers multiple earning ways, such as staking, savings, and liquidity farming.

MEXC vs Binance: What are Their Number of Supported Cryptocurrencies?

MEXC and Binance are both popular cryptocurrency exchanges, but they differ in the number of assets they support. MEXC supports more than 2,800 cryptocurrencies, including lesser-known altcoins. It also has around 3,696 trading pairs, giving users a wide range of options.

Binance, on the other hand, supports more than 400 cryptocurrencies, with about 1,395 spot trading pairs available. Luckily, you can trade Bitcoin, the most popular altcoins, and some newer altcoins, as Binance always adds new listings, especially for promising projects.

Start trading on Binance now and enjoy a $100 rebate, a 10% lifetime fee discount, and exclusive benefits!

MEXC vs Binance: What are Their Security Level?

MEXC and Binance provide strong security features, but their security measures differ. MEXC security measures are listed below;

1. Regular Security Audits: MEXC conducts regular security audits through third-party cybersecurity firms to check for security risks.

2. 2FA: MEXC encourages users to set up two-factor authentication. This security feature requires users to provide two verification forms before accessing their accounts. This can help MEXC users prevent unauthorized access to their accounts even if someone steals their passwords.

3. Withdrawal Whitelist: You can add multiple wallet addresses to the whitelist and withdraw funds to only pre-approved wallet addresses. This security feature prevents hackers from transferring funds to any wallet address not listed, even if they gain access to your account.

4. Cold Wallet Storage: MEXC stores a significant amount of user funds in offline wallets (cold wallets) rather than online wallets (hot wallets).

Binance security measures are listed below;

Binance also uses cold wallet, two-factor authentication, and withdrawal whitelist to protect users’ funds from hackers. They also implement other security measures like:

1. Anti-Phishing Codes: This helps users recognize official emails from the exchange. By setting a personal Anti-Phishing code in their account. Once you set it up, every email from Binance will carry that code. So, if you receive an email from Binance that doesn’t have the code, it is likely a phishing attempt.

2. Secure Asset Fund for Users (SAFU): Binance has set aside a reserve fund to compensate users in case of security breaches. To fund the reserve, Binance allocates 10% of its trading fees to the SAFU fund, so if a hack occurs, Binance will reimburse affected users.

Who Should Pick MEXC over Binance?

MEXC is suitable for Traders who prioritize access to new or low-cap tokens, no-KYC trading, and lower fees.

MEXC in a Nutshell

MEXC is a cryptocurrency exchange founded in 2018. The exchange is known for its wide range of trading options and support for new and smaller altcoins. Whether you’re into spot trading, futures, or margin trading, MEXC has something for you.

MEXC offers its users MEXC Savings, where they can earn rewards by locking up their crypto assets or participating in yield farming. The exchange has extensive features, but a user-friendly interface accompanies it.

Key Features of MEXC

MEXC stands out as one of the crypto exchanges with great features designed to give traders more opportunities to earn and grow their portfolios. Some of the best features include Spot trading & Copy trading, Futures M-Day, Launchpad, and Kickstarter.

1. Spot Trading on MEXC

MEXC makes spot trading simpler and efficient by offering high liquidity and fast order execution. Most trading pairs are pegged to USDT, and the platform’s advanced dashboard gives you real-time insights into trading volumes.

2. Copy Trading on MEXC

If you are new to trading, MEXC’s Copy Trading feature allows you to follow experienced traders and automatically copy their moves in the futures market. You can follow the traders based on their ROI, win rate, and overall performance.

3. MEXC Launchpad

MEXC handpicks high-potential projects, and users who hold at least 2,000 MX tokens can easily earn free token airdrops. Suppose you hold 1,000 MX tokens for 30 days. In that case, you can also participate in non-lockup events and get rewarded based on the number of tokens you commit.

4. MEXC Kickstarter

This is a pre-launch voting event where you can back new projects by voting. If a project gets enough support, everyone participating gets free token airdrops. To join, you need at least 500 MX tokens in your wallet 24 hours before the event starts.

5. MEXC Futures M-Day

MEXC Futures M-Day is a special event where you can earn rewards for trading specific futures contracts. The more you trade, the more lottery tickets you collect, increasing your chances of winning free airdrops. Even if you don’t win, participating earns you free raffle tickets and futures bonuses, which you can use as trading margins.

MEXC offers even more features not discussed in this article; you can check out this MEXC review article to learn more about the exchange.

Upsides & Downsides of MEXC

Upside: MEXC offers a wide range of cryptocurrencies with low trading fees and high liquidity. You can trade on MEXC without KYC verification, and as a new user, you have a chance to receive up to 8,000 USDT in sign-up bonuses. If you’re looking for the best crypto sign-up bonuses, MEXC is a top contender. Read this MEXC referral code article to find out how to qualify for this exclusive reward.

Downside: MEXC has limited fiat support, regulations around the platform are shaky, and customer support can be slow sometimes.

Who Should Pick Binance over MEXC?

Professional traders, institutional investors, and users who prioritize high liquidity, regulatory compliance, and easy fiat transactions should pick Binance over MEXC.

Binance in a Nutshell

Binance is the world’s biggest and most popular cryptocurrency exchange by trading volume. It was founded in 2017 by Changpeng Zhao (CZ) and quickly became a go-to platform for new and experienced crypto traders. Binance Exchange has over 300 tradable coins, including popular tokens, meme coins, GameFi, and AI coins.

One of the big perks of Binance is its low trading fees; if you use its BNB, you can get even more discounts. The platform also supports many and different trading methods like spot, margin, and peer-to-peer, along with various order types such as limit, market, and stop-limit orders.

Key Features of Binance

1. Binance Web3 Wallet: Binance has a built-in Web3 wallet that lets users easily switch to and explore the Web3 ecosystem and decentralized finance (DeFi). The Web3 wallet is a gateway for Binance traders to execute cross-chain token swaps, participate in exclusive airdrop campaigns, and explore various decentralized applications.

2. Binance Referral Program: Binance has a referral program that encourages existing users to refer their friends, family, and community to join the platform in return for rewards and bonuses. The referral program is divided into two arms: standard and lite. The first gives you 20% lifetime discounts on trading fees, while the second offers 100 USDT trading credit.

When you use our Binance referral code to register a new account, you will get up to $100 worth of gifts, lifetime discounts on trading fees, and other exclusive rewards you would miss if you registered a new account without the referral code.

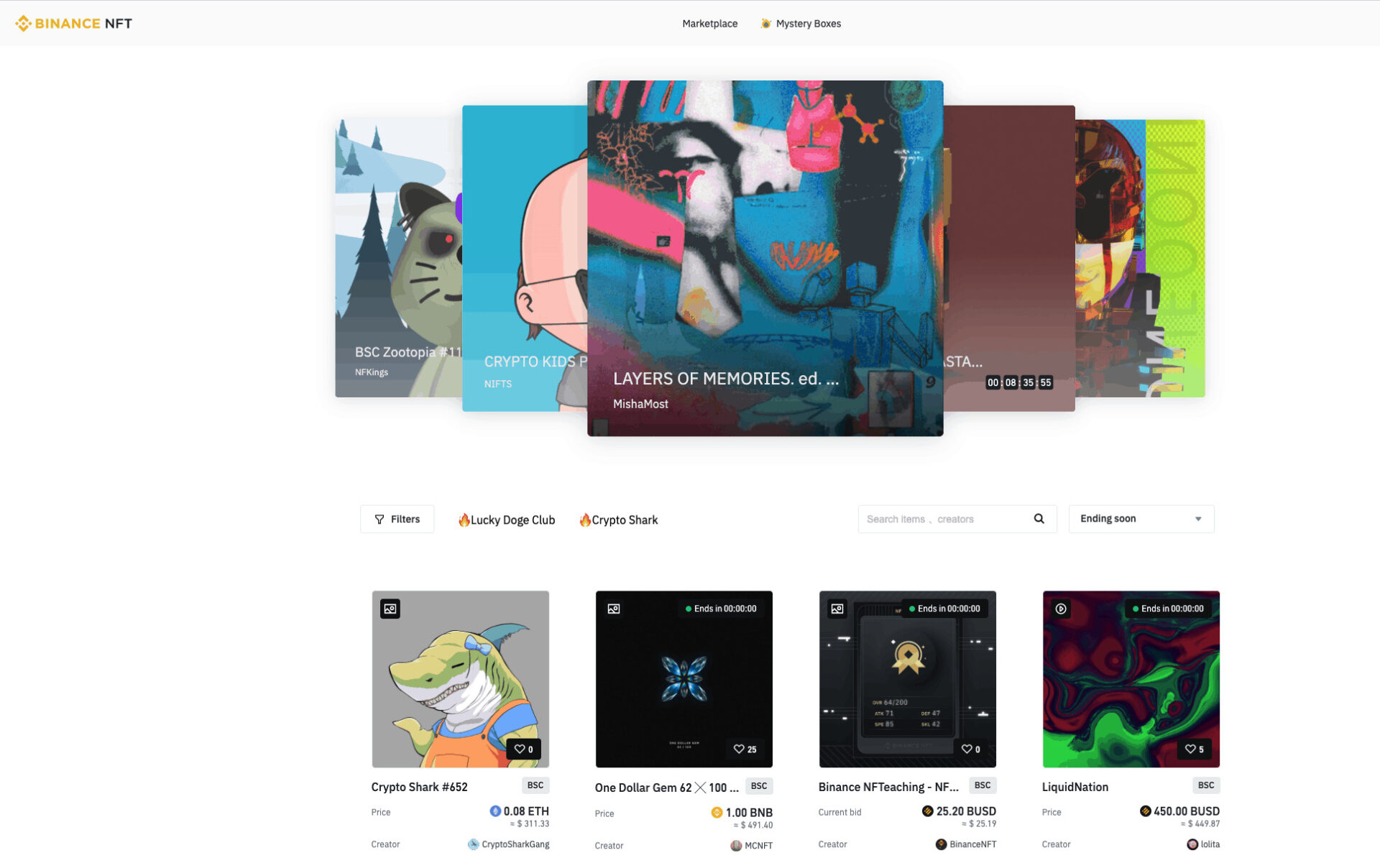

3. NFT Marketplace: Binance has a fully equipped NFT marketplace for traders to browse, mint, sell, bid on, and purchase NFTs from digital creators. Listing and browsing are free, and you can find some of the most popular NFT collections, like Golden Ape Club and BULL BTC CLUB.

Upsides & Downsides of Binance

Upsides: Binance has low trading fees and provides basic and advanced trading features for new and experienced traders. It also offers multiple earning opportunities, such as staking and savings. In this comprehensive Binance review, we discussed more features that make Binance a good exchange.

Downsides: Binance has faced regulatory scrutiny in multiple countries, and the mandatory KYC is a deal-breaker for traders looking to trade anonymously. Also, trading on the exchange might overwhelm new users due to extensive product offerings.

The post MEXC vs Binance (2025): Fees, Security, and Trading Comparison appeared first on CryptoNinjas.

CryptoNinjas