THORChain Under Fire as Swap Volumes Surge From Aftermath of Bybit Hack

Key Takeaways:

- THORChain swap volume surged past $1 billion post-Bybit hack.

- Concerns rise over its potential misuse for laundering stolen funds.

- RUNE price jumps amid increased platform activity.

THORChain, a decentralized cross-chain swap protocol, is facing heightened scrutiny after its swap volumes surged following the $1.4 billion exploit of cryptocurrency exchange Bybit. Although this recent influx of activity highlights the increasing need for THORChain’s offerings, it has also fueled fears around the misappropriation of stolen money on the platform — especially considering the use of groups like Lazarus.

#RUNE Jumps 33%

The RUNE price surge follows a 300% surge in the DEX trading volume on THORChain (@THORChain) in the past week.

Learn More: https://t.co/zCCbDYQmaY pic.twitter.com/sUvKklyHeJ

— Coinspeaker (@coinspeaker) February 27, 2025

Cross-Chain Swaps Fuel Record-Breaking Trading Volumes

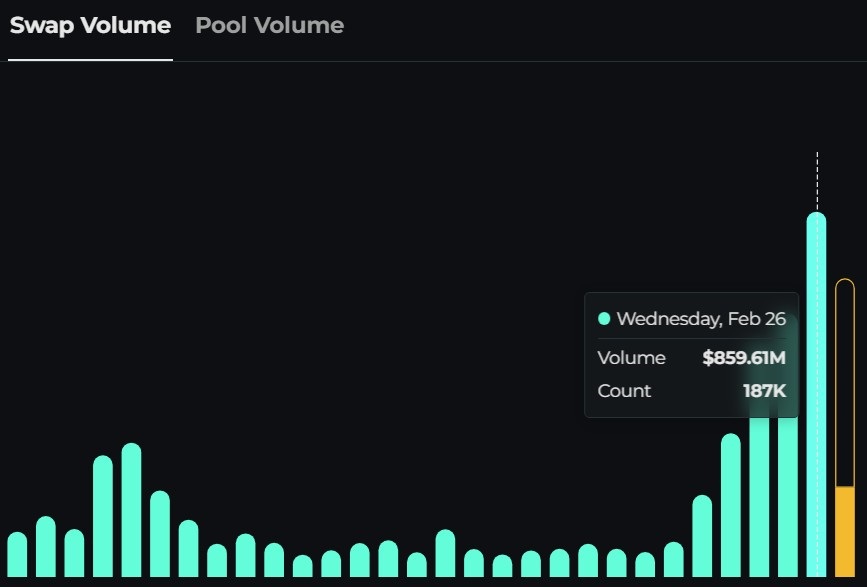

The data tells a powerful story in recent spikes. On Feb 26th, THORChain recorded $859.61 million in swaps. This marked the highest single-day volume ever recorded by the protocol, according to meticulously compiled data from THORChain Explorer. The surge continued uninterrupted into February 27th, with another $210 million moving through the platform. As a result, total swap volume surpassed the $1 billion mark in under 48 hours.

Since the Bybit hack, THORChain swap volume has spiked dramatically. Source: THORChain Explorer

THORChain functionality is bottom-up, meaning that it enables a direct swap between two different blockchains without any centralized intermediaries. That is, users may easily swap Ether (ETH) for Bitcoin (BTC) or vice versa in a decentralized context. These swaps are executed using RUNE, the native token of THORChain, which also helps maintain liquidity within its pools.

This has raised concerns that individuals may exploit it to obscure the origins of illicit funds. Decentralized cross-chain asset movements can complicate transaction tracing efforts and have been cited by law enforcement as a potential method for laundering stolen cryptocurrency.

Fear of Lazarus Group and the Flow of Dirty Money

A key factor behind the heightened scrutiny on THORChain is Lazarus’ past involvement in cryptocurrency laundering. Using Bitcoin (BTC) as a conversion tool for its stolen digital assets remains the primary method of obfuscation, according to blockchain analysts who have consistently tracked Lazarus’ movements. The group also uses decentralized platforms instead of centralized ones, making it more difficult to trace these funds.

Although there is no direct evidence linking this volume to the stolen Bybit funds, the sudden surge in THORChain’s swap volume around the same period has raised concerns that the protocol could be used to launder illicit assets.

For example, following past crypto exchange hacks associated with Lazarus, analysts have observed a recurring pattern in the movement of stolen funds on decentralized platforms, including cross-chain swap protocols. These movements are commonly made through a chain of quick transactions and conversions among various cryptocurrencies, aimed at severing the chain of custody and obfuscating the coins’ source.

It is important to note that this does not suggest THORChain’s direct involvement. But with its decentralized character, as well as its capacity to allow for cross-chain swaps, the platform could be an attractive instrument for the money laundering of stolen cryptocurrency.

THORChain’s Reaction and Community Discussion

The potential for abuse has led to a complicated discussion on THORChain’s discord and among its core devs. “Pluto”, a Nine Realms engineer who has significantly contributed to the development of the protocol, has acknowledged these concerns and recognized that illicit funds might have been laundered through the platform.

Pluto emphasized that the THORChain team is committed to implementing measures to mitigate illicit activities. They consist of helping with implementations of screening solutions for wallet and integration partners so that they can identify and block potentially suspicious transfers. They’ve also stressed that the installation of services isn’t the problem and that the decentralized nature of THORChain shouldn’t be demonized for how its users access its offerings.

When we first started seeing illicit flows on THORChain, our team bridged the gap for wallets and integration partners, helping them integrate screening services like @elliptic. I am pleased to that @SwapKitPowered and @RangoExchange offer this solution to their partners. Any… https://t.co/3yHifg925m

— Pluto (9R) (@Pluto9r) February 22, 2025

But that has not alleviated all concerns. Decentralization advocates in the cryptocurrency community have said THORChain must do more to prevent its use for illicit activities, even if that compromises THORChain’s decentralized properties. Others argue that it is up to law enforcement and regulatory agencies to track down and bring to justice those using decentralized platforms to launder stolen crypto.

this horrific cult actually needs to be permanently exiled from this industry.

this is the same “decentralized” protocol that rugged legitimate users and still—to this day—has their funds frozen af.

this is more disgusting than even the memecoins.

https://t.co/f6kZoNPURj

— Tay

(@tayvano_) February 27, 2025

Effect on RUNE Token and THORChain Environment

Regardless of the controversy, THORChain’s RUNE token has seen large price increases over the last few days. The data from CoinGecko shows RUNE up 36.6% in the last seven days. This surge likely reflects the growing demand for THORChain’s services and the rising liquidity within its pools.

The price surge highlights the balance between a decentralized platform’s perceived utility and the risks of potential misuse. Some might balk at putting money into a platform that is in the spotlight for having acted as a facilitator for illegal behavior, but others could be attracted by the increased liquidity and possible yields that accompany higher transaction volumes.

The long-term impact of the Bybit hack and the resulting scrutiny on the THORChain ecosystem remains uncertain. The protocol is expected to evolve further as it grows beyond this stage.

The Pursuit of Stolen Funds by Bybit

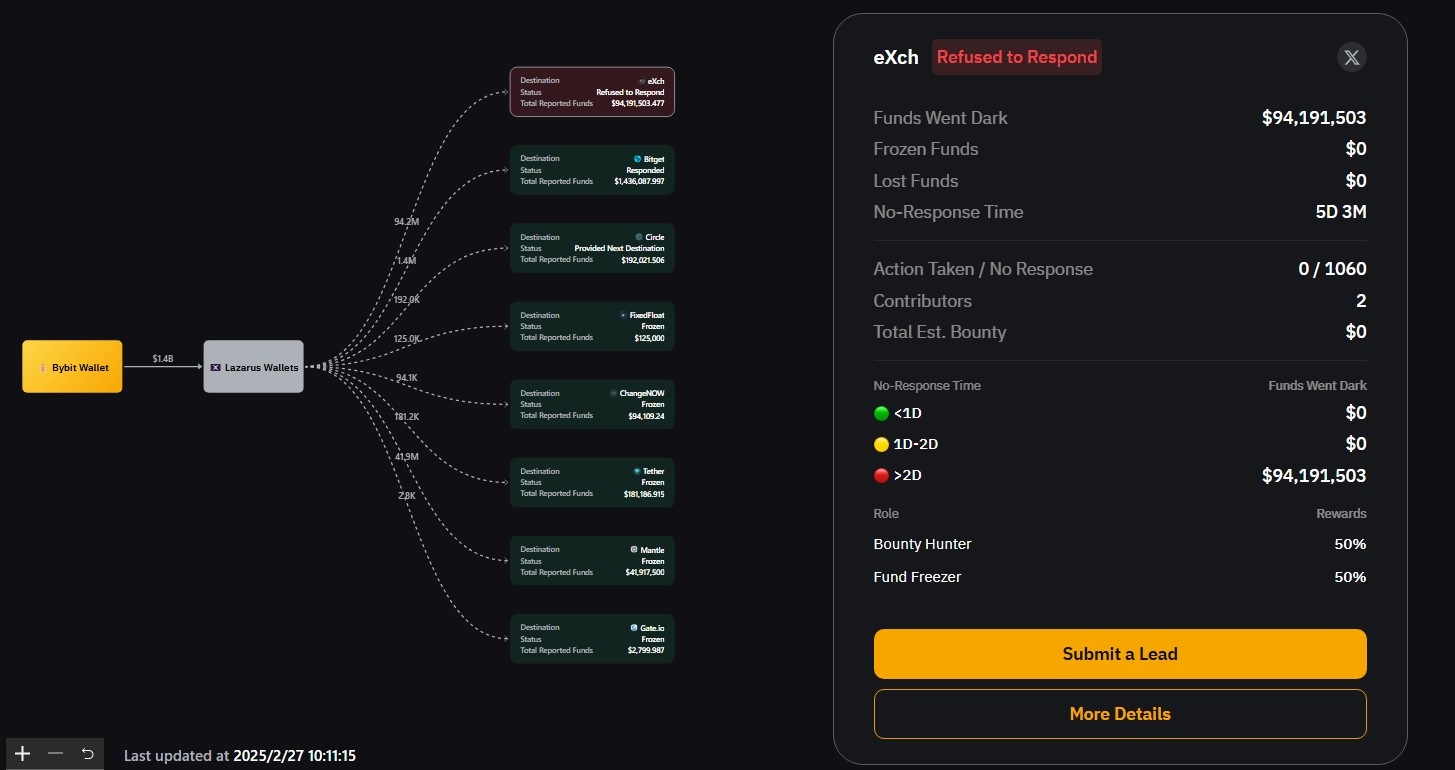

Bybit, the exchange targeted in the staggering $1.4 billion exploit, has mounted an exhaustive effort to trace the stolen funds and bring the attackers to justice. The exchange has launched a dedicated website to track the movement of stolen funds in real-time and is promising a bounty to any entity that helps freeze the assets.

More News: Bybit Suffers Massive $1.4 Billion Hack: What You Need to Know

As of February 27th, the Bybit website had named seven cryptocurrency exchanges that are cooperating with the investigation and one of the platforms, eXch, which it said was a “bad actor” that has reportedly declined to freeze funds related to the hack.

Bybit identified eXch as the only “bad actor”. Source: Lazarusbounty/Bybit

This highlights the need for greater cooperation between cryptocurrency exchanges, law enforcement agencies and regulators to tackle illicit activity in the digital asset industry.

The post THORChain Under Fire as Swap Volumes Surge From Aftermath of Bybit Hack appeared first on CryptoNinjas.

CryptoNinjas

Learn More:

Learn More:

(@tayvano_)

(@tayvano_)