MetaMask and Crypto Taxes

beginner

In the swiftly evolving world of cryptocurrency, staying on top of your tax obligations can feel like an impossible task. From my personal experience, understanding the tax implications of crypto transactions is not only crucial but can be quite complicated, given the volatile nature of this space. That’s why, in this article, I want to overview the basics of crypto taxes, particularly in regards to MetaMask, a widely used Ethereum wallet.

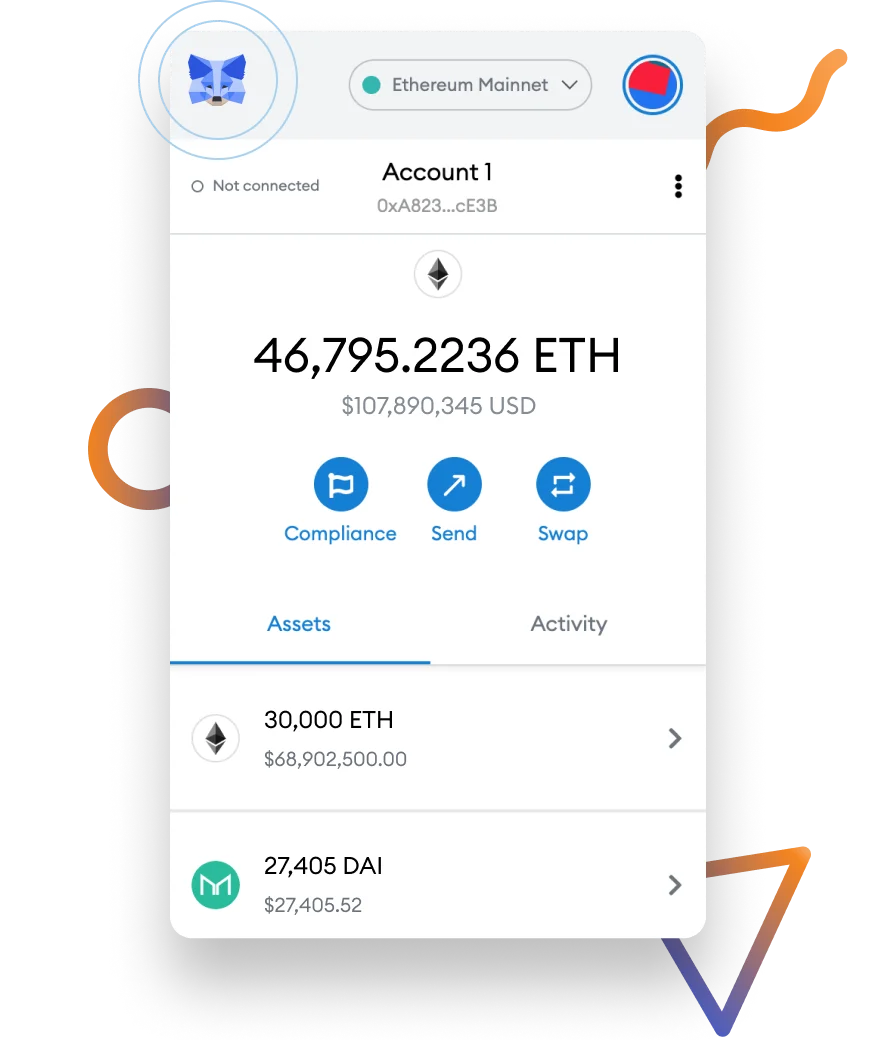

In my opinion, MetaMask has revolutionized the way we interact with the Ethereum blockchain. Its user-friendly interface enables easy management of your ETH wallet and a convenient way to conduct various types of transactions. But with the convenience of virtual currency comes the responsibility of reporting it correctly. Your MetaMask transactions are capital assets, and any capital gain or loss from these transactions can directly impact your tax liability.

In this article, I will look at crypto taxes and how they might concern your usage of the MetaMask wallet from the perspective of a US citizen. Please remember that tax laws can differ significantly from country to country. Always consult with a local tax professional to understand your obligations.

This article does not constitute financial advice.

Table of Contents

What is MetaMask?

MetaMask is a software cryptocurrency wallet used to interact with the Ethereum blockchain. It allows users to access their Ethereum wallet through a browser extension or mobile app, which can then be used to store, send and receive Ether and ERC20 tokens.

Wanna get more ETH tokens? You can buy Ethereum at fair rates and with low fees on our platform.

MetaMask wallet is a gateway to many decentralized applications (dApps) on the Ethereum blockchain, which positions it as a key player in the crypto ecosystem. By managing your private keys locally, it provides a user-friendly interface for crypto transactions while also ensuring your digital assets’ security.

How Do Cryptocurrency Taxes Work?

Understanding how cryptocurrency taxes work is crucial for anyone involved in the crypto space. In the United States, the Internal Revenue Service (IRS) views cryptocurrency as property, making it subject to crypto income and capital gains tax.

Taxable Events in the Crypto Market

A taxable event is any event or transaction that results in a tax consequence for the individual or business that executes the transaction. In the crypto market, taxable transactions might include trading cryptocurrency for fiat currency (like US dollars), using crypto to purchase goods or services, and trading one crypto for another.

Earning crypto as income, whether through mining, staking, or getting paid in digital assets, also constitutes a taxable event. Each of these transactions may result in capital gains or losses which must be reported on your tax return.

Crypto Tax Software

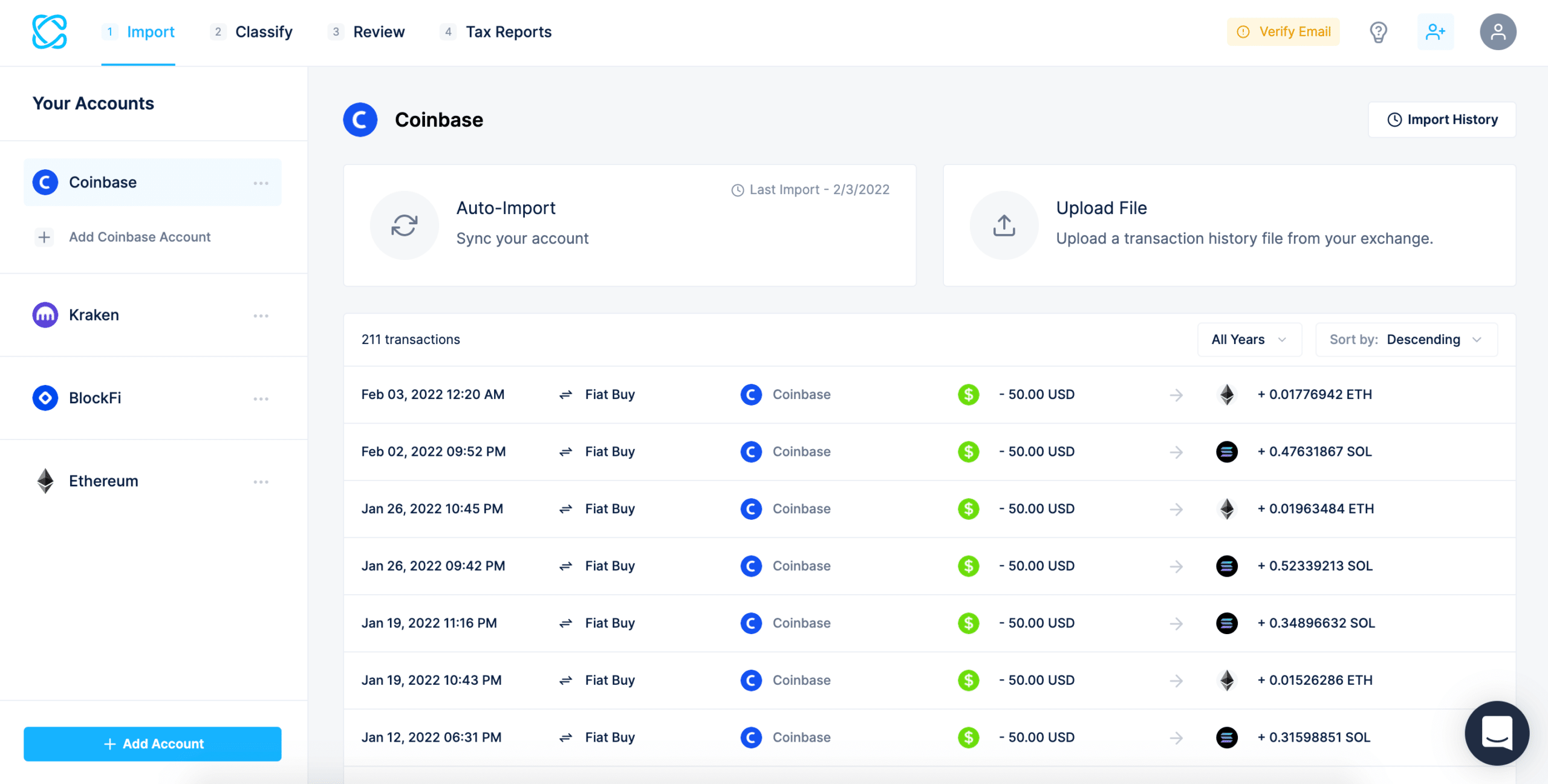

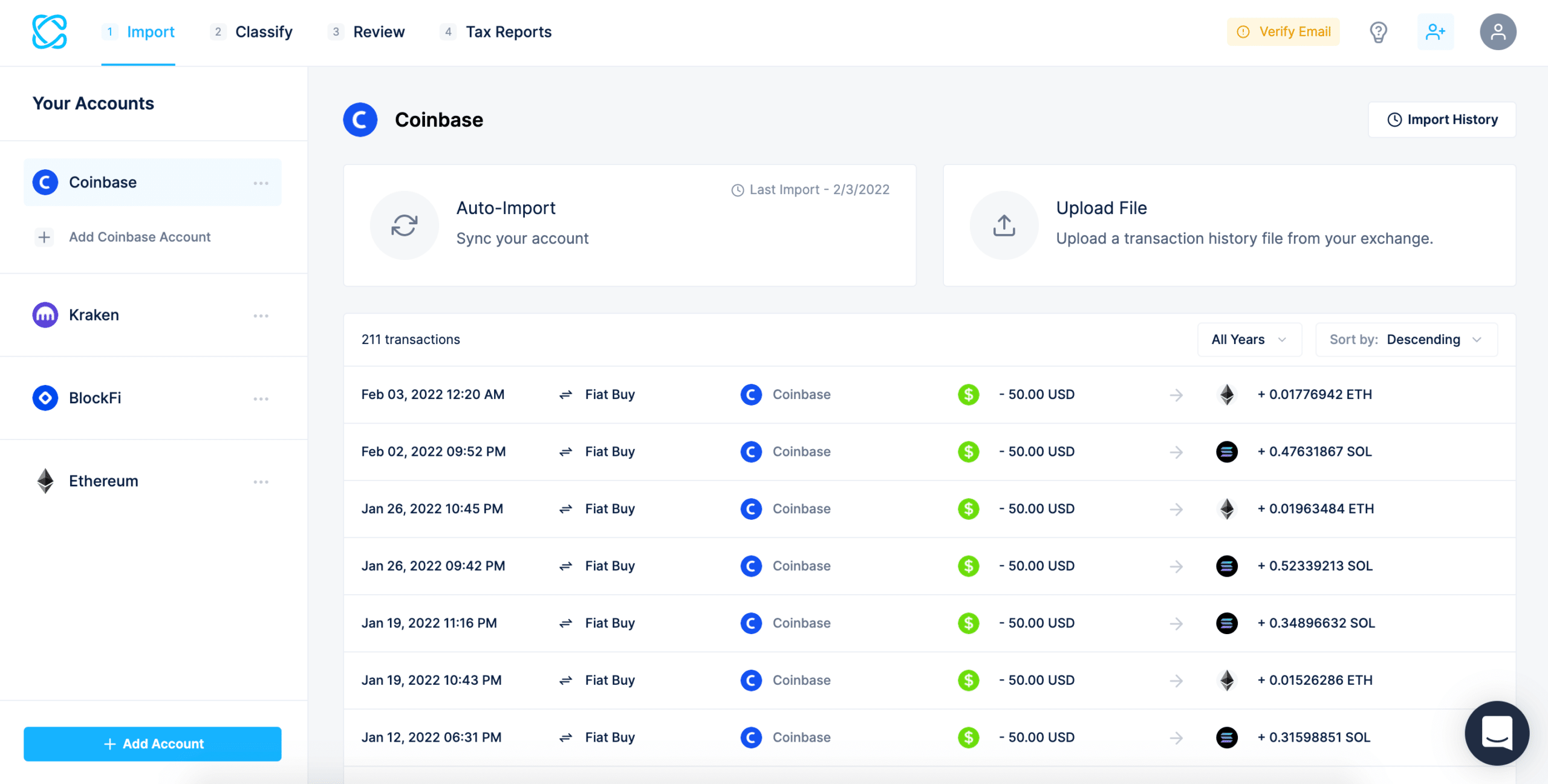

To simplify the complex process of tracking and calculating tax implications from your crypto activity, you might consider using a crypto tax software. These platforms allow you to aggregate transactions from various sources, calculate gains and losses, and generate necessary tax reports. They provide a comprehensive and efficient solution for crypto investors, particularly during the busy tax season.

Crypto Taxes Around the World

Although this article mainly looks at crypto taxes from the perspective of a US citizen, let’s also take a brief detour and see how cryptocurrency investments and transactions are taxed in other countries.

In the UK, for instance, the HM Revenue and Customs (HMRC) treats cryptocurrencies as foreign currency for most individuals. This means that capital gains tax and income tax rules apply, depending on the types of transactions involved. If you’re mining crypto, for instance, the activity might be considered a trade, and any crypto income would be taxed accordingly.

Meanwhile, in Canada, the Canada Revenue Agency (CRA) considers cryptocurrency as a commodity. Hence, any income from selling or buying crypto is considered a business income or a capital gain.

Down under in Australia, the Australian Taxation Office (ATO) classifies cryptocurrency as property and applies capital gains tax to any profits made from trading.

In contrast, some countries like Germany offer a tax exemption for cryptocurrencies held for more than a year.

It’s clear that the landscape of crypto taxes is as diverse as it is complex. While MetaMask simplifies transacting with your ETH wallet, it doesn’t track your MetaMask transaction history for tax purposes. Hence, it is essential for users to maintain accurate records of their transactions and understand tax regulations in their specific jurisdictions.

Does MetaMask Report To the IRS?

Currently, MetaMask does not report your crypto transactions to the IRS. Unlike traditional banks or stock exchanges, most crypto exchanges and wallets, including MetaMask, do not provide a 1099 form for their users. This means that the responsibility of recording and reporting taxable income falls on the individual taxpayer.

How To File Your MetaMask Taxes

To file your MetaMask taxes, start by exporting a comprehensive list of your crypto transactions made through MetaMask. Since MetaMask interacts with the Ethereum blockchain, every transaction made is publicly available and can be traced using your public Ethereum address.

Next, you’ll need to calculate your gains or losses for each taxable event. This involves determining the cost basis of your crypto (how much you originally paid when acquiring the asset) and subtracting it from the sale price. Remember, the IRS distinguishes between short-term capital gains (held for less than one year) and long-term capital gains (held for more than one year), each with different tax rates.

After your capital gains and losses are calculated, the net result is what needs to be reported on your tax forms. You’ll report your gains on IRS Form 8949 and Schedule D. If you’ve earned crypto as income, it should be reported as ordinary income.

Conclusion

It’s important for users of platforms like MetaMask to understand the tax implications of their crypto transactions. Due to the lack of direct reporting from such platforms, investors must keep diligent records and perhaps seek professional tax advice. Also, depending on the nature of your transactions, you may be eligible for a tax deduction – don’t miss out on that!

FAQ

How can I get a MetaMask wallet?

Getting a MetaMask wallet is quite straightforward. First, you need to download the MetaMask app, which is available as a browser extension for Chrome, Firefox, and Brave, or as a mobile app for iOS and Android devices. After downloading, you’ll be guided through the process of setting up a wallet, including backing up your seed phrase which is critical for recovery purposes.

Once set up, you’ll be given a wallet address where you can receive and send Ethereum and ERC20 tokens. The MetaMask API also provides developers a way to create, manage, and interact with the wallet programmatically.

Does MetaMask report to IRS?

MetaMask does not directly report your crypto holdings or transactions to the IRS or any other tax authorities. It is the user’s responsibility to keep track of their crypto assets and transactions for tax purposes. Negligence could potentially lead to tax evasion charges, which are taken very seriously.

Are gas fees taxed?

Gas fees, which are the costs of transactions on the Ethereum network, are indeed taxable. If you use the MetaMask gas fee calculator to determine the cost of your transaction, this amount is considered a part of the cost basis in a taxable event.

Can the IRS track Trust Wallet?

While the IRS doesn’t directly track Trust Wallet, they can potentially trace transactions via public blockchain data if required. As always, it is recommended to comply with tax regulations and report all relevant activities in your crypto tax report.

Who owns MetaMask?

MetaMask is owned by ConsenSys, a global blockchain company specializing in Ethereum products and tools. They’ve been a major player in the crypto space, contributing to the Ethereum ecosystem and beyond.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Source:Changelly.com